Volume 34, Number 3

Winter 2009-2010

Participants:

PETER C. BURLEY, CRE

Editor in Chief, Real Estate Issues

Larkspur, Colo.

MARK ZANDI, PH.D.

Chief Economist and Co-Founder

Moody’s Economy.com

West Chester, Pa.

Introduction

MARK ZANDI isn’t an easy person to catch up with. He’s very busy these days, always moving—sometimes in Washington advising policymakers, and sometimes at his desk at Moody’s Economy.com in West Chester writing his latest assessment of the economy or some part of it.

It’s really not surprising that he’s busy and in demand. Over the twenty-odd years that I’ve known him, I’ve learned more from Mark Zandi about how the economy works and how it influences my job and my business than I have from just about any other professional economist. Few economists can offer as clear an explanation of the complexities and implications of the economy’s various moving parts as Mark.

That’s why I needed to talk to him. I needed some clarity. 2009 was an unusually difficult year. The economy was hammered by intense crosswinds that blew through the financial markets, the housing market and the employment situation. Consumers and businesses alike have teetered. Many have collapsed. Little has been left unaffected by the economic storms that began in 2007 and intensified through early 2009. Recently, there are some troubling signs that commercial real estate, too, will suffer damage and could jeopardize the economic recovery itself. So, I wanted to ask Mark where things might be headed. Is it getting better? What might “better” look like? When will the jobs come back? What can we expect for this industry?

During the fall, I finally managed to visit briefly with Mark, via email, to get an update on his discussions with The Counselors this past spring at the Waldorf in New York, and to understand what to expect next. He has graciously offered some additional insight into where we have been, where we are right now and where we might be heading in the coming months. What follows is a transcript of our electronic conversation.

One-on-One

BURLEY: When we last met in New York this past spring, we were still in the midst of the longest, deepest, steepest, and most widespread recession since the Depression of the 1930s. Beginning in late 2007 and continuing, apparently, through at least the middle of 2009, we experienced a brutal retrenchment in economic activity that has lasted for nearly two years. The nation’s economy, as reflected in the GDP numbers, declined at an annualized 5.4 percent in the fourth quarter of 2008, 6.4 percent in the first quarter of 2009 and about 1 percent in the second quarter. Finally, in the third quarter of 2009 we saw GDP post a gain of just under 3 percent. For all of 2009, though, Moody’s Economy.com expects GDP to post a decline of about 2.5 percent. And, the outlook for 2010 is for rather tepid growth of just over 2 percent.

Total employment continues to contract and is down more than six million jobs since the beginning of the recession (more than three million so far this year alone). Unemployment continues to track higher, with many analysts (including Moody’s Economy.com) expecting joblessness above 10 percent through much of 2010, even rising as high as 11 percent by next summer.

Foreclosures continue. Weak home prices have undermined tax revenues, wreaking havoc on local and state budgets. And, importantly, consumer spending remains subdued, despite government supports like “Cash for Clunkers.”

There do appear to be some promising trends, of course. Housing appears to have hit a bottom of sorts, although there are some questions as to how long we may remain near or at that bottom, even as tax credits for first time buyers—and, now, repeat buyers—are extended into 2010. Home prices keep falling, though. The stock market is clearly higher, if at times tentatively, from the depths of last spring. Manufacturing indicators are somewhat improved, with the ISM survey reaching above 50 for the past few months, suggesting that recent inventory draw-downs have boosted production. Consumer demand appears modestly improved, at best, however, perhaps for the long term, with non-auto retail sales posting only small gains in the most recent “post-Clunkers” reports. And Confidence has been less than inspiring.

For promising signs of economic recovery, you suggested in New York that we watch for three indicators: 1) the TED-spread to fall into the 55–75 bp range; 2) a decline in unemployment claims; and, 3) an upward shift in consumer confidence. I note the TED-spread has dipped to its lowest level since before the subprime shock in 2007, and that should be comforting, as long as lenders are expressing a concomitant willingness to lend. I also note that unemployment claims appear to have eased, although they remain high, and continuing claims remain over six million, which is a pretty high level. Confidence improved but still hovers near the same levels we have seen since May.

