Introduction

Whilst real estate stood at the epicenter of the Global Financial Crisis (GFC), the asset class has held up with demonstrable resilience throughout the globally synchronized recessions spurred by the COVID-19 pandemic. With red hot residential markets in advanced and emerging market economies alike—from Canada to China and from the U.K. to Singapore—policymakers have actually intervened in some markets to quell the rise in price.1 Asset prices as a whole remain markedly lofty: with the exception of some retail, very little—if any—distress is evident across the real estate ‘food groups,’ even in hard-hit sectors such as office and hospitality.

With President Biden at the helm of the executive branch in Washington as the 46th president of the United States, real estate investors and developers both within America and from across the globe are weighing up the opportunities wrought by potential policy changes within the new administration. As we shall explore, some of the bright spots for property investment in the U.S, are ‘D.C. agnostic’. Namely, certain dynamics impacting investment in residential, logistics, data centers, film studios, hospitality, and proptech (or technology fuelling real estate) have been recently accelerated by COVID-19, but remain somewhat insulated from policy changes in Washington.

However, with the new government, marked shifts within the U.S. real estate industry are likely to occur within two principal arenas: housing and affordability, and climate and the environment. While potential shifts in policies with regard to urbanization, immigration, and infrastructure underpin and impact these developments, it is evident that housing and climate are shaping up as the two clear opportunities for real estate investors and developers, emerging from the new administration. As we shall see, the focus on housing and climate not only yields a chance for executives and investors to burnish their environmental, social and governance (ESG) credentials and strengthen their portfolios, but these developments might also contribute to a reduction of income inequality and improve social cohesion within a country which remains deeply divided.

At the Macro Level: Monetary and Fiscal Policy, Inflation, Interest Rates, and Asset Prices

In combating the twinned health and economic crises resulting from COVID-19, central banks from around the world have intervened to safeguard financial stability and liquidity to hard-hit economies, in tandem with unprecedented stimulus and relief measures implemented by governments. For many GFC-hit countries, expansionary monetary policy has been the norm for over a decade, with some countries entering the corona crisis with interest rates already in negative territory. In the face of sudden economic stops, monetary policy has demonstrated its limitations, and successive waves of fiscal relief packages disbursed by governments have provided critical liquidity support to help shore up balance sheets for households and for companies hard-hit by the pandemic.2

As multiple vaccines are disseminated across the globe, an uneven economic recovery has taken shape, with countries such as Italy, Spain, and the U.K. having experienced severe contractions in 2020, and with China actually posting real GDP growth in 2020.3 While investors remain exuberant about the prospects of additional stimulus measures—fueling the unleashing of pent-up demand and the onset of the ‘roaring twenties’—expectations for higher inflation have sent shudders through bond and equity markets in the U.S.

Nevertheless, considerable slack in the labor market remains in the U.S., with segments of the economy still far behind recovery.4 In early 2021, the real unemployment rate hovered around 10%.5 The aggregate unemployment rate for those at the bottom part of the wage quartile far exceeds that of the top—with many minimum wage jobs in sectors such as leisure and hospitality having been decimated during the crisis, whilst higher-earning white-collar workers have, for the most part, been able to retain their jobs working from home.6

Indeed, even thinking beyond unemployment numbers and focusing on income, many households within the bottom three quintiles of the income distribution came into the crisis in a situation of stagnation, or deep distress. The bottom 90th percentile of the income distribution in the U.S. has experienced no real wage growth since 1979.7 A combination of factors has led to this real wage stagnation over time. Companies have invested in improving total factor productivity (TFP), thereby replacing tasks with machines—a phenomenon which has existed since the dawn of the industrial age, and is indeed evident in Adam Smith’s Wealth of Nations (1773). The globalization of labor markets has also been a contributing factor to the secular decline in real wages, with commuter zones such as furniture production in Tennessee being hard hit. The decline of labor unions has also contributed to wage inequality over time.8

