Volume 38, Number 3

Winter 2013

By Valerie Seidel, Hunter Richards, and Owen Beitsch, Ph.D., CRE

Photo: ribeiroantonio/Shutterstock.com

Introduction

As recent hurricane events have demonstrated along the Eastern seaboard, even a relatively mild storm can cause enormous damage to coastal communities. When coastal properties become uninhabitable and roads impassable, the entire community sees the loss of economic output. Beachfront properties are highly coveted and offer some of the most valued real estate opportunities. However they are also vulnerable to erosion, inundation, storm damage and, consequently, insurance risk that begin to compromise that value, if not for an initial investor, possibly for a future investor or owner. In many coastal communities, waterfront property was developed decades ago, and initial development of a parcel is becoming a less frequent condition faced by local planning or permitting authorities. Stricter rules governing beachfront construction have been implemented throughout the country over the past four decades. As a result, some shorelines look very different than they would have had construction continued unabated. How does a coastal community balance the value of coastal economic development with the increasing costs of storm repairs as the shoreline shifts and changes?

In some communities, future revenues from tourist spending and property tax revenue are projected to fall by more than 30 percent by 2050 because of shifting shoreline patterns and loss of beach area. A one percent annual revenue decline says something about diminishing real estate values as well; this change represents a stark reality for any local government accustomed to growing tourism revenues and property values. The corollary issue is that local property owners or purchasers, even if not directly affected at their properties by the effects of sea level rise (SLR), will also experience the indirect effects of owning in communities with diminished budgetary resources to provide services. At the same time, a community may face higher costs for repair of infrastructure and beach clean-up of storm debris and restoration due to greater damage from storm events and more frequent flooding.

Today, with declining stock of vacant coastal property and more restrictive development standards, most coastal communities face fewer planning decisions that would convert undeveloped land to new development. Rather, likely scenarios are redevelopment of previously built areas as part of economic revitalization efforts, or rebuilding after a disaster—most likely a hurricane. Property owners face a choice after storm damage: to rebuild a pre-storm structure or pursue other options. Coastal communities need to be prepared with flexible options and desirable alternatives for these landowners. By having the building blocks in place in advance, a property owner can weigh the outcomes and determine if building elsewhere may be in his or her best interest.

Communities with clear objectives to achieve coastal resiliency have tools at their disposal. Coastal resiliency aims to reduce the risk of loss of life and property, reduce the community costs of servicing coastal properties and infrastructure, and ensure the sustainability of coastal ecosystems that help to protect investment. Gradually reducing density along the coast while increasing density elsewhere provides one clear transition process for both the property owner and community.

Economic Costs of Mitigation and Adaptation

For the real estate industry, what are the relevant questions? Where is property most vulnerable/valuable? Which characteristics make this so? Where are the opportunities for the future? What are the costs and benefits of protecting existing property and critical infrastructure against SLR?

Literature Review

Researchers have attempted to quantify the costs of SLR in a variety of ways. In “Risk Increase to Infrastructure Due To Sea Level Rise,”1 the authors set out to explore how the Metropolitan East Coast (MEC) region of New York, New Jersey and Connecticut would respond to a set of expected SLR scenarios. They looked at the costs and benefits brought on by SLR and the viability of potential adaptive strategies in the context of transportation and communication infrastructure such as bridges, roads, sewage, power, phone and other facilities. The study assessed storm surge risks while accounting for future SLR, finding that coastal flooding frequency will likely increase dramatically in the next century. Risk was defined as a regional sum of hazards (storm surge flood heights), assets (dollar values of transportation systems), and fragility (fractional loss of a facility given the hazard at the location).

Since construction in storm surge-exposed areas entails risk, an effort was made to estimate the economic impacts of SLR in the MEC. Loose estimates found potential losses as large as $250 billion, coming with the recommendation that the public and private sectors cooperate to assemble a thorough inventory of assets and risk for the region in the face of such high stakes. The study found that annualized costs of up to one billion dollars per year could be absorbed by the regional economy, but not without hardship to its residents. It was recommended that new developments avoid being implemented at low elevations through a new land use plan with tougher engineering codes and zoning enforcement.

