While the ESG movement continues to evolve through a two-steps-forward, one-step-backward mode in US politics, pressure from investors continues to grow – and while some large firms have built up their ESG staffing, many small to mid-size investment firms have been left to sort through a confusing mix of changing frameworks and standards. Meanwhile, investors and regulators are increasingly pushing for ESG efforts to progress beyond marketing presentations to produce real, measurable ESG outcomes.[i] This article provides a brief overview of how investors might use ESG in an efficient and effective mode to produce both real ESG and investment outcomes.

Evolving ESG Frameworks and Standards

First, some brief but important points regarding the structure of the ESG industry which is clearly still maturing. The primary approach that we currently see in the market is what we call Generation 2 of ESG or Gen 2. This approach supersedes Gen 1 ESG which was a focus on certifying buildings, e.g. LEED, FitWell and such. While Gen 1 was (and still is) a great way to focus on certain aspects of a particular building, it fell short as a complete ESG solution by not representing the entire holdings or social and governance structures of investment vehicles. Thus, Gen 2 ESG was born which focuses on the (E)nvironmental, (S)ocial and (G)overnance efforts of an entire investment vehicle. Gen 2 ESG efforts tend to be managed through a cost center either in the firm and/or with an outside consultant, and focus on meeting various ESG standards. The advantage of this approach is that Gen 2 frameworks encompass the entire investment vehicle rather than a subset of one or more buildings, set industry standards and help firms prioritize appropriate ESG activities. Frameworks that provide scores are also viewed favorably by some investors and pension consultants as it allows them to create databases and cost-effectively compare firms. On the ESG consulting side, Gen 2 has created two large sets of consultants – some that collect and archive data and some that assist with ESG scoring (in addition to a number of other consulting firms that specialize in various aspects of ESG including engineers, architects and energy management companies). Gen 2 frameworks also help investment firms effectively communicate what they have achieved to their investors.

However, Gen 2 has proven to have some flaws that are now motivating investors and regulators to move to a Generation 3 (Gen 3) ESG approach and for the ESG frameworks themselves to continue to evolve and change. First, the scoring metrics of Gen 2 have not proven to unequivocally create real outcomes either in respect to environmental, social and/or governance goals or in regard to investment performance.[ii] This has led to political pushback, particularly in the US.[iii]

The political backlash may be especially unfortunate if critical risk systems are only considered under an ESG umbrella and thus not implemented. In Europe for example, investors have noted higher property values or ‘greeniums’ as a result of greater sustainability characteristics.[iv] At a minimum, investment firms should implement climate risk management. This has nothing to do with whether you believe in climate change or not, and has entirely to do with fiduciary duties to investors because regulators (e.g. fines), insurance, and lending industries are highly focused on climate risk modeling. In the case of insurance, this involves not only insurance cost (which is rising faster than the pace of inflation), but if and how many insurers will even cover certain markets/properties, and on what terms, e.g. deductibles and coverage of certain events. If this is not part of an entity’s current investment committee memo, it should be integrated, regardless of the maturity of the ESG program. A good data source (FEMA) is free and provides a good starting point for evaluating property-level natural disaster risks. (It is also the system used by insurance and lending regulators).

Second, while some real estate firms have made strides to put ESG policies and processes in place, questions remain as to how or if they are implemented and how effective they are.[v] While 100% of firms responding to a 2022 DEI survey said that their policies address gender[vi], more than half of respondents to a 2022 survey of professional women working in real estate said that they had been passed over for a promotion and/or received lower pay because of gender and nearly half said that they had been subject to sexual harassment at some point in their career.[vii]

Attributes of Effective ESG Programs

Thus, Gen 3 ESG is developing. To maintain fiduciary responsibility and prevent political backlash, Gen 3 ESG must have dual goals. The first goal is to prioritize, measure and communicate real ESG outcomes. These may be defined for example as reducing energy, water, waste or greenhouse gas emissions, as well as other measurable goals. While Gen 2 ESG programs may put a number of policies, organizational charts, goals and processes in place, Gen 3 ESG programs measure, report and seek to achieve results, e.g. actual reductions in energy usage.