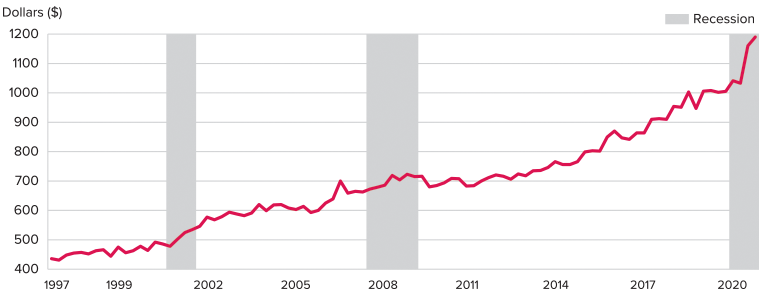

While many of these facets are shared by other advanced economies which have transitioned from old (that is, good producing) to new—(or services-providing) economic growth (including the U.K. and France), and have developed over the last few decades, there is one key factor which directly correlates with the rise of income inequality and the erosion of purchasing power for the middle class. Amidst an otherwise disinflationary environment, the cost of basic human goods—including housing, healthcare in the U.S., and transport in Europe—has been steadily rising. In the U.S., even if nominal wages have modestly recovered within recent years, incomes are not keeping pace with mandatory expenditure for households, including rent.9 Indeed, as we can see in Figure 1, even in the depths of the corona crisis throughout 2020, rents are rising.10, 11

Figure 1: Median Asking Rent for Vacant for Rent Units, U.S.: 1997-2020 (Current Dollars)

Source: U.S. Census Bureau, Current Population Survey/Housing Vacancy Survey,

Recession data: National Bureau of Economic Research, (www.nber.org)

At the time of writing, 1 in 5 Americans are behind on their rental payments (and 1 out of every 7 adults with children in their household lacks sufficient food).12 Set against this backdrop, it is difficult to imagine a resurgent and lasting run up in core inflation within the U.S. and other advanced economies.13 Even with the passing of the $1.9 trillion stimulus package—including $1,400 direct payments to households in need —there is still significant slack in the labor market, and deepening and widening income and wealth inequality. Federal Reserve Chairman Jerome Powell has stated that it might take more than three years for the Fed to reach its inflation target of 2%.14 Interest rates are likely to remain lower for longer, as the U.S. and other countries emerge from the twinned health and economic crises wrought by COVID-19.15

If interest rates remain lower for longer (and negative, in the case of some countries), the price of core real estate—especially in advanced economies such as the U.S. and the Eurozone—is likely to increase. In the years between the GFC and the corona crisis—amidst a backdrop of expansionary monetary policy—large institutional investors have rotated out of fixed income and stepped up allocations to core real estate, in pursuit of a bond-like return. Indeed, steadily increasing allocations to core residential and commercial real estate markets in Europe prompted then outgoing ECB President Mario Draghi to point to potential bubble risks within the Eurozone.16 With investors chasing yields—and with a shrinking supply of core real estate assets in major markets—prices are likely to continue to rise.17 This is perhaps one reason why we’ve witnessed so little distress in the real estate sector throughout the pandemic.

Real Estate Food Groups: D.C. Agnostic

Before considering the potential changes in the U.S. real estate landscape under the Biden administration, it is important to consider the dynamics underpinning opportunities in some of the real estate food groups which are somewhat ‘D.C. agnostic’, including residential, logistics, data centers, film studios, and proptech. Accordingly, these opportunities are also to be found across global markets.

Booming housing market: record low interest rates fuelling activity in the residential sector, and in some markets, contributing to record high prices.

Indeed, with central banks and governments committed to expansionary monetary policy in the wake of the pandemic, a lower interest rate-induced surge in buying homes (for those who can afford to) has unfolded within advanced economies across the globe, including Singapore, Canada, and the U.K.18, 19, 20 In December 2020, U.S. housing starts jumped to their highest level in 13 years.21 In early 2021, U.S. existing home sales reached the highest level in 14 years.22 Similarly, with the rush of pent-up demand emerging from initial lockdowns, house prices in the U.K. hit a six-year zenith.23

Looking beyond lower interest rates as a causal factor, purchases have been stepped up throughout the pandemic by those who have been able to work from home, and might have transitioned into a more amenable living arrangement, potentially with more space to live and work and play. With travel and entertainment expenditures curtailed, capital investments within homes have also surged. Indeed, homeowners in the U.S. spent an average of $17,140 on their homes in the first eight months of the pandemic.24

Due to the surge in demand, a shortage of supply, and ongoing tariffs and disruptions to supply chains, the price of lumber has spiked by 180% since the spring of 2020, eating into developers’ margins, and also contributing to the rise in house prices.25 It is important to note in the debates about the potential return of high inflation, house prices are not included in the consumer price index (CPI), which is the standard measure of inflation used by the Fed and the government to calculate monetary and fiscal policy.26, 27

