Volume 33, Number 1

Spring 2008

Panelists:

RAYMOND G. TORTO Ph.D., CRE

Principal and Chief Strategist

CB Richard Ellis – Torto Wheaton Research

Boston, Mass.

KENNETH P. RIGGS, JR., CRE

President and CEO

Real Estate Research Corp.

Chicago, Ill.

ALAN C. BILLINGSLEY, CRE

Head of Research,

North America RREEF

San Francisco, Calif.

Moderator:

PETER C. BURLEY, CRE

Associate Editor/REI Vice President,

Research Simpson Housing LLLP

Denver, Colo.

Peter Burley Sets the Scene

ON ANY GIVEN DAY, one can usually find me in my office “studying.” My job requires it. As the chief—and only— research executive in the building, I am the guy who monitors, analyzes, interprets and synthesizes incoming reports and data that reflect developments in U.S. economy and property markets. I write what I have learned for the various clients I serve within the company (read: the Boss, the Boss’s Boss and our investors). A big part of my daily routine is playing host to a parade of visitors in my office (read once again: the Boss), who often drop by to ask me what I have read or what I know about the latest reports on employment trends, interest rates or property market performance. Lately, say over the past few months, the visits have grown more frequent, and the questions just a bit more serious.

“So,” one visitor (er, the Boss) began, as he stood at my door, “are we there yet?”

“Where?” I asked, looking up, slightly unfocused, from my computer screen.

“Recession,” he said, matter-of-factly.

“I’m having a little trouble getting a fix on that,” I answered, “though the odds that we are headed that way seem to have increased in the past few weeks. Job growth is off. Spending over the holidays was a bit weak. And, there is simply no good news on the housing front. Debt markets are nearly frozen. And, to me, the very fact that the Fed is acting aggressively suggests that some concern may be warranted.”

“I think we’re gonna have a recession,” he said and walked down the hall.

As I said, the visits are more frequent. The questions are more serious. And lately, when I answer the questions and write about the economy and the property markets, I try to do so as honestly and in as straightforward a manner as I can without:

- injecting too much optimism into the discussion;

- scaring the bejeezus out of those who ask the questions or read my reports (i.e., the Boss).

Thinking to myself that perhaps it would be useful to inject a little fresh perspective into my daily studies, I decided that maybe I should be the one who asks the questions for a change. At the end of December, and again in mid-January, I sat down to glean some fresh, additional wisdom from three of our best known and most respected thinkers. “What might Ray or Alan or Ken say if I happened to stop by their door to ask, “Are we there yet?”

BURLEY: Housing markets continue to crash. Financial markets are in turmoil. Employment is slowing. Spending is beginning to slow. The Federal Reserve seems a little spooked, trimming its official forecast for 2008, and aggressively easing policy. The dollar is at a new near-term low.

Recent dynamics in the economy have been tipped over, first by the deep slump in the housing market, with few signs of stabilizing and additionally, by significant stress in the financial markets, with equity markets swinging wildly, and debt markets in turmoil. It seems almost as though some of the financial innovations that helped fuel expansion in the past have suddenly turned on us—I’m thinking especially about the multitude of fairly new securitized debt instruments that have entered the market in recent years, like CDOs and SIVs.

Home sales have fallen to their lowest level in 28 years. Owner home equity fell in 2007 for the first time in 16 years, suggesting weaker spending and economic growth ahead.

Additionally, there is evidence that loans of all kinds are showing stress, from home mortgages to construction loans to auto loans to consumer credit. Delinquencies and defaults are up, it seems, across the board. Even student loans appear to be on the verge of slipping into crisis.

Consumers and businesses alike are growing more pessimistic. The Moody’s Economy.com Business Confidence Index, for instance, is at its lowest level since its creation some five years ago, with components for sales, inventories and office space all deteriorating. The University of Michigan Consumer Sentiment Index dropped in early December, largely on expectations, to its lowest level since Hurricane Katrina and is at its second lowest level since the early 1990s. And, the Conference Board’s index of consumer confidence is effectively at its lowest since 2003. While confidence measures are seldom very good indicators of spending behavior, we have seen some evidence that consumers are pulling back, with rather soft retail sales reported in the fourth quarter of 2007. Consumer spending slowed in December to its weakest pace in six months…

