Inflation and Interest Rates was listed as the #1 issue in the 2022-23 Top Ten Issues Affecting Real Estate® by The Counselors of Real Estate®.

“The proximate threats to continued economic growth remain the pandemic and policy error.”

Executive Summary

Having focused on its mandate for maximum employment, the U.S. Federal Reserve is now singularly focused on inflation. Combined with sustained geopolitical risk and vanishing fiscal stimulus, tightened monetary policy will place upward pressure on cap rates and market volatility. Real estate transaction volume will, however, likely remain vibrant for the next year. The proximate threats to continued economic growth remain the COVID-19 pandemic and policy error at the U.S. Federal Reserve.

2019 and Pre-COVID

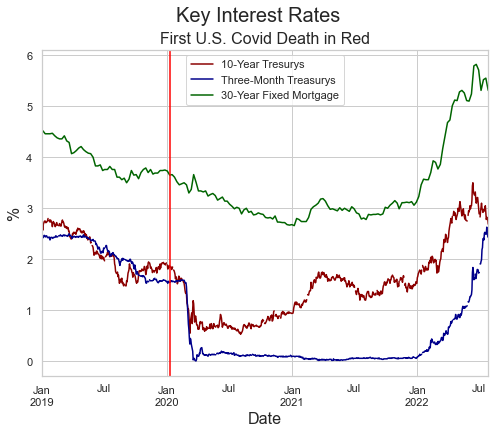

When teaching an honors finance course in fall 2019, I told my students that an inverted yield curve probabilistically predicted an economic recession in the next 12 to 18 months. In early September 2019, the curve stood at -50 basis points (bps). It had been negative since late July and would remain negative until early October. The Fed was also intervening in overnight lending markets.1 Simply put, the U.S. economy’s longest recorded economic expansion was ending before COVID-19 entered the lexicon.

The Impact and the Response

Initially a demand shock, COVID-19’s impacts persist. First-time claims for unemployment insurance (UI) skyrocketed, and between early March and early June 2020, over 40 million Americans filed first-time claims.2 The unemployment rate quadrupled between March and May 2020. By the end of Q2 2020, real output was contracting by nearly 10%.3 During the pandemic, market volatility exploded to levels not seen since the global financial crisis.

The magnitude of the crisis drove a substantial policy response. Fiscal policy included extended UI payments, the 2020 Paycheck Protection Plan, and the 2021 American Rescue Plan. Focusing on direct cash infusions to support consumption, this response amounted to a quarter of annual U.S. GDP.4 The Federal Reserve lowered its overnight lending rate to zero and more than doubled its balance sheet with asset purchases. The 10-year U.S. Treasury fell to an historic low of 54 bps in March 2020, and the average 30-year fixed residential mortgage fell to approximately 270 bps.

Durables Drive Inflation and the Pivot

Given complex international supply chains, the pandemic was also a supply shock with a substantial inflationary impact. Supported by federal policy, overall consumption recovered rapidly but was distorted relative to its pre-pandemic levels. Basically, consumers substituted dining out (non-durables consumption) with buying furniture (durables consumption). By April 2021, durables consumption was nearly 40% higher than its pre-pandemic level, while non-durables consumption was only 14% higher. Shipping costs associated with durables increased substantially and remain substantially elevated. These pandemic supply shocks have driven inflation well above the Fed’s stated policy of two percent. By one standard measure, inflation is at levels not seen since the early 1990’s. The ten-year break-even inflation rate remains well above 200 bps.5

With the Fed’s dual mandate of maximal employment and price stability, its initial focus was labor markets, which have largely recovered. It has now turned to price stability, signaling substantial rate increases in the medium term, including the recent increases in the FFR. It has also announced a “run-off” in its balance sheet. Both policies will place upward pressure on long-duration Treasuries, as well as cap rates (absent an offsetting increase in demand).

Endnotes

[2] Federal Reserve Economic Database (FRED).

[3] The advanced estimate for Q1 2022 showed a slight contraction based on inventory reduction.

[5] The 10-year break-even rate is the difference between the 10-year Treasury and Treasury Inflation Protected Securities (TIPS). It serves as an indication of markets’ inflation expectations over a 10-year horizon.

Photo: Cinemato/Shutterstock.com

Photo: Cinemato/Shutterstock.com