The Outlook for the US Economy, Commercial Real Estate, and Housing

Executive Summary

Economic and geopolitical uncertainty resulted in significant volatility for a wide variety of data points in 2022. Recession probabilities for 2023 remain high not just for the US but for many countries around the world; however, consensus forecasts suggest that most market players expect a relatively short, shallow downturn, with recovery to ensue later this year through 2024. Multifamily, commercial real estate, and housing followed different paths, with some property types having income drivers like rents and vacancies holding steady; while metrics like home prices entered correction territory.

I. Introduction

To say that calendar year 2022 ‘exhibited volatility’ is an understatement: for a host of measures ranging from consumer sentiment, key financial sector metrics, and performance metrics for US commercial real estate and housing – it was nothing less than a roller coaster. Some were not surprises: in late 2021, it was clear that the Federal Reserve was going to tighten monetary policy. Others are so-called ‘black swan events’ – by nature difficult if not impossible to predict – like the impact of the Russia-Ukraine military conflict. What should we expect for 2023? Are we done with the roller coaster ride? Or should we expect to rush back in for another round of high speed camelbacks and inversions, as if we had ‘fast pass’ lane access in an amusement park?

II. The Roller Coaster Ride That Was 2022

Camelback #1: The Real Economy

‘Camelbacks’ represent a hump-shaped hill element found on roller coasters, where you basically go up and down. For US GDP throughout 2022, the first half represented the bottom of the hump, and the latter half offered somewhat of a ride upwards.

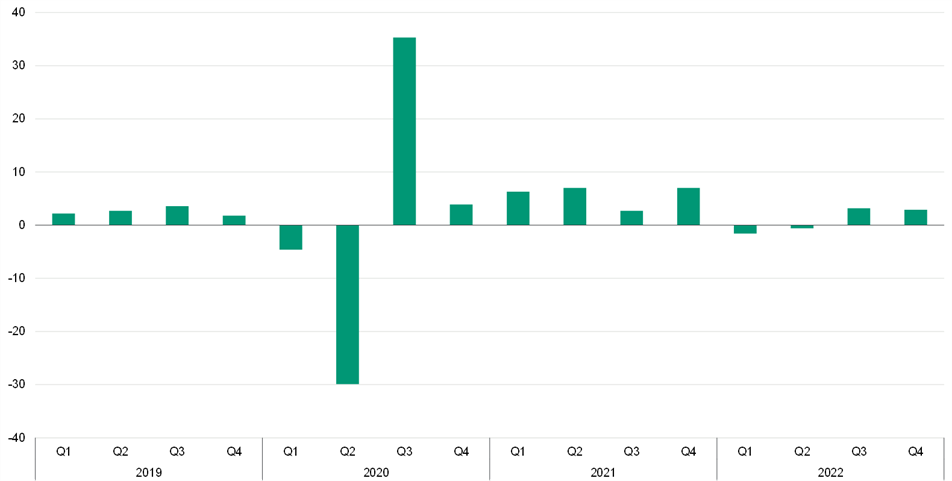

Figure 1. Quarterly US Real GDP Growth (Annualized) | 2019 to 2022

Source: Bureau of Economic Analysis

After posting two quarters of negative growth, US real GDP growth turned positive in the third quarter. Advanced estimates released by the Bureau of Economic Analysis (BEA) on January 26 shows that the US economy grew by 1.00% in real (inflation-adjusted) terms for all of 2022 (fourth quarter versus fourth quarter). Given how the BEA tracks GDP, annual 2021 versus annual 2022 actually paints a rosier picture, with the US economy growing by 2.1% net of inflation.

As it turns out, the worst of our fears for 2022 did not materialize. There may yet be a surprise from the National Bureau of Economic Research (NBER), the organization that is responsible for dating the start and end of US recessions. But despite common understanding[1] of recessions being ‘two or more quarters of negative GDP growth,’ it appears that we did not in fact run into a recession in 2022.

Camelback #2: Consumer Sentiment

And yet – very much because of high energy prices driven by the Russia-Ukraine military crisis – consumer sentiment followed a comparable roller coaster path throughout the year.