Cooper, Beevers and Oppenheimer authored a relevant study2 that examined the vulnerability of the New Jersey coast to SLR. Potential socioeconomic and natural resource effects, including coastal flooding, coastal beach erosion and saline intrusion also were considered. In addition to pinpointing the most vulnerable areas and calculating anticipated economic damages, the authors looked at the amount of damage that SLR could do to coastal wetlands. This damage consists of inundation of areas vital to supporting endangered plant species, and horseshoe crab and bird populations. A case study portion of the paper determined that immediate mitigation was needed at a site in Cape May Point, New Jersey. The case study concluded that although beach replenishment and rolling easements would likely be cost-effective in the near term, long-term strategies should focus on withdrawing development from the coast and moving inland over time.

A study conducted at the national level by Neumann, Yohe, Nicholls and Manion3 adds additional insight to the issue of SLR. The authors of this study argued that the Mid-Atlantic, South-Atlantic and Gulf Coast states are among the areas in the U.S. most vulnerable to SLR because of their low elevations, high economic value and high storm frequency. Key geographical factors affecting vulnerability include slope and elevation, projected investment and population growth, and land management practices. The paper notes that because of expected population growth along coastal areas in the U.S., economic vulnerability is likely to intensify as property values and infrastructure investment increase.

The paper outlines three general policy options for responding to coastal threats: protection, accommodation and planned retreat. As the authors put it: “protection seeks to exclude the hazard; accommodation allows human activities and the hazard to coexist, while planned retreat removes human activity from the hazardous zone.” Protection involves construction of structures such as dikes and sea walls, accommodation includes land use changes, and planned retreat might entail coastal development restrictions. The authors state in their conclusion that major coastal cities will need to improve their flood defenses and drainage systems to avoid significant losses.

A study by Bin4 focused on the effects SLR likely would have on real estate in North Carolina. Using economic data and geospatial information, the study claims that North Carolina’s rates of SLR are roughly double the global average. The study produced maps identifying the property that would be lost under different SLR scenarios with no adaptation; in addition, the study calculated the likely costs of lost property value associated with these scenarios. At the county level, the amount of property value at risk was estimated to be as high as 19 percent in some cases. The authors note that in addition to permanent flooding, temporary inundation caused by high tides and storms should also be taken into account when discussing coastal vulnerability. Last, the study addressed the value of North Carolina’s wetlands and the environmental, recreational and aesthetic benefits they provide. Loss of these wetlands could have further effects on property values.

According to a 2012 article in The New York Times,5 about 3.7 million people in the U.S. live in high-risk flood areas,

with Florida being the most vulnerable state; however, no coastal area is entirely exempt from risk. One grassroots project, Climate Central, is publishing information online that allows the public to search community-level risk factors by typing in their ZIP code. As such information becomes well circulated among the population, the real estate industry likely will need to adjust to shifting perceptions and preferences regarding coastal property and the effects of SLR. Consensus suggests that land below the 3.3-foot line will be permanently inundated in the future, possibly as early as 2100. Fortifications can protect high-risk areas, but they come with their own costs, and destructive storm surges with increased frequency will be a problem before inundation occurs. A University of Maryland Center for Integrative Environmental Research report by Ruth, Coelho, and Karetnikov6 reviewed the economic literature on SLR and its effects in the U.S., organized by region. It is further broken down by economic sector, for which effects and costs are estimated. At its time of writing, the paper reported a SLR rate between 0.08 and 0.12 inches annually, with a total rise between one and three feet expected over the next century. The paper acknowledges that coastal effects will vary by region, but the densely populated Northeast and Mid-Atlantic regions will find their coastal infrastructures, including energy and transportation, to be particularly affected by sea level change. Replacing damaged infrastructure will not be the only necessary action that will affect land use and property; for instance, re-routing traffic and relocation of structures and amenities will have deep effects on the properties around these actions. These authors suggest, however, that the costliest policy option is delayed action or inaction. The study calls for a consistent adaptation system, but one that is customizable on ever finer geographical scales.

