Volume 39, Number 3

Originally Published: Winter 2014

By Richard J. Roddewig, CRE, MAI, FRICS; and Rebel A. Cole, Ph.D., CRE

Photo: FerrizFrames/Shutterstock.com

Introduction

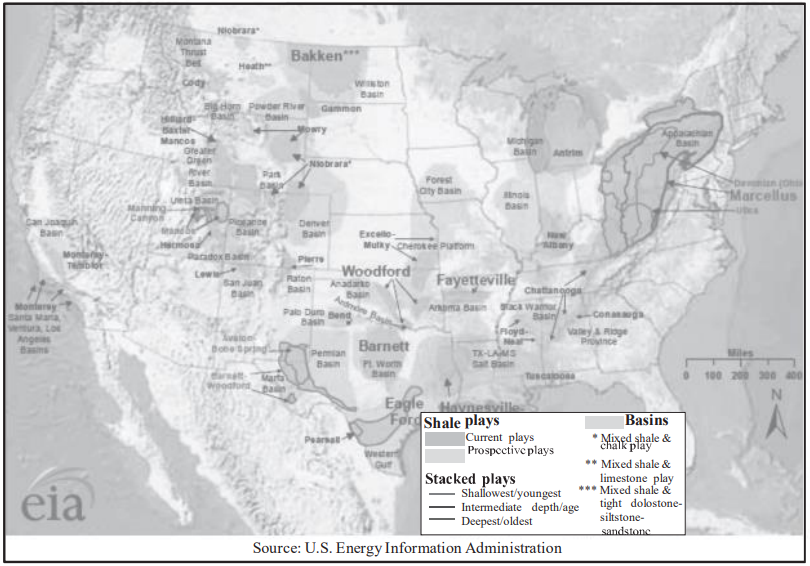

Fracking has emerged as an environmental and real estate issue in the past 10 years because of the enhancements in drilling technology that enable oil and gas to be economically captured from shale deposits in many parts of the country. Figure 1 below shows the various shale formations across the country in which fracking is either actively underway or potentially possible in the future.

Figure 1: Lower 48 States Shale Plays

In some fracking exploration and development areas, especially above the Marcellus Shale formation in New York and Pennsylvania, there are serious concerns that future groundwater contamination and methane leaks will invariably lead to adverse impacts on home prices and values and affect mortgage lending.

In this article, we discuss the following six points to consider before concluding that fracking will inevitability lead to adverse impacts on home prices, values and mortgage lending:

- First, economic factors that can enhance prices and values in fracking areas must be carefully weighed against environmental concerns that could create potential negative impacts;

- Second, the oil and gas industry and federal, state and local governments are developing programs, policies and regulations to decrease the risks of environmental contamination to respond to groundwater and well water contamination concerns, and to mitigate potential adverse impacts of fracking on home prices and values;

- Third, the real estate appraisal profession has developed well-established methods for determining the impact of those risks and the effectiveness of industry and government responses on prices and values;

- Fourth, the few fracking impact studies published to date have weaknesses and limitations, and are only an opening round in what will be a long process of understanding the effects of fracking on the single-family real estate market;

- Fifth, past studies related to oil field groundwater contamination and methane leaks show that real estate impacts, when they do occur, typically are temporary and can be eliminated by careful environmental and policy responses;

- Sixth and finally, mortgage lenders and real estate appraisers will be able to deal effectively with the additional risks for the security of mortgage loans extended to borrowers in communities and regions where fracking is taking place.

Real Estate Impacts from Fracking: Tallying the Pluses Against the Minuses

There are both pluses and potential minuses for communities and regions experiencing fracking exploration and development. Fracking creates jobs, and more workers mean increased demand for goods and services resulting in an enhancement to retail and commercial real estate values. While that can put pressure on local rents, making it more difficult to find affordable housing in fracking boom areas, it also enhances the value of existing rental properties, and even single-family homes. The net result is an economic benefit to the local economy and increased state and local tax revenues. For example, North Dakota, as a result of oil drilling in the Bakken formation, has the lowest unemployment rate in the country. Between 2007 and 2012, it also had the most counties showing increases in median household income. Shale development impact fees levied by some state and local governments have generated significant investment in local infrastructure, which in turn creates jobs and enhances local property values. For example, the Pennsylvania Public Utility Commission estimates that the Commonwealth of Pennsylvania collected $225.75 million in drilling impact fees in 2013, an increase of 11.4 percent over the 2012 impact collections1 and much of that revenue is redistributed to local governments.

The value of the land on which the fracking operations occurs also typically increases because of well site rents and royalty revenues. Rents—sometimes called “signing bonuses”—for drilling sites have been increasing rapidly. In Ohio, Pennsylvania and New York, signing bonuses that were at $2.00 to $5.00 per acre pre-2000 had increased to $30 per acre by 2005, more than $2,000 per acre in 2008, and typically ranged between $5,000 and $10,000 per acre in 2012.2 The Oil and Gas Monitor reports that “historically, in the eastern United States, oil and gas royalties were in the range of 12 to 14 percent” but that at least one production company has paid rates as high as 20 percent in fracking boom areas.3 Both Pennsylvania and New York have state laws guaranteeing a landowner royalty payments equal to at least 12.5 percent of the “value of production.”

The Governmental and Oil and Gas Industry Response to Fracking Concerns

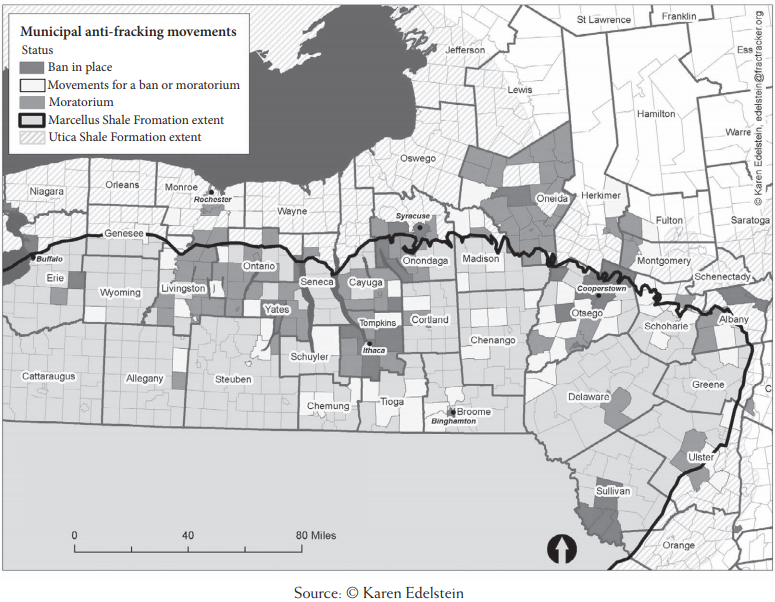

State and local governments across the country have been reviewing and revising regulations related to oil and gas explorations in response to some of the unique issues raised by horizontal drilling and fracking. A statewide fracking moratorium in New York has been in place for six years while the state’s Department of Environmental Control considers the scope of necessary regulations. As shown on Figure 2 below, many cities and towns in New York State have adopted zoning and land use laws either prohibiting fracking or significantly limiting its use as a drilling technique.4