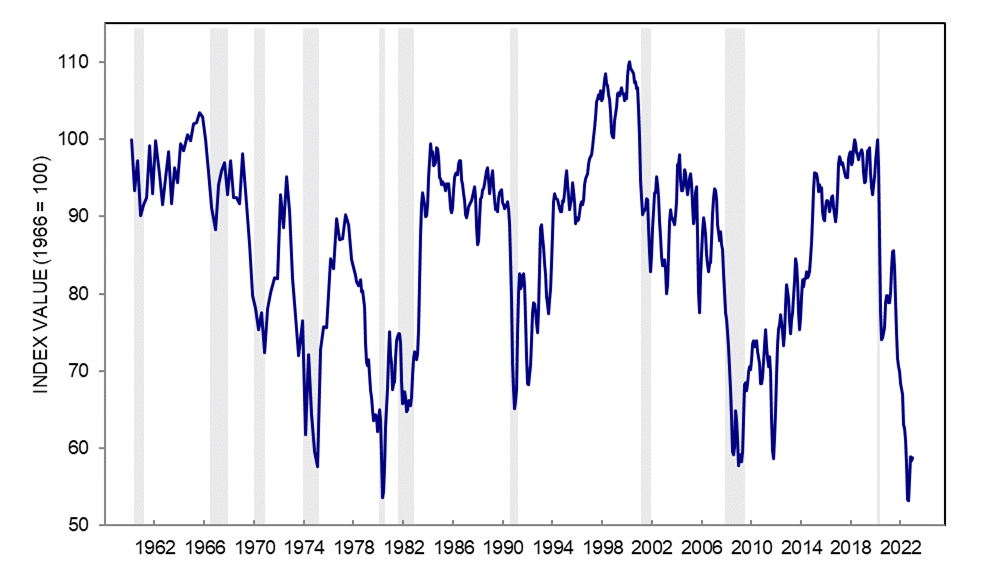

Figure 2. Index of Consumer Sentiment (1962-2022)

Source: University of Michigan Consumer Sentiment Survey, 1962-2022

The chart above shows how the University of Michigan’s Consumer Sentiment index actually hit an historic low in August 2022. According to this metric, US consumer sentiment began turning negative at or around the year prior – July 2021 – following that camelback hump downwards at a steeper rate from March 2022 onwards. The index has been rising since September 2022, right around the time gas prices stabilized.

Inversion #1: Recession Probabilities

‘Inversions’ in roller coasters represent tracks that turn riders upside down before returning them to a upright position. Throughout 2022 recession probabilities across the world have risen (and stayed high). That represents an ‘inversion’ relative to economic growth: we are expecting a much higher risk of contraction for many economies around the world, as opposed to GDP rising.

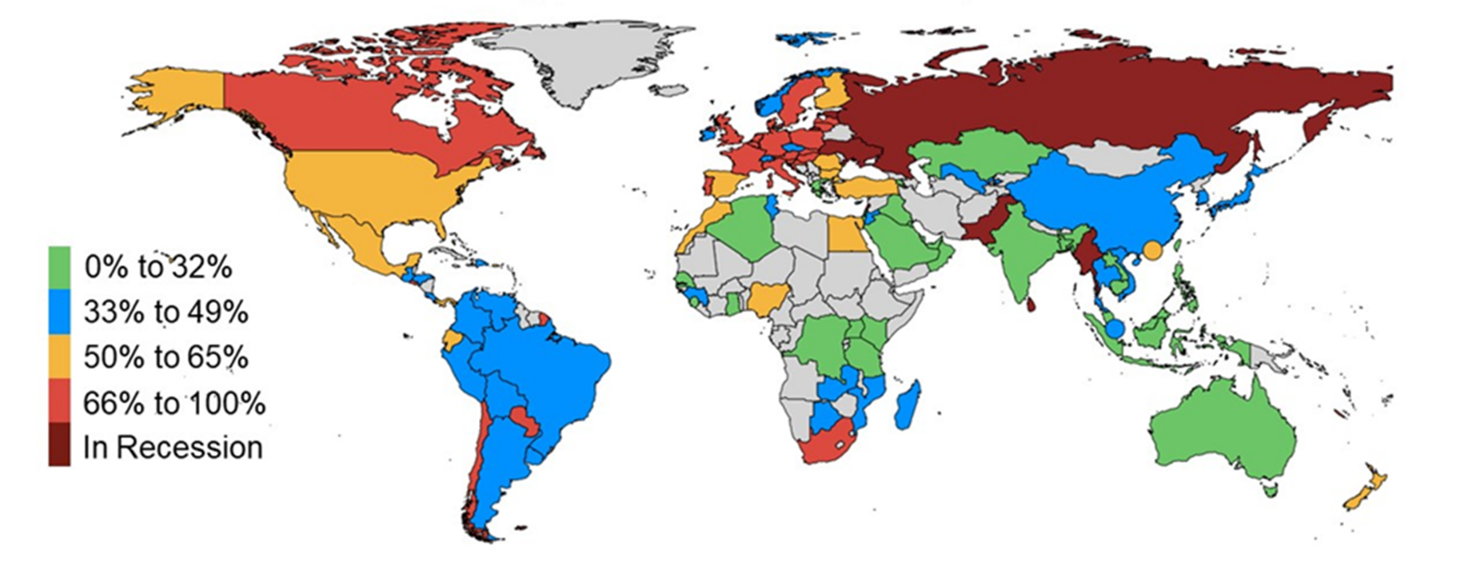

Figure 3. Recession Probabilities Around The World

Source: Moody’s Analytics

Moody’s Analytics estimates that the US sits at a 50 to 65% chance of a recession in 2023. Our baseline forecast is that the US economy will still grow, however, at or around 1.0%. What justifies this relative optimism?