In sum, the literature review points to several main ideas concerning SLR that real estate professionals should consider while planning for the future. Real estate professionals must consider the specific risks faced in each region of interest as a very real source of potential cost that must be weighed. This, of course, includes coastal properties, and especially the most vulnerable ones such as areas in Florida and Louisiana. However, the degree of vulnerability is not the only variable to be considered. The source of risk must also be examined; for example, exposure to regional amenities may be more important than previously thought.

Study and Results

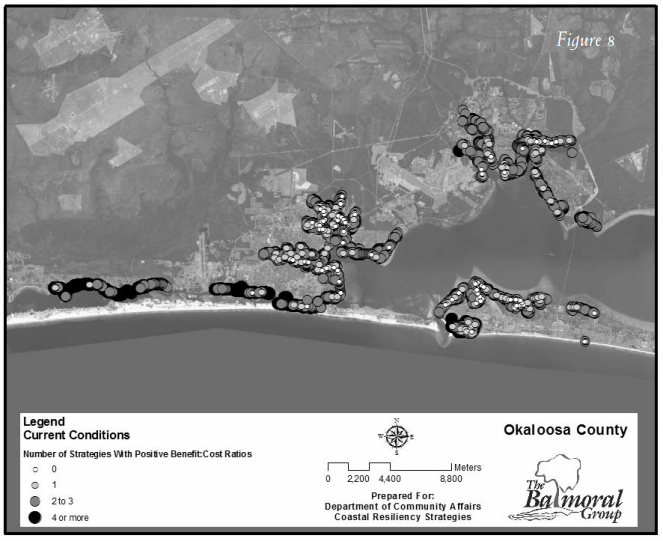

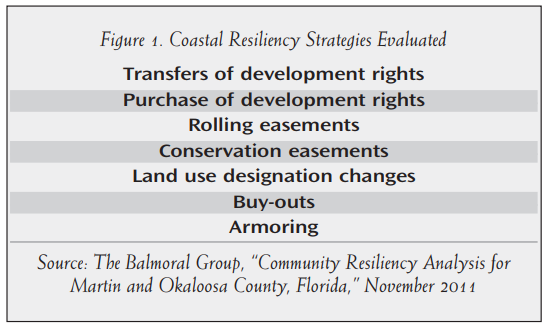

To address the questions at the outset of this article, a case study cost-benefit analysis conducted in Florida is considered. The Balmoral Group was retained by the Florida Department of Economic Opportunity to evaluate the feasibility of coastal resiliency strategies. In this case, adaptation, retreat and mitigation strategies were compared at the parcel level for two coastal counties with disparate demographics, topography and economies (see Figure 1). At the outset, the expectation was that specific strategies would prove to be cost effective, and should be incorporated into local planning documents, including the comprehensive plan and land development regulations, while other strategies would prove not to be and would no longer be considered, at least under current cost structures.

Cost Benefit Analysis Under Current Conditions

The analysis began with a series of procedures designed to ensure transferability of this methodology to other coastal areas. For each county, the study examined all parcels in the Coastal High Hazard Area (CHHA).7 Analysis was first completed at the parcel level on every single-family residential (SFR) parcel for each strategy, then completed for multi-family and commercial/industrial parcels. The parcel-level cost-benefit analysis estimated the measurable effects a policy change would have on all people (or communities) in each county over a 20-year period. The effects were monetized to quantify them in dollar terms. The dollar value of each effect was then discounted into current (net present value) dollars for comparison across policy alternatives.

Examination of the results found that benefit-cost ratios followed distinct spatial patterns, based on their proximity to specific amenities, such as beach recreation areas or conservation lands. For multi-family residential and commercial/industrial properties, cost and benefits were estimated by geographical area, based on the parcel’s access to the amenities driving the benefit-cost ratio, which was categorized as high, average and low. The purpose of this approach was to isolate the effects of commercial property characteristics versus residential, in the same location. A list of costs and benefits associated with each strategy was generated, including:

- Acquisition costs: to buy land, easements or development rights;

- Construction costs: for armoring or demolition;

- Administrative costs: to oversee programs such as transfers of development rights, conservation easements or land acquisition;

- Avoided costs of municipal services: for properties that no longer need fire, water or sewer services;

- Amenity values: values the public is willing to pay for open space, conservation land, recreational amenities or ecological protection;

- Foregone revenues: such as future rents if a property is not rebuilt after a storm.

