In today’s rapidly evolving office market, the landscape bears striking similarities to the mid-1990s, when investors like Steve Witkoff thrived by acquiring undervalued assets in New York City. Similarly, despite fluctuating rents and occupancy levels, today’s investors have unique investment opportunities.

According to recent data from Deloitte, office properties have been largely insulated from the latest economic declines. On average across the twenty largest metropolitan areas in the United States, an office property purchased five years ago is still valued 15% higher today than it was at the time of acquisition. While having an office building with a value greater than original purchase price is positive, there are still a substantial number of office buildings that have values that are lower than original purchase with no prospect of increasing value. These buildings are permanently impaired.

Additionally, future loan maturities represent an additional head wind. An estimated $2 trillion in CRE loans will mature through 2027 according to a recent October 2024 report by Hines. Many owners will have to decide on what they will do – sell – refinance with additional equity contributed or deed in lieu/foreclosure. Plenty also seem to be choosing extensions from their list of options, which has contributed to the $2 trillion estimate.

The office value decline and loan maturity challenges represent significant challenges to owners, investors, and bankers – trying to access – find the winners. While faced with these challenges, the office sector also represents an opportunity. Some believe “picking the winners” represents a generational wealth opportunity with the idea – office is not dead. We have outlined some ideas on how to approach and evaluate the office sector.

Office is not dead. While remote work has become more prevalent, offices still hold significant value for many businesses and employees for several reasons:

- Collaboration and Creativity: In-person interactions can foster collaboration and spark creativity that might be harder to achieve remotely. The energy of a shared space often leads to spontaneous brainstorming sessions.

- Company Culture: The office is a hub for social interactions and team bonding. A strong company culture can be harder to cultivate in a fully remote environment.

- Structured Environment: Some employees thrive in the structured environment of an office, where the separation between work and home life is clearer and work is often more efficient.

- Resource Access: Offices can provide access to resources, technology, and equipment that might not be as readily available at home.

- Training and Development: New employees or those in need of mentoring may benefit more from in-person training and guidance.

- Conversion of office space to other uses: The conversion of office space into residential, mixed-use, and hospitality properties has accelerated. Major metro areas, including New York, Los Angeles and San Francisco, have launched initiatives to incentivize adaptive reuse.

However, the game has changed. While some companies, like Amazon, have required a return to the office five days a week, most businesses are implementing hybrid arrangements. A recent survey found that workers prefer a hybrid arrangement over a remote or five-day office arrangement. This shift requires a new approach to investment and property acquisition.

Understanding the Current Office Market

The office market has undergone significant transformation, influenced by remote work trends and changing employee expectations. In light of these changes, prospective investors must adapt their strategies. One crucial adjustment is the reevaluation of what constitutes stabilized occupancy.

In the past, a 90% occupancy rate was deemed sufficient; today, a more realistic benchmark might be lower, as low as 70% or even 60% in certain markets. As of mid-year 2024, the U.S. office vacancy rate overall was 17.5%. This was the first time with no quarterly increase in almost three years.

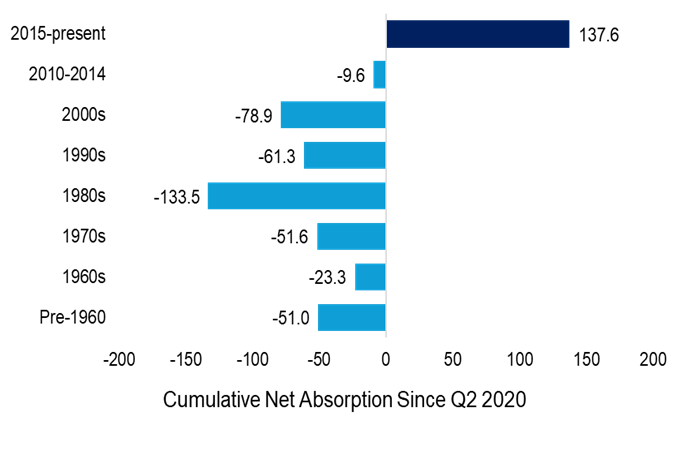

Other factors to consider are the age and location of the property. The chart below illustrates how there has been positive net absorption of newer office buildings at the expense of older buildings.