Not-Quite Inversion: Job Creation Trends

Despite headlines of several companies and industries shedding jobs, it does not look like job losses have become systematic. Throughout 2022, job creation has slowed – that is not a surprise when GDP growth shifts from 5.5% from 2021 to 0.91% in 2022. But it has yet to turn negative – in other words, despite recent announcements from Google/Alphabet, Microsoft, Amazon, and other tech companies about layoffs,[2] it has (as of January 2023) yet to spill over into widespread job cuts across many industries.

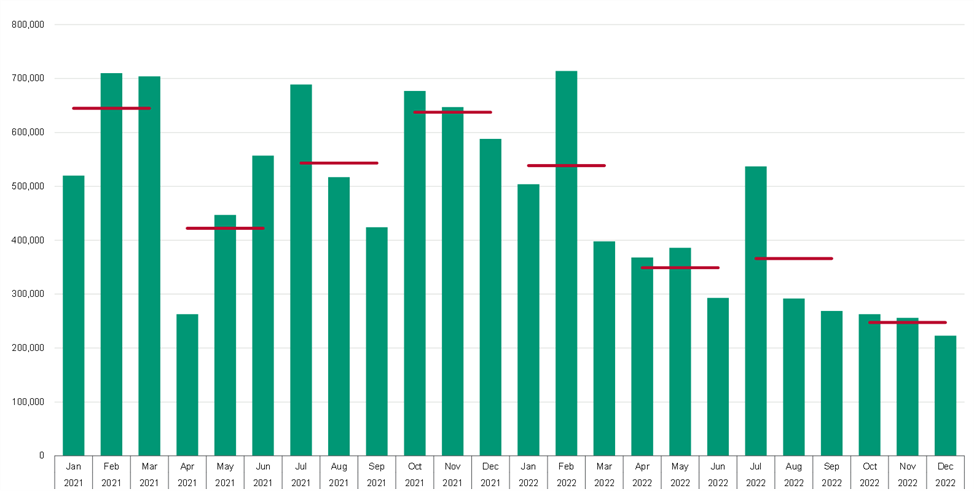

Figure 4. Job Creation Trends from 2021 to the Present

Source: Bureau of Labor Statistics

Is that downward trend worrisome? Yes. Statistically speaking, the moment monthly job numbers from the BLS post negatives, there is a 50% chance that a recession has already begun. Consumer sentiment might measure how respondents feel, but once job losses become widespread negative consumer sentiment usually translates into a pullback in consumer spending: you will cut expenses once you’ve lost your source of income.

Still, there appears to be some reason for relative optimism. Job openings are down from recent highs, but one metric suggests that the majority (79%) of workers laid off in the tech industry find jobs within 90 days.[3] Furthermore, a recent survey of CEOs conducted by the Conference Board suggest that despite expectations of a recession in the near term, they are going to try to weather a slowdown without widespread job cuts.[4] If this holds true, then we might just escape a recession.

Potential Inversion: The 10-Year Treasury

As we shift the discussion to commercial real estate and housing, here is a preview of our discussion of CRE capital markets in Section V. The 10-year Treasury, typically used as the benchmark risk-free rate for CRE and housing investments given comparable duration, has been on a generally upward ride since it hit historic lows in mid-2022.

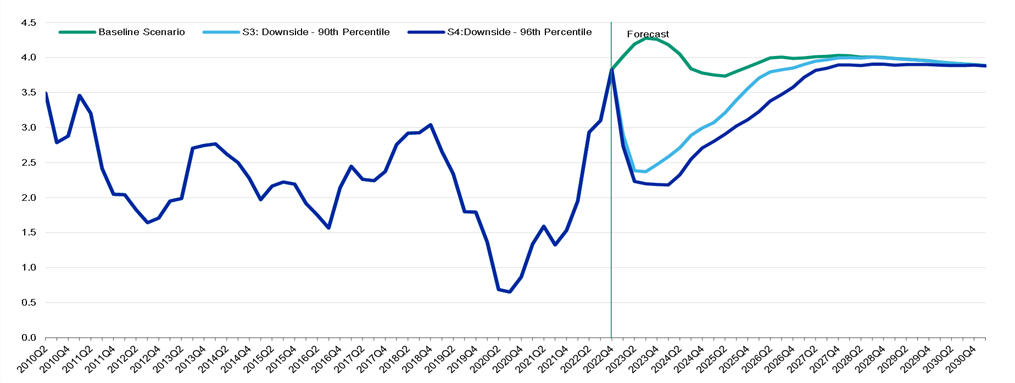

Figure 5. History and Forecasts for the US 10 Yr TSY

Source: Moody’s Analytics

The green line to the right of the vertical line labeled ‘Forecast’ shows that we expect the 10-year Treasury to peak at 4.26% later this year, and begin to decline and stabilize. We are expecting to end 2024 at 3.78%, with long term averages at or around 4%.