Figure 2: Municipal Anti-Fracking Movements in New York State

To avoid outright bans on fracking at the state and/or local levels, the oil and gas industry knows it must address public concerns about the possible effects of fracking on the environment and on home prices and values in areas experiencing the fracking boom. As a result, the oil and gas industry and various professional groups have been responding to environmental concerns by working with states to improve regulations and to develop “best management practices” (BMPs) for fracking. For example, the Times-Tribune newspaper headquartered in Scranton, Pennsylvania, in the Marcellus Shale fracking region reported in May of 2013 that the oil and gas industry was working in conjunction with the Pennsylvania Department of Environmental Protection to protect drinking water wells from above-ground drilling-related activities and to improve construction standards for domestic supply wells.5 The Marcellus Shale Coalition, an oil and gas industry-aligned organization in the New York, Pennsylvania and West Virginia fracking boom area, has issued various recommended practices related to drilling, pipelines, stray gas incidents, water testing prior to drilling, and drill site development and restoration.6 Although some of the language in the Marcellus Shale Coalition’s BMPs is quite general, more detailed standards are being developed by other organizations. The American Society of Testing Material (ASTM) has created a subcommittee to develop consensus standards related to “critical areas” such as site investigation and permitting, well installation integrity, drilling techniques, management and disposal of drilling fluids, groundwater monitoring and remediation, well fluid reinjection techniques, and well abandonment.7

Other non-oil and gas professional organizations that also are stakeholders in assuring that fracking is done in a manner that minimizes adverse environmental impacts have been putting pressure on the industry and state governments to do more to protect groundwater from contamination and methane intrusion. For example, the National Ground Water Association, while recognizing that “no widespread water quality or quantity issues have been definitively documented that are attributable to the hydraulic fracturing process itself.” has developed a set of principles “as a foundation for policymaking focused on groundwater and drinking water protection.”8 The principles include:

- proper construction and maintenance of water wells;

- improved construction standards for domestic water supply wells and more effective state and local government enforcement of well construction standards;

- improved construction standards for oil and gas production wells to assure integrity and prevent migration of fluids and gas;

- proper sealing of unused or abandoned water wells and production wells;

- water management plans in areas where water is scarce;

- implementation of best management practices for handling surface spills;

- disclosure of all chemicals used in the fracking process;

- pre- and post-drilling testing of groundwater according to a set of recommended testing protocols;

- integrated groundwater studies to determine short- and long-term impacts of fracking; and

- acceptance by the oil and gas industry of its financial responsibility for enhanced long-term groundwater monitoring and for remediation when contamination to groundwater sources does result from fracking.

Government regulators have been responding. The United States Environmental Protection Agency (EPA) has been involved in a three-year review of the effect of fracking on drinking water. The EPA issued a progress report in December of 2012, and a draft report for public comment is expected in 2014. In May of 2014, the EPA announced it was considering regulations requiring the fracking industry to publicly identify the chemicals used in the hydraulic fluids essential to the process.9 Among the states that adopted stronger regulations for fracking as well as traditional oil and gas exploration and drilling are Montana,10 Wyoming,11 California,12 and Illinois.13 Pressure from such outside organizations and government regulators will result in enhanced procedures to avoid contamination from fracking which, in turn, will likely lessen future public concerns about fracking, and reduce or eliminate any current adverse impacts on property prices because of groundwater contamination and methane intrusion concerns.

Long Established and Generally Recognized Appraisal Methods Can Be Used to Determine the Real Estate Impacts of Fracking

As discussed in an article entitled “Power Lines and Property Prices,” which appeared in the previous issue of Real Estate Issues (Volume 39 Number 2), the real estate appraisal profession over the past four decades has developed a set of recognized and generally accepted techniques for determining the impact of “detrimental conditions,” including groundwater contamination and vapor intrusion, on real estate prices and values. The Appraisal Standards Board (ASB) in Washington, D.C. has issued specific guidance for determining the impact of “adverse environmental conditions” on prices and values.14 The ASB’s Advisory Opinion 9 (AO-9) deals specifically with properties affected by such adverse environmental conditions. As discussed in that power-line-impact article, AO-9 requires that every analysis of the impact of an environmental condition on property value “must be based on market data, rather than unsupported opinion or judgment.”15

It is, and will continue to be, licensed real estate appraisers who, on a daily basis, will be determining the impact of fracking on real estate prices and values in particular markets undergoing the exploration and horizontal drilling boom. Their single-family home appraisals, undertaken to support mortgage loans, will be the testing ground on which the effects of fracking on real estate prices and values are determined. They are also likely to be the expert witnesses in the looming litigation concerning the effects of fracking on home values.16

Unlike unlicensed economists who analyze home prices in areas experiencing fracking, licensed real-estate appraisers are required by standards of professional practice to apply a set of carefully selected techniques to determine such impacts. Licensed appraisers are required by their professional standards to utilize the methods that their peers would use in similar assignments, and they determine what their peers would do in similar situations by reference to their professional appraisal journals and publications, their professional meetings and conferences, and their professional appraisal education courses, seminars and appraisal discussion groups.17 This is echoed in many publications of the Appraisal Institute, the largest professional organization of real estate appraisers, including Real Estate Damages: Applied Economics and Detrimental Conditions, Second Edition, 2008, which, on page 238, reads: “In the analysis of detrimental conditions, it is important that the appraiser be knowledgeable about the available tools, properly select and apply those tools, avoid unproven or suspect methodologies, and ultimately have relevant market data to support opinions and conclusions.”

The courses and peer-reviewed publications of the appraisal profession list the following generally recognized and accepted methods for determining the impact on real estate markets, property prices, market rents, and market value from environmental conditions such as groundwater contamination or vapor intrusion that could result from fracking:

- analysis of environmental case studies;

- paired sales analysis;

- multiple regression analysis;

- adjusting income and capitalization rates to reflect environmental risk; and

- market interviews (but only as part of the other four generally accepted techniques or to support or supplement results from the other four methods).18

Those courses and publications also make clear the following central caveat: proximity to a source of an adverse environmental condition—or even the presence of known contamination on a property—does not automatically cause an adverse impact to prices and values.19 And, while opinions of homeowners and other non-real estate professionals may have some relevance to understanding a marketplace, such opinions are not a substitute for analysis of actual sales prices.