Source: JLL

Location also matters. The chart below shows that there has been positive net absorption in Atlanta, Detroit, St. Louis, Austin, Salt Lake, Charlotte, Columbus, and Denver. While positive, not all of these markets are investable at the current time. Some of these cities still face headwinds, such as oversupply risks, economic volatility, or difficulty in securing financing, making them less attractive for investment despite their positive absorption trends.

Source: CBRE

Key Investment Strategies

- Patient Capital and Smart Underwriting: The current market demands a combination of courage and patience. Investors must conduct thorough underwriting to assess properties’ viability. Acquisition basis is important. This means looking beyond superficial metrics and understanding deeper market dynamics. Investors need flexible capital that allows the sponsor to properly execute the business plan.

- Building Upgrades: Companies that offer hybrid work options are conscious of the fact that they are competing with the employee’s home office, and therefore there is a need to offer an improved in-office experience to encourage attendance.

Properties must meet modern standards for comfort and utility. Investing in upgrades that enhance the work environment is crucial, especially in a competitive landscape. Features like collaborative spaces, natural light and modern amenities can attract tenants who prioritize a pleasant workplace. Tenants will also look at buildings that perform well with respect to sustainability and environmental performance (particularly interior environment like air quality) and wellness (i.e. WELL certified).

- Flexible Leasing Options: Shorter lease terms (3-5 years) can benefit both landlords and tenants. For investors, this strategy allows for regular reassessment of market conditions and tenant needs.

- Pre-Built Units: To minimize tenant improvement costs, consider offering pre-built, generic office spaces. These units can appeal to various businesses and allow for quicker tenant turnover.

- Understanding Submarkets: Investors should have a comprehensive understanding of the submarkets in which they are considering investments. This includes: adjusting vacancy statistics to account for shadow space—unused but available space; sublease offerings; the quality of local neighborhood amenities; and the nature of the employee commute, which affects access to parking and /or transit (depending on sub-market). This type of more in-depth analysis can reveal the true availability of office space and inform investment decisions.

Considerations

Choosing the right location is the most critical factor in office investment viability. Markets with historically high occupancy rates are likely to recover faster from downturns. Conversely, areas with weak demographics, poor governance or high crime rates pose significant risks. Investors should conduct thorough research into local political climates and economic conditions, avoiding municipalities that lack effective governance.

Another essential component of successful office investment is maintaining a strong equity cushion. Avoiding leverage is critical; investors should ensure they have sufficient equity to weather fluctuations in the market. Investors want to be rewarded for the risk associated with office investing – targeting IRRs of 20% or greater. Given the potential for prolonged economic shifts, be prepared to hold properties for longer periods—beyond the typical 3–5-year exit strategy. Target hold period of ten years.

Conclusion

Deloitte’s 2025 commercial real estate outlook survey found that real estate investors are optimistic about 2025. Eighty-eight percent of global respondents report that they expect their company’s revenues to increase. This optimism suggests that despite the challenges facing certain asset classes—particularly office space—there is confidence in the sector’s ability to adapt and find new growth opportunities.

As the office market continues to evolve in response to hybrid work trends, distressed asset sales, and adaptive reuse initiatives, investors see potential for well-calculated bets. However, the key lies in balancing boldness with prudence. While opportunities exist, particularly in acquiring underpriced assets or financing conversions, the longevity of these prospects remains uncertain. The resolution of outstanding permanently impaired loans and properties will likely be a protracted process, dependent on factors such as interest rate movements, lender flexibility, and economic conditions.

The question of how long this window of opportunity will remain open is difficult to answer. If rates stabilize and the economy strengthens, distressed office assets may clear faster, narrowing the investment window. However, if economic uncertainty persists or lenders extend loan terms rather than forcing liquidations, the process could drag out over several years. While making precise predictions is difficult, investors should be mindful of the shifting timeline for price discovery and loan resolution, adjusting their strategies accordingly.

@March Studio/Shutterstock.com

@March Studio/Shutterstock.com