Downside scenarios are presented in the light and dark blue lines, representing what might happen in a minor downturn and a major downturn (respectively). A minor downturn is a ‘typical’ recession of around six to nine months; a ‘major’ downturn is comparable to the Great Financial Crisis of 2008-2009. It is interesting to note that though we expect rates to fall, we do not expect it to crater below 2.0% – even in a major downturn. This is correlated with the expectation that the Federal Reserve is under pressure to keep rates at elevated levels, even if we encounter a downturn – at least until inflationary pressures truly ease.

But let’s end our discussion of economic prospects on a positive note: for at least this metric, it looks like we have recovered (and even exceeded) pre-pandemic levels.

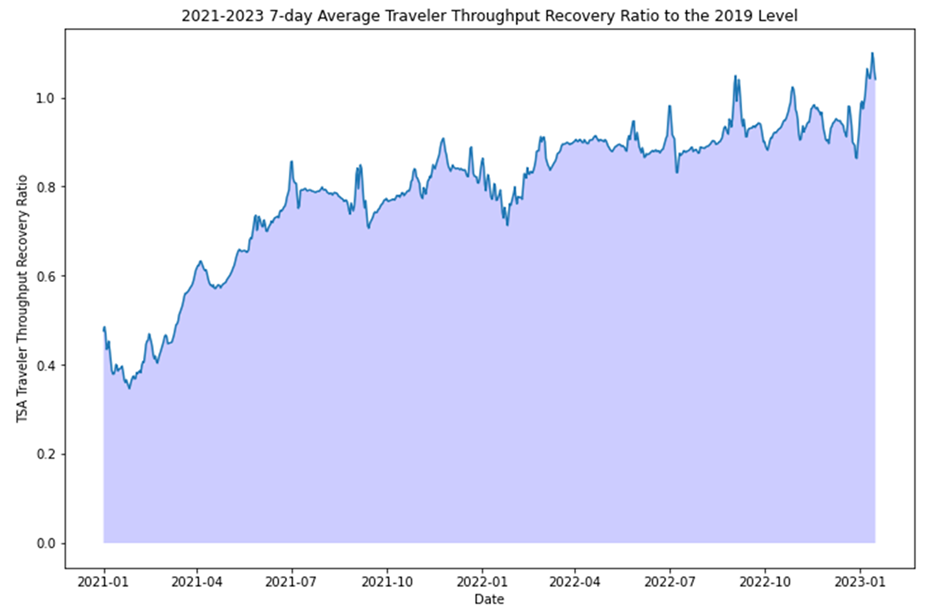

Figure 6. TSA Traveler Volume (2021-2023, Relative to 2019 Levels)

Source: Transportation Security Administration

As of late 2022, the measure above tracking the volume of passengers passing through TSA checkpoints has hovered at or around 95% or more of pre-pandemic averages. We hit a new high of 110% last January 13 (at the very right of this chart). While anecdotal evidence suggests that business travel has yet to truly bounce back, the glass half full perspective of how leisure travel has supported this return to (relative) normalcy – despite higher airfare, driven by higher energy prices – still justifiably represents good news.

In sum, our baseline expectation is that the US economy will grow by 1.0% in 2023, although recession probabilities remain uncomfortably high at 50 to 65%. The past year represented a roller coaster ride for many important metrics – and expect more of the same in 2023 given ongoing uncertainty around the economy and geopolitics.

III. Commercial Real Estate Outlook

In this section we present updated fourth quarter data for the office, retail, and multifamily sectors, along with our current forecasts for 2023.

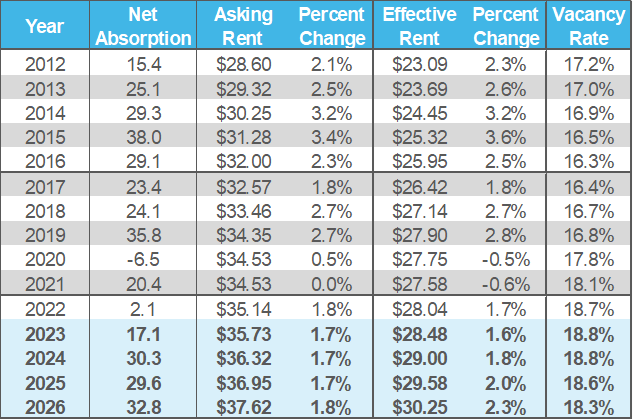

III.A. The Future of Office Remains Uncertain

The national vacancy rate for office properties rose by 20 basis points in the final three months of 2022, ending the year at 18.7%. It is now higher than prior ‘pandemic highs’ which topped out at 18.5% in the second quarter of 2022. Asking and effective rents barely rose, increasing by 0.3% and 0.1%, respectively, in the fourth quarter. Annual rent growth was positive but middling for 2022, coming in at 1.8% and 1.7%. Since these are nominal growth rates, inflation-adjusted growth rates are in negative territory.