Problems and Issues in the Use of Hedonic Regression Modeling to Determine the Real Estate Impacts of Fracking

How have the environmental concerns that accompany fracking affected home prices and values in fracking boom areas? To date, there have been only a few published studies of that issue. The two most frequently cited studies are two non-peer-reviewed working papers distributed by researchers at Duke University.20 Both studies, one dated 2012 and the other 2014, employ hedonic regression analysis—a methodology discussed in more detail below. Regression modeling has long been used by academic real estate economists and property tax assessors. It is less frequently used by licensed real estate appraisers in their everyday appraisal practice. A hedonic regression model can be defined simply as “a statistical technique used to isolate the effect and contribution of various housing attributes to real estate prices.”21 The 14th edition of The Appraisal of Real Estate has the following, more detailed definition that concludes with a reference to how regression analysis can be used to support an opinion of the effect of a contamination situation on prices and values:

“Regression analysis is a statistical technique in which a mathematical equation can be derived to quantify the relationship between a dependent (outcome) variable and one or more independent (input) variables. In appraisal the dependent variable is usually price or rent. The independent variables are usually broadly derived from the four forces that affect value (social, economic, governmental, and environmental) and the physical characteristics of the land and improvements…. it is not uncommon to include an environmental variable or variables when investigating the effects of an external factor such as traffic noise or factory odor.”22

And, as indicated above, hedonic regression analysis has long been recognized as one of the appropriate methods for determining the impact of various types of detrimental conditions, including groundwater contamination and other types of environmental conditions and risks on property prices and values. However, there are significant challenges involved in arriving at relevant and statistically significant conclusions when using complex regression models, as discussed in many previous articles in Real Estate Issues,23 The Appraisal Journal24 and elsewhere. And the appraisal profession has clearly recognized that regression modeling has only a limited role in assignments involving analysis of the impacts of various types of environmental conditions on prices and values25 and is not a substitute for individual property-by-property analysis.

Another fracking article that appeared in the most recent issue of Real Estate Issues (Volume 39 Number 2) summarizes the results of those two studies as follows:

“A 2012 study published by the National Bureau of Economics Research, Duke University and Resources for the Future analyzed the effects of shale gas development on property values in Washington County, Pennsylvania. Those researchers found that, ‘by itself, groundwater risk reduces property values by up to 24 percent.’ Similarly, a more recent investigation by researchers from Duke University, Resources for the Future, and the Environmental Defense Fund found large negative impacts on property values for groundwater dependent homes in areas with shale gas development.”

The first of the two Duke University researcher studies (2012) focuses on Washington County, Pennsylvania, while the second (2014) expands the area of analysis to other areas in Pennsylvania and parts of New York. The 2014 paper appears to be a major revision of the 2012 paper that incorporates numerous improvements over the methodology used in the first paper, such as analyzing matched pairs of properties, using fixed effects models to control for property heterogeneity, and looking only at properties adjacent to the Public Service Water Area (PSWA) boundaries that delineate properties relying upon piped central water versus on-site well water.

Both studies were conducted by the same team of researchers from Resources for the Future, the Environmental Defense Fund and Duke University. Both are unpublished and non-peer-reviewed working papers sponsored by the National Bureau of Economics Research. Both utilize hedonic regression to analyze property values. Both attempt to link the risk of groundwater contamination from fracking to lower sales prices.

The 2014 paper presents more formidable evidence concerning possible price diminution attributable to the perceived risk of groundwater contamination since it is based on a more comprehensive sales price data base from a broader region of both Pennsylvania and New York and uses a superior methodology.

Among the more important conclusions of the 2014 study are the following:

- Only homes on individual domestic wells showed adverse impacts to prices. Homes that are supplied with piped central water (as opposed to individual wells) “in fact benefit from being adjacent to drilled and producing [fracking] wells” due to “royalty payments (or expectations of royalties) from productive wells.”26

- The adverse impacts on prices of homes served by individual wells ranged from -10 to -22.4 percent, and the impacts decrease as distance from a well increase.

- Since the study only deals with the “perception of risk” and not the actual impact of groundwater contamination—apparently there had been no significant adverse groundwater or methane contamination incidents that could be studied in the areas researched—”there could be large gains to the housing market from regulations that reduce the risk.”27

- Visibility of a well is an important factor—when properties benefit from proximity, the benefit is greater if the well drilling pad is not visible, and when properties are impacted in price, the impacts are greater when the well is visible.

- The estimated effect of a -22.4 percent impact shown in Table 1 for houses within 1.0 kilometer of each well pad appears to be at odds with prior studies of risks associated with living in areas experiencing traditional oil and gas drilling, areas with documented contaminated groundwater, and areas with methane gas or petroleum-related vapor intrusion issues,28 as we discuss below.

- The specification of the Muehlenbachs, et al. 2014 model raises some questions about its reported -10 to -22.4 percent impact for properties served by on-site domestic water wells. The property specific characteristics included as variables (in addition to well water vs. piped central water) are age of home, total living area, number of bathrooms, number of bedrooms, and lot size.29 This excludes a variety of other property specific characteristics that the authors call “unobservable house and neighborhood attributes . . . that might otherwise bias our results.” Some of these “unobservable attributes” relate to the actual fracking leasing, drilling and payment process itself, while others are more general property characteristics that are likely important variables affecting prices paid.

In both the 2012 and 2014 papers, the authors fail to account fully for the fact that the sales price of a property is a function of the value of the land, the improvements on the land, and the rights to the minerals below the land. When a property sells with diminished or no mineral rights, it will sell for less than an otherwise identical property with full mineral rights. When a property sells with encumbrances, such as easements or surface rights granted for construction, access roads, etc., it will sell for less than an unencumbered property. To the extent that property owners near wellheads outside of the PSWAs are more likely to have diminished their property rights through leases to third parties or encumbered surface rights, sale prices of their properties would be significantly lower than otherwise identical properties, unless the properties also were continuing to generate lease and royalty payments.

In both papers, the authors fail to account for terms of drilling leases. Many property owners in rural areas came to the bargaining table very early in the shale boom, selling or leasing their mineral rights for what turned out to be bargain-basement prices.30 If properties located outside the PSWAs were more likely to have diminished their property rights through leases, easements, etc., then a hedonic pricing model that fails to account for this would find that these properties sell for less than properties located within the PSWA. Yet this ‘diminution’ would not be attributable to the deleterious effect of fracking; rather it would be attributable to the leases, easements, etc.

While the 2014 paper is a marked improvement over the 2012 paper, looking at more than a million property sales, the newer study fails to address other issues that call into question the authors’ conclusions about the link between groundwater contamination risk and sale prices.

