Climate risk is often discussed as a statistical hypothetical in real estate. The chance of extreme weather events and the potential for rising energy prices are addressed in any number of predictive models or financial projections.

But one transition risk has come to the forefront in the last few years by virtue of its objective and calculable risk: Building Performance Standards (BPS) policies.

THE ADVENT OF BUILDING PERFORMANCE STANDARDS

For the past decade, the most exacting environmental policies facing existing buildings focused on benchmarking – requirements that enabled jurisdictions to collect and measure buildings’ energy use. Benchmarking enabled real estate to “manage what was measured” and was in part responsible for a reduction in energy of 2-6% across several cities[1]. The policy did not, however, produce results commensurate with the pace and scale required to meet the Carbon Neutral by 2050 goals committed to by nearly 150 US cities.[2]

Building Performance Standards policies (BPS) emerged within the last few years as the jurisdictions’ means of achieving their neutrality goals. A BPS policy is defined by its ability to set prescriptive energy and/or emission targets for commercial real estate that extend 10 to 20 years – with interim escalating targets that must be met at a range of every 3 to 6 years. Perhaps the most impactful feature of BPS relative to benchmarking is the scale of the policy’s “alternative compliance payments” or fees.

A failure to comply with benchmarking ordinances comes with a maximum fine of $2,000 to $3,000[3] per year. Alternatively, BPS can demand alternative compliance payments in the scale of millions of dollars depending on how far short of the interim target a building falls. Washington, DC is notable for setting its maximum per building penalty for non-compliance at $7.5 million dollars.[4]

The scale of the fees and the long duration of BPS policies have added two unavoidable topics to the conversation around climate risk:

- There is now an objective – not theoretical – financial cost of inaction, and

- The typical payback period for a decarbonization investment has extended to the length of the policy.

The Opportunity Cost of Inaction

BPS fines set the opportunity cost of inaction in the climate risk conversation. They represent the “do nothing” strategy for commercial real estate. As organizations understand how costly business-as-usual is becoming, they can leverage BPS to make the case for decarbonization investments in their assets. The BPS fine is a calculable baseline to use as a starting budget for capital and operational improvements. The accuracy of the anticipated fines is therefore crucial to investment decisions. But that is easier said than done when it comes to disjointed local policies.

A NATIONAL COALITION WITH LOCAL NUANCE

As of April 2023, over 40 state and local governments have signed on to the White House’s National BPS Coalition with a commitment to “inclusively design and implement building performance policies and programs in their jurisdictions” by Earth Day 2024[5] (See Figure 1). The impact of these policies will be national in scale as “15 billion square feet of applicable floor space”[6] is impacted by these local policies that reach from coast-to-coast and across the Midwest.

However, no two of the 10 active BPS policies in the United States are alike which presents a unique challenge to portfolio owners operating in multiple cities and states.

Figure 1: National BPS Coalition

Building Performance Standards vary by jurisdiction in five key areas:

- Impacted Property Types

- Size Thresholds

- Compliance Timelines

- Measurement criteria

- Alternative Compliance Payments and/or Penalties, and;

The first three—(1) Type, (2) Size, and (3) Timeline – are relatively simple to parse out and plan for. The nuance of the other categories—(4) Measurement Criteria and (5) Payments—present the real planning difficulty. As an example:

- Washington, DC bases its compliance targets on a building’s weather-normalized site EUI, relative ENERGY STAR® Score, or source energy use intensity (EUI) for properties without applicable ENERGY STAR Scores. Penalties and Alternative Compliance Payments are set at a maximum of $10 per each square foot of gross floor area with an absolute maximum set at $7,500,000. The payments will consider the compliance pathway chosen, reductions achieved at the property, and reductions achieved in other buildings of the same property type.

- New York City sets a ceiling on the kgCO2e per square foot that a building must stay below. The city has established the Alternative Compliance Payment as an annual “carbon tax” that will assess properties at $268 per metric ton of carbon over the limit. This penalty is slightly above the currently agreed upon social cost of carbon.

- Denver prescribes a specific weather-normalized site EUI target or an overall 30% reduction in site EUI for each property type to adhere to. Denver reserves the right to assess buildings at $0.70 per kBtu of energy savings not achieved but will assess buildings at $0.30 per kBtu to incentivize investment into meeting the compliance standards. The city has also introduced maintenance penalties to take effect after 2031.

The scale and ubiquity of these coming policies marks an undeniable shift in how real estate must plan for decarbonization.