Logistics and the transformation of retail: the acceleration of online shopping and e-commerce as a result of COVID-19

Beyond sheltering in place, shopping in place has become the new normal for households unable to engage in economic interactions in traditional brick and mortar outlets during the lockdowns. Prior to the pandemic, at the end of 2019, online sales only made up about 11% of total retail sales in the U.S. (with similar figures for France and the Netherlands).28, 29 By some estimates, this figure nearly doubled to 21.3% in 2020.30

However, as the virus recedes, this figure is likely to plateau and grow steadily rather than skyrocket. Data from the EU evidences that for Europeans who opted to shop in person rather than online in 2019, 73% prefer this experience due to the ability to touch and feel products; out of habit; and out of loyalty to shops.31

This suggests that once consumers feel safe to engage in in-person interactions, that the death of brick and mortar is far from nigh, and that the presence of a physical shop will likely remain central for some retailers (such as luxury companies offering an ‘experiential’ service alongside goods). For retailers who have maintained or grown sales during COVID-19, many adapted to the new environment and incorporated various elements of omnichannel for the first time, including in-store pickup and home delivery.32

Notwithstanding, as brick and mortar adjusts, the near doubling of online sales during 2020 has further accelerated the rush of capital to logistics plays, from warehousing to micro-fulfillment centers supporting last mile or ‘last hour’ deliveries in urban areas.33, 34 By one estimate, total e-commerce sales in the U.S. could hit $1.5 trillion by 2025, which would increase the demand for industrial real estate to an additional 1 billion square feet.35 While valuations remain elevated – for both physical assets and for acquiring VC companies in the supply chain space alike—demand is likely to remain red hot in the years to come.36

TMT (Technology, Media, Telecom) play: data centers and film studios

The ‘WFH’ (working from home) dynamic has spurred a boom in associated industries since the start of the pandemic, from semiconductor chips to telecoms. In lieu of in person interactions – from offices to physical conferences – the virtual workspace is accelerating demand for data centers.37 Additionally, with mounting concerns around cybersecurity, and changing regulations on data privacy, demand for data centers is only likely to expand.

The ‘play at home’ dynamic has also accelerated a trend of investing in film studios. With many households’ insatiable appetite for film streaming services, some of the most sophisticated real estate investors have scooped up prestigious film studios in New York and Los Angeles.38 As streaming demand is likely to temporarily wane with eventual reopenings and returns to in-person entertainment, the proliferation of and preference for ‘original’ content creation from some of the world’s largest media companies is likely to propel further pools of capital into the studio space.

PropTech

Some real estate developers observe that one of the last big shocks to U.S. real estate—the attacks of September 11th—introduced a whole new priority of security within buildings (particularly in the office space), so the experience of the COVID-19 pandemic has catalyzed the necessity for operators to adopt new measures for safety, health and wellness. Developers have swiftly pivoted to invest in thermal screening, contract tracing, air purification, and de-densification, both within the office space, as well as reimagining amenity spaces in multifamily.

It goes without saying that the entire proptech industry will likely be accelerated as a result of these new capital expenditures in health and wellness, including investments in clean air tech. Additionally, in a lofty price environment, operators will be on the hunt for ways to create greater efficiencies across the real estate landscape via PropTech. Lastly, as we shall explore, the overwhelming emphasis on climate change, the environment is also likely to prompt investors to double down on PropTech investments which enhance ESG criteria for building management.39 Given the explosion of investor and LP interest in sustainability, the scope for investing in PropTech which enables or enhances building sustainability is likely to blossom, not only in the U.S. of course, but in markets across the globe.

Urbanization

The victory of Joe Biden—combined with a newly Democrat-controlled Senate—ushered in a sigh of relief on behalf of some real estate investors with significant exposure in cities within ‘blue states’ such as New York and California. Although the new Congress did not shape up to be the ‘blue wave’ which some pundits had forecasted, the prospect has certainly improved for directing federal relief to state and local governments whose balance sheets have been decimated in the wake of COVID-19. Indeed, the latest $1.9 trillion package earmarks $350bn of funds for state and local governments, which provides crucial support for governments to continue basic services in the wake of severe revenue shortfalls during the pandemic.40

Indeed, despite the rollout of powerful vaccines, some former urban dwellers who have decamped to the suburbs or rural idylls await a fizzling out of the virus, eschewing the density of major cities until human proximity is no longer perceived as a health risk. Accordingly, facing acute revenue shortfalls, as well as plunging demand for public transport, state and local officials have pleaded with Washington for support in lieu of tax dollars. Any relief provided will be a huge boon and an added incentive for these leaders to woo taxpayers back to their urban havens.