In the 2014 study, the authors analyze the subsample of their properties that sold more than once during their sample period; this enables them to include property fixed effects to control for time-invariant property characteristics that are omitted from their model. While this is an important improvement over their 2012 analysis, this methodology cannot account for one of the most important omitted characteristics: the mineral rights that are the subject of leases to the energy companies, which are not time-invariant. In fact, it is highly likely that the mineral rights changed between sales. Without this information, the authors’ hedonic models are hopelessly compromised. In marked contrast, a licensed appraiser would take into account the mineral rights that do or do not convey with a particular property. In addition, the properties analyzed are not a random sample so that the authors’ results would only be relevant for other properties that sold more than once during the sample period.

In another part of the 2014 study, the authors limit their sample to properties located within 1,000 meters of the border of the PSWA, again, in an attempt to control for property heterogeneity. This analysis, however, suffers from the same problem as other analysis samples: the majority of wellheads are located outside the PSWAs, so that properties outside the PSWA are closer to the wellheads and more likely to convey with diminished

mineral rights. In this analysis, the authors look at properties less than one kilometer, less than 1.5 kilometers, and less than 2 kilometers from wellheads. However, the sample less than 1.5 kilometers and less than two kilometers from wellheads appears from the data to also contain the properties less than one kilometer from the wellheads, so their analysis tells us nothing about diminution in value for properties located between one and two kilometers from wellheads; the latter results are likely driven by the properties located less than one kilometer from the wellheads. One way to address this issue is to include piecewise indicator variables for distances, such as 0K – 0.5K, 0.5K – 1.0K, 1.0K – 1.5K, and 1.5K – 2K. The authors’ results likely reflect the diminished mineral rights and surface rights that convey with sales in the immediate vicinity of the wellheads, but they fail to acknowledge this likelihood.

A thorough review of both the 2012 and 2014 studies is hampered by the limited information provided to the reader by the authors. Many important descriptive statistics, such as the median, mean, standard error, minimum and maximum values that would enable the reader to evaluate the representativeness of data included in the analysis, and to identify potential outliers that can badly bias a hedonic regression model, are not provided. The authors present only means and standard deviations for the full sample of 1.04 million property sales; no minimums or maximums are presented so that the reader cannot tell if outliers are included in their analysis. The authors fail to present descriptive statistics for any of their subsamples, such as the 400,000 repeat sales, or the 3,000 PSWA boundary properties, even though they claim that these subsamples provide their most important and convincing results.

The authors also fail to present the coefficients and standard errors/t-statistics for explanatory variables in their hedonic regressions—other than the groundwater contamination variables of interest. This makes it impossible for the reader to judge whether or not their model makes economic sense; for example, is the coefficient on square footage positive or negative? We simply don’t know because the authors withhold this information from the reader.

The authors account for time-fixed effects by including a set of county-year indicator variables, in spite of the fact that housing prices changed by large percentages during the sample period. With such a large sample, month dummies would be much more effective in controlling for intra-year price changes. Moreover, the county-year dummies account only for the average effects across all properties in a county, no matter the location within the county. Our previous experience with such models indicates that prices in rural areas often move quite differently from prices in urban areas; hence, the authors have failed to properly control for the macroeconomic impact of the subprime financial crisis. If prices fell by more in the rural areas than in the urban areas, one might obtain the same results as the authors—properties located in the rural areas outside of PWSAs sell for less than otherwise identical properties within the largely urban PWSAs–but this would say nothing about the impact of fracking. Or if the Great Recession and housing market collapse resulted in more foreclosure sales in groundwater well areas than in central water areas, that too could be contributing to differential price impacts in these areas, but, again, would say nothing about the impact of fracking.

Failure to consider whether foreclosure sales or even short sales should be eliminated—or at least determine if they should be—is one of many central issues that licensed real estate appraisers would consider in structuring a matched pairs regression model such as that employed by the authors. The researchers acknowledge that in “matched pairs analysis” “the key to success . . . is to structure the problem so that unobservable house and neighborhood attributes are not correlated with treatment status.”31 One of the ways the researchers claim to have controlled for this is to “require exact matches by census tract” and explain this by the following example: “The idea behind these restrictions is that houses within six kilometers of a well pad in the same census tract that rely on the same water source will be located in similar neighborhoods.”32

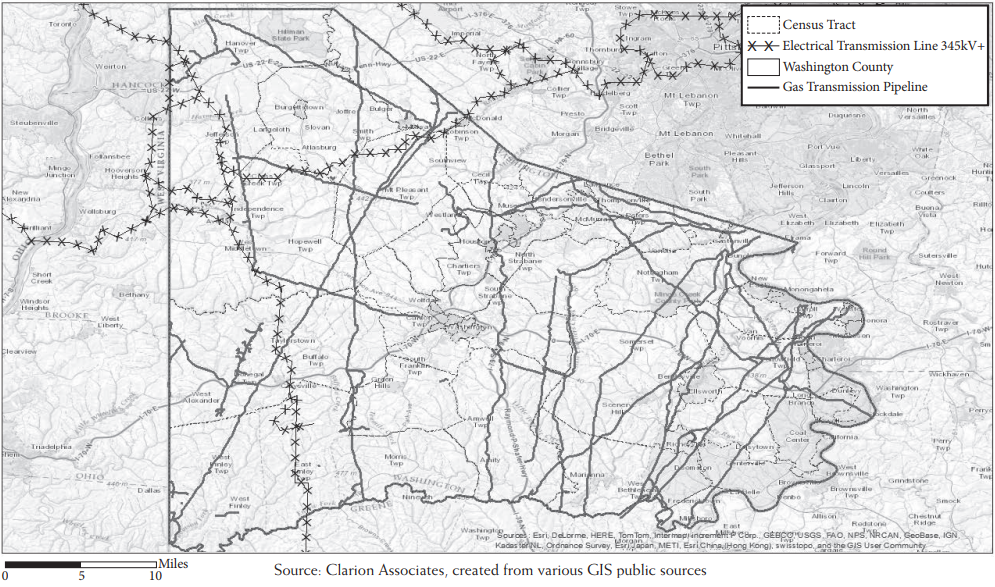

But many census tracts in the 36 Pennsylvania counties included in the 2014 sale price study are quite extensive in geographic area and vary significantly in topography as well as in location of various amenities and disamenities that may also be affecting prices paid for homes in groundwater domestic well areas. Among the factors that will cause variation in price even within the same census tract are the following:

- school district boundaries;

- location on paved or unpaved roads, and whether the road is maintained by local government;

- slope, topography and resulting impact on land usability;

- location in a floodplain or with creek or stream frontage or wetlands;

- proximity to noise and traffic from interstate highways;

- proximity to oil and gas pipelines and high voltage power line corridors.

