Summer 2015, Volume 40, No. 1

By Thomas W. Hamilton, Ph.D., CRE, MAI, FRICS, CDEI

The real estate appraisal profession has for years discussed various types of ownership interests in real property that can be valued. Of these, the leased fee and the fee simple have drawn significant attention as to their proper use in various appraisal assignments. What this article presents is a fresh view on the topic of valuing leased property and how this fresh view addresses many of the issues raised by David Lennhoff, CRE, in a recent Real Estate Issues dealing with answering the “wrong question.”1 This fresh look on valuing leased property helps the appraiser to define markets more clearly and concisely, and guides the appraiser to conclude the unsurpassed highest and best use of the property being appraised.

A New View of the World

On June 22, 1633, the Holy See of the Roman Catholic Church in Rome handed down the following order: “We pronounce, judge, and declare, that you, the said Galileo … have rendered yourself vehemently suspected by this Holy Office of heresy, that is, of having believed and held the doctrine (which is false and contrary to the Holy and Divine Scriptures) that the sun is the center of the world, and that it does not move from east to west, and that the earth does move, and is not the center of the world.”

Modifying one’s belief in a learned and universally accepted concept is difficult, regardless of how undeniably true the alternative may be. The same can be said how the leased fee interest is viewed in real property valuation. The leased fee interest, as currently applied in the appraisal profession, is equivalent to the fee simple interest of a property that is currently leased to others (i.e., a leased fee simple interest). The basis for this new view is based on the premise that a fee simple leased property contains two sets of property rights components, one being the real property interest (the fee simple interest) and the other a personal property interest (the lease contract).

When a leased property has lease terms and conditions that are equivalent to the overall market terms and conditions for comparable leased properties, the value of the leasehold interest (i.e., the chattel real) in the property is zero. Equivalently the net, contributory value of the lease contract (i.e., the quasi-personality) to the fee owner of the property is also zero, and this directly results in the market value of the leased fee interest (the fee simple interest of a property leased to others) to exactly equal the market value of the fee simple interest. Simultaneously, the full bundle of property rights held by an estate in real property, regardless whether the property is leased or owner occupied, can be identical because the full bundle is transacted from grantor to grantee through the simultaneous execution of the real estate deed and the assignment of the personal property lease. It is only when an appraiser is using contract rents that are specific to the subject property in the valuation assignment (and not market-based rents) is the special condition of the traditionally accepted “leased fee interest” being valued.

The Full Bundle of Rights

Valuing real estate for ad valorem purposes is becoming even more complex as assessors and property owners fight over definitions and the valuation procedures associated with those definitions. To assist in this discussion, this article describes the terms, conditions and procedures that are necessary to achieve proper valuation for ad valorem purposes when the standard for valuation is the market value of the fee simple interest.

There are two primary issues at hand in this discussion: the transfer of property rights and highest and best use (HBU). Before HBU can be thoroughly discussed, the transfer of property rights must first be determined. When valuing property for ad valorem tax purposes, the market value of the fee simple interest is (usually) needed. The fee simple interest is a freehold estate in real property ownership. The term “fee” means that an ownership interest in land and all attached to the land is inheritable, and fee estates are “freeholds” which means that the fee interest is either uncertain or unlimited in duration. Historically, the terms fee and fee simple are interchangeable and therefore equivalent, and the first discussion of leased fee refers to the ownership of the fee interest when a property is leased was in 1926.2

This evolved into the term “leased fee” that appraisers use today. The fee simple interest (or simply, the fee interest) is considered the greatest type of interest in property ownership available and is often termed the “fee simple absolute estate.” What this means is that the fee simple absolute estate (interest), the fee simple estate (interest), and the fee estate (interest) are synonymous terms and indicate the same thing—the greatest possible ownership of a land parcel including all the rights, interests, limitations, obligations and improvements to that land parcel.

