By Merrie S. Frankel By Merrie S. FrankelPresident | Minerva Realty Consultants |

REIT performance has improved this year over 2018 providing a cautiously optimistic outlook. 1Q19 earnings season indicated that a better capital environment and solid operating fundamentals foretell a promising year for many REITs. Attendees at recent conferences dismiss the idea of a 2019 recession, but are undecided about 2020. Of note are how REITs fared year-end 2018, REIT performance during 1Q19, and the major issues to consider this year.

U.S. REITs Performed Well at Year-End 2018 and 1Q19

U.S. REITs posted total returns of -4.1% at year-end 2018 and 16.7% at March 29, 2019 leading the S&P by +3% — the best 1Q19 since 2000. 225 U.S. REITs hold an equity market capitalization at 1Q19 of $1.2 trillion (vs. $1 trillion at YE19), a little more than the $876 billion market cap of Amazon at 1Q19. Real estate was the second best performing S&P 500 sector in 1Q19. Preliminary results indicate that 1Q19 earnings hold promise due to reduced capital costs, broad access to capital, solid operating fundamentals for most sectors, and a rebound in REIT stock prices. REITs tend to own the strongest assets with best locations for some sectors in their markets, so should perform better than many of their non-REIT peers.

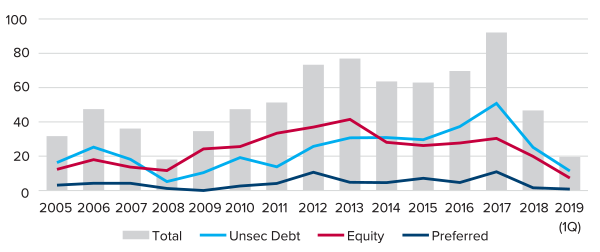

REIT issuance of equity, unsecured debt and preferred stock declined to $46.7 billion at year-end 2018 and $19.5 billion at 1Q19 from a high of $92.1 billion in 2017 (see Figure 1).

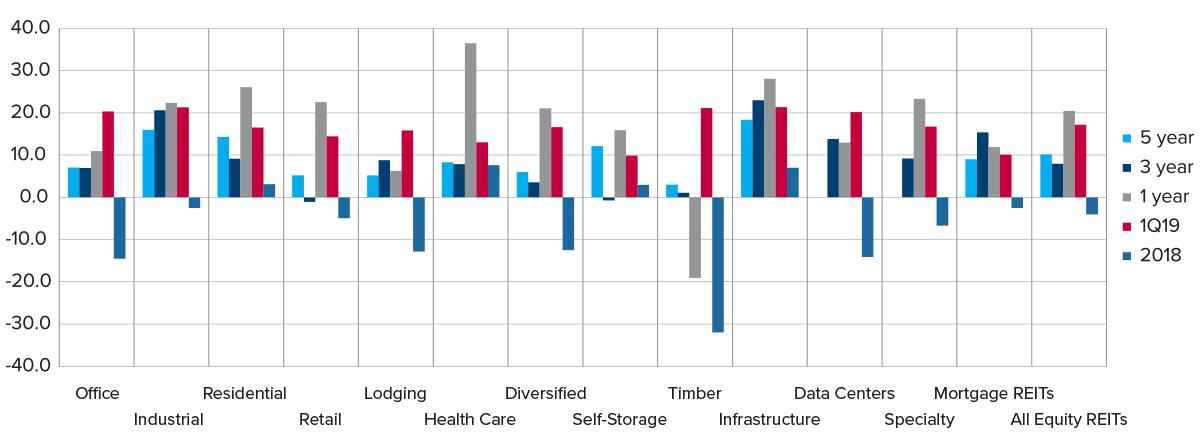

Figure 1: U.S. REIT Equity Performance (Total Return at 3/29/19)

Source: FTSE Nareit US Real Estate Index 3/29/19; 1, 3, 5-yr returns through 3/29/19

Reasons for the decline are that:

- Most REITs have been proactively addressing their debt maturities while accessing the equity market aggressively over the past years as interest rates declined and ahead of potential movements in interest rates, and

- Due to low cap rates, it is more difficult to find acquisitions that pencil out, although many REITs still have strong acquisition pipelines.

REIT returns rebounded in 1Q19 to 15.9% for Americas REITs vs. 15.6% for Asia/Pacific REITs, 15% for Global REITs, 11.7% for European REITs, and 1.4% for Middle East/Africa REITs. The top-performing REIT sectors on a total return basis in 2018 were health care, infrastructure, and residential, not far from 1Q19’s top performers of infrastructure, residential and timber (see Figure 2).

Figure 2: REIT Issuance

Source: FTSE Nareit; Historical Offerings of Securities 3/31/19; Equity includes IPO and secondary offerings

Issues for REITs

Retail

Although all sectors are performing well in 2019 on a total return basis, retail is subject to the overhang of e-commerce, consumer sentiment, and elevated store closure announcements in 2019 that could approach 2017 levels. However, as with most sectors, there is a greater bifurcation between the higher and lower quality properties.

REIT Mergers & Acquisitions

REIT M&A in 2018 surpassed 2017 ($26 billion) and other years with ten deals totaling $74 billion, most of which were public to public transactions. The main reason for the busy M&A year is the dichotomy between public and private valuations where many public REITs trade below NAV. Real estate M&A activity in 2018 was 140% above the 5-year trend with Brookfield and Blackstone deploying over half of the total. Private investors with a long-term focus are perceived to be more patient vs. public investors that are earnings focused and reactive to daily market volatility. Public companies are often not rewarded for growing complex businesses through JVs or acquisitions.

Technology Innovation/PropTech

Technology is the current disrupter. Various REITs have invested in property technology (PropTech) ventures with other REITs to evaluate, finance and test the emerging technologies. Whether it is a PropTech investment or creating a new property database, model or app, the intersection of technology with the real estate business should provide better, more reliable and different ways to access real estate information. Many REITs are also experimenting with technology to address customers’ needs, increase operating efficiencies, and cut costs.

The bottom line is that REIT fundamentals continue to improve as they refinance through debt and equity issuances, dispose of non-core properties, and create more portfolio opportunities through the use of technology. •