Washington County, Pennsylvania, was the focus of the 2012 Muehlenbachs study and was one of the 36 Pennsylvania counties included in the more robust 2014 study. Figure 3 below shows the 2010 census tracts in Washington County. It also shows the location of gas transmission lines and 345,000 kilovolt power lines, as well as rivers and streams and the varied topography. The map demonstrates that the price impact of many such “unobservables” have not been eliminated simply by structuring the paired sales analysis on a census tract level.33 Some parts of a single census tract may be affected by steep slopes and proximity to creeks and rivers, power lines, and gas transmission lines while other parts of the same census tract are not.

Figure 3: 2010 Census Tracts in Washington County

There are many other potential issues related to the 2014 study, including the following that can only be resolved by a review of the entire data set and model:

- It is impossible to tell if some houses have sold for lower (or higher) prices because the prior owners already had leased their drilling rights but sold the home while retaining the drilling royalties.

- It is impossible to know if the well pads are producing or dry. Endnote 27 to the article indicates that 42 percent of the wells drilled do not produce gas. That factor could lower prices paid for homes on dry well sites with no anticipation of future leasing revenues and increase prices paid by buyers of nearby homesites with lowered risk of future groundwater contamination.

- While the researchers controlled for time effects with a dummy variable for year of sale, there can be significant differences in sale prices from month to month in the same year, especially in times of quickly rising or falling prices. Including a dummy variable for year of sale averages out these month-to-month changes but does not necessarily control for changes in price over time.

- In some tests, the authors “match” samples of groundwater and pipe water but it is impossible to determine from the information in the article how effective this is.34

- The data set may not have been properly quality controlled to eliminate large outliers as evidenced by the unusually large standard deviations for some of the variables specified in the model.35

Past Real Estate Market Studies Indicate That Investigation and Remediation Can Limit Price and Value Impacts from Oil and Gas Contamination

Past experience and market research indicate that groundwater and soil contamination because of oil and gas vary and can be eliminated by prompt investigation, remediation and market assurance programs. A good example of such a situation is the Tomball Oil and Gas Field in Harris County on the northwest edge of the Houston metro area, the subject of a groundwater contamination investigation by the State of Texas. The Tomball Field had been in active oil and gas production for more than a half century. Hydrocarbon contamination (benzene) and chlorides from the Tomball Field contaminated groundwater in the Boudreaux Estates portion of the town of Tomball.36 At the time of the contamination discovery, domestic water in Boudreaux Estates was provided by private on-site wells. Test results disclosed that fewer than half the wells were affected by contamination.37 As part of the settlement of litigation over the impact of the groundwater contamination, ExxonMobil agreed to pay for installation of a central water supply line, pay for hookups to residents that agreed to be connected, and pay for well-plugging for owners that requested it. Plugging of wells and connection to the central water supply system was voluntary rather than mandatory.

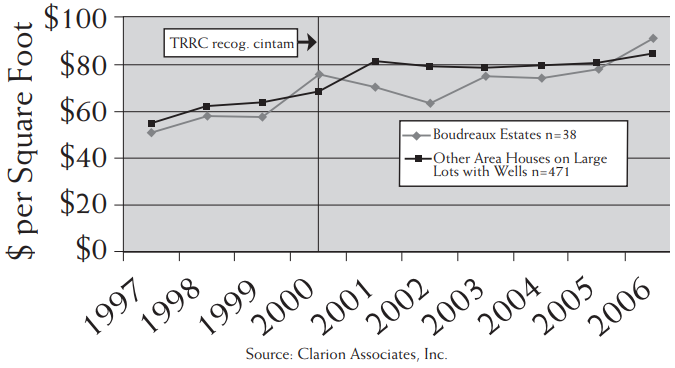

To determine the effect of the groundwater contamination, home prices in Boudreaux Estates can be compared with prices for a control group of other homes in northwest Harris County built on similarly sized lots and with similar on-site wells and septic systems. The price trend comparisons for the period before and aft er the Texas Railroad Commission first recognized the groundwater contamination situation in Boudreaux Estates are shown in Figure 4 below.

Figure 4: Home Price per Square Foot Boudreaux Estates vs. Other Area Houses on Large Lots with Wells

The graphed data indicate a possible temporary impact on prices in Boudreaux Estates during 2001–2002, the years immediately following the discovery and announcement of groundwater contamination. In three of the four years prior to 2001, prices in Boudreaux Estates were slightly below prices for the control group. However, prices dropped significantly in Boudreaux Estates in 2001 and 2002 before rebounding in 2003. Sale prices in 2003 and afterward returned to their historical pattern prior to 2001, that is, they were a bit lower than the average price in the control group. The return to the normal relationship coincided with the finalization of plans for the central water line in 2003 and commencement of construction of the central supply line and distribution lines within Boudreaux Estates in 2004.

That evidence indicates no permanent impact on prices in Boudreaux Estates from the groundwater contamination situation. It also indicates a possible temporary impact on prices of between 10 and 20 percent during the years 2001 and 2002. Any impact on prices had ended by February 2004 when the Texas Railroad Commission announced that ExxonMobil would install central water lines and pay for hookups.

In the 1980s Seattle discovered that methane was leaking from its closed Midway Landfill. The situation become so serious that 11 families were evacuated from the neighborhood between November 1985 and February 1986. According to the director of the City of Seattle’s Engineering Department at the time, “there was general perception among residents in the area that their properties and their community had lost all value” and angry community meetings attended by as many as 600 residents resulted in extensive negative media coverage.38

The city launched aggressive efforts to monitor and control the methane leakage while also launching what it called a “Good Neighbor Program “to stabilize property values, to rekindle real estate activity, and to restore confidence in the Midway area as a safe and stable family community and a desirable place to live.”39 A central component was a property value assurance program. The City of Seattle agreed to make up the difference between an independently derived fair market value estimate disregarding the methane gas situation and the actual sale price of a home. If a homeowner listed but could not sell a home within six months, the city would buy the home at fair market value. The program was designed to end “either two years after the gas was removed from the neighborhood, or when 10 homes sold for full FMV (fair market value) without any City subsidy.”40

By December of 1986, the City had been able to reduce methane levels in homes to background ambient air levels. By March of 1988, thanks to the effects of the home price guarantees in the Good Neighbor Program, eleven sales had closed at 100 percent of fair market value and by January of 1990, 49 homes had so sold. A total of 104 privately transacted sales occurred during the operation of the program from 1986 through 1989. The average impact on market price/value as measured by the subsidies paid by the City to privately transacted homes steadily decreased from an average of 9.38 percent in 1986 to 8.16 percent in 1987 and to only 2.45 percent and 2.78 percent in 1988 and 1989.

