The Counselors of Real Estate® and its 1,000 credentialed real estate advisors have identified the current and emerging issues expected to have the most significant impact on all sectors of real estate. The Top Ten Issues Affecting Real Estate® are determined through broad membership polling, discussion, and debate. Now in its 13th year, this signature thought leadership initiative is an invaluable resource to clients of Counselors worldwide and to the real estate industry in general.

The rate of change in the industry is rapid and—with many of the issues interrelated—the common denominators are people, goods, and money. We welcome your feedback on the 2025 Top Ten Issues Affecting Real Estate®.

The Issues

Issue #1

Global & U.S. Elections

Subject Matter Experts: Constantine Korologos, CRE and Nicholas Chatzitsolis, CRE

The only certainty is the uncertainty.

Elections are front and center in the U.S. and globally with major elections across more than 70 countries that could shake up an already volatile geopolitical landscape. For real estate, the big issue is the uncertainty these elections create and how that uncertainty layers into real estate performance and decisions.

In the U.S., the late-game shift from a Biden to Harris presidential ticket and the selection of Minnesota Tim Walz, has only fueled that uncertainty. It is difficult to near impossible to predict the outcome of the presidential race, as well as which party will control the House and Senate following the November election.

On the other side of the election, there is still more uncertainty ahead in what results are likely to mean for key policy moves with a Congress that has a difficult time agreeing on anything. The outcome of the election and who ends up in the White House will have a big impact on issues such as regulation, trade, corporate taxes, sustainability, and immigration policy.

Key issues to watch:

- A Biden/Harris proposal that would call on Congress to pass legislation giving corporate landlords a choice to either cap multifamily rent increases on existing units at 5% or risk losing current valuable federal tax breaks.

- The elimination or modification of the 1031 like-kind exchange appears to have resurfaced again.

- Presidential policy also has the potential to impact economic growth and inflation, which will in turn influence Fed monetary policy in 2025 and beyond.

High stakes elections

Other countries are concerned about the possible power shift in the U.S. One issue in particular is whether a change in leadership in the U.S. would result in increased military involvement in the Russia-Ukraine war, which could escalate violence and volatility in the region. A second key issue is whether the new president would be less inclined to collaborate with other countries, instead taking a view that every country should be self-sufficient. Both of those issues could have significant impacts on global trade and regional economies.

And while the U.S. casts a big shadow, there are high stakes elections across the globe in countries such as Taiwan, Mexico, South Africa, and the EU, among others. The key theme is uncertainty and instability, which has a number of ramifications for the geopolitical climate and global economy. For example, legislative elections in France resulted in an unprecedented situation where its parliament is now divided into three parties, which has created confusion with no one party in clear control. That environment combined with high interest rates and rising building costs contributes to bigger challenges in property markets.

A side dish of politics

Uncertainty related to the political landscape is definitely one of the factors that is weighing on real estate decision-making and transaction activity. Regardless of the election results, investors will be looking for greater clarity on how the outcome is likely to impact key issues such as regulation, economic growth, inflation, and interest rates. Global elections that contribute to greater geopolitical risk also will impact expectations for risk-adjusted returns and real estate asset pricing.

Specific to the U.S., the outcome of the presidential election is an important consideration. However, the main focus or entrée so to speak is the huge load of looming commercial real estate loan maturities. All eyes are on the higher interest rates and liquidity issues that could result in challenges for borrowers and lenders holding the debt and the potential buying opportunities that may emerge due to distress. Although regulators will have a say in how that bank debt ends up being unwound, the new administration will play an important role in setting the tone for regulators and driving the economic path forward that influences Fed decision-making on interest rates. With the August 2024 job report appearing to signal a weakening economy, the equity markets have reacted, raising concerns of a recession. The direction of policy could have an even greater impact. Hang on for the ride.

Issue #2

Cost of Financing

Subject Matter Expert: James Costello III, CRE

Investors are still “stuck” on high costs

Where are financing costs headed? If any of us could pinpoint with certainty how interest rates are going to move over the next 12 months, we would likely be sitting on a yacht somewhere in the Caribbean. With that caveat, inflation does appear to be cooling and is within reach of the Fed’s 2% target.

Investors who had been anticipating as many as five rate cuts in 2024 have been sorely disappointed. This disappointment has, in turn, weighed on investor expectations for commercial property. The Fed began its rate-cutting cycle in September, while the timing and number of subsequent cuts remain to be seen.