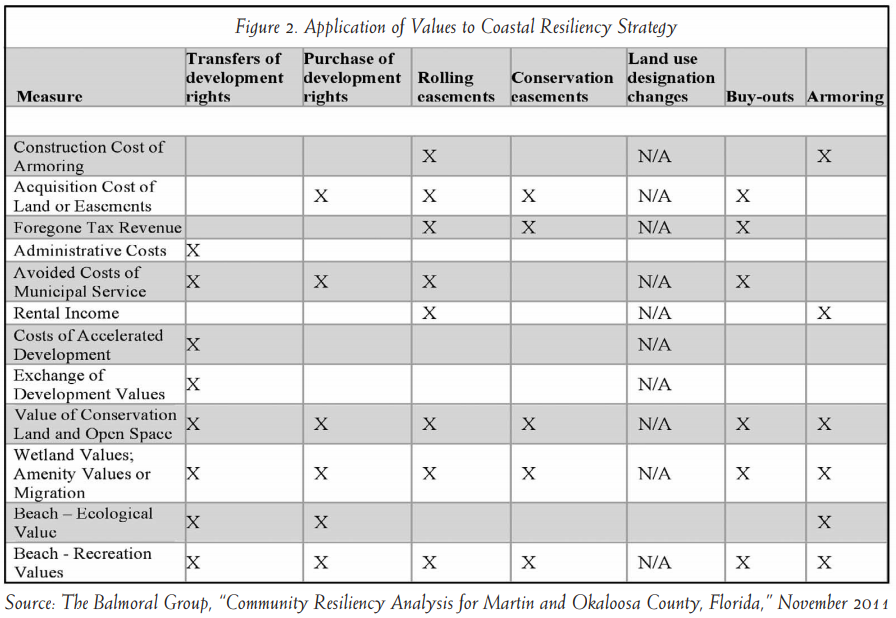

Figure 2 summarizes the specific cost-benefit measures applied to each strategy.

A strategy is considered viable if benefits exceed costs. Analysis was performed to identify which strategies were viable for each parcel in the CHHA. Cost-effectiveness varied widely at the parcel level, and followed distinct spatial patterns. Properties closest to the most amenities have the most strategies that are feasible. Generally speaking, and possibly counterintuitively, properties with the highest property values have the fewest strategies that are cost effective. The reason is that the breakeven threshold is so high. For example, an oceanfront home faces different options for coastal resiliency than a parcel that is further from the direct energy of waves, and offers different ecological services, aesthetics and engineering challenges.