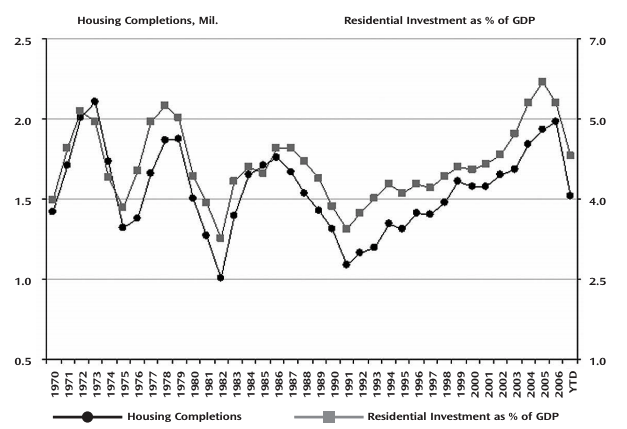

Housing Completions and Residential Investment as a Percent of GDP, 1970-2007

Source: CBRE/Torto Wheaton Research

What’s your assessment of the state of the U.S. economy, given the slumping housing market, turmoil in the financial markets, a slowdown in employment and consumer spending, and pessimism among consumers and businesses? Are we headed into a recession? Are we already in a recession?

TORTO: First of all, the question is not whither recession but how slow will growth be and for how long? A positive growth of .2 or a negative growth of -.2 has the same negative effects for our economy.

We are amazed at the resiliency of the U.S. economy. Consumers are still stepping up and businesses are posed to continue investments and serving the export markets. As long as we continue to create about 80,000–100,000 jobs a month, and businesses can borrow from the banks and markets, we expect to see slow but positive GDP growth.

The most insidious risk is the instability of the credit markets and whether we can get back to normalcy in first quarter of 2008 in these markets. We expect the overbuilding of the residential sector to be a drag on the economy until the end of 2009, subtracting from overall GDP growth. For 2008, we see GDP growth in the one percent range.

We will pull out of this slowdown when the housing drag is no more and as the export market for our goods and farm products continues to grow. The graph above shows the importance of housing to the overall economy, being as high as 6 percent of GDP in 2005, and now at 4 percent….as housing starts fall, it will detract from GDP growth and offset the positive stories for business investment and business exports.

RIGGS: There are quite a few signs that the economy is at risk—record high oil prices, a weak dollar, government deficits, geopolitical risk, the subprime mortgage meltdown, and the global credit crisis—but no hard evidence yet that we are in a recession. The most recent measure of GDP growth, taken Dec. 20, 2007, indicates a final estimate of 4.9 percent for third quarter 2007, which is higher than the 3.8 percent growth in second quarter. Also, productivity growth of 6 percent, solid corporate balance sheets, strong demographics, low interest rates and the Federal Reserve’s aggressive approach to cutting rates to stay ahead of a recessionary curve, and a weak dollar, all demonstrate the strength of the U.S. economy.

That said, however, many economists are projecting slower economic growth over the next few quarters. And, with continued high oil prices and high winter heating costs, slow job growth, a reduction in home building, and the continued negative hype associated with election year politics, it will feel like a recession to many, especially those in hard-hit areas of the country or in industries with declining growth.

Main Street, or the consumer, still comprises two-thirds of our economy. If employment doesn’t slow too much, and consumers keep their jobs and continue to spend, the foundation for economic growth will remain solid. Additionally, growth in exports will continue to shore up the U.S. economy. During the second quarter of 2007, imports fell 2.7 percent, while exports increased 7.5 percent, which was due in great part to the weak dollar. Business and government spending in 2008 will also help to keep the economy growing.

BILLINGSLEY: I do not believe the economic fundamentals warrant a recession. Nevertheless, there is a high probability—about 50 percent—that we will get one in 2008, as a result of what I believe are overreactions in the equity and debt markets. A market psychology is setting in that could lead to more severe job layoffs, to more restrained hiring, and to fearful consumers, pushing us into recessionary territory. In any event, the choice appears to be between our base case of very weak employment and GDP growth in the coming year, versus a mild recession, with modest negative employment and GDP growth. In either case, a needed slowdown will allow us to recover from a “bubble” we created in asset prices and over-leveraged debt markets. Renewed growth would follow in 2009 and beyond.