What does appear clear is that, barring an unforeseen shock, the era of free money that has existed since 2009 is over. Considering the long run for cheap capital, that is proving to be a tough adjustment. We have a whole generation of people who weren’t in the market before 2009, and their expectations were formed in an environment where central banks around the world were injecting liquidity into the system.

Has the bleeding stopped?

There’s no question that higher costs are making it more difficult to assess market value and pencil out deals. On a positive note, the sharp drop in transaction volume that occurred last year shows some signs of stabilizing. According to MSCI Real Assets, the slide in deal volume and pricing that started in 2022 came to an end in the second quarter 2024 with a minor 2% dip in year-over-year volume.

Although it is too soon to call a market bottom, the fact that the bleeding has stopped is good news. The spike in interest rates created an immediate aftershock in the market, and it has taken a while for expectations that rates are going to be higher for longer to roll through the marketplace. But people are starting to get the message. Deal volume is not falling at the same extreme pace, and it appears that deal volume is close to stabilization. Rate cuts by central banks in Canada and Europe also is giving U.S. investors some hope that a monetary policy turning point is approaching.

Now for the glass half-empty side. Second quarter deal volume received a big boost from Blackstone’s $10 billion acquisition of AIR communities. Without it, volume would have been down 13% year-over-year for the quarter. So, even though the market is nearing a turning point, it would not be a surprise to see deal flow fall again in the third quarter. In addition, rate cuts alone may not be enough to fuel deal-making with investors wary about slowing rent growth impacting NOI.

Buyers on the sidelines

Assuming that the rate environment is normalizing, what will it take to unstick deal flow? Part of what needs to change is more interest from both buyers and sellers. Right now, owners don’t want to sell in unless they must and buyers are wary of paying too high prices, particularly in a market where there is the potential for forced sales of distressed assets related to loan maturities.

Despite financing costs that have gone from sub 4% to more than 7%, some buyers are still finding ways to make acquisitions work, such as by targeting higher cap rate deals. However, it could be another two years before buyers are willing to jump into the market more aggressively given the higher interest rates and lingering uncertainty on Fed rate cuts.

Issue #3

Loan Maturities & Debt Repricing

Subject Matter Expert: Constantine Korologos, CRE

Kicking the can on commercial real estate loan maturities

The real estate industry isn’t making much of a dent in clearing its mountain of looming debt maturities. According to Trepp, nearly $1.8 trillion in commercial real estate loans are set to mature before the end of 2026.

Lenders are doing their best to postpone maturing debt with extensions and modifications. Many of the loans that were set to mature in 2023 were extended into 2024 and beyond, and loans maturing in 2024 are being extended out to 2025. The hope is that conditions will shift to relieve some of the pressure on liquidity, whether it’s lower interest rates, fresh equity capital, or improving NOI performance.

At some point, the ability to push maturities out is going to hit a wall. If, or more likely, when it does, lenders are going to be facing a higher volume of loans that will be more challenging to clear. The banks hold a significant proportion of that debt and have limited flexibility in what they can do about it because of regulatory oversight. Banks are not going to be able to continue to extend loans without sufficient capital reserves behind it.

Climbing out of a deep hole

Subsequent to the half point rate cut in September, baseline forecasts from economists are for the federal funds rate to decline from a 23-year high of 5.25–5.50% to settle at 3.5 to 4.0% by the end of 2025. While that can change with shifts in economic conditions and government policy (remember, we have an election in November), there is no indication that rates will approach the recent lows of the last four years. Either way, it is still significantly higher for those borrowers who were buying property at sub-4% cap rates and putting debt on property when rates were approaching zero. Borrowers with near-term maturities are looking at new debt service payments that, for many, could be as much as 75% to even 100% higher than their prior loan.

Debt cost “on steroids” also pushed values up, which makes it more difficult to refinance as values reset at lower levels. Even if interest rates do come down as presently forecast, it may not be enough for those borrowers facing maturity balances that are too high to refinance. The outcome is likely to result in a shake-out among weaker operators and those owners that are not well capitalized.

How “Noisy” will resolution be?

Borrowers and lenders alike are looking to buy more time with extensions. If the loan maturities can be unwound slowly, it creates an opportunity for the market to catch up so that less has to be worked out. How those maturities are resolved has the potential to create a domino effect on values.