PLANNING FOR BPS

Jeff Sprau, CEO of Legence, the first Energy Transition Accelerator for the built environment notes: “The policy landscape is evolving rapidly and the time to act is now. Commercial real estate owners and operators need to initiate analysis and revise capital planning efforts to avoid paying costly fines for assets in jurisdictions with Building Performance Standards.”

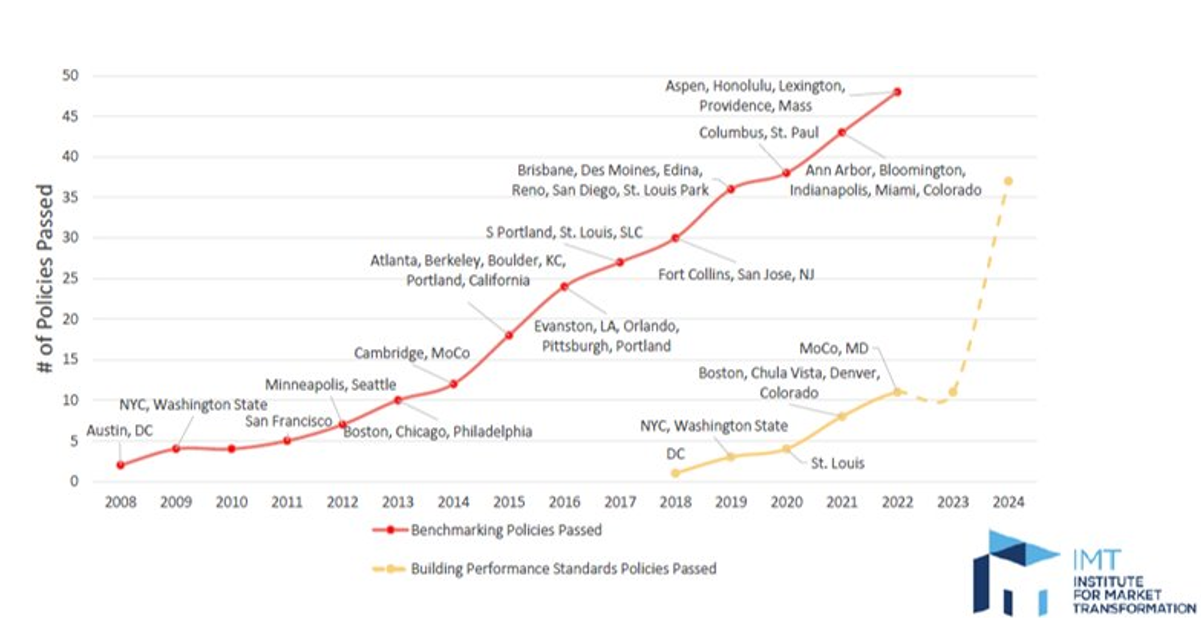

Building performance standards seem a foregone conclusion. Local governments’ commitment to and passage of Building Performance Standards is occurring on a far faster timeline than their predecessor, Benchmarking (See Figure 2). The best way that real estate can protect themselves from the risk of these coming policies is to plan for their eventuality by identifying:

- Where the polices will pass

- When the policy goes into effect, and

- How much the interventions will cost relative to the value of the asset.

Figure 2 – Policies Passed

Where: Locating the Policies

Fortunately, the National BPS Coalition is a simple, living source of the likely jurisdictions to pass a BPS policy. The first step in de-risking a property or a portfolio is to review which assets fall within the boundaries of the committed cities, counties, and states. This indicator should be reviewed in capital planning for those assets—as well as the acquisition and disposition process for properties in these areas.

When: The Deadlines for Action

The first aspect identified in the BPS policy development and rulemaking process is the timeline of compliance. Typically, the first interim threshold is set 3-5 years after the time of the policy’s passage. Equally important to consider is the fact that the initial “target” is not intended to impact a majority of a jurisdiction’s building stock. For example, 80% of the buildings under New York City’s BPS, Local Law 97, are expected to pass the 2025 target threshold.[7] A rule of thumb for existing and upcoming BPS policies is to plan for 2030.

Planning for those 2030 thresholds is a longer process than it seems and requires owners to work backwards to set their internal timelines.

To prove that a property meets a 2030 performance target, it will need a year’s worth of reported data. This places the deadline for energy efficiency improvement installations in 2029.

Those improvements will have to be financed, contracted, and installed in 2027-2028.

This minimum 3-years of lead time for comfortably complying with a BPS target means that the identification and planning process should start as soon as possible.

