Over Net Asset Values

Who would not want to have a window into the future and be able to see what the value of real estate investments would be, especially when going through a crisis, as is the COVID-19 pandemic?

Most financial institutions and major players in the real estate industry conduct surveys and develop analysis with their outlook at various stages in the future. This information becomes a valuable tool that helps investors, developers, and portfolio owners, in the planning and management of their assets and projects.

In the arena in which we participate as valuators and real estate advisors, we constantly consult many data sources, both from the U.S. and Mexico. Among these is Green Street Advisors, who are a meritorious source for information on various indicators of the behavior of real estate, including their analysis of the Premiums (or Discounts) on the Net Asset Value, of each of the sectors that make up the large Commercial Real Estate group. That is, the “Premiums”, or Discounts, on which REITs (similar to FIBRAs) are traded in relation to the underlying private market value of their properties.1

In the U.S., REITs (Real Estate Investment Trusts) comprised of industrial properties are being traded at a “Premium” today, suggesting that property prices in this sector have not declined because of the pandemic, or that the change is temporary. It is also possible that the values of high-quality industrial properties have moved above the value they had before COVID’s arrival, driven by the tailwinds from e-Commerce and interest in Nearshore Manufacturing.

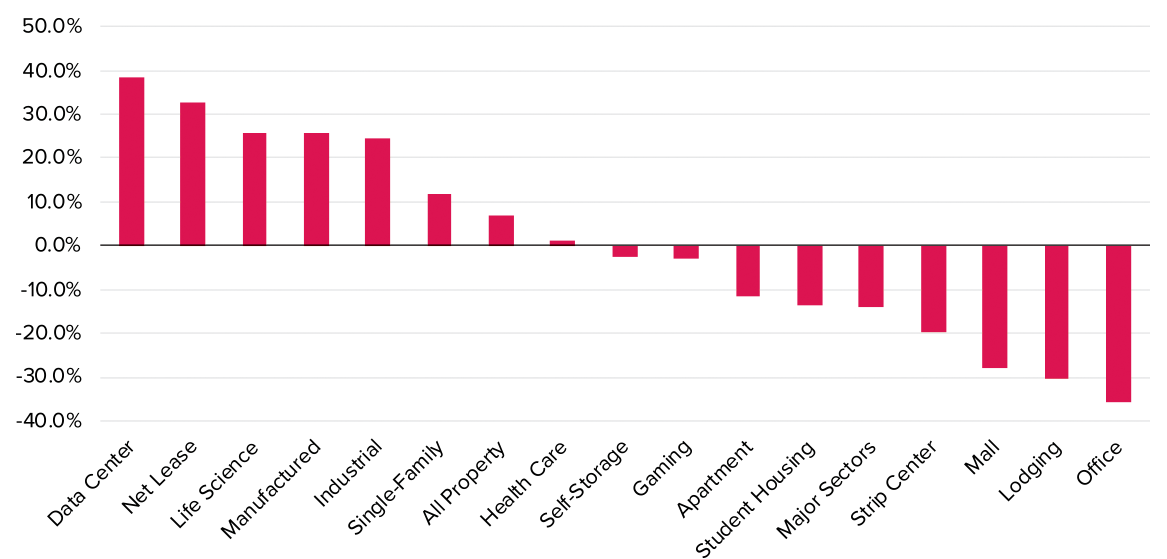

From the analysis practiced on July 1, 2020, by Green Street under the title “Property Sector NAV Premiums” on the REITs in its coverage universe, it is possible to observe the public market’s opinion of impending asset value changes caused by COVID. The premiums or discounts at which REITs trade relative to the underlying value of their property portfolios have been predictive of future changes in property values. As such, private market investors are advised to pay attention to the public markets (see Figure 1).

Figure 1: Property Sector NAV Premiums

|

Property Sector |

NAV Premiums |

Property Sector |

NAV Premiums |

|

Data Center |

38.6% |

Gaming |

-3.0% |

|

Net Lease |

32.7% |

Apartment |

-11.5% |

|

Life Science |

25.8% |

Student Housing |

-13.4% |

|

Manufactured |

25.8% |

Major Sectors |

-14.1% |

|

Industrial |

24.7% |

Strip Center |

-19.7% |

|

Single-Family |

11.6% |

Mall |

-28.1% |

|

All Property |

7.0% |

Lodging |

-30.4% |

|

Health Care |

1.2% |

Office |

-35.8% |

|

Self-Storage |

-2.4% |

Data by Green Street Advisors

Although the data is based on real estate portfolios located in the U.S., there is a similarity of behavior, mainly related to the Industrial, Office, Mall, Strip Mall and Hotel sectors in Mexico. The “Net Lease” sector comprises properties of one or more sectors; they can be a mix of retail, office, restaurant and industrial, but what sets them apart are the terms of the rental contract. Net Leases are typically 10 to 20 years old and one in which the owner has very few financial responsibilities.

The Industrial Sector Remains Sovereign

The Industrial sector under COVID-19 in Mexico remains broadly resilient, particularly high-quality properties with the physical and location characteristics suitable for e-Commerce, Last Mile, or on border areas for customers interested in Nearshore Manufacturing.

In the podcast on FIBRAs and Capital Markets under COVID-19, Colliers International and SiiLA Mexico, agree that the industrial sector is one of the least affected by COVID.2 However, SiiLA indicates (“The Value of Post COVID-19 Properties”)3 that the logistics sector, being one of the most defensive, will have the challenge of organizing its supply chain.

Signs of Confidence and Opportunity?

Market behavior is underpinned by key economic indicators, supply, and demand. Investors’ reaction to them is known as “Investor Sentiment”. During a crisis, when there is a lack of transactions, it is an indicator of the absence of confidence in that a recovery is near, but when important operations are carried out, during critical times, such as the current pandemic, it is an indication that there is confidence that the crisis will be resolved within a reasonable time or that the sector involved has characteristics that make it resilient to disruptors that affect the market. In some cases, during turbulent times, market conditions change in such a way that despite the high risk affected by most sectors, as in this case are Retail, Lodging and Office, given the high demand for quality space and strategic location for e-Commerce or for Nearshore Manufacturing, the industrial properties that meet these requirements benefit by becoming attractive opportunities.

In Mexico, during critical times of COVID-19, between April and July 2020, three transactions have been carried out in which two important real estate players acquired a total of 15 properties: Colliers (10) and O’Donnell (5), reaching a total of 4,546,123 square feet (422,349 square meters) of “Premium” gross rentable area, planned for e-Commerce and Last Mile, for around $402 million; significant acquisitions of “Premium” properties, located in top strategic markets, such as Mexico City and Guadalajara, and which can be taken as a sign of confidence in the future of this sector. •

Do you disagree with the author’s conclusion? Have a different opinion or point of view? Please share your thoughts with REI, or better yet prepare and submit a manuscript for publication by emailing the Real Estate Issues Executive Editor (or Board) on this article to rei@cre.org.

Endnotes

1. FIBRAs, or Fideicomiso de Infraestructura y Bienes Raíces, are investment trust vehicles in Mexico. ↩

2. “Podcast: FIBRAs y Mercados de Capital.” SiiLA México, YouTube. April 15, 2020. https://youtu.be/R3MJIT2y2vY. ↩

3. “El valor de las propiedades post COVID-19.” SiiLA México. May 22, 2020. https://www.siilamexico.blog/post/el-valor-de-las-propiedades-post-covid-19. ↩

Photo: AGCuesta/Shutterstock.com

Photo: AGCuesta/Shutterstock.com