Looking beyond the present pandemic, cities are likely to lead the recovery in services-oriented economies such as the U.S. Demand for blue-collar services—including leisure, hospitality, entertainment, and personal services—is likely to rebound once the virus subsides. As for white-collar services—which encompass the bulk of those who have been able to work from home, and decamp from cities—companies within financial, business and professional services, real estate, investment management, technology, and life sciences—will require an office space for their leaders and employees to innovate, collaborate, and to engage with clients. Similarly, many workers who have relied upon conferences for networking have suffered from videoconferencing fatigue, and miss the magic which only in-person communications can afford. Both of these forms of interaction—the re-imagined office and the business conference—are likely to resume once the health and safety of the workplace can be secure for workers and participants. Given the statistically positive relationship between innovation and urban density over time, the resumption of business activity in the post-pandemic world is unlikely to unfold in the world’s major cities.41

Accordingly, state and municipal authorities will need to look to real estate developers as business partners in rebuilding cities and communities in the wake of COVID-19. While federal funding can act as a critical stopgap measure for the shortfall in tax dollars, private developers will be a vital component of rebuilding cities in the wake of the pandemic. As we shall see, affordable housing and mitigating climate change are critical components of forging equitable and sustainable growth in urban centers. As such, some of the policies arising from the relief packages in the U.S. (consistent with President Biden’s policies from the campaign trail) yield greater opportunities for developers to be part of the solution.

Immigration

Implicitly connected with urbanization—and with economic growth—President Biden’s policies on immigration have the potential to catalyze new demand within cities. Indeed, some of the President’s first executive orders entailed revoking policies from the previous administration regarding restricting the entry of immigrants to the U.S.42 Studies show that inventors from diverse backgrounds tend to agglomerate in areas of urban density.43 Within the U.S., some of these foreign-born workers have made outsized contributions to the growth of the technology sector.44 Larger cities tend to offer the opportunities for networking and ‘assimilation’, as well as rich collaboration.45

Insofar as the Biden administration continues to try and implement its immigration agenda, we can likely expect new entrants to be magnetized to America’s major metropolitan areas, further contributing to the rebound of innovative, diverse, and GDP-contributing cities, injecting a new sense of dynamism and demand for the country’s urban real estate developers and investors. It should also be noted that pro-immigration policies might also result in an adjustment of residential asset prices within cities. With mobility curtailed during the coronavirus pandemic, foreign purchases of homes have been down across global markets, from Singapore to the U.S.46 One can expect that once travel restrictions and lockdowns lift—as well as with more long-lasting changes to immigration encouraging flows of human capital—that we might see a pickup in pricing for some of the major MSAs (metropolitan statistical area) in the U.S.47

Build This House: The Changing Tide On Affordable Housing Policy

One of the most significant changes emanating from the Biden administration for the real estate market is that of housing policy. In understanding the potential opportunities resulting from the changes, it is important to note two things. Firstly, these shifts—unfolding in some of the successive waves of stimulus packages—are consistent with President Biden’s campaign trail policies on affordable housing, and addressing the needs of Americans who are rent-burdened (those spending more than 30% of their income on housing costs), and on housing as relates to climate).48 Secondly—and perhaps crucially—the focus on housing is currently shared by both sides of the party bench, Democrat and Republican. In the debates conducted within Congress concerning both the $900 billion relief package passed in late December 2020, and the $1.9 trillion rescue package, it is evident that housing is a bipartisan concern, and therefore a potential bright spot for collaboration and reaching across party lines in an otherwise divided Congress.

Before getting to the changes in policy, let’s consider the current state of the market. With the costs associated with homeownership steadily rising, a growing number of households within the U.S. are renters. Increasingly, many face a crisis of affordability: in 2017, 48% of renters in the U.S. were classified as ‘rent burdened’: that is, spending over 30% of their income on rent.49 In 2018, 1 out of 4 renters spent over half of their income on rent.50 As previously discussed, real wages have not kept up with the rise in the cost of shelter. This duress is acutely felt at the bottom part of the income bracket: for the median renter taking home less than $15,000 per year, only $410 per month remains as discretionary income after rental obligations are paid.51