Those trends, which are clearly better than they were at the beginning of 2009, or even last spring, do offer some hope that the economy may, indeed, be showing signs of life—dare I say “green shoots?” Are they still just “green shoots?” What are your expectations now? Are we on a trajectory for real recovery? If so, what might that recovery look like over the next year or two?

ZANDI: The Great Recession has given way to a tentative and fragile economic recovery. I expect the recovery to evolve into a self-sustaining economic expansion, but that won’t be until 2011. The recovery will be a slog throughout much of 2010; at times we will feel pretty good about how things are going but, at other times, we will feel uncomfortable.

Monetary and fiscal stimulus will continue to support the economy and an improving global economy will fuel better exports. Very weak hiring by still cautious and creditconstrained businesses, the ongoing foreclosure crisis, commercial real estate mortgage defaults, and a poor state and local government fiscal situation will remain as significant weights on the recovery for much of 2010.

BURLEY: The stock market keeps climbing. Is that a bet on recovery—that conditions might improve sooner rather than later?

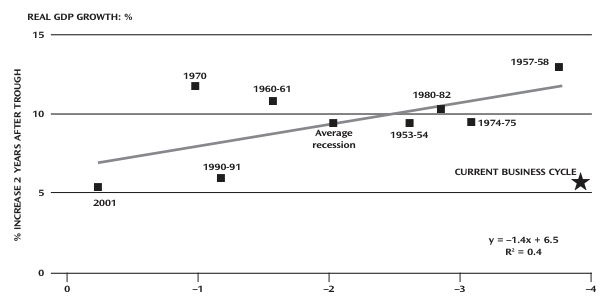

Chart 1: Not Your Fathers’ or Grandfathers’ Business Cycle

Source: Moody’s Economy.com

ZANDI: Yes, the stock market is correctly expecting the recovery to gain traction and to avoid sliding back into recession. However, the robust recent gains in stock prices do seem to overstate the economy’s prospects for 2010, but this may be a reflection of the better conditions for the larger companies whose stocks are publicly traded. Small and mid-sized firms are not doing nearly as well. Big businesses are benefiting from their global links and the weaker dollar and their greater access to credit. The stock market may not be as reflective of the prospects for the broader economy as it has been in times past. It is also important to note that despite the fact that stock prices are up, they are still some 25 percent below their 2007 peak; stock investors don’t expect the economy to come roaring back.

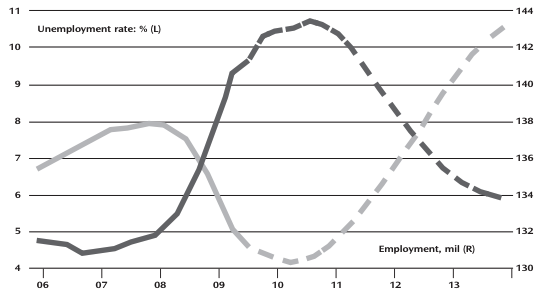

BURLEY: I’d like to talk about the employment situation, as it has been near and dear to my own heart for much of 2009. The latest (November) outlook survey from the National Association for Business Economics (NABE) shows that the majority of economists expect net employment losses to bottom out in the first quarter of 2010, but that a full recovery of the jobs that have been lost might not be clear until 2012. Unemployment, according to the survey, “…will remain stubbornly high…” as well. Given that you see a self-sustaining recovery coming perhaps in 2011, do you agree with the NABE employment outlook? What is your outlook for job growth and unemployment over the next couple of years—will it get much worse before it gets better?

ZANDI: Yes, I agree that the job losses will end early in 2010 and for meaningful job growth to resume by yearend 2010. Unemployment will rise through next summer, peaking as high as 11 percent. Full-employment, which is consistent with a 5.5 percent unemployment rate, isn’t likely until 2013. Even this depends on continued, very aggressive policy support; the Fed needs to keep rates at near zero throughout 2010, and fiscal policymakers need to come forward with more temporary tax cuts and spending increases.