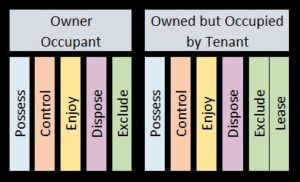

When transferring ownership of the property, a warranty deed will not only include the names of the grantor and grantee, the physical description of the property, and consideration of the grantee and words of conveyance by the grantor, it will also include any appurtenances and hereditaments of the property, including leases which are termed quasi-personalty.3 In addition to recording deeds for the sale of real property, many states also require leases to be recorded to give official public notice of such transactions, and the recordation order for these public documents is specific. Regarding recordation in the case of a sale-leaseback transaction, the real property deed is recorded first and the lease is recorded afterwards. This is necessary to ensure that the true parties to the subsequent lease are properly reflected in the titled ownership of the estate in real property even though both are executed together at a real estate closing. These issues are extremely important considerations in the valuation process for leased property since the real property bundle of rights associated with leased property transactions must be addressed and recognized properly. In the chart below, the bundle of rights and obligations—both real and personal—associated with an owner occupied property are compared to the bundle of rights and obligations of a leased property (owned, but occupied by a tenant).

Ownership Rights for Owner Occupied and Leased Property

The typical bundle of rights associated with the fee simple estate (owner occupied) include the right of possession (the property is owned by the title holder), the right of control (the owner controls the property’s use), the right of enjoyment (the holder can use the property in any legal manner), the right of disposition (the holder can sell the property), and the right of exclusion (the holder can deny people access to the property), among possibly other rights. It is when a property is leased to others that an additional personal property interest is created—this is the lease contract interest in the property. This lease intertwined with the real property right of exclusion in the fee simple bundle of rights through proper execution. This is why the lease is termed a quasi-personality. In other words, the right to exclude remains with the bundle of rights transferred in a property transaction because the specific terms of exclusion giving the tenant temporary occupancy of the property (the quasi-personality) are present in the lease contract that is assigned during the property’s conveyance along with the remaining bundle of rights in the deed.

As depicted in Figure 1, the lease contract does not remove any rights from the bundle of rights of the fee simple estate, but rather it is an addition to the fee simple estate. This is evidenced by the fact that whenever a property that is currently leased is sold from one party to another, the new owner (the grantee listed in the deed) obtains not only the full bundle of realty rights associated with the property, but also the quasi-personality interests and obligations of the lease. The right to exclude others is conveyed to the new owner through the lease that is part of the bundle of rights contained in a leased property’s transfer, and, upon termination of the lease contract, the right of exclusion is no longer governed by the lease but is held exclusively by the owner of the estate in real property—the grantee of the conveyance. An example of this process is developed and explained later.

The bundle of rights depicted in Figure 1 is also consistent with generally accepted appraisal practice where leased properties, whose contractual lease terms are at market levels, are said to have a value that is at “market,” or is numerically equivalent to the fee simple value of the property. It is also maintained by the appraisal profession that even though the value of the “leased fee” property is equal to the “fee simple” value of the property, conceptually the two real property interests are different. This second statement is not true because the leased property has the same bundle of real property rights as a fee simple property. The leased property simply contains an additional set of personal property rights and obligations that exist in the lease contract, but the real property rights of possession, control, enjoyment, disposition and exclusion all exist and are conveyed and/ or assigned from the grantor to the grantee. This means that the same set of real property rights can exist in all conveyed properties regardless if they are leased or owner occupied, and if the purpose of the appraisal assignment is to value only the real estate the appraiser must simply remove the incremental value of the personal property component (i.e., remove the net value of the lease). When the lease contained in a property transaction is identical to market terms and conditions, the net value of the lease is zero; and the value of the leased property is equal to the fee simple value of the property.

Big-Box and Specialty Retail Valuation

In the Real Estate Issues article,4 Mr. Lennhoff discusses some topics that are at issue in property tax litigation across the country that he states lead to the “right answer to the wrong question,” and this article will explain how Mr. Lennhoff ’s discussions can lead to the wrong answer to the wrong question. Mr. Lennhoff uses Appraisal Institute definitions throughout his discussion to emphasize his points, however, legal definitions of these terms will yield different conclusions. For example, Black’s Law5 defines fee simple as:

“An interest in land that, being the broadest property interest allowed by law, endures until the current holder dies without heirs; esp., a fee simple absolute— often shortened to fee.”