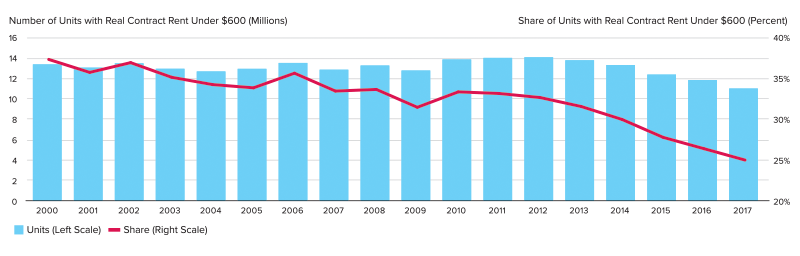

While the demand for rental properties grows across multiple demographic groups there is a market mismatch in supply. While construction of rental properties has reached its highest level in three decades, there is currently an oversupply of luxury high-end rental units, and at the same time, a dwindling number of low-income or affordable units, as shown in Figure 2.

Figure 2: Low-Cost Units Account for a Shrinking Share of the U.S.’s Rental Stock

Notes: Rental units may be occupied, vacant for rent, or rented but unoccupied; excludes units occupied without cash rent. Dollar values adjusted for inflation using the CPI-U for All Items Less Shelter. Contract rent excludes all utilities paid separately.

Source: JCHS tabulations of U.S. Census Bureau, American Community Survey 1-Year Estimates via IPUMS

Granted, the number of market-rate renters is growing. Nevertheless, some 47.5% of all renters in the U.S. remain cost-burdened—nearly double the number of high-income renters as a share of the total market.52 Since the GFC, there has been a ‘steep drop off’ in the construction of affordable housing, and the construction of federally subsidized housing has flatlined since 2010.53, 54 To put it quite clearly, whilst wages have not kept up with the rise in price for most of the country’s renters, supply has not kept up with demand.

Even amidst the COVID-19 pandemic, with America on the brink of potentially the worst evictions crisis since the Great Depression, rents continue to rise.55 At current tally, COVID relief packages within the U.S. are likely insufficient to address the deepening economic distress and rental insecurity felt by some American households. In early 2021, nearly 20% of renters in the U.S. are behind on rent payments. In back payments of both rent and utilities, a staggering $57.3 billion is owed, which is more than double the amount of rental assistance earmarked in the $900bn December 2020 stimulus package.56

In terms of spurring long-lasting opportunities to correct the supply and demand imbalance, the benevolent news is that lawmakers included a change to the Lower Income Housing Tax Credit (LIHTC) in the December 2020 package, resulting in a sea change to existing policy. Initiated as part of the 1986 Tax Reform, the LIHTC works by the federal government allocating a certain amount of tax credits to state governments. Authorities then award these credits to developers in an RFP process, who then might sell the credits to investors. Previously, the calculation of the credits was tied to borrowing rates set by the Treasury. The December 2020 relief package introduced a new floor rate of 4%, which means that the credits will be more lucrative.57 In turn, by increasing the subsidy, this renders more projects feasible, which might catalyze a ‘flood’ of investments. One estimate is that this could finance an additional 126,000 affordable apartments in the U.S. by 2029 (with 23,000 additional units alone over the next decade).58

This policy shift is extremely beneficial, insofar as it addresses the critical supply imbalance of low-income housing to demand, and has the potential to implement long-lasting changes to the crisis of affordability, rather than just short-term relief to economic distress. As policymakers and business leaders seek to learn from the experience of the corona crisis in the ‘great reset’ of economies and societies, one idea which has been touted in the U.S. is to introduce more ‘automatic stabilizers’: that is, putting in place a wider social safety net which can be automatically triggered to households in need during times of crisis (something countries such as France and Germany already have in place).59 One policy idea would be to automatically expand the availability of Section 8 vouchers once an economic crisis reaches a certain threshold, rather than to await the passing of policy to expand rent subsidies in a potentially gridlocked Congress.60

Another policy idea currently being explored is that of changing zoning regulations within cities to allow more opportunities for developers to increase supply. As one study highlights, expanding the potential for flexibility of land use, and ‘reducing barriers to development would make building apartments less expensive.61 For example, this could include the development of ‘skinny apartments’, such as to be found in Philadelphia on a slender lot.62 While state and municipal leaders counter budget shortfalls in the wake of the pandemic, class B office buildings could be ‘upzoned’ into affordable housing—a policy currently in consideration with Governor Cuomo in the State of New York.63 Within NYC and amidst such ‘adaptive reuse’ of office space, it is important to note that buildings with more than 35% of units as rent-stabilized can be exempt from the New York Climate Mobilization act, which would avoid an increase in capital improvement cost for rent-stabilized units.64