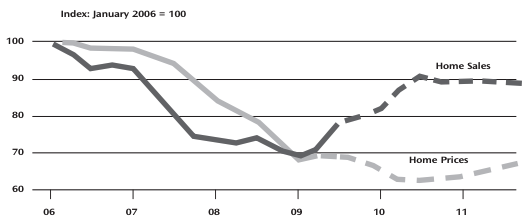

BURLEY: And home sales. The National Association of REALTORS® said existing home sales rose 10.1 percent in October, the biggest monthly increase in a decade. Clearly, federal programs to lower mortgage rates and homebuyer credits are luring more buyers into the market. And, prices are off 7 percent from a year ago and continue to fall, with many analysts expecting prices to hit another low in 2010, falling an additional 5–10 percent. Certainly that helps affordability. But, it also surely has a negative effect on homeowner equity and wealth. What are your expectations for the housing markets?

ZANDI: Home sales and housing construction have hit bottom, but house prices will suffer another leg down. Based on the national Case-Shiller House Price Index, I expect prices to fall 38 percent peak-to-trough, with the trough in the third quarter of 2010. Prices are down 30 percent through the third quarter of 2009. Prices actually rose a bit this past summer as foreclosure sales abated, with mortgage servicers trying to figure out the HAMP loan modification plan. As they determine that many homeowners won’t qualify for the plan, foreclosure sales will pick up by early next year. The key statistic for determining when house prices hit bottom is the share of home sales that are distressed; foreclosure or short sales. This share will rise in early 2010, and thus house prices will fall further.

Chart 2: The Labor Market Will Recover Slowly

Source: Moody’s Economy.com

BURLEY: Are there other signs of recovery—nationally or regionally—that you see or that we might want to watch for?

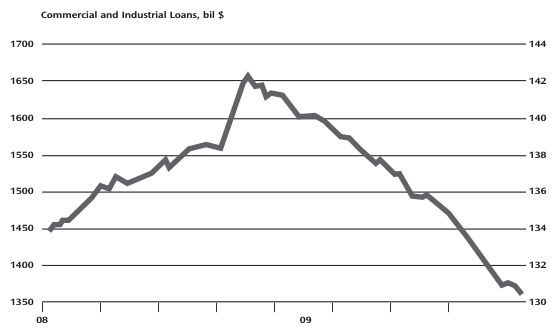

ZANDI: Commercial and industrial lending would also be a good indicator to watch. C&I loans outstanding continue to slump, indicating that credit remains tight for many businesses. This is limiting their ability to expand their businesses and resume hiring. If C&I lending stabilizes that would be a positive sign; if it begins to increase, that would be a clear indication that a self-sustaining economic expansion has begun.

BURLEY: How about regionally? In the past, you have mentioned that signs of recovery might be evident earlier in areas with heavier concentrations of technology and healthcare. Does that still seem to be the case? And, will a Healthcare Reform bill change the map at all? What about regional (renewable or otherwise) energy markets? Would a “Cap and Trade” energy bill change that outlook?

ZANDI: The upper Midwest economy, which is more dependent on agriculture and energy, has already begun to recover strongly, as are parts of the Northeast economy driven by healthcare, educational services and the federal government.

Tech centers and global gateway city economies are set to turn next. Examples of these cities include Raleigh, North Carolina; Austin, Texas; Seattle; and San Jose, California.

Some industrial centers are also doing better, although this is a bounce off of extraordinarily depressed levels. Healthcare reform will, at the end of the day, not change the map, at least not in the near future, nor will energy legislation which is increasingly unlikely to pass through Congress anytime soon.

BURLEY: Do our little “green shoots” need yet more nurturing ( i.e., Stimulus) to make the recovery stronger and more durable?