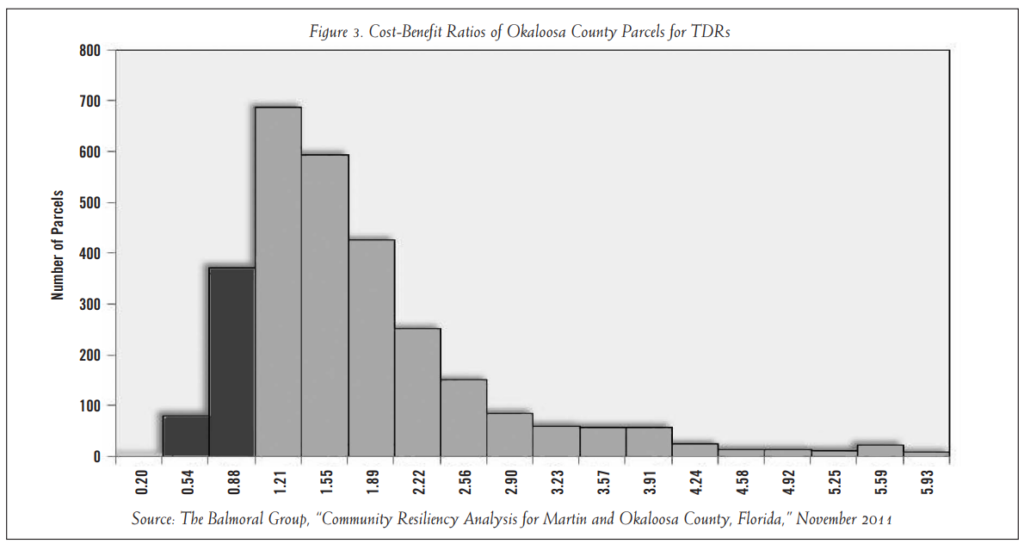

An example of the transfer of development rights (TDR) analysis for a specific parcel is provided in Figure 3. In this case, the parcel at hand is located near three important amenities: a public access point to the beach, a permanent conservation area and a sensitive wetland area. As a result, there are quantifiable benefits based on the parcel’s proximity to the amenities and the public’s willingness to pay for the amenities. The underlying premise of the TDR analysis is that the parcel would not be redeveloped after a storm, and instead redevelopment would occur inland at a higher density. Based on decision rules developed with state and county planners, the parcel is assumed to be eligible for a density ratio that is 2.5 times higher if redeveloped inland than the current density available to the existing site. This generates two costs and benefits: the avoided cost of no longer providing municipal services to the site, and the cost of making municipal services available earlier than might otherwise occur inland. Both are quantified based on the number of units at the existing site, using average costs of providing municipal services ($7,192 per unit in 2012 dollars), versus the cost of developing infrastructure to provide the same services at the new receiving area inland. The cost of providing the services inland is assumed to occur earlier but not differently than it would have in the absence of the TDR transaction; hence the monetized value of the difference in costs to the community is the cost to finance required improvements earlier than otherwise planned. Financing costs were estimated based on current market rates for municipal bonds applied to the $7,192 cost per dwelling unit for a 10-year time period.

Finally, value of the development right is calculated based on the differential between the existing parcel and the receiving area parcel. As an example, assume a coastal parcel within the CHHA consisting of two acres has current and actual density of four units/acre (average unit size of 2,000 square feet (sf)) with average and current sales indicating property values are approximately $220/sf. Faced with a decision of reconstruction after another major storm or other damage event, the landowner may opt to exercise TDRs to construct eight units on the existing parcel, or 20 units on a parcel within the receiving area further inland, where current sales indicate property values are approximately $80/sf. The value to the developer and community of the TDR is the differential value between the two developments, which can be estimated at ((20du/ac. X 2ac. X 2000sf x $80/sf) – (4du/ac. x 2 ac. x $220/sf x 2,000sf)), or (6,400,000 – 3,520,000), or $2.88 million. For the example parcel, this value calculated to about $500,000.

The ratio of benefits to costs gives a measure of the return on investment for a particular strategy; if the benefit-cost