According to the Dictionary of Real Estate Appraisal, the definition of fee simple is quite different:

“Absolute ownership unencumbered by any other interest or estate, subject only to the limitations imposed by the government powers of taxation, eminent domain, police power, and escheat.”6

By focusing on the Appraisal Institute definition of fee simple, and in particular the phrase “unencumbered by any other interest or estate,” appraisers for property owners in ad valorem litigation follow the premise that Mr. Lennhoff explains on page 23 of his article: a property must be vacant and available to be leased in the valuation process (i.e., the property must be “dark”). Using the Black’s Law definition, a property does not need to be “vacant and available to be leased” to obtain a fee simple appraised value as long as the full bundle of rights is included. The concept of a property being vacant and available to be leased (i.e., “dark”), which is based primarily on the premise of a property being “unencumbered,” is the basis for differentiating between “fee simple” property transactions and “leased fee” property transactions and how and when such transactions can or should be used to obtain the market value of the fee simple estate. Additionally, but rarely if ever addressed in the valuation assignment for property tax purposes using the “dark property” premise, if an existing property is “dark,” something adverse must have occurred previously to cause the property to be dark. In particular, Mr. Lennhoff uses examples of Circuit City and Hechinger properties that needed to be “re-dressed” to meet generic market standards, however he fails to explain why these stores were dark property transactions. When a market changes, whether it is a real estate market or the general economy, there will be fallout. Both the Circuit City (2009) and the Hechinger (1999) chains of stores went through liquidation bankruptcy. This added unplanned supply of space to real estate marketplaces that were not ready to absorb this new supply, causing distress in property prices. These types of dark properties are not typical market transactions, because they are by definition liquidations of distressed properties. The underlying economic reasons of why these properties are liquidated, distressed properties is often ignored by appraisers when valuing an owner’s interest in ad valorem litigation.

Regarding discussion of “leased fee,” the entire bundle of rights associated with the fee interest in property actually does convey from grantor to grantee when that property is leased because the lease contract that contains the right of exclusion (or to use, or to occupy) is simultaneously conveyed along with the deed to the real estate, and the appraiser therefore does not answer the wrong question. In fact, the right to exclude others transfers with the property from seller to buyer. For example, Builder Bob owns a property and leases it to Larry Lessee. The lease stipulates that Larry Lessee can occupy the property until the lease term expires upon which Larry Lessee must give his right of occupancy back to Builder Bob (because the parties to the lease are Larry Lessee as tenant and Builder Bob as owner). Before the lease expires, Builder Bob decides to sell the property to Ivan Investor subject to the lease between Larry Lessee and Builder Bob and Ivan Investor agrees to the purchase subject to the existing lease. Builder Bob transfers all of his rights in the property to Ivan Investor, including the lease which is “quasi-personality” (i.e., personal property). Upon the termination of the personal property lease contract, Larry Lessee leaves the property. So, who has the right to occupy the property once Larry Lessee leaves? If the right of exclusion (or to use, or to occupy) did not transfer between Builder Bob and Ivan Investor, then when Larry Lessee’s lease expired Builder Bob would still have the right of exclusion (or to use or to occupy). But this is not the case, because when Builder Bob deeded his ownership rights to Ivan Investor, the right of exclusion transferred through the assignment of the lease between Builder Bob and Ivan Investor as part of the deed’s wording. In effect, the transaction of this leased property included the full bundle of rights.

Another issue that appraisers for property owners use in ad valorem litigation surrounds the concept that a current occupant cannot be a potential buyer or occupant for the property. Nowhere in real estate economic or appraisal theory is this a requisite condition in determining the demand for real estate in the market analysis process. A current occupant of property is one of the potential demanders/users in the entire universe of potential demanders/users. In fact, the current occupant is one of the more likely buyers or occupants for the property. Excluding the current occupant is a proactive, selection bias error that results in limiting the actual market forces of supply and demand in the marketplace, and it will skew the market demand potential for the property. Even if the property is built-to-suit, there must have been sufficient market evidence initially to support the development of a first-generation user at market rates, and using Mr. Lennhoff ’s own words, “there is no reason the occupant should be willing to pay more than a dollar more than the rest of the pool. Why should he?”7 The appraiser’s correct market of competitive, comparable properties for first-generation space is actually other first-generation user property transactions and rents, and the appraiser should not use second-generation, distressed or “dark” transactions as comparables. It simply does not make economic sense in a competitive marketplace that first-generation space users will pay more than what they would pay for other space if that other space has the same market features and attributes because they wouldn’t “pay more than a dollar more.” For first-generation users, the second-generation space does not have the same market features and attributes required by the first-generation space user and therefore are not actually comparable.

