By John M. Philipchuck By John M. PhilipchuckFounder & Managing Partner | IMPACTUS, LLC |

Origins of the “OZ”

With inadequate public and philanthropic resources available to address social and economic challenges in underserved communities throughout the United States, tapping into private capital has always been a viable solution. Enter Opportunity Zones.

The Opportunity Zone (“OZ”) program is a new community investment tool established by Congress through the Tax Cuts and Jobs Act of 2017, signed into law on December 22, 2017. The OZ program was designed to incentivize long-term equity investments into low income and economically distressed areas. While the program is active today, legislative details are still being ironed out with input from private industry advocates.

The concept of Opportunity Zones was first presented publicly in 2015 in a white paper written by economists Jared Bernstein, the former Chief Economist under Vice President Joe Biden, and Kevin Hassett, the current Chairman of the Council of Economic Advisers under President Trump. Economic Innovation Group, a bipartisan public policy organization founded by Sean Parker of tech giants Napster and Facebook, and Steve Glickman, a former Senior Economic Advisor under President Barack Obama, originally conceived the OZ program.

OZ’s Reach

The OZ program is the largest community investment tool in the U.S. in decades and is expected to create an entirely new asset class and investment marketplace. Recent estimates suggest U.S. investors hold $6.1 trillion of unrealized capital gains, a massive capital base with strong incentive to support OZ investments, including real estate.1

There are more than 8,700 OZs designated by census tract. They are scattered throughout the U.S. and its territories, with roughly 75% of OZs located in urban areas and 25% in rural communities. An estimated 35 million homes and over 1.5 million businesses are covered under the legislation.2

The All-Powerful OZ

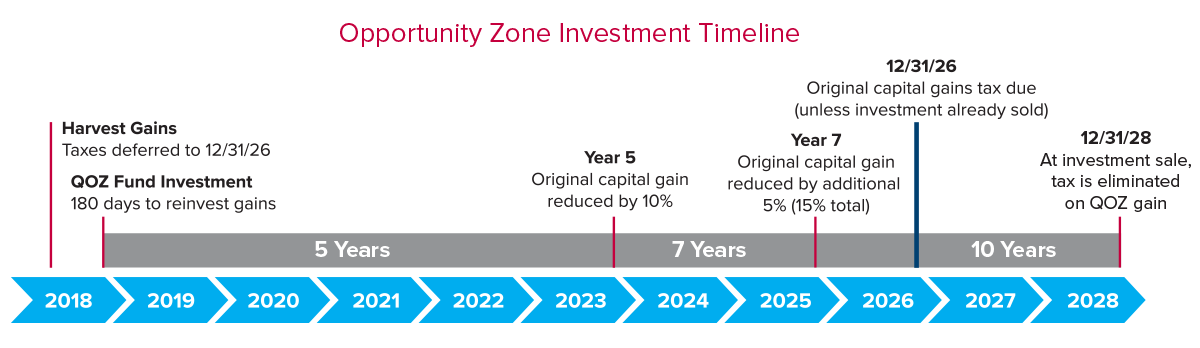

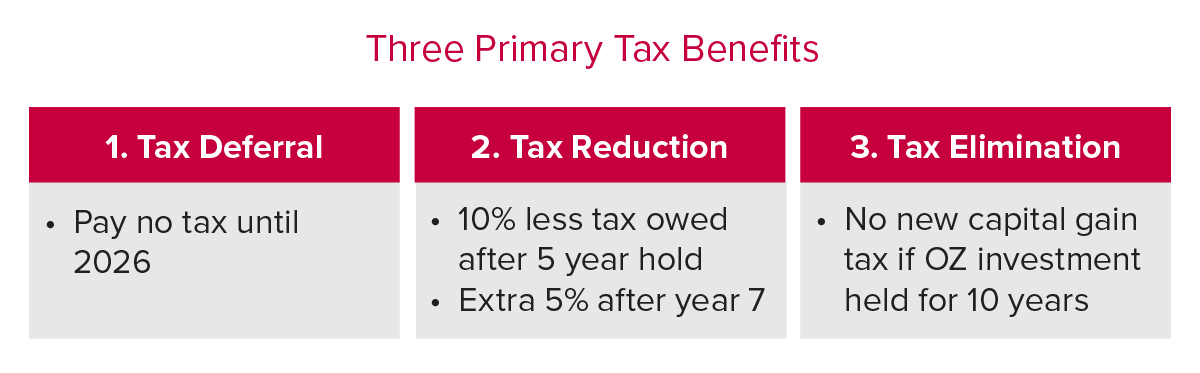

Taxpayers who recognize a gain from the sale of another investment or asset can defer paying taxes on those gains through 2026 if a portion of or all of the gains are reinvested into a Qualified Opportunity Zone (“QOZ”) property or business through a Qualified Opportunity Fund (“QOF”). Taxpayers are further incentivized to hold their QOZ investments for five or more years, which reduces the tax liability through a step-up in basis.3

In addition to the aforementioned tax benefits, investors who roll eligible capital gains into a QOF and hold their investment at least 10 years will pay no new capital gains tax on appreciation of the QOZ investment, eliminating the capital gains tax altogether.

QOFs must be comprised of equity investments only and hold at least 90% of assets in QOZs. Investments can be made into any asset type including, but not limited, to real estate, newly issued company stock, business property, infrastructure, and start-ups.

Real estate is subject to a “substantial improvement” requirement and is considered substantially improved if the QOF doubles the original basis in the property within a 30-month period post acquisition. As a result, new development and major rehabilitation projects are the most likely targets of QOFs.4

Massive After-Tax Benefits

Opportunity Zone investments present an attractive opportunity for investors sitting on unrealized gains. Upon the sale of an asset, OZ investors have 180 days to roll over their capital gain into a QOF. Once the investor completes the rollover, their capital gain is eligible for incentivized tax treatment. OZ investors are incented to put capital to work early in the program, given that the incremental after-tax return diminishes over time.