The second goal of Gen 3 ESG is to improve investment outcomes by identifying ESG-generated investment opportunities and reducing risks through ESG implementation, while considering a firm’s unique structure and investment goals. Gen 3 programs consider the materiality of ESG goals as they are implemented and evaluated against their potential investment outcomes, i.e., not focusing on reducing energy to get a score (Gen 2), but evaluating the cost of implementing and reporting the energy savings versus the cost savings the energy reduction will generate, any improvement (or not) in the pricing of the asset that it might generate, and the property’s business plan; e.g. if the building will be sold in two years, will the implementation costs exceed the investment benefits over the short hold period?

Gen 3 ESG is notably different from Gen 2 in that it is not a cost center, but is effectively integrated throughout all levels of the firm’s team and business units to create real, measurable results. While Gen 2 may paper an ESG organizational structure, Gen 3 effectively implements through a whole-firm team to produce measurable results. This requires a change in the culture of the firm which can be very difficult and must start with knowledge and dedication at the topmost echelons of the board and management team.

Thus, while Gen 2 ESG creates scores and reports, Gen 3 ESG creates outcomes, e.g., “we reduced our energy consumption by x% from x year – and after considering the costs to implement and report the energy savings, it improved our returns (multiples, payback period, etc.) by x%.” We now have dual accomplishments -energy consumption reduction and improved investment performance.

Gen 3 ESG also focuses on opportunities, e.g., can leasing or renewals be improved, or can the firm achieve better financing or be awarded greater insurance coverage by implementing resiliency, building certification or other ESG programs? For example, some building certifications may be expected by lessees in some Class A office markets while Class B users or industrial tenants may not care. Additionally, many building certification programs are more applicable to certain property types. Firms focused on investment performance should be thoughtful about how or if those certifications help their business model, regardless of an ESG framework score.