If second-generation properties were truly comparable with first-generation properties, first-generation big-box retailers would purchase the distressed property at bargain prices and make greater returns on their real estate investments (either owned or leased) by acquiring the bargains.

In discussing marketing time, appraisers for property owners often claim that the leases for big-box retail do not compete in an open market, but rather the lease payments are simply a function of development costs. This is neither new nor surprising and nothing more than the “Front Door” approach that developers use regularly to determine the financial feasibility for their development projects. The developer’s construction costs are known or computed, and, from those costs, a minimally acceptable rental rate is determined based on market costs of capital. If the rental market will support the developer’s minimally acceptable rental rate from the “Front Door” analysis, then the project is deemed feasible. It is also using this analysis that an appraiser determines a property’s highest and best use as improved. Given all the potential uses and configurations of improvements to land, the one configured use that achieves the greatest profitability is deemed highest and best. The other way that developers analyze projects is called a “Back Door” approach. This method starts with net rents and derives a maximum developer’s construction cost. So, if a potential big-box retail user is concerned about maximizing its profitability, then they would focus on the “Back Door” approach to find the maximum cost they are willing to incur to obtain a property (or build it or have it built). Combined together, these two approaches yield an economic rent that is synonymous with market rent.8 Since retailers compete in their own relevant markets for real estate and retail consumers, the successful retail development for a particular user will incrementally out-bid the competition by a dollar to obtain the property and control that location. Paraphrasing Mr. Lennhoff ’s recent article, why would they overpay? Once the retailer successfully controls and develops the property, it knows the all-in cost of the project and applies a cost of capital to the project costs to determine a fair market rent that is consistent with the highest and best use of the site. What this process shows is that the marketing time needed to determine the market rent is built into the development process which is based on market costs of land, labor, capital, and entrepreneurial effort. To argue otherwise and, in effect say that they are overpaying for real estate, is to say that these multi-billion dollar big-box corporations do not understand basic corporate finance and do not conduct capital budgeting exercises—nor are they pursuing their fiduciary responsibility to maximize shareholder wealth. This is difficult to believe.

Regarding sale-leaseback transactions, if there always is a financial advantage to develop real estate using these types of transactions, then all real estate development would use a sale-leaseback. A space user would be financially imprudent to use anything but a sale-leaseback arrangement if there always was a financial advantage to the sale-leaseback. In an efficient financial marketplace, all financing sources are priced according to their individual risk characteristics, and the financial markets are for the most part fairly efficient in properly assigning risk to the various sources of capital. There are potential income and capital gains tax advantages and detriments to using sale-leaseback financing, but as with any financing that is not part of valuing the fee simple interest in a property and any such benefit or detriment can be addressed in both the sales comparison and the income approaches to value. To refute or ignore a sale-leaseback transaction solely on the presence of the sale-leaseback agreement in a transaction is not sufficient. If the financial marketplace is efficient, then the weighted average cost of capital in the sale-leaseback will be equivalent to the weighted average cost of capital in a traditionally financed acquisition. This argument follows hand-in-hand with the front door/back door arguments addressed previously.

In the highest and best use analysis process, after the market analysis component is completed, the final step is to determine the one use of the property that achieves the highest and best use for the site. If the highest and best use and the current use are the same, then the current use is highest and best. If that is the case, then the market value of the value in use will be equal to the market value of the fee simple interest in the property, even if the property is currently under lease. Too often the highest and best use of a property is generically stated, when the true highest and best use of a property is, and can be, more distinctly defined. According to Module 5 of the Appraisal Institute’s course, “Business Practices and Ethics,” students are warned—in the section discussing Highest and Best Use— that HBU “is nearly always critical” and that in “many problematic appraisals, the highest and best use analysis is flawed and insufficiently reported” such as when HBU leads to “conclusions that are too broadly stated (e.g., “commercial” or “residential”).”9 It is not just identifying which property rights that matter, identifying the proper market of competitive properties is critical. Furthermore, the Appraisal of Real Estate describes the highest and best use analysis process:

“General categories such as ‘an office building,’ ‘a commercial building,’ or ‘a one-unit residence’ may be adequate in some situations, but in others the particular use demanded by market participants must be specified, such as ‘a suburban office with 10 or more floors’ or ‘a three-bedroom residence with at least 2,500 square feet.’ In any case the appraiser should provide market evidence that leads to an understanding of the use or uses, the timing for those uses and the probable users and buyers.”10(emphasis added)