The current slowdown (or recession) was inevitable, something we had been expecting to happen in 2006. We were experiencing a classic bubble over consumer spending, home price increases and financing risk. I didn’t fully appreciate just how bad it had gotten, but the subprime implosion was merely the pin that popped this bubble. Given how far this cycle expanded, we built way too many homes, and that is having negative implications on many aspects of the economy. All this has been made worse by a very significant U.S. budget deficit, which places yet more pressure on the financial markets, and has had much to do with the falling value of the dollar.

On the other side of the coin, our economy retains many of its strengths. If we hadn’t had this housing/consumer bubble, GDP growth would probably have been at or above trend. Corporate profits are healthy, financial institutions were the healthiest they have been in a long time—at least before the subprime write-downs—and export growth is very healthy.

We should see renewed growth at around trend in 2009 through at least 2011. The overbuilt housing market will be less of a force in 2009, while financial markets should have recovered.

A risk that I see to this relatively positive view is inflation. I am worried that the Fed, the White House and Congress are so focused on cushioning or avoiding a recession that we end up creating an environment that will fuel inflation going into 2009 or soon thereafter. The Fed would then have to hit the brakes, causing a classic recession. Some of the fiscal stimulus being discussed sounds quite reasonable, including modest near-term tax rebates, business investment incentives and infrastructure spending. Assuming the cumulative total of these initiatives do not greatly increase the budget deficit, and do not extend into 2009, the results could be positive and help us to avoid or cushion any recession. However, I am hearing a drumbeat that suggests these efforts are too modest, and that any stimulus needs to be much more substantial, and extend beyond 2008. Suggestions are also surfacing that the Bush tax cuts be made permanent. A significant increase in the federal budget will place us in grave danger of rising inflation, once the economy begins to rebound. The Fed will have few tools that it can use—other than quickly raising the Fed Funds Rate—to combat inflation. This scenario scares me much more than the prospect of a near-term mild recession. The resultant recession in 2009 or 2010 would likely be severe, and it could end this cycle of economic expansion. As with the last time we whipped inflation in the 1990s, the adjustment would be prolonged.

Employment

BURLEY: A look at the past year to eighteen months indicates that employment growth has been steadily slowing. Do you think that’s likely to continue? If it does continue, what do you see as the implications for demand in the property markets?

TORTO: The long-term trend is down, and it would take an extraordinary event, such a major financial institution going out of business, to push this trend down further. We have already seen declining levels or rates of absorption for all property types as a result of the slowdown.

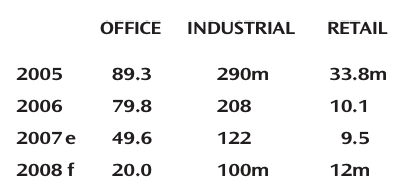

Absorption Trends (square feet)

RIGGS: The pace of job growth is obviously slowing, and is expected to continue growing at a slower pace than it has during the last few years. This is due largely to the slowdown in the housing market and in subprime lending, which includes jobs in construction, home mortgage origination/lending, construction materials, and home furnishings. But there are strong possibilities for job growth in such sectors as technology, energy, health, and educational services, and hiring in these areas will help to offset some of the weaknesses elsewhere.

The decrease in employment has already started to affect some of the commercial real estate sectors. Although the office sector remains fairly strong and vacancy rates continue to decline in some areas, RERC has begun to see reduced demand in other markets, with vacancy increasing and rental growth decreasing. Industrial warehouse space also is mixed, with demand increasing in some areas and slowing in others. Generally, warehouse demand remains particularly strong in the port cities due to the strength of exports. If non-discretionary spending takes up a significantly greater part of consumer spending, demand for retail space will decline.