Building Green: Real Estate and The Environment

In addition to changes in immigration, one of the first executive orders signed by President Biden was for the U.S. to rejoin the Paris Climate Agreement, thereby stepping up the country’s Nationally Determined Commitments (NDC) to reduce greenhouse gas emissions. Consistent with his climate plan promulgated on the campaign trail, President Biden’s move to rejoin Paris effectively raises the climate change fighting efforts of the U.S. from a state and municipal level to a federal level.65

As part of his climate plan, Biden has set a target of reducing the carbon footprint of buildings in the U.S. by 50% by 2035.66, 67 This would include incentivization for ‘deep retrofits’ such as implementing greater efficiencies, generating more power onsite with clean energy.68 Additionally, Biden has encouraged climate-friendly retrofittings to existing building stock, something currently pursued by governments around the world including Canada and South Korea.69 While this is likely to spur new job creation—pivotal in the wake of the corona crisis—it will likely also result in an increase in capital expenditure and labor cost for developers.

Beyond the tidal shift in policy from Washington—with the climate agenda enshrined in federal policy—the avalanche effect of investors increasingly mandating the inclusion of climate risk and ESG protocols in their portfolios will undoubtedly further propel new development (as well as upgrades to existing stock) along the path of sustainability. Moreover, as the U.S. shifts from ‘relief and rescue’ to economic recovery, new opportunities might also blossom if Congress eventually passes a long-awaited infrastructure bill. Should the bill include incentives for privatizations, and green and brownfield investment in hard infrastructure assets such as roads, bridges, ports—and even schools and hospitals—this might induce a multiplier effect on real estate development in urban, suburban, and rural areas alike.

Conclusion

In sum, as the U.S. emerges from the COVID-19 pandemic, under the helm of a new presidency and a new Congress, opportunities abound for real estate investors and developers from across the globe, in both the housing sector as well in upgrading and generating sustainable development. Crucially, some of the changes in legislation to the LIHTC deepen the financial incentive for developers and investors to create a direly needed supply of low-income housing. In so doing, real estate executives can become part of the solution in addressing the crisis of affordability within the U.S., a major contributing factor to income and wealth inequality, and hence social tension within America. Housing is also a critical part of community-minded investments, a lynchpin of President Biden’s policies on housing.70 While some observers highlight the causal factor of a loss of a sense of community to the present polarised culture in the U.S., real estate investors can again become part of the solution in helping to foster deeper social cohesion (beyond just ticking a box for ESG criteria).71 As the Biden administration considers plans for smart cities, affordability will be an absolutely crucial component of constructing not only smart cities but also a ‘smart nation’.

It is worth pointing out that as the world confronts the climate emergency, and as the U.S. assumes a role on the global stage by prioritizing commitments to mitigate climate change at the federal level, tensions may emerge between environmental policy and social policy – or the ‘E’ and the ‘S’ components in ESG. As policymakers and developers work together to form solutions in the post-COVID built environment, the ability to weigh up and pragmatically measure the social goods arising from a potential project. Climate policy can actually conflict with the provision of more affordable housing, and it is incumbent upon executives, investors, and political leaders to be able to appropriately balance the long-term implications of such trade-offs.72 •

Endnotes

1. https://asia.nikkei.com/Business/Markets/Property/China-caps-mortgage-loans-to-ward-off-housing-bubbles ↩

2. That is, one might that cutting interest rates in order to stimulate consumption and investment – what has been referred to as Keynesian stimulus in the wake of a recession – is not entirely effective at stimulating demand when households are prevented from consuming, and businesses are reticent to invest given the high uncertainty from the pandemic. ↩

3. https://www.imf.org/en/Publications/WEO/Issues/2021/01/26/2021-world-economic-outlook-update ↩

4. See, for example, https://www.bloomberg.com/news/articles/2021-04-08/powell-says-uneven-global-vaccination-roll-out-is-recovery-risk ↩