In order to benefit from the five and seven year tax discounts (tax payment deadline is December 2026), taxpayers must reinvest their gains by December 31, 2019.

OZ vs. 1031

Similar to OZs, Section 1031 of the IRS tax code allows investors to defer paying capital gains taxes on the sale of real estate as long as the proceeds from the sale are reinvested into “like-kind” property within 180 days.5 Unlike 1031, OZ eligible gains are not limited to the sale of real estate and can be long-term or short-term gains. Investors can invest gains from the sale of stocks, bonds, a business or even artwork.

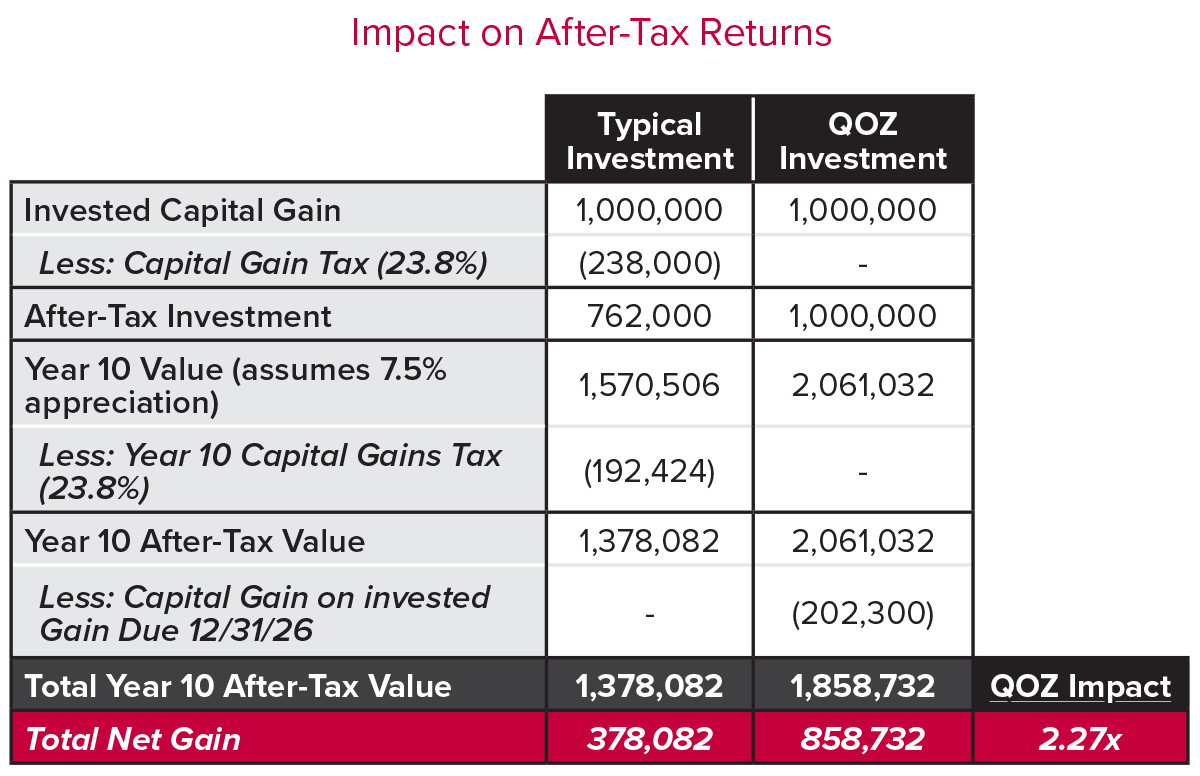

Another advantage of an OZ investment over a 1031 is that capital gains for 10-year holders are reduced over time, and new gains are eliminated, not just deferred.6 The illustration below shows the benefit of both deferring and reducing the capital gain tax. The first column is a typical investment where a 23.8% tax rate on a $1.0 million invested capital gain results in a $238,000 tax payment in year 0. The second column shows a QOZ investment in which the capital gain is deferred until 2026. The 15% reduction in tax rate in year 7 results in a tax of only $202,300 in year 7 and the opportunity to significantly increase long-term profits by investing more in year 0.

What’s Behind the Curtain?

Critics of the OZ program have asserted the negative implications of massive capital infusion into the most disadvantaged neighborhoods. Gentrification and displacement comes to mind, followed by misuses of investor capital. For any tax incentive program of this size and scale to be thought of as successful, QOFs ought to embrace a Triple Bottom Line approach, focusing on Social, Environmental and Financial impact in OZs.

The Real Opportunity Beyond the Opportunity Zone

As we delve further into this new program, let us “begin with the OZ community in mind” and be both social and financial fiduciaries of this capital. QOFs should be encouraged to (i) engage OZ community leaders and understand their needs, (ii) embrace sensible regulation and reporting requirements to ensure the program achieves desired outcomes, and (iii) prudently invest capital that lifts all people and places, while providing adequate returns to investors. With this framework in mind, our real estate leaders will launch catalytic projects that revitalize communities in greatest need of our contributions. •

1. Economic Innovation Group ↩

2. Walker & Dunlop, Opportunity Zones & Funds – An Investor’s Guide, August 2018 ↩

3. IRS.gov, https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions ↩

4. Novogradac, https://www.novoco.com/notes-from-novogradac/new-opportunity-zones-could-be-used-finance-rental-housing ↩

5. IRS.gov, https://www.irs.gov/newsroom/like-kind-exchanges-under-irc-code-section-1031 ↩

6. Walker & Dunlop, Opportunity Zones & Funds – An Investor’s Guide, August 2018 ↩