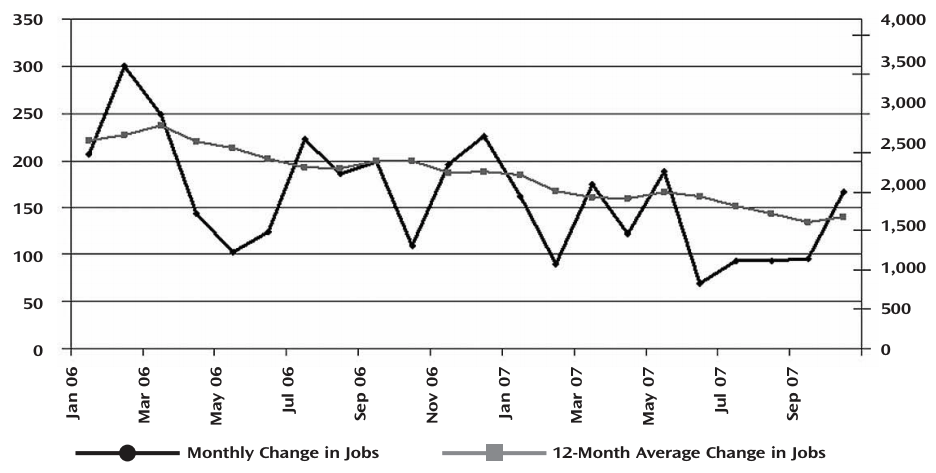

Employment Trends in 2006 and 2007

Source: CBRE/Torto Wheaton Research

BILLINGSLEY: Employment has been a relatively happy story, given all that has happened in the economy. The major losses have been in housing and housing related industries, most notably home mortgage companies. These jobs will not start to come back until well into 2009. However, other sectors of the economy will be employment generators. But, 2008 will not be a good year, with net new employment growing at the slowest pace since 2003. The unemployment rate will peak at of about 5.5 percent. This is still not a high level of unemployment, and is the same as in 2004. It could be a sufficient loss of job growth to push us into a mild recession, however.

Still, this slow and restrained employment growth will have a near-term impact on property markets. Office markets will experience slower absorption in 2008 than many had previously forecast. Some of this will be a holding off on adding employees until future economic conditions become clear. As a result, rent growth will also be restrained. Nevertheless, on a national basis, we are expecting rent growth to remain positive.

Housing Markets

BURLEY: Combined new and existing home sales are off more than 33 percent from their 2005 peak. Some economists are talking about a protracted housing downturn, with little improvement through 2008, possibly through 2009 or longer. What’s your outlook for housing in 2008 and beyond?

TORTO: Current housing production has not fallen enough to let the inventory reduce. Many homebuilders are trying to keep their businesses going and this requires them to keep building. We expect we will see some big homebuilders in bankruptcy before 2008 is over.

RIGGS: The housing decline is expected to bottom out during the first half of 2008. It has been estimated that from 2005 until the trough in the residential market crisis occurs later this year, home prices will have declined about 11 percent. This sounds like alot, and if you are someone who has to sell your home right now, you will feel the pinch of lower prices. But when you think about how the price of homes nearly doubled during the past five years or so, a correction of this size is not out of line.

Even so, the overall decline in the housing market will subtract one percent from the nation’s GDP during 2008. With housing starts at their lowest level in more than a decade, S&P and Global Insight expect the year-over-year decline in residential construction to bottom out in the first quarter of 2008 at -20.8 percent, and become positive again in second quarter 2009.

BILLINGSLEY: The over-supplied housing market will take at least through 2009 to recover, meaning prices will stabilize and allow for some growth in 2010. However, some of the worst markets will take longer, while some markets will feel little impact at all. In the most heavily oversupplied markets, rental apartments will be negatively impacted as excess for-sale units are turned over to the rental market.

Financial Market Implications

BURLEY: Against the backdrop of the mortgage meltdown and the subsequent losses hitting financial companies and banks, the government has announced mortgage interest rate freezes for some subprime loans, and the Federal Reserve has cut interest rates. Will these actions help the situation, and is the Fed walking a tightrope by lowering rates at the risk of higher inflation and a weaker dollar?

TORTO: Yes. Yes. However, the problem here is a highly leveraged asset whose value has fallen, and given that new supply keeps rising, no one knows where the bottom is. The Fed has no choice to do what it is doing, taking the risk on inflation that it is taking. The ultimate solution is to turn off the supply spigot and allow inventories of housing (single-family and condos) to be slowly depleted. And this action is not in the Fed’s control, but is driven by homebuilders and the market.

RIGGS: Given the uncertainty that the subprime crisis has created in the financial markets, any type of rescue effort has some level of benefit—real or perceived. The question is, to what degree this will help, and does the action inadvertently prolong the market correction? In the short term, the Fed clearly provided confidence to the financial markets that it is paying attention and will take action to make sure that the crisis doesn’t spill over into other financial arenas. In the longer term, the government policies have helped to soften the impact, but they will result in the subprime situation taking longer to correct itself versus allowing the free market to clear itself without government intervention. I like the Fed action, but I am not a big fan of government policies that interfere with the free market clearing mechanism.