The Seattle property value assurance program was one of the first, if not the first, such program in the United States. Since then, property value assurance programs have been used widely around the country, both proactively as part of approvals of landfills that create community concerns about possible groundwater, air and methane contamination, as well as in the wake of oil and gas pipeline leaks and explosions.41

Fracking and the Mortgage Market

A recent law review article42 (Radow, 2014) discusses issues related to mortgage lending in fracking boom areas and posits that mortgage lenders will increasingly be reluctant to make home loans in fracking boom areas because of the environmental and liability risks. However, the article readily admits that “nationwide, people own properties encumbered by mortgages and gas leases.” The author presents anecdotal evidence but no statistical data to support any conclusion that banks are turning down mortgage loans in fracking areas in any large numbers. Many of the environmental risks that accompany fracking also accompany traditional oil and gas drilling. Mortgage markets in the traditional oil patch of Texas, Oklahoma and Louisiana have a long history of dealing with issues related to drilling leases and proximity of oil wells and production pipelines.

And real estate appraisers in those areas long have dealt with the requirements of mortgage lenders related to reporting and analysis of environmental conditions. For example, the March 2005 versions of Fannie Mae Form 1004 and Freddie Mac Form 70 (Uniform Residential Appraisal Report, or URAR) require the appraiser under the “Site” section of page 1 to answer “Yes” or “No” to the following question: “Are there any adverse site conditions or external factors (easements, encroachments, environmental conditions, land uses, etc.)?” This puts a responsibility on the appraiser to look for “environmental conditions” and then describe them. The published FHA and HUD guidelines for single-family home appraisals include specific requirements related to investigating, noting and commenting on “all hazards and nuisances affecting the subject property that may endanger the health and safety of the occupants and/or the structural integrity of marketability of the property.” Among the listed items are “known hazards and adverse conditions” including “toxic chemicals, radioactive materials, other pollution, hazardous activities, potential damage from soil or other differential ground movements, ground water, inadequate surface drainage, flood, erosion, excessive noise and other hazards on or off site.”43 If hazards or nuisances are observed that need to be remediated,44 the appraiser must describe the condition(s) and include in the site section of the report a statement that the appraisal opinion is “subject to repairs” and/or “subject to inspection.” Supporting documentation provided by the appraiser may include extra photos or copies of site studies or analyses, property reports, surveys or plot plans, etc.

And appraisers in areas that are the subject of environmental investigation or concerns, but in which no remediation is necessary, typically handle the issue of the impact of the situation on prices and values by identifying the environmental issue and the area affected and then selecting the comparable sales from the same affected area. Th at process typically assures that the market value conclusion reflects the effect of the environmental situation on prices in the particular local marketplace as of the date of value in the appraisal report.45 In rare cases, a lender may ask the appraiser to determine the effect of the environmental situation on the market value. In such a case, a sales analysis using sales from a similar neighborhood or area unaffected by the environmental situation can be compared to prices in the affected area through a paired sales analysis or trend line analysis such as that described earlier involving the Boudreaux Estates neighborhood in Tomball, Texas. Because of its inherent limitations, hedonic regression modeling, such as that used in the two Muehlenbachs, et al. studies, is not typically used as part of the property-by-property analysis that accompanies the single-family home lending process. As a Real Estate Issues article dealing with real estate appraising in New Orleans in the wake of Hurricane Katrina noted: “Because of their inaccuracies, the home lending industry had not been widely utilizing AVM products to determine the value of individual properties for mortgage origination: ‘The reluctance to use this product [AVMs] for first mortgages is due to uncertainty concerning the reliability of the product in high loan-to-value situations.’ ”46 An even more recent article in Real Estate Issues reviewing the accuracy of Zillow’s hedonic models concluded that “mean error rates are so great that they are of little value” in determining market values of either high-priced or low-priced homes.47

Conclusion

The fracking boom has been accompanied by important environmental issues and concerns about the impacts of fracking on real estate prices and values in areas experiencing the boom. However, there has been only limited research to date on the actual effects of those concerns on prices and values. Two of the most frequently cited studies involving prices in portions of Pennsylvania and New York above the Marcellus Shale formation have significant model specification issues. The limited information presented in each study also makes it difficult to determine their statistical reliability. The two articles also acknowledge that impacts can vary by source of domestic water (domestic well vs. central piped water) and that the price impacts reflect concern that may be eliminated by new federal, state and local regulations concerning the fracking process.

Research into the effects of fracking on real estate prices and values has just begun. Much more work needs to be done. And as new regulations are adopted, it will be possible to determine their effect on prices and values. Recognized and generally accepted appraisal methods developed in response to various environmental issues and situations are available to determine the impact of fracking and the resulting environmental issues. Those generally accepted research methods have been effective in understanding the impacts of past ground water contamination from oil exploration and methane gas leaks from landfills. If past experience is a guide, any adverse impacts on home prices and values resulting from environmental conditions resulting from fracking, if and when they occur, will likely be only temporary in nature, and can be eliminated or minimized by sound governmental regulations and programs, thorough investigation of any spills or gas leaks, and appropriate remediation in accordance with well-established health and safety standards.

Endnotes

1. Marcellus Shale Coalition, “Shale Impact Fee Tax Revenues ‘A Tremendous Help’ for Pa. Communities,” June 4, 2014,

http://marcelluscoalition.org/2014/06/shale-impact-fee-tax-revenues-a-tremendous-help-for-pa-communities. ↩

2. Properties can transact with or without, the rights to natural gas production. Previous owner may have captured lease payments for future production. ↩

3. Terence M. Fay, “Fracking: Economic and Environmental Considerations,” Oil and Gas Monitor, July 2, 2012. http://oilandgasmonitor.com. A study by the Pennsylvania Chapter of the National Association of Royalty Owners as referenced in a 2013 Allegheny Institute report also reports that royalty payments were “typically not above 12.5 percent in the beginning, but as the boom progressed the royalty share has ranged up to 20 percent, depending on the individual contract.” Allegheny Institute for Public Policy, “Marcellus Royalty Payments Rising Rapidly,” May 30, 2013, http://www.alleghenyinstitute.org/marcellus-royalty-payments-rising-rapidly/. ↩

4. The legal authority of New York local governments to adopt fracking moratoria has been challenged in a series of lawsuits. ↩

5. According to the article, Pennsylvania is “one of only a few states in the nation that does not have private water well construction standards” and that the state needed new regulations to “to address pre-existing water quality problems and make sure water wells are stable enough to handle any nearby industrial activity, including oil and gas operations.” Laura Legere, “Sunday Times review of DEP drilling records reveals water damage, murky testing methods,” May 19, 2013, http://thetimes-tribune.com/news. ↩