If the building across the street has debt that’s maturing and they can't refinance it, the note may be sold at a discount to a new owner who has a much lower basis, and that changes the competitive landscape. They could reduce rents and pull tenants away from neighboring buildings, which may result in further distress and loan defaults; distress could fuel more distress.

Is this wave of loan maturities going to push distress to levels such that the impact results in more bank failures, or can it be unwound methodically with less of a noisy impact? There is no clear answer to that yet. The market is still watching to see how things unfold. Certainly, there is a lot of opportunistic “dry powder” capital that has been raised, waiting on the sidelines to jump on assets and notes at an appropriately priced, risk-adjusted level. Ultimately, it is not so much the staggering volume of maturities that is concerning as it is how those maturities are managed and what kind of “collateral damage” occurs as those loans clear the system.

Issue #4

Geopolitics & Regional Wars

Subject Matter Experts: Hugh Kelly, Ph.D., CRE Emeritus

We live in a risky world, and we need to pay for it.

It doesn’t take a geopolitical expert to see the turmoil flaring up in hotspots around the world from wars in Ukraine and Gaza to attacks on shipping vessels in the Suez Canal.

We pay for that risk in many ways. The geopolitical landscape is a complicated web that sends ripple effects into real estate markets through factors including as supply chain disruption, inflation, immigration, labor, housing affordability, climate, and monetary policy. Such factors in turn impact costs, supply and demand for real estate, expectations for risk-adjusted returns, and, ultimately, how real estate is priced.

Safe harbor for capital

During times of increased risk, international capital flows to the safe harbor of the U.S. dollar and U.S. dollar-denominated investments. That international capital has a very real impact on U.S. commercial real estate prices. Although real estate transaction volume has not rebounded to levels that existed prior to the Fed’s recent rate hiking, capital will come back as people adapt to the new rate environment.

The positive impact of international capital is offset by two things. The first is that the basic supply and demand vying for commercial properties is attenuated in various sectors. Office is struggling with the slow return to the workplace. Retail is feeling pressures from e-commerce and weak consumer confidence, and industrial is dealing with supply chain disruptions that affect the demand for large industrial warehouses. Investment pricing has to reflect these risks and uncertainties.

Pricing in risk

The bottom line is that cap rates will move higher. Investors should expect prices, capitalization rates, and debt rates to have a greater risk premium that reflects the increased risk around us. Even with the Fed potentially easing rates, we’re in a “higher-for-longer” period in the risk-free rate. But the risk premium is too thin; the layer of return above the Treasury rate has to expand rather than compress. So, even if the Fed reduces the risk-free rate by 25, 50, or 75 basis points, cap rates are not going to decline by the same measure.

One last takeaway for real estate; it's very dangerous to extrapolate the future based on the last couple of years. Real estate tends to think in terms of cycles and trends, but we’ve just been through a massive disruption in the form of the pandemic, and the wars and conflicts we’re now seeing around the world are not well modelled by cycles.

We must accept that we are in a disrupted world and look beyond simple algorithms and simple patterns. This is not a time to be making broad-based assumptions. Make plans based on the idiosyncratic conditions that face us, and the particulars in a given property type and geographic market. Knowledgeably real estate investors have always understood that you can make good investments in bad markets, and you can make bad investments in good markets. Those kinds of judgments are critical in an era where risk is the dominant framing condition.

Issue #5

Insurance Costs

Subject Matter Expert: Robert Griswold, CRE

From sticker shock to cost-saving strategies

Soaring insurance costs over the past few years have created a steady stream of anecdotes of double- and even triple-digit premium increases.

Owners are reeling from a perfect storm of converging forces that include inflationary pressure on construction costs, updates on insured property values, and a push from insurers to recoup losses from a flurry of extreme weather events. Last year was another record-breaking year of damaging global natural disasters with $380 billion in economic losses – only 31% of which were covered by insurance, according to Aon’s 2024 Climate and Catastrophe Insight Report.

Although a smaller part of insurance spend, the casualty side of the market also is becoming more challenging. Properties in the residential, hospitality, and senior living spaces are disproportionately affected. Claims are growing from both a number and dollar standpoint, in part because of higher costs related to injury claims, as well as “runaway juries” that are delivering inflated awards.