Figure 7. Office Performance Metrics

Source: Moody’s Analytics

The future of the office sector remains decidedly uncertain, given the persistence of hybrid work. We have now gone through several cycles of senior management, all the way up to CEOs of large firms, expressing a desire or intent to bring employees back into the office, but office physical occupancy measures remain below pre-pandemic levels. As of the week of January 11, Kastle data for ten large cities shows average physical occupancy rates of 46.9% – that is not much changed from 2021 and 2022.[5]

Furthermore, if it is true that recession fears remain high and CEOs will choose to eschew widespread layoffs, unused office space is likely to be high on the agenda for employers seeking to manage margins. Moody’s launched a restructuring program profiled in the Wall Street Journal in August of 2022, explicitly aiming to reduce its real estate footprint while expanding lower-cost operational hubs.[6] It expects to result in $40 to $60 million in annualized savings, the majority of which would be invested towards promotions, hiring, and workplace improvements.

If we do enter a recession in the short run, expect more challenges for office properties given these overall trends.

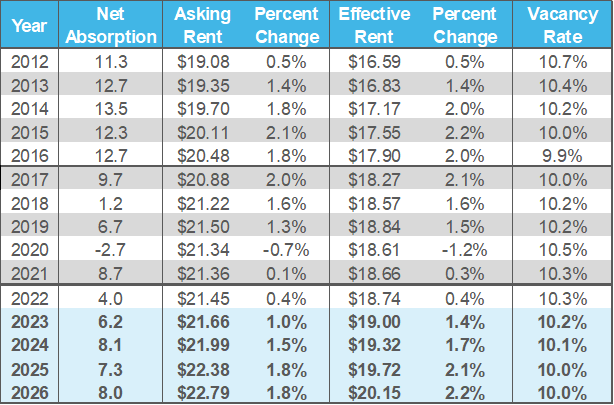

III.B. Retail Rents Rise, Though Vacancies Remain Elevated

Asking and effective rents for neighborhood and community shopping centers both rose by 0.4% for all of 2022, according to the latest data up to and including the fourth quarter. Vacancies were flat throughout the year, mired at a relatively elevated 10.3%. This is only 30 basis points below pandemic highs of 10.6%.

Figure 8. Retail Performance Metrics

Source: Moody’s Analytics

While the ‘death of brick and mortar retail’ has not quite materialized, it is also true that the property type is still heavily affected by the shift towards online channels. Moody’s Analytics does not expect much of a recovery, therefore, over the medium term, with vacancies trending downwards to 10.0% in 2026.

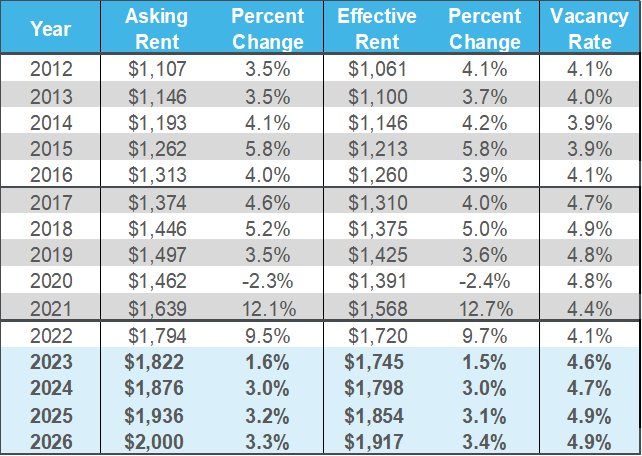

III.C. Multifamily Performs Well, But For How Long?

By contrast to office and retail, multifamily performance metrics held up remarkably well throughout 2022. The national vacancy rate continued to hover in the mid-4s, anywhere from 50 to 100 basis points below the long run average of between 5.2% to 5.5%. Asking and effective rents rose by an impressive 9.5% and 9.7%, respectively, for all of 2022.

Figure 9. Apartment Performance Metrics

Source: Moody’s Analytics

That does, however, represent a climbdown relative to the (admittedly record) highs from 2021, when asking and effective rents increased by 12.1% and 12.7%. Furthermore, because the property type has held up so well over the last cycle, developers have continued to build – supply growth has been healthy and is projected to continue over the next couple of years. In the face of a slowing economy, rising interest rates, and potentially reduced demand for housing, a large influx of new supply in the near term is likely not going to provide tailwinds for performance metrics like rents and vacancies.

This does not mean that the outlook for housing as a whole is bleak. Demographic trends in the US certainly suggest that the stock of affordable housing is undersupplied. But there are significant headwinds in the short run, because of the overall expectations of elevated interest rates. And this is very much reflected in the single family housing market.