5. https://www.federalreserve.gov/newsevents/speech/powell20210210a.htm ↩

6. https://www.federalreserve.gov/newsevents/speech/powell20210210a.htm ↩

7. https://www.epi.org/publication/charting-wage-stagnation/ ↩

8. See, for example, https://www.epi.org/blog/weakened-labor-movement-leads-to-rising-economic-inequality/ ↩

9. https://www.epi.org/nominal-wage-tracker/ ↩

10. https://www.bls.gov/news.release/cpi.t01.htm ↩

11. In aggregate. It should be stated that within some cities and in some rental categories, the cost of rent has fallen. See, for example, Gupta, Arpit and Mittal, Vrinda and Peeters, Jonas and Van Nieuwerburgh, Stijn, Flattening the Curve: Pandemic-Induced Revaluation of Urban Real Estate (February 26, 2021). Available at SSRN: https://ssrn.com/abstract=3780012 or http://dx.doi.org/10.2139/ssrn.3780012. Accessed 12 Apr 2021. ↩

12. https://www.cbpp.org/research/poverty-and-inequality/tracking-the-covid-19-recessions-effects-on-food-housing-and ↩

13. Importantly, core inflation strips out food and energy prices, or headline inflation. As a result of shocks to both supply and demand – with the former caused not only by the pandemic but also adverse weather events – commodity prices are likely to remain volatile for some time. ↩

14. https://www.bloomberg.com/news/articles/2021-02-24/powell-reiterates-view-that-labor-market-has-a-long-way-to-go ↩

15. https://www.cnbc.com/2021/01/14/powell-sees-no-interest-rate-hikes-on-the-horizon-as-long-as-inflation-stays-low.html ↩

16. https://www.reuters.com/article/uk-imf-worldbank-ecb-idUKKBN1WX1TO ↩

17. https://realassets.ipe.com/real-estate/tyler-goodwin-why-core-is-going-to-get-more-expensive/10047936.article ↩

18. https://www.bloomberg.com/news/articles/2021-02-15/singapore-home-sales-exceed-two-year-high-as-curbs-may-loom?srnd=premium ↩

19. https://www.cbc.ca/news/business/canada-home-sales-1.5874577#:~:text=Almost%20552%2C000%20homes%20traded%20hands,the%20final%20month%20of%202019. ↩

20. https://www.bloomberg.com/news/articles/2020-10-18/u-k-home-prices-jump-to-record-as-sales-reach-all-time-high ↩

21. https://www.cnbc.com/2020/01/17/us-housing-starts-december-2019.html ↩

22. https://www.wsj.com/articles/u-s-existing-home-sales-reach-highest-level-in-14-years-11611327933 ↩

23. https://www.ft.com/content/c3950b2b-43a5-43f4-8bb1-2e2a462f04de ↩

24. https://www.barrons.com/articles/whether-big-or-small-home-improvement-projects-are-trendy-in-2020-01605539638 ↩

25. https://nahbnow.com/2021/02/record-high-lumber-prices-add-24k-to-the-price-of-a-new-home/ ↩

26. https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.pdf ↩

27. https://www.bls.gov/cpi/questions-and-answers.htm ↩

28. https://fred.stlouisfed.org/series/ECOMPCTSA ↩

29. https://www.retailresearch.org/online-retail.html ↩

30. https://www.digitalcommerce360.com/article/us-ecommerce-sales/ ↩

31. https://ec.europa.eu/eurostat/statistics-explained/pdfscache/46776.pdf ↩

32. https://ecommercenews.eu/the-impact-of-covid-19-on-ecommerce/ ↩

33. https://www.bizjournals.com/newyork/news/2020/11/25/prologis-buys-queens-warehouse-for-51-million.html ↩

34. https://www.sterlingorganization.com/joe-dykstra-joins-sterling-organization-as-president-of-newly-formed-subsidiary-sterling-logistics-properties/ ↩

35. https://www.us.jll.com/en/newsroom/grand-logistics-center-industrial-project-in-queens-financed↩

36. See, for example, https://www.vccircle.com/tvs-supply-chain-ropes-in-new-investor-at-elevated-valuation/ ↩

37. https://www.datacenterknowledge.com/business/investment-bankers-expect-pandemic-fuel-long-term-data-center-boom ↩

38. https://www.globest.com/2020/10/01/nycs-iconic-silvercup-studios-acquired-by-jv/?slreturn=20210127154903; https://therealdeal.com/la/2021/01/27/hackman-capital-pays-160m-for-sony-animation-studio/ ↩