BILLINGSLEY: The interest rate freeze, as has been widely reported, only affects a minority of problem loans. Still, I do believe it will be modestly helpful. But there is a basic problem in that just too many homes have been built, and we really don’t have enough households to stick in them regardless of how cheap they might be. In the worst-affected markets, many of these mortgages were made to investors. There is just no way that these are not foreclosures and write-offs. Investors in residential secured mortgages will take some heavy losses. This will just need to happen and we need to get it behind us. Probably most subprime borrowers will need to go into foreclosure. This is unfortunate, but at the end of the day, these borrowers will be renters, as before. And, because the subprime mortgages did not require much equity, they are not “out” that much. The aspect of this whole mess that worries me most is its impact on home values, and in turn, the impact on consumer confidence and consumer expenditures. I really don’t think the government has much of a role here, other than the cuts in the Fed Funds Rate. Home values have to adjust to take into account the excess supply. The combination of the drag on the economy from the housing sector, reduced consumer expenditure growth, and turmoil in the equity and debt markets could well be sufficiently severe to throw us into recession.

The Fed is walking a difficult tightrope with inflation due to the weakening dollar, and particularly due to rising commodity prices—most spectacularly, oil. For 2008, I don’t think inflation will be a serious problem. I believe that economic growth in the U.S. and globally will slow sufficiently to take the pressure off inflation while the Fed fights recession with the Funds Rate. But, it is going to be tricky, and they will need to be cautious. I guess I worry more about 2009. If you look at most growth forecasts, it should be a pretty good year for economic growth. However, the Federal budget deficit is projected to significantly ramp up, with reduced revenue due to slower growth in 2008, coinciding with reduced taxes due to AMT “reform,” escalating expenditures, tax cuts, etc. In the interim, there is little chance of a strengthening dollar, and it could fall further. The danger is that in 2009, the Fed may need to slam on the brakes. Our forecast is that the rate should be back to 4.5 percent by year-end 2009, but the risk is that heavier-handed action will be necessary. That scares me more than the near-term risks.

Speaking of the Dollar

BURLEY: While it has been an orderly (relatively) decline so far, the value of the dollar has weakened considerably. And financial market turmoil has not helped. The trade-weighted dollar, measured against a basket of other currencies, is off by around 30 percent. Even the Canadian Loonie has hit parity with the U.S. dollar. The weaker dollar helps exports. But, the U.S. export sector, which represents about 12 percent of GDP on net, can’t hold the economy up alone for very long. And, much of the export boost is confined to a few regions of the country. Additionally, the weaker dollar makes imports more expensive, including the price of oil, which has surged in recent months to a $90–$100 range and threatens an inflationary surge.

Is the declining value of the dollar a significant inflationary risk, and could it have an effect on interest rates? Also, has the dollar’s weakness attracted foreign investors who are shopping for specific property types?

TORTO: We only have anecdotal evidence on foreign buyers, and they are there in large numbers. But, there is no evidence they can fill the void either in retail sales or condo purchases.

Residential investment hit a peak of about six percent of GDP in 2005. Exports at 12 percent, and growing quickly, can help grow this economy. Although we hear of lots of inflation risk, we do not see pricing power in manufacturing and services. Rather, it seems that margins are being cut or productivity accelerated. Of course, we do see inflation in commodities and food, and this is a serious inflation risk. But I would argue it is a risk we need to take to put the financial system back to normalcy—that is, the markets and institutions are open for lending.

RIGGS: For now, inflation is less of a threat than a slowed economy, or even worse, an economy in recession. It’s under control and is rising at a reasonable and manageable annual rate within Fed expectations, excluding volatile food and energy prices. There is little pricing power to pass along these increases, except in the food and energy sectors. However, as all of these factors continue to weigh in on costs, inflation becomes a bigger threat and one that the Fed will have to deal with.

The longer the confluence of a weaker dollar, high energy prices, high commodity prices, and a weakening economy persist, the greater the likelihood inflation becomes a threat. Normally, this will result in higher interest rates. However, at this point, the highest probability rests with continuing lower interest rates until we work through the global credit crisis.

Foreign investors have been increasing their investment in commercial properties in the U.S. since 2004, and this trend has increased with the weakening of the dollar. The countries and regions investing the most in U.S. commercial real estate include Australia, Germany, Canada, and the Middle East. International investors have changed their strategy and are adding more “value-added,” riskier properties. Their investments also include off-market transactions and joint ventures.