Again, in an occupied property, a probable user of that property includes the current tenant or owner and this situation does not immediately cause the current use to be a value in use—it could very well be the highest and best use (and user) which is essential for a market value appraisal assignment. This particular case, where the highest and best use is the current use, is a moot issue and could result in the value in use to equal the market value because the appraisal assignment is to give a market value opinion of the fee simple interest of the current (highest and best) use. To purposefully exclude a known and existing user from the highest and best analysis introduces appraiser bias. If the existing use and user are highest and best, this would introduce a hypothetical condition to the appraisal assignment — something that is known to be contrary to existing fact. That is not the market value standard for ad valorem property valuation. This is true for all market value appraisal assignments.

The Approaches to Value

As discussed to this point, there are many issues regarding how big-box property is developed and rented and how the appraiser conducts the highest and best use analysis. Oftentimes, appraisers for property owners in ad valorem litigation will stress that there are significant quantities of vacant big box properties in many markets, suggesting that they are equal substitutes for recently constructed and highly successful big box properties, and that the data for the vacant properties should be used in the various approaches to value. These issues flow through Mr. Lennhoff ’s discussion of the various approaches to value as well.11 A major issue often missing in these appraisal reports for property owners is the underlying reason why big box stores are vacant and available. Changing market forces including things such as wholesale liquidations due to bankruptcy, or a shift in consumer trends to a different type of retail environment such as lifestyle centers have made the “dark and vacant” properties second-generation properties. As such, big-box retailers often move to different locations within an area/region because the local marketplace has shifted its focus to that new location. What was once the “prime” location for retail is now secondary, tertiary or even lower on the consumer preference hierarchy for desirable shopping locations. As such, retailers will chase the consumer market, leaving behind lesser quality locations for the next better location. This is analogous to fishing — fishermen go to where the fish are biting. Likewise, to say that vacant retail in secondary or tertiary submarkets is equally desirable to the “prime” submarket is illogical. It is equally illogical to claim that the rents or prices paid for secondary or tertiary locations are equal substitutes for the rents paid in “prime” locations. In fact, for some retail uses (such as pharmacies), the difference between being on a fully signaled intersection with multiple access points and not having such features (such as mid-block or limited ingress/egress) can change the highest and best use of the property and will most likely drastically reduce the value of a property lacking the better attributes—even if they are adjacent to one another. The appraiser must be diligent to sufficiently refine the market analysis and the highest and best use analysis so as not to be overly broad. To do so will result in an aggregation bias that distorts the true market conditions affecting the subject property’s price and rents.

Regarding special property transactions such as 1031 exchanges, appraisers often miss one key and necessary element of a 1031 exchange of real estate. The exchange must be real estate for real estate. If some of the value of the property given up for the exchange is not real estate, it cannot be included in the new property’s taxable basis. According to the IRS, “Real property and personal property can both qualify as exchange properties under Section 1031; but real property can never be like-kind to personal property.”12 Therefore, if both parties to a 1031 exchange attest to the fact that the real property transferred in a 1031 exchange is real estate for capital gains tax deferral purposes, then it cannot be personal property.

When developing value opinions in the income approach, appraisers for property owners in ad valorem litigation will focus on second-generation sales and rents because they use the limiting definition of fee simple and subsequently misidentify the highest and best use of the property. What they are left to use in the income approach are properties that are second-generation properties that don’t directly compete with first-generation properties and are often sold or leased at very low prices. In his section on income capitalization, Mr. Lennhoff states that these are not “fire-sale” opportunities. Even if they are not “fire-sale” opportunities,13 they do oftentimes represent properties from secondary and tertiary locations with substantially different economic considerations for prices and rents from what exist for properties in “prime” locations. Additionally, there is no need for an appraiser to require lease up costs for fully occupied leased properties because there is no economic rationale to require a property to be “dark” to obtain the fee simple value. If the appraisal assignment is to determine the market value of the property under the hypothetical condition that a property is vacant (when it is, in fact, fully occupied), then a “go dark” analysis would be applied, otherwise it is an unnecessary and illogical step that will lead to an incorrect value conclusion. Nowhere in the legal definition of fee simple is it required for a property to be “vacant and available to be leased.”14