How Much: Avoiding the Fees while Upgrading an Asset

For all the local nuance in the policies themselves, each jurisdiction is clear in their goals:

The National BPS Coalition signatories are focused more on the emissions reductions of their building stock than they want to collect fees.

When fees are collected, they will be the responsibility of the building owners. It is imperative that leases be updated or renewed to include performance-based lease language[8] that allows for the cost of these building upgrades to be shared with tenants.

A proactive planning approach that starts now can mean the avoidance of the alternative compliance payments altogether. And a performance-based lease can align the incentives of landlords and tenants to reduce energy use along with regulatory risk.

RE TECH APPROACH

RE Tech Advisors[9] is fortunate to have earned a vantage point in the commercial real estate industry through its work with nearly 90% of the firms in the National Council of Real Estate Investment Fiduciaries’ ODCE index fund totaling $212 billion of net real estate assets (ODCE). These firms address climate risk at both the portfolio level and the asset level.

Beginning at the portfolio level, CRE firms have solicited RE Tech’s council in understanding their portfolio’s overall performance as a baseline to guide their decarbonization decisions. This approach takes three broad steps:

- Conduct a Greenhouse Gas (GHG) Inventory

RE Tech works with its clients to gather all available data related to a firm’s GHG emission sources – from electricity and natural gas consumption to vehicle fleets and business travel. That data is compiled into a Greenhouse Gas Inventory where RE Tech ascribes a CO2-equivalent figure to the firm’s Scope 1, 2, & 3 emission sources. - Set a Carbon Target

With the GHG Inventory as a baseline, firms are advised to set feasible carbon target and reduction timeline that take into account portfolio-level opportunities. - Develop a Decarbonization Strategy

RE Tech develops a decarbonization strategy to bring the portfolio from its GHG Inventory’s baseline through to the firm’s ultimate carbon target. Mitigation opportunities from energy efficiency, on-site renewables, off-site renewables & green power procurement, and RECs & offsets are overlayed to create a path to net zero. The climate risk presented by BPS is used in the decarbonization strategy to prioritize interventions on properties within impacted jurisdictions.

The portfolio-level approach is then implemented on an asset-level scale in order for properties to out-perform a given BPS policy’s emission threshold. The asset-level approach takes the form of:

- Identifying Potential “Stranded Assets”

RE Tech utilizes a proprietary tool that overlays a property’s energy and emissions data as reported in Energy Star Portfolio Manager with the targets of its BPS to calculate the fines due on that property for the full timeline of the policy. This automates the opportunity cost of inaction as described above and can pinpoint the year where any given asset faces risk of stranding. - Assess Mitigation Options

If and when a property is identified as a potential stranded asset, RE Tech assesses the available mitigation measures to include contacting the property team to understand the equipment, employing an ASHRAE Level II audit report, and evaluating the potential of green power. - Implement Decarbonization and Resiliency Measures

The opportunity cost of the BPS defines the starting budget and the BPS deadlines define the timeline. With those in hand, the asset-level risk can be addressed by acting upon the mitigation options to out-perform the BPS emission targets.

This methodological approach addressing climate transition risk at the portfolio and asset levels offers a pathway to decarbonizing properties at the most financially and operationally efficient trajectory. But in instances where a BPS timeline does not align with a firm’s preferred method, the policies’ alternative compliance pathways can be pursued.

ALTERNATIVE COMPLIANCE PATHWAYS

BPS policies allow property owners to outline alternative plans for decarbonization when the prescriptive deadlines are otherwise infeasible. These alternative pathways allow for the utilization of flexible compliance options such as renewable energy or electrification credits and pursuing alternative compliance plans.

A typical model for BPS requires owners to select a pathway outlining the general approach for compliance. Washington, DC’s pathways illustrate common options for decarbonization.[10]

- Performance Pathway: Reduce site EUI by 20%.

- Standard Target Pathway: Reach the standard (ENERGY STAR Score or Source EUI) for your property type.

- Prescriptive Pathway: Implement cost-effective efficiency measures.

- Alternative Compliance Pathway: Special circumstances.

The (1) performance, (2) standard, and (3) prescriptive pathways allow owners to tailor decarbonization plans for each property use type and even building and take into account investment strategies, operational approaches, and technical interventions that can achieve BPS compliance on a separate timescale. Flexible options such as RECs require a robust assessment of property and portfolio characteristics—for example, property types that already use a lot of electricity like commercial office buildings benefit from the option to offset emissions through renewable energy credits where applicable.[11]

Special circumstances – the fourth style of alternative pathway – takes into account changes to a building’s inherent characteristics or property type, financial hardship, capital expenditure planning to align with system life cycles, newly constructed properties, campuses with blended targets, or pursual of deep retrofits.