39. See, for example, https://investableuniverse.com/2020/11/09/blackstone-energy-partners-therma-re-tech/ ↩

40. https://www.ft.com/content/21c4bdb4-41eb-4c57-b4af-630da956a950 ↩

41. The relationship between urbanization, innovation, and the future of growth – and the implications for real estate in the post-pandemic world – is beyond the scope of this article. Please see https://www.pwc.com/us/en/services/consulting/risk-regulatory/cornering-the-globe/urbanization-real-estate-after-covid-19.html ↩

42. https://www.whitehouse.gov/briefing-room/presidential-actions/2021/02/24/a-proclamation-on-revoking-proclamation-10014/ ↩

43. https://www.nber.org/system/files/chapters/c7987/c7987.pdf ↩

44. https://www.nber.org/system/files/chapters/c7987/c7987.pdf ↩

45. https://www.nber.org/system/files/chapters/c7987/c7987.pdf ↩

46. https://www.bloomberg.com/news/articles/2021-01-27/foreign-buying-of-singapore-private-homes-drops-to-17-year-low ↩

47. https://rismedia.com/2020/08/08/nar-foreign-investment-down-existing-home-sales/ ↩

48. https://joebiden.com/housing/ ↩

49. https://www.gao.gov/assets/710/707179.pdf ↩

50. https://www.jchs.harvard.edu/sites/default/files/Harvard_JCHS_Americas_Rental_Housing_2020.pdf ↩

51. https://www.jchs.harvard.edu/sites/default/files/Harvard_JCHS_Americas_Rental_Housing_2020.pdf ↩

52. https://www.jchs.harvard.edu/sites/default/files/Harvard_JCHS_Americas_Rental_Housing_2020.pdf ; Pg. 26.; https://www.jchs.harvard.edu/sites/default/files/Harvard_JCHS_Americas_Rental_Housing_2020.pdf Pg 1. ↩

53. https://www.taxpolicycenter.org/briefing-book/what-low-income-housing-tax-credit-and-how-does-it-work ↩

54. https://www.jchs.harvard.edu/sites/default/files/Harvard_JCHS_Americas_Rental_Housing_2020.pdf ↩

55. https://www.bls.gov/news.release/cpi.t01.htm ↩

56. https://www.cnbc.com/2021/01/25/nearly-20percent-of-renters-in-america-are-behind-on-their-payments.html ↩

57. https://therealdeal.com/national/2020/12/21/stimulus-deal-includes-major-change-to-affordable-housing-financing/ ↩

58. https://therealdeal.com/national/2020/12/21/stimulus-deal-includes-major-change-to-affordable-housing-financing/ ↩

59. See, for example, https://www.piie.com/publications/policy-briefs/fiscal-resiliency-deeply-uncertain-world-role-semiautonomous-discretion ↩

60. Private conversation with a seasoned affordable housing developer in U.S. ↩

61. https://www.brookings.edu/research/flexible-zoning-and-streamlined-procedures-can-make-housing-more-affordable/ ↩

62. https://www.brookings.edu/research/flexible-zoning-and-streamlined-procedures-can-make-housing-more-affordable/ ↩

63. https://therealdeal.com/2021/01/20/state-proposes-zoning-override-for-commercial-to-resi-conversions/ ↩

64. https://www.smartcitiesdive.com/news/nyc-strengthens-climate-mobilization-act-building-requirements/588070/ ↩

65. Also, in one of his first executive orders, Biden initiated a moratorium on leasing for oil and gas in federal lands and waters. https://www.npr.org/sections/president-biden-takes-office/2021/01/27/960941799/biden-to-pause-oil-and-gas-leasing-on-public-lands-and-waters. ↩

66. https://joebiden.com/housing/ ↩

67. For a deeper discussion on the relationship between climate change and real estate, see: https://www.pwc.com/us/en/services/consulting/risk-regulatory/cornering-the-globe/building-green-affordable-real-estate-esg.html ↩

68. https://joebiden.com/housing/ ↩

69. https://apnews.com/press-release/accesswire/business-government-business-and-finance-environment-and-nature-economic-policy-air-pollution-04a9b6748ef9f40329ad854ceba8ff87 ↩

70. https://joebiden.com/housing/. It should also be noted that Biden has touted the idea of reforming Opportunity Zone legislation to encourage developers to launch projects with a focus on the community and affordability, rather than using the tax incentive as an opportunity for ‘gentrification’ of urban centers. ↩

71. See Rajan, R. The Third Pillar. ↩

72. https://www.scientificamerican.com/article/policy-can-clash-with-affordable-housing/ ↩

Photo: Luca Perra/Shutterstock.com

Photo: Luca Perra/Shutterstock.com