Further exacerbating the pain property owners are feeling from rising costs is onerous government legislation. In California, for example, there are now dozens of “habitability lawsuits” filed every day where multifamily property owners and their insurers are forced to settle rather than risk being on the hook to pay the plaintiff’s legal fees. A California law says if the plaintiff prevails at all (even 1% of a claim), the plaintiff can submit all their legal fees for reimbursement from the defendant, which further highlights the need for tort reform.

Focus shifts to solutions

The market is showing some signs of relief in stabilizing cost increases in the property insurance market. That is welcome news for property owners as property insurance typically makes up about 60 to 70% of the overall premium spend on a property-level basis. However, with insurance costs now taking a bigger bite out of NOI, attention for many owners is shifting to developing better strategies to manage risk and value-engineer coverage.

Owners need to work with insurance brokers to make sure underwriters have accurate, up-to-date information on a property and replacement costs so that they can then plug into their underwriting models to accurately assess valuations. Industrial is an example where CoreLogic estimates may be 30% higher than the typical replacement cost.

Rightsizing coverage and assessing deductibles also can help to generate cost savings or increased efficiency. In multifamily, for example, some owners are structuring insurance coverage with an aggregate deductible. Similar to an individual’s healthcare insurance deductible, a policyholder pays out of pocket for costs up to a certain threshold and then coverage kicks in when that deductible is reached. An added benefit of this structure is that it empowers owners to better manage those costs.

The search for alternatives

Alternative risk transfer is another way to structure insurance. For some, it’s a way to manage financial risk, while for others it’s a solution for owners that are having a difficult time getting coverage from the traditional insurance marketplace. Programs are highly customized to an individual owner or company rather than an “off-the-shelf” solution. However, in most cases, programs are structured with some blend of risk transfer across a portfolio that helps to manage risk and create a fixed rate across a multi-year policy.

The most important thing for owners and managers to look at over the longer term is why are losses increasing, and how can they more efficiently manage risk? Can you take on some of that exposure and self-insure, or how can you better structure contracts with third parties to transfer that risk? The old way of buying insurance is likely a relic of the past, and owners will need to look at devising solutions to make their programs as efficient as possible over the longer term.

Issue #6

Housing Affordability & Attainability

Subject Matter Expert: Kim Betancourt, CRE

[Editor’s Note: This summary was compiled and written by Beth Mattson-Teig based on an interview with Kim Betancourt.]

Rising costs exacerbate housing affordability

The lack of affordable housing has been a persistent problem that appears to be getting worse, not better. Although multifamily rent growth stabilized and has even turned negative within some metros over the last year, rents have generally climbed steadily higher over the past 15 years. Nationally, average multifamily rents are estimated to have increased by 45% for the 2009-2023 period, according to Fannie Mae.

Affordability is partly a function of the housing shortage, which, according to Fannie Mae, is estimated at 4.4 million units, as of 2019 across all types of housing in the U.S. Despite high levels of multifamily construction in recent years, the market is still playing catch-up from the pullback in building that occurred during the Great Recession. Further compounding the problem is that development has not been evenly spread out across the country, with activity concentrated in about 15 to 20 of the nation’s larger metros.

We do need to build more housing to address the shortage, but the country can’t solely rely on building our way to affordability. Another important piece is preserving more of the existing naturally occurring affordable housing. The path forward will require both components.

Renters bear bigger cost burden

Of course, “affordable housing” is not isolated to just low-income households. More affordable housing is needed across the board, from the capital ‘A’ Affordable housing that provides subsidies for low- and moderate-income renters to the lower-case ‘a’ affordable housing, which is also called naturally occurring affordable housing, as well as workforce housing.

Notably, the percentage of cost-burdened renters increased following the pandemic. The most recent data from the American Community Survey as of 2022 shows that nearly 54% of all renters were considered cost-burdened, which means they spend more than 30% of their household income on rent and utilities. That percentage is higher than during the Great Recession, when 48.7% of renters were considered cost burdened.

Challenging outlook

The shortage of affordable housing is not getting any better, and the concern is that it could get worse over the next few years due to a combination of factors. One is the recent trend in declining multifamily construction starts, which means less new supply with fewer projected deliveries two and three years from now. Another is demographics that suggest growing demand. The group most likely to rent apartments is the age group between 20 and 34 years old, and demand from that cohort is expected to continue to increase over the next several years. Those supply and demand dynamics are likely to further exacerbate housing affordability, beginning as soon as the end of 2025.