Foreign investors also are seeking different sectors for investment, including infrastructure, resorts, senior housing, storage, and student housing. Currently, New York City ranks as the top market for foreign investment in commercial real estate. Other top markets include Los Angeles, San Francisco and Seattle.

BILLINGSLEY: The falling dollar is a significant inflationary risk. At this time, inflation is restrained due to the slowing economy. I believe the dollar has further to fall, although probably not by more than 10 percent. Other central banks are also lowering their rates, so I believe bottom should be reached in 2008. This will begin to entice foreign investment during 2008, which will help to further stabilize the U.S. economy. Still, the U.S. must get its budget deficit under control before renewed economic growth in 2009 escalates inflationary pressures. This is a risk to the recovery from the 2008 slowdown.

The Property Markets

BURLEY: What do you see as the bottom-line impact of recent developments in the economy on commercial property markets?

TORTO: Slowing absorption will lead to higher vacancy rates in all sectors except hotels over the next few quarters. We see rent growth having general momentum and rising in line with inflation in the 2’s.

RIGGS: The slowdown in the economic landscape has all investors paying attention to the demand side of the equation. The most important element to commercial real estate investors is job growth. As consumer confidence wanes and businesses become leery of expansion plans, so does the potential for job expansion, and thus the demand for space. The debt crisis put an end to cap rate compression, but improving space market fundamentals provided a boost to property values and pricing. This somber economic outlook has resulted in investors dialing back on earnings expectations for commercial properties, thus cooling off the urgency of buying more commercial real estate.

BILLINGSLEY: Commercial properties are worth 5–10 percent less than a year ago, in spite of improving market fundamentals, with continued rent growth and restrained new supply. The capital markets are demanding greater yield from these investments. In addition, lenders are far more restrained on the terms and pricing of debt. As a result, yields are being bid upward, and pricing downward.

BURLEY: There is some evidence that office market demand is already slowing. And, if retail performance continues the recent trend, then retail will likely slow as well. What about industrial space?

RIGGS: This varies by industrial classification, as we have myriad of types of space from bulk warehouse, flex space, R&D and traditional industrial. Properties in the port cities, and bulk warehouse properties are doing very well; this is also true of R&D in technology-driven areas, whereas traditional industrial properties in traditional locations are experiencing the effects of the slower economy, from both the business and consumer fronts. The cheaper dollar that has triggered increased exports is favoring the industrial property sector.

BILLINGSLEY: The office market has been the strongest sector in the past couple of years—the latest to recover from the 2001 recession. Demand in most markets is declining from previous forecasts, with 2008 seen to be a particularly slow year. We expect that between slowing demand and rising supply, vacancy rates will tick up about 100 basis points during the year. Still, it’s a relatively strong sector, particularly in strong supply-constrained CBD and inner suburban submarkets. We’ve been predicting the slowing in consumer sales growth for several years, and it’s finally really starting to happen. In 2008, retail sales growth will reach a cyclical low—at or around inflation. Most retailers have been in good shape financially, with the exception of home furnishings and improvement retailers. A number of home furnishings retailers are going out of business. Most other retailers will survive the next year in a more competitive environment. However, retail center owners will have a more difficult time driving rents. Class B centers, particularly malls, will have an especially difficult time next year.

Industrial will be the steadiest of sectors, with continued import and export volumes driving demand. Rents will be restrained, however, given increases in supply and a weaker economic market. Some peripheral exurban big box industrial markets will feel some pain

BURLEY: Will apartment markets benefit from housing foreclosures, or will they suffer as employment continues to slow?

TORTO: As people are forced out of their homes from foreclosures, we see the number of renters rising significantly. However, the biggest competition for multi is from renters going to the single-family and not moving into the institutional multi-family product.

RIGGS: The net impact will be that apartment demand will continue in a positive direction, but at a slower rate. However, as the supply of new units is expected to continue and shadow supply from unsold homes increases, vacancy will likely edge slightly higher, thus generating only moderate rent growth.

BILLINGSLEY: Residential is a tale of two markets. Highly overbuilt for-sale markets will also have weak rental apartment markets, as for-sale product is converted to rental. Many failed condos and condo conversions will also compete. However, those markets that were not overbuilt, particularly the expensive coastal markets that are still experiencing healthy job growth, will experience one of the best markets they have seen in years.

BURLEY: In recent months we have seen a modest uptick in cap rates, as expected, in a few markets. Where are commercial property values likely to be in a year or two?