6. http://marcelluscoalition.org/category/library/recommended-practices/. ↩

7. http://www.astm.org/sn/features/hydraulic-fracturing-nd12.html. ↩

8. “Hydraulic Fracturing: Meeting the Nation’s Energy Needs While Protecting Groundwater Resources,” National Ground Water Association, Feb. 19, 2014, pp. 2–3. ↩

9. www.bloomberg.com/news/2014-05-09/epa-considers-requiring-disclosure-of-fracking-chemicals.html. ↩

10. The Montana Board of Oil and Gas Conservation (MBOGC) adopted new rules in August 2011 related to prior approval for fracking operations, disclosure of the composition of fracking fluids, and well construction and testing. ↩

11. In 2010, Wyoming became the first state to require disclosure of some of the chemicals used in fracking fluids. Montana in 2013 adopted additional rules requiring testing of wells and springs within 0.5 miles of drilling sites both before and after drilling. ↩

12. California passed legislation in 2013 requiring drilling companies to obtain fracking permits, notify neighbors of proposed fracking locations, publicly disclose some fracking chemicals, and test and monitor groundwater quality. ↩

13. Illinois in 2013 enacted what some have called the “strictest regulations” in the country. The new rules not only require public disclosure of fracking chemicals and groundwater testing and monitoring, but also “hold the companies liable for contamination.” ↩

14. State licensing laws require real estate appraisers to follow the Uniform Standards of Professional Appraisal Practice (USPAP) promulgated by the Appraisal Standards Board in the late 1980s in the aftermath of the federal bailout of the savings and loan industry. ↩

15. USPAP 2014–2015 Advisory Opinions, p. A-20, pp. 177–178. ↩

16. A Fall 2011 article in Natural Resources & Environment estimated there had been 15 to 20 lawsuits filed since September of 2009. The article claimed that “nearly all of the plaintiffs in these suits are either landowners who leased oil and gas rights to the defendants or landowners who reside in close proximity to where hydraulic fracturing operations were conducted.” Barclay Nicholson and Kadian Blanson, “Tracking Fracking Case Law: Hydraulic Fracturing Litigation,” Natural Resources & Environment, Vol. 26, No. 2, American Bar Association, Fall 2001. Some cases have involved claims for adverse impacts to prices and values as well as loss of use and enjoyment of plaintiffs’ homes. Most have involved one or two plaintiff homeowners, or members of one family, but others have included a larger number of homes. See, for example, Fiorentino v. Cabot Oil & Gas Corp., et al., No. 3:02-cv-02284 (M.D. Pa., Nov. 19, 2009) involving property value impact and other claims by 19 Susquehanna County families. In Arkansas, three class actions were filed in federal district court. Two of the cases involved a proposed class consisting of all Arkansas residents who reside or own property within three miles of wells and gas extractions operations. See, Ginardi v. Frontier Gas Services, LLC, et al., No. 4-11-cv-0420 BRW (E.D. Ark. May 17, 2011); Tucker v. Southwestern Energy Co., et al., No. 1:11-cv-0044-DPM (E.D. Ark. May 17, 2011); and Berry v. Southwestern Energy Co., et al., No. 1:11-cv-0045-BRW (E.D. Ark. May 17, 2011). ↩

17. USPAP, 2014–2015, supra, FAQ 160, p. F-73. ↩

18. For detailed presentation and discussion of these techniques, see generally, the 2010 Appraisal Institute seminar entitled Analyzing the Effects of Environmental Contamination on Real Property and Thomas O. Jackson, PhD, MAI, “Methods and Techniques for Contaminated Property Valuation,” The Appraisal Journal, October 2003, p. 311. ↩

19. “The fact that a property is impacted by a detrimental condition does not automatically mean that it has a material impact on the property’s value. Detrimental conditions may or may not cause a material impact on value. Frequently, detrimental conditions have no material impact on value whatsoever.” Randall Bell, MAI, with contributing authors Orell C. Anderson, MAI; Michael V. Sanders, MAI, SRA, Real Estate Damages: Applied Economics and Detrimental Conditions, Second Edition, The Appraisal Institute, 2008, p 238. ↩

20. The two studies are Lucija Muehlenbachs, et al., “Shale Gas Development and Property Values: Diff erences Across Drinking Water Sources,” National Bureau of Economic Research, Working Paper 18390 (September 2012), available at http://public.econ.duke.edu/~timmins/w18390.pdf; and Lucija Muehlenbachs, et al., “The Housing Market Impacts of Shale Gas Development,” National Bureau of Economic Research, Working Paper 19796 (January 2014), available at http://public.econ.duke.edu/~timmins/MST_AER_1_3_2014.pdf. ↩

21. Brian H. Hurd, “Valuing superfund site cleanup: evidence of recovering stigmatized property values,” Appraisal Journal, October 2002. Pp. 427–431 ↩

22. The Appraisal of Real Estate, 14th ed. (Chicago: The Appraisal Institute, 2013), p.295. ↩

23. A 2012 article in Real Estate Issues discussed the regression modeling problems encountered in New Orleans in the wake of Hurricane Katrina. Richard J. Roddewig, CRE, MAI, FRICS; Charles T. Brigden, CRE, ASA, FRICS; and Gary R. Papke, CRE, MAI, AICP, “Real Estate Counseling in Class Action Litigation: Determining Real Estate Damages from Natural Disasters,” Real Estate Issues, Volume 37, No. 2 and 3, 2012, 77, at 93. Because of the regression modeling problems, New Orleans and Louisiana Office of Community Development officials had decided by January of 2007 to commission individual appraisal reports by local appraisers to determine pre-storm values for purposes of the Road Home Program to provide aid to New Orleans home owners. ↩

24. See, for example, Thomas O. Jackson, Ph.D., MAI, “Methods and Techniques for Contaminated Property Valuation,” The Appraisal Journal, October 2003. ↩

25. The Instructor Notes to the 2010 Appraisal Institute seminar entitled Analyzing the Effects of Environmental Contamination on Real Property states that regression modeling is useful in measuring “the average differences between groups of properties (impacted and non-impacted neighborhoods)” but “it is not used for estimating individual property values.” (Seminar, Part 4, Instructor Notes, pp. In-15 and In-16). However, there may be some situations in tax assessment appraisal practice when mass appraisal modeling to determine the individual value of a contaminated property is appropriate. And, regression modeling to determine impacts on values of individual properties may also be appropriate when used (and weighted appropriately) in conjunction with other contaminated property appraisal techniques, such as individual appraisal reports using two sets (affected and unaffected) of sales comparables, trend line analysis and case studies. ↩