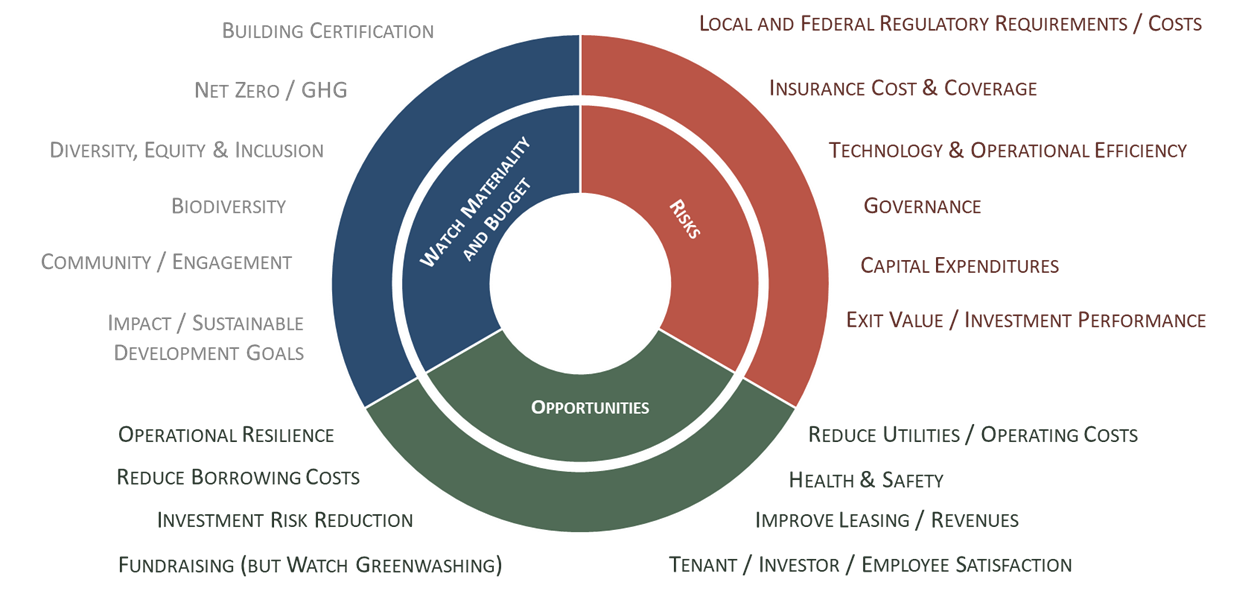

Some ESG goals may seem more difficult to explicitly tie to investment outcomes. However, many of these goals as shown in the blue section of Figure 1 include some of society’s biggest social movements and environmental tipping points. Investment firms should consider then how their ESG goals can be implemented while still retaining their fiduciary duty to their investors.

Figure 1: Consideration of ESG Opportunities and Risks

As an example, biodiversity is generally an indistinct part of typical real estate ESG scoring frameworks. However, with wildlife populations down by 68% since 1970,[viii] 45% of forests destroyed and a third of coral reefs facing collapse over the next 10 to 20 years,[ix] biodiversity is an important environmental ‘tipping point’ from which it may be impossible to recover. Some Gen 2 ESG programs have put beehives on their office building roofs as part of their biodiversity efforts. That generates nice marketing materials and has minimal costs. However, scientists suggest that beehives do not improve biodiversity and may even harm it.[x] A Gen 3 ESG program might instead focus on sustaining water and land environments that support biodiversity (two United Nations Sustainable Development Goals) by doing things such as using native/wildlife-friendly landscaping, creating bioswales, permeable paving and other water retention mechanisms, and integrating natural areas in building and site architecture. In addition to improving biodiversity, these efforts could lead to lower energy, landscaping and water costs, and in turn enhance leasing and improve property values.[xi]

Implementing an Outcome-Based ESG Program

Implementing an effective Gen 3 ESG program should start with an introspective view of the firm’s stakeholder goals and then match those goals to the appropriate ESG framework to help identify priorities, not the reverse. Stakeholders include the firm’s leadership as well as anyone who has an integral role in directing investment outcomes, e.g. significant tenants or investors, and internal or external leasing, development, architectural or other key decision makers. When creating an ESG plan, it is helpful to create a three-year plan – and definitely allow at least a year to implement anything that might be worthy of reporting.

ESG programs are increasingly being driven by investor requirements, and those requirements vary significantly by type of investor – large pensions and non-US investors being the most demanding. For smaller firms with non-institutional investors or pension investors in the ESG ‘pushback’ states, a very small ESG program and/or basic regulatory risk management systems may be quite sufficient at this time. Others may want to start small and grow into a more substantial program over time. At a minimum, firms should review this plan annually as regulatory, investor and framework requirements continue to evolve.

When choosing an ESG framework, investment firms may consider a scoring framework and/or a reporting framework. Scoring frameworks are the most rigorous and provide scores for particular attributes that can be used to compare an investment vehicle or firm to its peers. GRESB and Principles for Responsible Investment (PRI) are the most commonly used scoring frameworks for US real estate firms. GRESB is distinguishable as it requires significant reporting of energy, water, waste and emissions at the property level. Building certifications are also a significant component of the GRESB score. PRI is an independent organization that is supported by the United Nations. It does not require building level reporting but does enquire about processes and policies needed to create effective environmental and social outcomes and the governance structures needed to carry out those goals.

Climate risk evaluation is part of most real estate related ESG frameworks, particularly as guided by the Task Force on Climate Related Financial Disclosures (TCFD). TCFD was created by the Financial Stability Board which is an international body that monitors and makes recommendations about the global financial system. TCFD reviews climate risk in terms of event-driven risks, risks due to longer term changes in climate patterns and transitional risks that may arise as economies transition to lower carbon economies, e.g. potential changes in demand, pricing or regulations. TCFD is also being seriously considered and modeled by insurers and lenders and thus this exercise should be considered as part of risk management outside of ESG programs.