TORTO: The lack of liquidity and struggle to do deals makes it difficult to say. That said, we think values will be within 5–10 percent of where they are now in a year or two. Not clear at the moment which way.

RIGGS: Commercial real estate is holding its own reasonably well, given the significant disruption created in the subprime market, which has resulted in a global credit market crisis. We clearly see a bifurcation in property market pricing with a flight to quality. Top-tier assets that are well leased and well located have not seen a decline in values/pricing or an increase in cap rates. But, this is not true of properties that lack strong occupancies or possess an average location. Further, we have seen that properties that traditionally fit the high leverage profile are not able to attract the capital structure that made their pricing “work” prior to the credit crisis. Overall, prices for most property sectors in most markets will likely see flat to modest decreases over the coming years, and properties that are top-tier assets will see gains at much slower rates than have been experienced in the past; this is a trend that has already begun. Retail and hotel properties already have seen some decreases in average prices, but as the economic fears begin to subside, especially in the later part of 2008, prices in those sectors should turn around—but also at a much slower rate.

BILLINGSLEY: Cap rates have adjusted upward between 25 and 50 basis points in the past year. Over the next year to 18 months, we expect another 25–50 basis points adjustment. When the dust settles, cap rates will be up 75–100 basis points over their peak.

BURLEY: What effects will the liquidity crunch have on property market transactions? Are investors looking at real estate today the same way they did a year ago? Has the debt crisis affected real estate as an asset class?

TORTO: Commercial real estate as an asset class is in about the same place as before the debt crisis, relatively speaking. However, excess returns were generated by the flow of capital funded via the CMBS market, which comprised 22 percent of the $3 trillion debt in commercial real estate, growing about 18 percent per year. With this almost gone, the transaction volume will be down, but it is anybody’s guess as to how much. Of course, the portfolio lenders are filling the void a bit, but they do not have the capacity to fill it entirely. One thing we know is that CMBS did fund about 40 percent of the transactions over five million in 2007. And, for first Q 2008, it is estimated that CMBS volume will be 4–5 billion. 1Q 2007 was around 50 billion. The writing is on the wall.

RIGGS: Clearly, the level of debt capital that was available in 2006 and early 2007 was a high-water mark for our industry. There will be less and more discriminating debt and equity capital available for investment for commercial real estate. This pullback in available capital is a good thing. Capital was getting too aggressive, and pricing was getting ahead of property fundamentals with most properties priced for perfection. Therefore, the level of transactions will slow from the pace seen in 2006, but there still will be sufficient debt and equity capital available to allow for a healthy level of market transactions. The liquidity crunch saved the commercial real estate industry from following the fate of the subprime market and a significant market correction that was bound to happen if we kept going at the pace seen in late 2006.

BILLINGSLEY: In 2008, equity will be highly valued, given the difficulty of highly leveraging properties. Fully leased properties can be financed attractively at 65 percent LTV and at attractive yields. This will provide an opportunity for equity players, including pension funds and foreign investors.

Value-added transactions also are difficult for traditional leveraged buyers, given the lenders insistence on coverage. Again, equity buyers with conservative leverage requirements will be at a competitive advantage.

There will be less capital chasing real estate in 2008 than was the case in 2006 and 2007, both of which were banner years.

BURLEY: Are investors looking at real estate today the same way they did a year ago?

RIGGS: No, and we would not expect them to, given how the world has changed. In an ironic way, commercial real estate looks more stable and attractive to the investment alternatives of stocks and bonds. Investors are much more discriminate and selective in their property selection and the markets that they will invest in. The market has become more risk averse, and there is a flight to quality. Cash investors and single-asset lenders view it as a good time to buy or lend on properties today and to be able to negotiate a fair deal on the pricing side with little pricing competition from high-leverage players or securitized lenders. The tide has shifted—cash is king, and there are more investment opportunities with fewer bidders.

BILLINGSLEY: Institutional investors appear to be maintaining or even increasing their allocations to real estate. These equity-oriented investors have been largely out of the acquisitions market the past year. With the repricing of assets, and the disappearance of highly leveraged buyers who could justify high prices, the market will once again look attractive. While they will not return right away, toward the end of 2008, we expect them to re-enter the market.

Real estate will revert to its historic role as an income vehicle, not a growth vehicle. In addition, as fears of inflation are likely return a year or two from now, it will also show its role as an inflation hedge.

BURLEY: Thank you all for your insights.