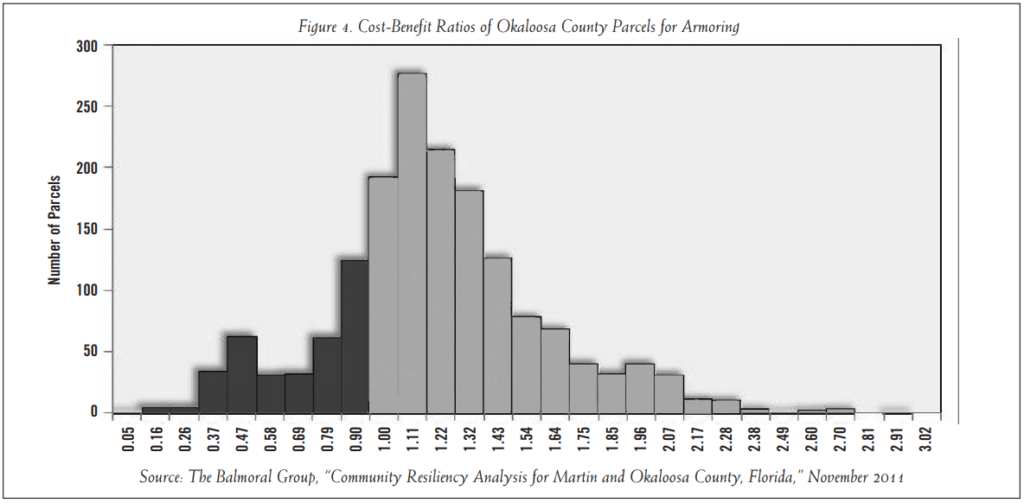

ratio is 2:1, the implication is that on average, for each dollar of cost, two dollars in benefits are returned. The examples in figures 3 and 4 show how benefit-cost ratios vary for two different strategies in the same county. The two strategies illustrated here, TDRs and armoring, are discussed in detail in the following section, but are used here to show how benefit-cost ratios vary across parcels and strategies.8 TDRs have ratios greater than 1.0 (i.e., benefits exceed costs) for 2,490 residential parcels in the Okaloosa County CHHA, while for 456 residential parcels, the ratio is less than 1.0 (i.e., the costs exceed benefits). Across all Okaloosa CHHA parcels, the average ratio is 1.69: for every $100 in community costs, the community receives $169 in benefits. The ratio varies widely across parcels, ranging from a low of 0.24 to more than 5.0. Figure 3, where black columns indicate parcels that are not viable, and gray columns indicate the number of parcels with positive ratios. In contrast, Figure 4 shows that Okaloosa County has a relatively large number of parcels that are not viable candidates for armoring, with an average benefit-cost ratio of just 1.15, and a maximum ratio of less than 3.0.

Overall, the analysis found that multiple strategies were cost effective for the vast majority of single-family residential parcels. For example, out of 3,000 CHHA parcels in Okaloosa County, all but 38 had more than one cost-effective strategy. For multi-family, commercial and industrial land use types, spatial patterns generally mirrored SFR results. Some land use types showed greater variation in benefit-cost ratios than SFR parcels; others showed larger ratios. In general, land use type (SFR, commercial, etc.) is less important to the benefit-cost ratio than is the location of the parcel, and property value is less important than proximity to amenities.

The following sections identify key characteristics of each policy that drive the benefit-cost ratios, as well as specific characteristics that may make that policy an effective strategy.

Incentive-Based Approaches

In communities where property owners can change the development rights associated with their land readily without committing to achieving other community objectives, additional development rights will not have economic value, and cannot be used effectively as an incentive. Likewise, there will be little opportunity to create incentives if a community has already zoned properties to achieve high density in areas where there is no demand. Current practices toward granting development rights that are at odds with existing comprehensive plans or zoning require careful and realistic consideration. To achieve success with any incentive-based planning tool, development rights must be treated as having economic value.

Incentive-based approaches are cost effective for most property types and parcels. The average benefit-cost ratio for TDRs is 1.69 and 1.77 for Okaloosa and Martin Counties, respectively. While purchases of development rights (PDRs) have higher benefit-cost ratio averages of 3.61 and 3.21 for Okaloosa and Martin Counties, PDRs are beyond the reach of political will in most communities. Local ordinances that allow for flexibility in trading development rights between near-shore parcels and inland properties without restrictive criteria may have the greatest single impact in attaining coastal resiliency.

Transfers of Development Rights

Transfers of Development Rights may be used to promote coastal resiliency by providing landowners with alternatives to rebuilding in the CHHA after a storm. TDRs have failed to be used in most communities because of unfamiliarity with the process by developers, a failure by many local governments to “prime” the program with funds or development credits into the TDR bank and because of narrowly defined rules that have accompanied their introduction. TDRs are most likely to be effective if the landowner sees opportunity for flexibility in exercising his or her rights of property ownership. Research within Florida has found that many TDR transactions have occurred outside a formal program, as an ad hoc situation to achieve the objectives of both the landowner and local government.

Although TDRs typically have been envisioned as tools to control residential density on undeveloped land, land uses other than residential may be just as appropriate for TDR transactions. If the current land use on a beachfront piece of property is commercial, the community has just as much interest in transferring this land use landward as they do if the parcel is residential. Thus after a storm, the owner may rebuild on the property, transfer or sell the development rights so that an inland piece of property may be developed or redeveloped at a substantially higher density.

A useful example arose in Satellite Beach, Florida, when city officials negotiated with the owner of a destroyed oceanfront hotel. Rather than rebuild, the owner donated the parcel as public land and rebuilt at higher density inland. The oceanfront site has reverted to natural land, and the properties across the street will be the next oceanfront parcels as the natural site continues to erode. Thus, tax values will also migrate inland, as rebuilding events occur gradually over decades.