ZANDI: Yes, I think it is important for the Federal Reserve and fiscal policymakers to remain aggressive in supporting the economic recovery. This means that the Fed should maintain a zero funds rate and fiscal policymakers will extend and expand various parts of the expiring fiscal stimulus.

It is even reasonable to expect the Fed to increase its credit easing efforts and for fiscal policymakers to consider such things as a job tax credit if the job market remains weak and the recovery threatens to unravel back into recession.

Recession risks remain uncomfortably high, but more importantly it is very important to guard against going back into recession. If the economy does fall back into recession, it will be very difficult to get out given double digit unemployment, the zero funds rate, and the $1.4 trillion budget deficit in the just-ended 2009 fiscal year.

Chart 3: Rising Foreclosure Sales Will Undermine Prices

Source: Moody’s Economy.com

BURLEY: Looking at our own business, commercial real estate is facing a looming credit crisis. According to a second quarter 2009 report from Deutsche Bank1, deterioration in commercial property loan performance is accelerating—the total delinquency rate reached 4.1 percent in June, 2.2 times higher than in March 2009, and 3.5 times higher than in December 2008. Deutsche Bank expects delinquencies to rise even further over next 24 months, overwhelming servicers with some 2,100 delinquent fixed-rate loans amounting to roughly $28 billion.

The report projects that losses could reach 4.3–6.3 percent of the outstanding CMBS universe, roughly $31–$46 billion. It also estimates that roughly $400–$450 billion in CMBS would not qualify to refinance were they to survive until maturity. More than $2 trillion in commercial mortgages, including CMBS, bank and life company portfolios, will likely mature between now and 2013. Debt deterioration appears to have accelerated across all property types. Even small, expected improvements in rents and vacancy rates appear insufficient to offset the scope of the problem, at least in the near term (of 24 months or so). And, with demand fundamentals looking weak for the foreseeable future, and valuations taking a huge hit from their peak in 2007, the majority of those loans might not qualify for refinancing sufficient to retire the existing debt. Does the deterioration in commercial mortgage credit represent a threat to recovery in the broader economy?

ZANDI: Yes, the commercial real estate bust poses a significant threat to the tentative recovery. Not only does this mean that commercial construction will continue to weaken, a direct weight on economic activity but, more importantly, it will result in hundreds of bank failures. While small banks are at most risk, these banks are vital providers of credit to small businesses which are vital to job creation. Without credit, small businesses are unable expand their operations and the job machine will not engage.

BURLEY: Do you have an outlook with respect to how the CMBS/commercial mortgage situation might play out?

ZANDI: Defaults will continue to mount, but probably won’t be quite as severe, as policymakers are responding by providing different ways for mortgage owners to show some forbearance to property owners. The FDIC’s recent guidance to banks allowing them to break apart loans into good and bad loans is an example of this. I also suspect that commercial credit will begin to flow more freely once employment, and thus the absorption of space, stabilizes. Commercial real estate will be a weight on the economy, but will not push back under, at least not on its own.

Chart 4: Banks Must Resume Lending

Source: Moody’s Economy.com, Conference Board

BURLEY: Clearly, the situation has forced the property markets into a defensive crouch. My personal view is that we will probably have to deal with this problem one property or portfolio at a time. Lenders are going to have to become more confident that the long term prospects in the property markets are good and likely to get better. And, property owners and investors are going to have to become a bit more realistic in their expectations.

What is your outlook for commercial property markets, in terms of property fundamentals and performance? Is there a particular segment (office, multifamily, retail, etc.) that you see recovering sooner? Where? East Coast? West Coast? Southwest?

ZANDI: I don’t think a particular property type and/or region will lead the way to recovery. Instead, investors will have to look metro area by metro area and property type by property type. Investing will be much more difficult than in times past when simply investing in the Sunbelt was a virtual slam dunk.

Endnote

1.“Commercial Real Estate Outlook: Q2 2009, Between a Rock and a Hard Place,” Richard Parkus, Head of CMBS Research, Deutsche Bank AG, July 2009, (http://brokered.t35.com/dbreport2q09.pdf).