Appraisers for property owners in ad valorem litigation will often assume that the value in use is not the highest and best use of the property. If the value in use is the highest and best use, then the procedure of explaining why a newly constructed property is “overbuilt” from the very beginning of its existence results in creating a straw-man argument. The straw-man argument goes like this: assume that the highest and best use of the site is not as a major warehouse outlet (e.g., Costco), but rather something else that has a lower required ceiling height. The extra 10 feet of clearance for the major warehouse outlet is properly termed functional obsolescence (in the form of a superadequacy), but only if the use is not as a major warehouse outlet. If however, the structure had a 20-foot clear height and the highest and best use of the site was determined to be a major warehouse outlet (such as Costco), then there would be a different functional obsolescence in the building (in the form of a deficiency). The answer to the question again depends on the highest and best use of the property, and the current use of a property is not an automatically discarded possibility in the highest and best use analysis process, but rather it must be considered as a potential use and other potential uses must be more financially feasible to eliminate the current use from consideration.

Conclusion

Like Mr. Lennhoff states in his conclusion,15 an appraiser “must correctly value the mandated basis of ad valorem tax, which is usually the market value of the fee interest.”

The fee interest, as shown in this article, can exist for an owner occupied property or for a property leased to others when one recognizes that the right to exclude is inextricably intertwined with the lease contract and never really leaves the balance of the bundle of rights. As such two major issues must be addressed in such a task: the highest and best use of the property; and the real property rights and interests inherent of property ownership when a property transacts. This is particularly important in appraisals for ad valorem litigation. As was shown in the first part of this article, the complete bundle of rights transfer between grantor and grantee regardless if the property is leased to others, and this is consistent with the legal definition of fee simple. The concept that a property leased to others contains fewer “sticks” in its bundle is simply not true. They are all there, and there are additional personal property rights that also transfer. Secondly, the highest and best use and the market analysis components of the appraisal assignment must dictate how the appraiser conducts the individual approaches to value. Oftentimes major errors exist in an appraisal because the appraiser fails to properly recognize and analyze specific real estate markets, and that results in the appraiser not concluding the true highest and best use of the property and therefore uses incorrect data and methods in the approaches to value in the appraisal assignment.

Endnotes

1. David C. Lennhoff, CRE, “Valuation of Big‐Box Retail for Assessment Purposes: Right Answer to the Wrong Question,” Real Estate Issues, 39(3), 2014, pp 21‐21.↩

2. McMichael, Stanley L. and Bingham, Robert F., City Growth and Values, Stanley McMichael Publishing Organization(Cleveland, Ohio, 1923). This is the seminal work that uses the term “leased fee” in describing the valuation process for fee interests under lease.↩

3. See Black’s Law Abridged Dictionary, 7th Edition, p. 933 (2000).↩

4. “Valuation of Big‐Box Retail for Assessment Purposes: Right Answer to the Wrong Question,” op cit. pp. 21‐32.↩

5. See Black’s Law Abridged Dictionary, 7th Edition, p. 499 (2000).↩

6. Appraisal Institute, The Dictionary of Real Estate Appraisal¸5th ed. (Chicago: Appraisal Institute, 2010), p. 78.↩

7. “Valuation of Big‐Box Retail for Assessment Purposes: Right Answer to the Wrong Question”, op. cit. 24.↩

8. See “Economic Rent” definition in Appraisal Institute, The Dictionary of Real Estate Appraisal, 5th ed. (Chicago: Appraisal Institute, 2010).↩

9. Appraisal Institute Course ‐ Business Practices and Ethics – Module 5. Retrieved from http://appraisalinstitute.angellearning.com/↩

10. Appraisal Institute, The Appraisal of Real Estate, 14th ed. (Chicago: Appraisal Institute, 2013) p. 356.↩

11. “Valuation of Big Box Retail for Assessment Purposes: Right Answer to the Wrong Question”, op cit p. 26.↩

12. IRS, http://www.irs.gov/uac/Like‐Kind‐Exchanges‐Under‐IRC‐Code‐Section‐1031, FS‐2008‐18, February 2008.↩

13. “Valuation of Big Box Retail for Assessment Purposes: Right Answer to the Wrong Question op. cit. p. 27.↩

14. Ibid. p. 28.↩

15. Ibid. p. 31↩