Affordable housing is not an easy problem to solve, and what is clear is that government alone can’t fix it. The private sector needs to be involved. Certainly, the market needs low-income housing tax credits, local subsidies, and zoning to support the creation and preservation of affordable housing. We want to make sure that communities are safe and built in a way that makes sense, but we also must allow for innovation and more density.

Issue #7

Artificial Intelligence

The AI spotlight shifts to inputs and algorithms

Subject Matter Expert: Timothy H. Savage, Ph.D., CRE

The meteoric rise of ChatGPT pushed AI into mainstream consciousness. As we noted in the 2023-2024 Top Ten report, the AI genie is “out of the bottle” with growing discussions around applications. AI continues to advance with individuals becoming more accustomed to using large language models, of which there are many.

Although it’s easy to get lost in the noise surrounding AI, there is growing awareness that significant work still needs to be done. AI runs on algorithms, and quality inputs to those algorithms are crucial in driving effective data-driven results. Specifically, three substantial issues as it relates to commercial real estate are accuracy, granularity, and timeliness.

Sharpening data inputs

Accuracy, granularity, and timeliness lie at the core use of AI in real estate. Multifamily figured this out a long time ago, which is why they can use algorithms to optimize rents based on vacancy and other factors. The core lies in the input accuracy. We call it measurement bias, but an algorithm simply cannot step around inaccurate data. It is far more important to see 10% of the universe accurately than it is to see 100% of the universe inaccurately.

The shortcomings in timeliness are obvious. Stock markets trade in nanoseconds, but commercial real estate has a lag in collecting data on trades and valuations. Granularity gets to the idea of location, or as we like to say in real estate – location, location, location. This is where AI faces limitations.

Real estate professionals understand that assets differ, but they cannot be moved. An office building in Omaha is not the same as an office building in New York City. Currently, the algorithm doesn’t fully understand this concept because the algorithm doesn't live anywhere. It doesn't understand the value of a Main & Main location. It can be taught that, but only through human intervention.

More work ahead

There is some collective wariness around AI inputs. How good is the data? How useful are the decisions that arise from that data? We need to address these ideas.

Historically, commercial real estate data has been fragmented, although there are several prominent organizations that are addressing data regularization. Private equity shops recognize that they have large volumes of data in-house that can potentially fuel better data-driven decisions. We can better train the algorithms if data is accurate, granular, and timely.

It also is important to acknowledge the importance of algorithms to the real estate of data centers.

The challenge that data centers face is AI algorithms cannot currently be serialized. A good analogy is the Clark Griswold string of holiday lights. If one bulb went out, the entire string didn’t work. Then we learned to serialize so that if one bulb didn’t work, the rest of the lights would still function. We don't yet have the technology to serialize these AI algorithms.

As a result, AI algorithms require a huge amount of computing power, which in turn is fueling the boom in data center development. Data centers are built on a process that is economically inefficient, but historically humans have solved these problems. A risk for commercial real estate is that if we do serialize algorithms, data centers become a less sexy investing opportunity.

Issue #8

Sustainability

Subject Matter Expert: Daniele Horton, CRE and Vladislav Ilic, CRE

Prepping for future-ready real estate

Sustainability is nothing new for a real estate industry that has focused on energy efficiency and green buildings for decades. Two issues now pushing sustainability into the top 10 are extreme weather events and a changing regulatory environment.

The financial risks related to extreme weather are difficult to ignore. Events such as hurricanes, tornadoes, flooding, and wildfires are increasing in frequency and severity. The U.S. National Oceanic and Atmospheric Administration (NOAA) confirmed that 2023 was Earth’s hottest year on record, with an unprecedented 28 disasters in the U.S. that exceeded $1 billion in damages.

Property owners are continuing to feel growing pressure from both internal and external sources to better understand their carbon footprints and engage in decarbonization. Part of that pressure stems from growth in sustainable investments and sustainable finance, as well as a push for greater corporate accountability. Demand for greater transparency into sustainability also is providing added fuel for a changing regulatory environment.

Carrot vs stick approach

Whether real estate owners choose to be proactive or reactive, there is a new regulatory framework around sustainability on the horizon. Europe is taking the lead in introducing more stringent regulations and reporting requirements. The EU’s new Corporate Sustainability Reporting Directive (CSRD), which is set to go into effect with reporting on 2024 financials in 2025, strengthens the rules concerning the social and environmental information that companies must report. The rules apply primarily to large public companies based in the EU, as well as some non-EU companies that have significant operations or sales in that region. The U.K. also has created a new Minimum Energy Efficiency Standards (MEES) that require landlords to achieve an Energy Performance Certificate (EPC) rating of “E” or above or face potential penalties.