Regardless of the pathway chosen, the policies are clear that absolute exemptions to building performance standards are exceptionally difficult to pursue or achieve. Denver, Colorado even goes so far as to assess penalties at a higher rate for buildings with alternative compliance plans.[12] So unless the property is already in severe distress (with plans for demolition, vacancy, or bankruptcy), improving the building’s performance remains a financial inevitability.

Performance pathways, alternative compliance plans, and flexible credit options provide scaffolding for long-term decarbonization strategies but will require the investment of specialized resources, third-party contracts, and advanced planning.

A SHIFT IN MARKET THINKING: FROM ESG TO CLIMATE RISK

Building Performance Standard policies are not the end game for real estate emissions. They are the beginning of a tangible and enforceable approach to climate risk. As BPS and other building codes and regulatory interventions pass throughout the country, decarbonization planning will increasingly become a necessary aspect of property evaluations and acquisition assessments. The commercial real estate firms who lag in their adoption and compliance with such policies will face reputational as well as financial risk as their terminal exit values are impacted by any undue delays.

But as this climate risk increases, the decarbonization market will continue to mature. Estimates from New York City project $20 billion of investment in the energy retrofit market over the next decade to support the creation of 141,000 jobs in the city alone[13]. This required investment stands to accelerate the technology and talent required for both cities and CRE portfolios to reach their increasingly ambitious climate goals.

BPS is an objective and calculable starting point for decisions in climate risk mitigation. But it is only the start of what’s to come in the ESG market.

ENDNOTES

[1] Institute for Market Transformation. “The Benefits of Benchmarking Building Performance.” https://www.imt.org/wp-content/uploads/2018/02/PCC_Benefits_of_Benchmarking.pdf December 2015

[2] C40. “Cities Race to Zero – Committed Cities. https://www.c40knowledgehub.org/s/cities-race-to-zero-public?language=en_US

[3] Denver Hub. Energize Denver Technical Guide to Penalties and Enforcement. https://denvergov.org/files/assets/public/climate-action/documents/energize-denver-hub/technical-guidance-penaltiesenforcement-en.pdf

[4] DC Dept. of Energy & Environment. BEPS Compliance and Enforcement Guidebook for Compliance Cycle 1 Chapter 6 – Enforcement https://dc.beam-portal.org/helpdesk/kb/BEPS_Guidebook/75/

[5] National BPS Coalition. “About the National BPS Coalition”. https://nationalbpscoalition.org/

[6] White House. “Fact Sheet: Biden-Harris administration Launches Coalition of States and Local Governments to Strengthen Building Performance Standards. https://www.whitehouse.gov/briefing-room/statements-releases/2022/01/21/fact-sheet-biden-harris-administration-launches-coalition-of-states-and-local-governments-to-strengthen-building-performance-standards/

[7] Urban Green, “Retrofit Market Analysis.” June 18, 2019. https://www.urbangreencouncil.org/wp-content/uploads/2022/11/2019.06.18-Urban-Green-Retrofit-Market-Analysis.pdf

[8] Green Lease Leaders. Sample Lease Language for a Green Lease. https://www.greenleaseleaders.com/green-lease-library

[9] Authored by RE Tech Advisors, a commercial real estate advisory firm focused on designing and implementing innovative and practical sustainability solutions.

[10] Building Innovation Hub. “BEPS Compliance Pathway Timelines.” https://buildinginnovationhub.org/resource/regulation-basics/understanding-beps/beps-compliance-pathway-deadlines/.

[11] Urban Green Council. “LL97 RECs: Balancing flexibility and decarbonization.” November 30, 2022. https://www.urbangreencouncil.org/ll97-recs-balancing-flexibility-and-decarbonization/.

[12] City and Council of Denver. “Energize Denver Benchmarking and Energy Performance Requirements Technical Guidance.” November 17, 2022. https://denvergov.org/files/assets/public/climate-action/documents/energize-denver-hub/ed-technical-guidance-nov-2022-with-alt-text.pdf.

[13] NYC Comptroller. “Cap the Credits: Strong Implementation of Local Law 97.” https://comptroller.nyc.gov/reports/cap-the-credits/

VectorMine/Shutterstock.com

VectorMine/Shutterstock.com