IV. The Outlook for the Housing Market

IV.A. Rising Interest Rates Has Reduced Demand for Homes

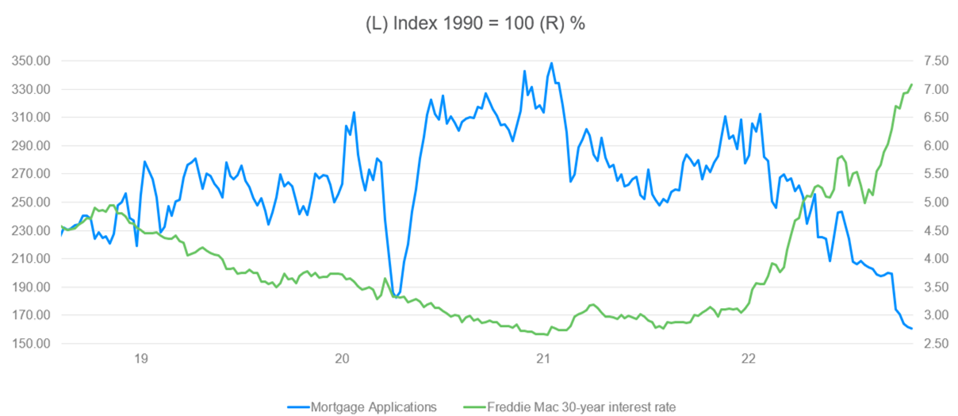

Rising interest rates as reflected in rising mortgage rates hammered the residential housing market in 2022. Housing affordability is plummeting, leading to fewer people applying for mortgages. New and existing-home sales are dropping, home builders are bearish and pulling back on construction, and house prices have fallen from their recent peaks.

The rising rate on 30-year mortgages is directly responsible for the decline in the residential real estate sector. Based on Freddie Mac’s primary mortgage market survey, in December the rate averaged 6.36%, more than double last December’s rate of 3.1%. Rates have been steadily climbing throughout 2022 as the Federal Reserve works to get inflation under control leading to a significant decline in house price affordability.

The typical monthly mortgage payment, based on the median home price and a 20% down payment, rose approximately 55% between the third quarter of 2021 to the third quarter of 2022. This is driving a collapse in demand to purchase homes. With mortgage rates exceeding 7% for the first time in two decades in October, and set to remain high, compared to 2021, the housing market will continue to face pressure due to affordability.

Mortgage demand has plummeted over 40% since the beginning of the year and is now below pre-pandemic levels. Since most home sellers are also homebuyers many potential home sellers are locked into mortgages at interest rates that can be less than half of today’s rates. It is now significantly harder for them to afford to move. Potential new-home buyers have not only been hurt by the rising cost of mortgages but have had to spend increasing amounts on rent and other necessities as inflation has risen.

Figure 10. Mortgage Applications Plunge as Interest Rates Rise

Source: Mortgage Bankers Association, Freddie Mac, Moody’s Analytics

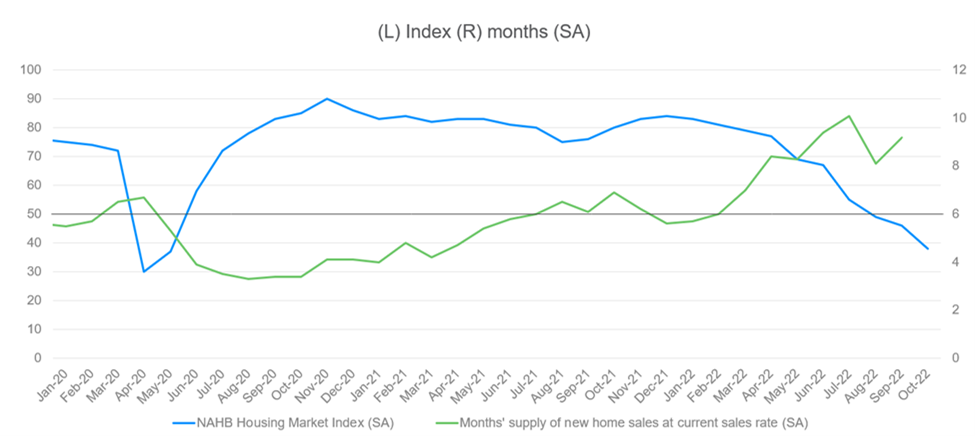

As demand has dried up, home sales have followed. Existing-home sales are down nearly 34% compared with a year ago. While new home sales are down 15.3% from a year ago. Falling sales has driven new home inventories up, and now stand at 8.6 month’s supply in September. This has led home builders to become bearish on the market. Both nationally, and for all four reported regions, the NAHB Builders Confidence Index has dropped well below 50.