Investment firms may also use a number of reporting frameworks to prioritize ESG efforts and communicate their ESG activities to their stakeholders. These may be used alone or in addition to other ESG frameworks. Commonly used reporting frameworks by real estate firms in the US include GRI and SASB (Sustainability Accounting Standards Board) with input from UNSDG. The Global Reporting Initiative (GRI) is based on standards set by the Global Sustainability Standards Board (GSSB) and was developed to help prepare a sustainability report. It incorporates universal standards, sector specific standards, e.g. real estate, and identification of material topics. The United Nations has specified 17 Sustainable Development Goals (UNSDGs) that are often identified as part of other frameworks. These contain a broad range of environmental, social and stewardship goals. SASB was incorporated into the International Sustainability Standards Boards (ISSB) of the IFRS (International Financial Reporting Standards) Foundation in 2022. IFRS was established to develop high-quality, understandable, enforceable, and globally accepted accounting and sustainability disclosure standards. SASB provides standards for reporting metrics such as energy and water management and climate change adaptation.

The varying frameworks allow for variances in firm structure, sector and goals as well as investor requirements. Thus, choosing the correct framework is critical to having an effective ESG program. When creating a three-year ESG plan, firms should consider the following steps.

- Ensure the framework you choose meets your stakeholder priorities.

- Identify and prioritize key actions that will create real ESG outcomes and enhance your investment performance.

- Use the appropriate framework as a guideline to best practices to set implementation priorities.

- Identify and train your ESG team, including internal and potentially external stakeholders, software providers and consultants as needed to implement your ESG goals.

- Budget and allocate needed resources in a thoughtful and effective manner. Identify opportunities for cost savings, e.g., property-level certifications are expensive and not applicable for all property types.

- Implement an ESG program that is appropriate for the firm’s size and capabilities.

- Create a base-line of activities that allows the firm to build an effective program over time.

- Implement appropriate metrics and targets to avoid greenwashing, and plan how activities will be communicated to stakeholders. Allow at least a year to begin reporting.

- Use ESG to improve the firm’s reputation – avoid starting an ESG journey with a low framework score.

Since the ESG movement is still maturing, investors should expect continued changes in ESG frameworks and standards going forward. While this may be initially frustrating and confusing, the multiple frameworks serve a purpose by allowing firms with different structures and investment goals to progress and will hopefully improve both ESG and investment outcomes as well as communications to investors.

[i] “ESG: Everything Everywhere All at Once,” SEC Commissioner Mark T. Uyeda Speech, US Securities and Exchange Commission, January 27, 2023.

[ii] “ESG Does Neither Much Good nor Very Well,” Keeley, Terrence R., Wall Street Journal, September 12, 2022.

[iii] “Republicans Ramp Up Anti-ESG Campaign for 2023,” Kishan , Saijel and Danielle Moran, Bloomberg, December 29, 2022.

[iv] “Real estate: Sustainable properties at a ‘greenium’,” Mitra, Piyasi, Funds Europe, 2023.

[v] “SEC Charges Goldman Sachs Asset Management for Failing to Follow its Policies and Procedures Involving ESG Investments,” US Securities and Exchange Commission Press Release, November 22, 2022.

[vi] “Global Real Estate DEI Survey 2022,” ANREV, Ferguson Partners, INREV, NAREIM, NCREIF, PREA, RealPac, ULI, November 2022.

[vii] “Women are Slowly by Surely Making Strides Up the CRE Ladder,” RETS Associates, February 2023.

[viii] World Economic Forum as specified in “Nature Positive and Net Zero: the Ecology of Real Estate,” Urban Land Institute, 2022.

[ix] United Nations Convention on Biological Diversity, https://www.cbd.int/convention/guide/?id=changing.

[x] “The Problem with Honey Bees,” McAfee, Alison, Scientific American, November 4, 2020.

[xi] “Nature Positive and Net Zero: the Ecology of Real Estate,” Urban Land Institute, 2022

Bim/Getty Images Signature

Bim/Getty Images Signature