Although Europe is emerging as a market leader, it’s not a perfect roadmap for others to follow. New requirements are complex and difficult to navigate, and some view it as an uneven playing field, with a bigger compliance burden on larger corporations. In addition, not everyone is starting at the same level in terms of their knowledge and capabilities. In short, it could be a bumpy path, undoubtedly with pain points and modifications ahead to adhere to new reporting requirements.

In the U.S., the SEC’s new rules on climate reporting may never see the light of day following a series of legal challenges. However, even without formal mandates, more companies are voluntarily increasing their investment in sustainability, and there also is an expectation that more stringent regulations will continue to be put in place at the local and state levels. To date, roughly two dozen U.S. states have introduced legislation aimed at improving building performance standards related to reducing greenhouse gas emissions and increasing energy efficiency in buildings. That changing regulatory environment is going to push the commercial real estate industry to get ahead of new rules and protect property values by future-proofing assets.

The business case for resiliency

Whether the language is around “sustainability” or “green” or “ESG,” the underlying focus is the same. There is a push to position buildings as future-ready by making them more energy-efficient and more resilient in an environment where the frequency and severity of extreme weather events are on the rise.

Commercial real estate needs to embrace technology and AI to not only advance sustainability initiatives, but to better understand carbon footprints, capture data to measure consumption, comply with regulations and reporting requirements, and track progress in achieving decarbonization and sustainability goals.

Granted, it’s difficult for owners who may be fighting tooth and nail to hold onto properties to think about sustainability on top of those challenges. But it’s also critical to focus on sustainability to preserve value and manage a multitude of risks, whether it is regulatory risk, investor risk, and extreme weather events, among others. All of these factors have very real financial implications and are driving a strong business case for increasing investment in sustainability.

Issue #9

Office Vacancies, The Tax Base & The Health of Urban Cores

Subject Matter Expert: Ruth Colp-Haber, CRE

While other areas of commercial real estate have recovered from the dramatic effects of the pandemic, office is continuing to battle fundamental changes in how and where people choose to work that have weakened overall demand for space. According to CBRE Econometric Advisors, the overall U.S. vacancy rate is expected to peak at 19.7% by the end of 2024.

We’ve been waiting for work from home to abate, whether that’s workers choosing to return or employers insisting people come back. Yet there has been little progress over the past two years. In New York City, for example, the attendance rate is approximately 50%.

Structural shifts in workplace behavior have big ripple effects for office owners, lenders, and investors, as well as the health of central business districts (CBDs). Urban centers have long relied on office buildings for their contributions to the tax base and a daytime office population that drives a bigger real estate ecosystem and CBD experience.

Seismic ripple effects

The office sector faces big questions that will continue to play out over the next five years. What’s going to happen to these empty buildings? What’s going to happen to the debt on these buildings? What’s going to happen to the cities that have diminished tax revenue?

Challenges are not the same everywhere. But when one goes to a CBD in a major metro such as New York, San Francisco, Chicago, or Philadelphia, the impact on the landlords is evident. Lower occupancies mean lower NOI and lower valuations. Capital for office properties has dried up, and even for those that can find financing, capital is more expensive, and owners need to put in more equity. Many of the office buildings that are facing the biggest occupancy challenges need updating and renovations, which will require even more capital.

CBD office is at the core of a city's economy, and many cities are beginning to fear the effects of depressed CBDs. In some cases, property values have dropped by as much as 50% or more. It takes time for lower values to work through the appraisal and tax appeal process before it starts impacting city finances. But we shall see the impact over the next decade.

Time for creative thinking

All of these big cities need more affordable housing, but converting office space into housing is not an easy thing. It's expensive, it's time-consuming. Sometimes it doesn't make sense, and the more practical solution is to demolish the office rather than converting the existing structure to a new use. The successful cities will reinvent themselves, and we're starting to see that in New York. The areas of the economy that need help, such as residential, healthcare, and education, are emerging as users for parts of these commercial buildings.

The decline of urban centers is not a new phenomenon. Cities have seen cycles of decline where there has been an exodus from downtowns to the suburbs for various reasons, such as crime and a better cost of living. Once again, now is the time to dig in and be creative and imaginative in strengthening CBDs, which is going to involve a more diversified mix of uses and repurposing of empty office buildings. Solutions also will require more collaboration between the industry and public and private community leaders.