Figure 11. Builder Confidence Enters Bear Territory

Source: US Census Bureau, NAHB, Moody’s Analytics

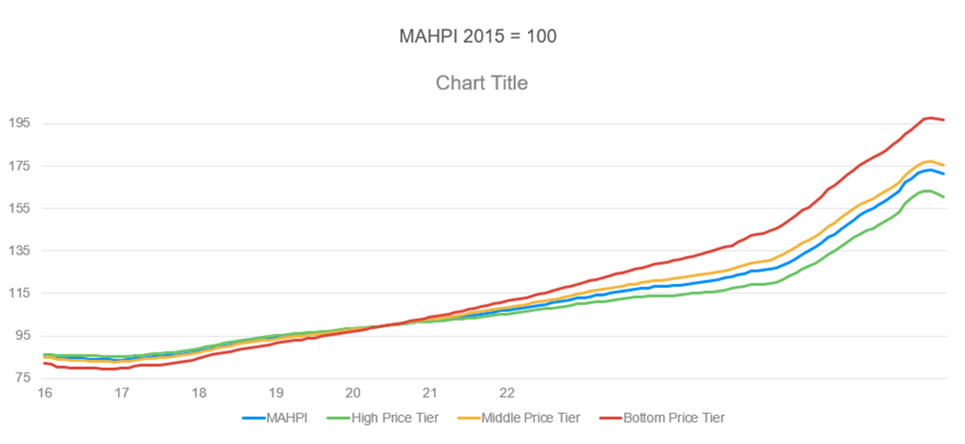

The collapse in demand and sales is impacting home prices, which were down from summer peaks by over 1% nationally according to the MA HPI. The lower end of the market has been more resilient, barely falling since peaking over the summer compared to a decline of 1.6% for the top third of the market. Lower priced homes are expected to perform better than higher priced homes given underlying demand from young adults and the dearth of supply of starter homes.

IV.B. Home Price Corrections Have Begun, But How Low Will Prices Go?

The Covid-19 pandemic altered consumer preferences for housing. Combined with historically low mortgage rates, buyers drove up house prices at a record rate, leaving the market more than 25% over-valued relative to its long-run fundamental value. Based on Moody’s Analytics estimates, the national housing market was more over-valued in 2022Q2 than it was during the ’06 Housing Bubble.[7] These valuation levels are not sustainable. Prices are expected to continue to fall 5 to 10% from their recent peaks by the beginning of 2025. The most highly over-valued metro areas will see the largest declines including Boise, Phoenix, Austin and Nashville.

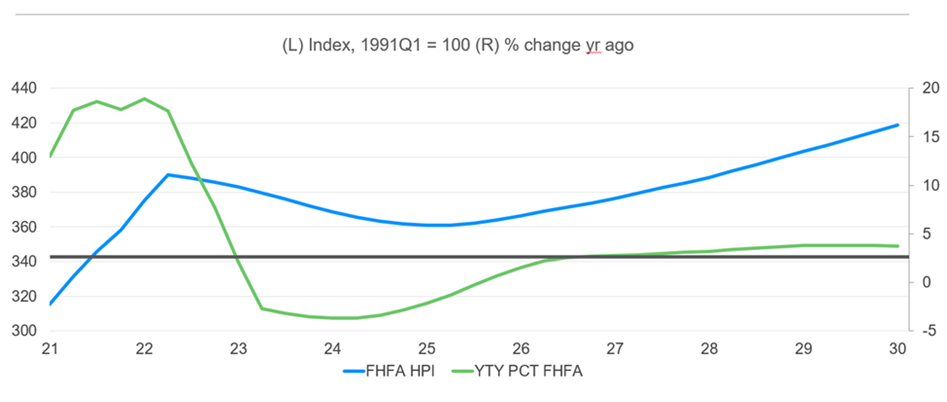

Figure 12. Home Price Correction Has Started

Source: Moody’s Analytics

It is important to note that a 7.5% decline is only a correction and not a crash. House prices will not crater like they did during the Great Recession. We expect that the FHFA purchase-only HPI will fall back to late 2021 levels in early 2025. Only this year’s gains will be wiped out by declines. For perspective: in 2025, when the next low is reached, we expect prices nearly 30% higher than they were at the beginning of 2020.

Figure 13. House Prices Will Continue to Correct

Source: Moody’s Analytics

The underlying need for housing remains strong given current demographics, with recent estimates of a 1.5 million unit housing deficit given expectations for household formations and current vacancy rates. [8] Further, despite recent anecdotal evidence of demand destruction through multigenerational and roommate living arrangements, vacancy rates as of November still indicate that inventory is tight.

The following section will end with a short discussion of capital markets for commercial real estate.