26. Muehlenbachs, et al., 2014, p. 36. ↩

27. Ibid., p. 37. ↩

28. As the 2012 study states, a 2005 investigation of “exposure to sour gas wells and flaring oil batteries in Central Alberta, Canada” found a negative property value impact of 3.0 to 4.0 percent and a 2012 paper analyzing prices in Washington County, Pennsylvania, found only a “small negative impact on property values.” Muehlenbachs, et al. (2012), p. t 5–6. The two referenced studies are P.C. Boxall, W. H. Chan, and M.L. McMillan, “The impact of oil and natural gas facilities on rural residential property values: a spatial hedonic analysis,” Resource and Energy Economics, Vol. 27, No. 33, 248–269; and H. Allen Klaiber and Sathya Gopalakrishnan, “The Impact of Shale Exploration on Housing Values in Pennsylvania,” Working Paper, 2012. ↩

29. Other locational variables relate to distance from an MSA, various demographic characteristics of the census tract in which the home is located, distances from well pads, number of wellbores and number of undrilled permits in the vicinity. ↩

30. See “Lowball gas leases haunt Pennsylvania landowners,” The Leader (Corning, N.Y.), July 25, 2011. Available at: http://www.the-leader.com/article/20110725/News/307259925#307259925. ↩

31. Muehlenbachs, et al., 2014, at 23. ↩

32. Ibid. ↩

33. The Muehlenbachs, et al., attempt to control for neighborhood “unobservables” raises the following fundamental issue in specifying every regression model: No model can property account for all of the independent variables that affect prices paid for real property and is always subject to the “omitted variable” problem. See George Letz and Ko Wang, “Residential Appraisal and the Lending Process: A Survey of Issues,” Journal of Real Estate Research, Vol. 15, Nos. 1 and 2, 1998. There is also no agreement among economists as to which factors affecting price should be included in a model. Scott Atkinson and Thomas Crocker reviewed 15 hedonic price value models produced by other researchers. They found little agreement as to which independent (predictor) variables should be included. The 15 studies recognized 110 different potential independent variables. The number of predictor variables used typically ranged between 15 and 18, with one study using 29 and another only 11. See, “A Bayesian Approach to Assessing the Robustness of Hedonic Property Value Studies,” Journal of Applied Econometrics, Vol. 2, pp. 27–45, 1987. ↩

34. The authors explain this “matching” process as limiting the sales actually analyzed based on four criteria: (1) sales within six km of a well pad; (2) homes in the same census tract; (3) that occurred in the same year; and (4) differentiation between homes on wells and those on centrally supplied piped water. ↩

35. The standard deviations for lot size (acres), PWSA, and PA/Off are particularly large. Th at is solid evidence of unusually large outliers in the variables. Th is is particularly important in terms of lot size because, as the authors readily admit, lot size is an important contributor to the price that drilling companies are willing to pay for leases. ↩

36. One of the lots in Boudreaux Estates actually contained a producing well. ↩

37. The Houston Chronicle reported that 166 wells were tested in Boudreaux Estates and two nearby subdivisions. High levels of chlorides were reported in 43 wells (25.9 percent) and high levels of benzene levels in 15 wells (9.0 percent) “Cumulative Monthly and Quarterly Water Treatment System Analytical Results in Boudreaux Estates,” as found on website http://www.tomballwatersettlement.com. Th is website was established pursuant to Cause 2000-60119 Wayne Sisson, et al. vs. Exxon Mobil Corporation, in the 125th Judicial District Court, Harris County, Texas.) However, test results posted on the Internet aft er settlement of litigation over the contamination showed only four wells in Boudreaux Estates with even a single test result with benzene levels above heath risk levels of five ppb. ↩

38. Gary Zarker, director, Seattle Engineering Department, “Seattle-Kent Good Neighbor Program: Final Report 1990,” as included in Richard J. Roddewig, MAI, CRE, editor, Valuing Contaminated Properties: An Appraisal Institute Anthology, Appraisal Institute, 2002, p. 508. ↩

39. Zarker, supra, as included in Roddewig, supra, p. 509. ↩

40. Ibid. ↩

41. For detailed information about the various ways in which value insurance programs can be structured, especially to resolve concerns about the impact of contamination on market value and future sale prices, see, Jerry M. Dent, II, CRE, FRICS, and Christina M. McLean, CRE, CFA, “Value Assurance Programs: An Alternative Response to Property Value Disputes,” The Environmental Litigator, Vol. 20, No. 2, Spring 2009; and Christina M. McLean, CRE, CFA and Jerry M. Dent, II, CRE, FRICS, “Value Assurance Programs: A Case Study in a Model City,” The Environmental Litigator, Vol. 22, No. 4, Summer 2011. ↩

42. The article is Elisabeth N. Radow, “At the Intersection of Wall Street and Main: Impacts of Hydraulic Fracturing on Residential Property Interests, Risk Allocation, and Implications for the Secondary Mortgage Market,” Albany Law Review, Vol. 77, Issue 2, pp. 673–704 (April 16, 2014), available at http://www.albanylawreview.org/Articles/Vol77_2/77.2.0673%20Radow.pdf. ↩

43. http://HUD.gov.offices/adm/hudclips/handbooks/hsgh/4150.2. ↩

44. Licensed real estate appraisers, like the real estate brokers and the general public, look to the federal and state health and safety standards as well as investigation and remediation action plans and reports when deciding whether a particular level of a substance amounts to “environmental contamination” that needs to be reported and considered in the appraisal process. Advisory Opinion 9 (AO-9) of USPAP defines “environmental contamination” as “adverse environmental conditions resulting from the release of hazardous substances into the air, surface water, groundwater or soil. Generally, the concentrations of these substances would exceed regulatory limits established by the appropriate federal, state, and/or local agencies.” USPAP, 2014–15 Edition, p. A-17, Lines 77–79. ↩

45. The process by which licensed real estate appraisers handle environmental issues on FNMA and Freddie Mac appraisal forms is the subject of one of the sessions of the educational sessions at the Appraisal Institute’s 2014 annual meeting in Austin, Texas. See, “URAR Form Appraisal Reports and Adverse Environmental Conditions: Issues, Problems and Techniques,” www.appraisalinstitute.org/2014-annual-meeting-sessions-descriptions-and-speakers. ↩

46. Richard J. Roddewig, CRE, MAI, FRICS; Charles T. Brigden, CRE, ASA, FRICS; and Gary R. Papke, CRE, MAI, FRICS, AICP, “Real Estate Counseling in Class Action Litigation: Lessons from Hurricane Katrina,” Real Estate Issues, Vol. 37, Nos. 2 and 3, 2012. ↩

47. Charles Corcoran, Ph.D., CFA, and Fei Liu, “Accuracy of Zillow’s Home Value Estimates,” Real Estate Issues, Vol. 39, No. 1, 2014, 45, at page 48. ↩