Issue #10

Price Expectations Gap

Subject Matter Expert: James Costello, III, CRE

Loan maturities could help bridge the divide

Buyers and sellers are still in a standoff when it comes to asset prices. The good news is that the gap isn’t getting any wider.

Prices were falling at a fast clip in 2023, and every sector has gone through a pricing adjustment – some bigger than others. However, even for the industry’s problem child – CBD office – declines are decelerating. Prices on CBD office assets that were on a year-over-year pace of decline at 35% in 2023 improved to -29.4% as of second quarter, according to MSCI Real Assets. Although those are still tough numbers, that provides at least some glimmer of hope that things may be turning the corner.

Pricing shock is dissipating

The data shows that the worst of the pricing declines are in the past and pricing is now trending towards improvement across most property types. Industrial is one sector where there is less of a pricing gap because buyer demand and pricing has held up better than other sectors. Industrial reported an 8.6% one-year increase in pricing in the second quarter, according to the RCA CPPI™.

It does appear that the pricing shocks that the market experienced when interest rates started spiking are moderating. That is not to say that trends will continue on a straight upward path. A number of factors could pop up that could change that trajectory and weaken pricing, such as slowing economic growth or a drop in consumer spending.

Buyers wait for distress

For now, many buyers and sellers are stubbornly holding firm on their positions. Sellers don’t want to take a loss unless they have to, and buyers are still wary of overpaying for assets in a market where interest rates are higher, and growth and income could decline. However, the big wave of loan maturities could very well push both sides together.

Owners facing a costly refi will have to make some tough decisions, and there is a lot of capital on the sidelines that could begin to move more aggressively depending on the asset. Other variables that could help to narrow the gap are a decline in interest rates, as many hope, or a reacceleration of rent growth.

And while buyers are still cautious of making a move that ends up catching that falling knife, there may be less chance of having their fingers cut off now than there was a year ago. So, they may be a little more willing to take risks.

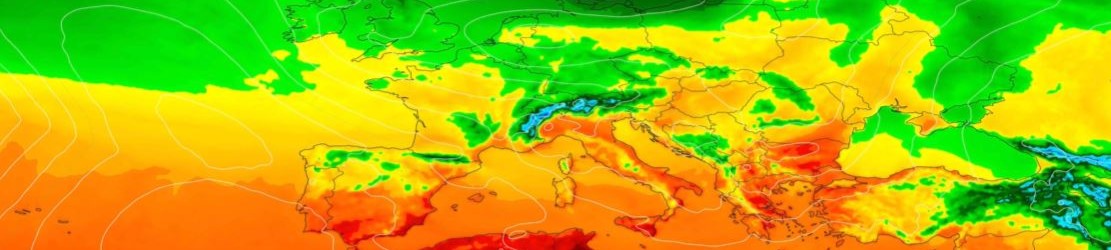

The European Top Ten Issues

The ongoing war in Ukraine continues to have a significant impact on events in Europe. This includes disruptions in supply chains and the availability of Ukrainian workers in various parts of Europe. It also affects the supply and costs of essential resources such as gas and oil. However, the most critical issue is the continued suffering of civilians in the war-affected areas, including Ukraine.

The ongoing war in Ukraine continues to have a significant impact on events in Europe. This includes disruptions in supply chains and the availability of Ukrainian workers in various parts of Europe. It also affects the supply and costs of essential resources such as gas and oil. However, the most critical issue is the continued suffering of civilians in the war-affected areas, including Ukraine.

In terms of financing, despite the downward trend in interest rates, the current cost of financing in combination with a mix of high construction costs, increasing approval process requirements, and the need for measures to benefit the environment such as meeting ESG and Green initiatives as well as the EU Taxonomy, still represent a huge issue for new development in many regions of the EU. The problem also extends to secondary markets, where there are demands for refinancing, a drop in value, and increased pressure on financing and equity due to the push for improved technical standards of existing buildings. A noticeable gap in price expectations/needs in both the investment and rental markets leads to deferred demand that may be realized once the situation stabilizes.

The differences in the priority of issues between Europe and the U.S. are based on the continent-specific urgency of each issue. However, it's important to note that we are dealing with the same problems, albeit with varying degrees of urgency.