Real Estate Capital Markets: Evolution, Structure, Participants by Merrie Frankel, JD, MBA; Dr. Hugh Kelly, PhD, CRE Emeritus and Constantine Korogolos, CRE, MAI, MRICS

Published 2024

One is unlikely to refer or describe a textbook as concise, clear, and highly readable in the same sentence as well-structured, informative and pithy, yet this book is all of these and more. Although it is primarily targeted for real estate education, real estate practitioners in all areas of real estate will find the book provides a full background on the history of capital markets in the US as well as modern practice.

Each chapter provides footnotes and references for further investigation and explanation either in the classroom or on one’s own.

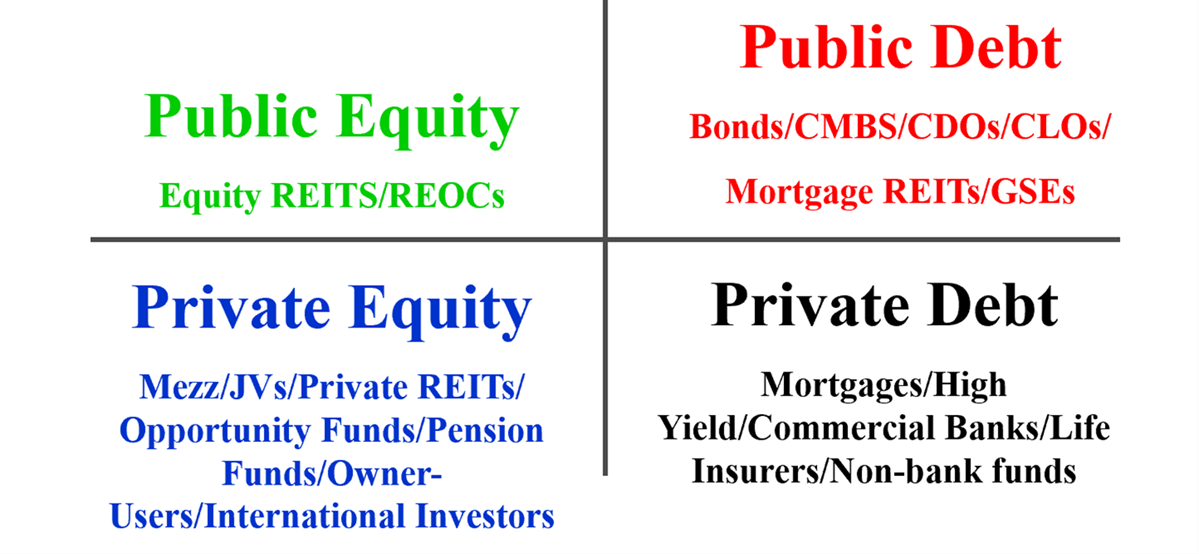

Graphs and tables are appropriately placed, uncomplicated and enhance text discussion. I especially like the four-quadrant chart, the table on bonds as well as several charts on capital flows.

One of the book’s premises is that over the past several decades, real estate capital markets have been put to the test and because of volatile economic periods, have evolved into a more rigorous practice to reduce risk and incorporate more structure into the decision-making and investment process.

This premise is demonstrated throughout the book with detailed information on various real estate financing structures including the use and structure of derivatives, collateralized mortgage obligations, pooling of real estate mortgages for increased liquidity in the capital markets, REITS and others.

Nearly all of the examples provide clear, concise and yet detailed information on various debt structures, how they are utilized in the capital markets by investors, lenders, agencies and holders of real estate.

In Chapter 4, the meat of the debt markets presentation, there is also a discussion of “covered bonds,” a corporate bond that originated in Europe but has grown to be a global product although not used in the US as there is not a legislative framework for regulation should the issuer (usually a financial institution) become insolvent. Covered bonds are currently issued in 40 countries (35 of which have bond legislation). They are similar to but are believed to be much safer than asset-backed securities and mortgage-backed securities as they continue to be obligations of the issuer. In addition, there are benefits to the issuer including lower costs, different maturities, interest rates and currencies, and the pool of assets can be dynamic. Covered bonds can be more attractive to an investor with reduced risk. (If it seems as though I am advocating for covered bonds, I perhaps am, as I have found these to be a more attractive debt bond that traditional corporate bonds).

Although the future remains to be seen, according to the Association of Foreign Investors in Real Estate (AFIRE), the amount of foreign capital investment in real estate is expected to increase over the next five to ten years based on a recent survey conducted by the organization. AFIRE reports that from their survey, 8 of 10 foreign investors intend to increase their investment in US real estate despite a plethora of challenges for them in the US, particularly with taxes and withholding. It is widely recognized globally that the US is one of, if not the, largest and most diversified real estate sector in the world.

Ultimately, my favorite chapter of the book is the last, “The Future of Real Estate Capital Markets” perhaps because I am a practitioner of assessing future trends in the real estate market. This chapter brings home that change is inevitable and our efforts to discern the application and performance of real estate capital markets must take into account qualitative as well as quantitative factors. Coupled with this is the notion that we must also be increasingly conscious of the potential for “shock waves,” and disruption in the market. The book references and recommends the reading of Nicholas Taleb’s Black Swan: The Impact of the Highly Improbable; Joseph Schumpeter’s Capitalism, Socialism and Democracy and W. Edwards Deming’s Quality, Productivity, and Competitive Position.

“The anticipation that more sophisticated capital markets will lead to less long-term volatility – boom and bust cycles, has yet to come to pass.” The definitive conclusion, in my view.

I highly recommend Real Estate Capital Markets as a textbook even though I have been away from college for some time, as well as for those looking for a diverse and solid overview of how real estate capital markets operate today and the outlook. As real estate capital markets become ever more sophisticated through effective and widespread use of technology and other investment models, which will ultimately benefit domestic and foreign investors in the effective raising and management of capital, we must acknowledge that we live in an imperfect world and capital markets are not immune to this reality.