V. Quo Vadis, Capital Markets?

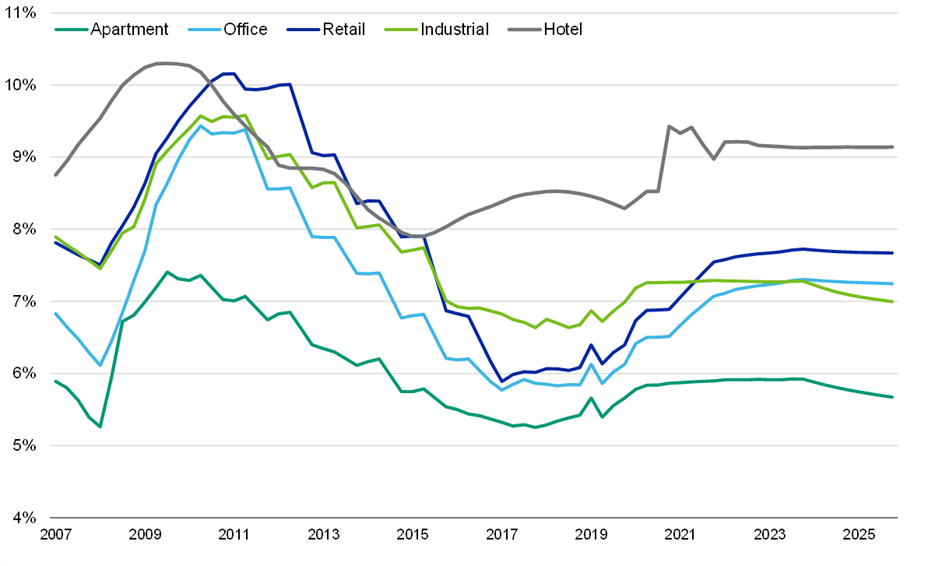

Figure 14 below presents our cap rate forecasts for apartment, office, retail, industrial, and hotel properties. Overall, we expect cap rates to increase in 2023 because of upward pressure from rising capital costs, driven by everything we have discussed. With that said, we expect that increases will be more pronounced for property types that are relatively out of favor – like office and retail. Multifamily cap rates will likely also rise, but perhaps not to levels that we expect office and retail cap rates to breach.

Figure 14. Cap Rate Forecasts

Source: Moody’s Analytics

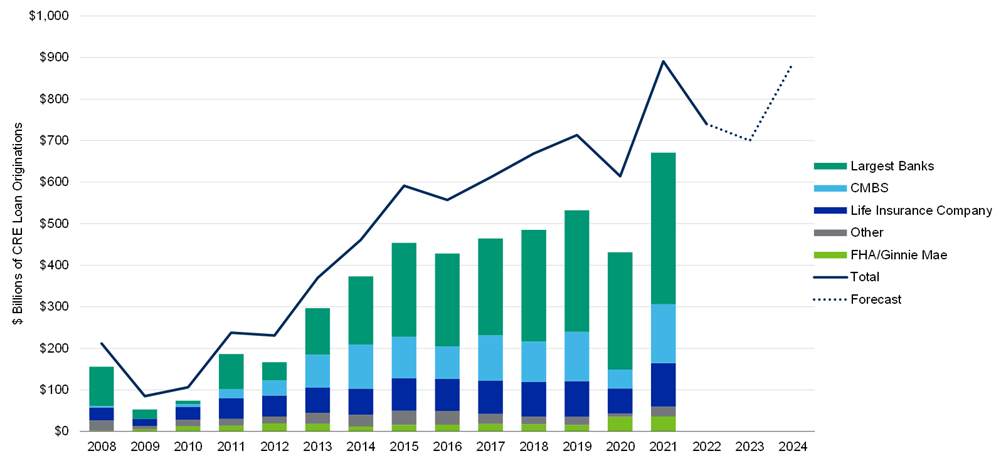

What does this all mean for the CRE lending markets? The Mortgage Bankers Association (MBA) released their latest forecasts for origination volume last January 17. Totals for 2022 are still being finalized, but it is likely to have come in at $740 billion, representing a 17.3% decline versus the $895 billion record figure from 2021.

Figure 15. Multifamily and CRE Originations

Source: Mortgage Bankers Association, Moody’s Analytics

The MBA expects origination volume to decline by another 5% (to $700 billion) this year. But on a very optimistic note, the MBA then expects originations to rise by a significant number in 2024: that dotted line spikes back up to $885 billion in 2024 (a 26.4% increase versus 2023). That is very close to the record high $895 billion from 2021.

VI. Conclusion

While consensus expectations suggest that 2023 may well be when some form of economic dislocation happens in the US, forecasts suggest that 2024 may mark not just a return to positive growth: for some metrics like multifamily and commercial lending, the recovery may be spectacular. Time will tell whether optimistic or pessimistic perspectives will win out, but what does seem pragmatic is for market players to prepare for continuing uncertainty and volatility in 2023. The roller coaster ride from 2022 does not appear to be over yet.

ENDNOTES

[1] The NBER actually considers a whole host of other factors to determine whether the depth, duration, and dispersion of any contraction in economic activity should be properly considered a recession at the national level. https://www.nber.org/research/business-cycle-dating/business-cycle-dating-procedure-frequently-asked-questions

[2] This platform tracks announcements of layoffs in the tech sector and related industries: https://layoffs.fyi/

[3] https://www.wsj.com/articles/laid-off-tech-workers-quickly-find-new-jobs-11672097730

[4] https://www.wsj.com/articles/ceos-say-they-expect-a-u-s-recession-but-most-think-it-will-be-short-11673500868

[5] https://www.kastle.com/safety-wellness/getting-america-back-to-work/

[6] https://www.wsj.com/articles/companies-weigh-fresh-cuts-as-operating-costs-go-up-11659519001

[7] https://www.economy.com/economicview/analysis/390301/US-Housing-More-Overvalued-Than-Ever

Bigc Studio/Shutterstock.com

Bigc Studio/Shutterstock.com