All parcels within the CHHA were considered potential TDR candidates. Generally speaking, the costs and benefits are driven by development values, administrative costs and nonmarket costs to the community of accelerated development in the receiving area for development.

Purchase of Development Rights

Development rights have value in communities that utilize development rights as having value. In theory, development rights can be bought and sold: a landowner who has accumulated development credits in excess of what he or she requires can sell the credits to another landowner or to the local government to be used elsewhere. A purchase of development rights by local government can be viewed as analogous to a corporation buying back its stock: if the county wishes to limit development, reducing the total quantity of development rights available increases the value of remaining development rights in circulation.

As with TDRs, all parcels within the CHHA were considered potential PDR candidates and the costs and benefits of PDRs are driven by development values, administrative costs, and nonmarket costs to the community of accelerated development in the receiving area for development.

Ownership-Based Approaches

Ownership-based approaches had the highest returns overall in both counties, but fewer applicable candidates. Benefit-cost ratios for conservation easements averaged more than 5.0 for both counties. Ratios for rolling easements averaged 2.47 and 1.49 for Okaloosa and Martin Counties respectively, and nearly every qualified parcel showed a ratio greater than 1.0. Ratios for land acquisition averaged less than 1.0, indicating that only a few parcels are good candidates for acquisition.

Conservation Easements

Conservation easements restrict the right to future development of defined parcels, or portions thereof, in exchange for cash or tax benefits. Conservation easements negotiated with the objective of coastal resiliency are likely to be motivated primarily by tax benefits to the seller, combined with a desire for the land to remain undeveloped.

All parcels within the CHHA with proximity to wetlands, conservation lands or the shoreline were considered potential conservation easement candidates. The fair cost of a conservation easement is the market value of the future net income lost because of restrictions on future development, and may include all or part of the reduced taxes (both income and property) for the seller; past transactions were used to estimate approximate costs. The benefits of conservation easements are estimated based on the value of ecosystem services that are generated by the specific easement.

Rolling Easements

Rolling easements exchange foregone future revenues from development or continued use for a current payment. A rolling easement can be applied to a property deed at the time of development (which would lower the property value) or it can be purchased in a fashion analogous to a conservation easement. In effect, a rolling easement allows a landowner a gentle transition to a future moment in time when rebuilding will no longer be an option; until that moment, the landowner may continue to rent, develop or otherwise use the property in permissible uses as if the easement had not been granted. However, the easement prevents the owner from taking steps to delay or prevent the encroachment of the coastline (and thereby protect the investment). A critically important component of a rolling easement is that it provides advance notice to property owners that their land must at some point revert to public or natural use. It is in this capacity that rolling easements can be used most beneficially with developed parcels. Of equal importance is the implied assertion that at some point, municipal infrastructure servicing the parcels will be part of the retreat strategy. If the parcel is allowed to revert to natural state after a third hurricane wipes it out, the accompanying assumption is that water, wastewater, electricity and other services would not be restored either.

All waterfront parcels within the CHHA below the elevation of the evacuation route were considered potential rolling easement candidates. Because of the slope of coastal lands in both counties, this criterion may be different in other states and regions across the county, but the concept is transferrable intact. The costs associated with a rolling easement scenario include monetary consideration given in exchange for the rolling easement payment, potential difficulty in establishing a value system, and likely (future) demolition costs of any structures on the property. For current conditions, the demolition cost would be zero, as rolling easements assume that only a future condition would create a need to exercise the easement option. Under future conditions, demolition costs are a factor.

Land Acquisition

Land has been acquired in both counties to achieve community objectives where repeated flooding events have occurred, or environmentally sensitive lands have been purchased to protect native habitats or provide access to the coast. Most local government land acquisition programs require taxpayer funding, and environmental stewardship programs often rely on a local millage dedicated to that purpose, while frequently flooded properties may be purchased by the city/county using federal grant money. In the former case, advisory panels may review potential parcels for purchase and prioritization based on established protocol and specific characteristics, within a predetermined budget amount. Land that is acquired also must be maintained in perpetuity, and is removed from the tax rolls permanently, so there are considerations beyond the immediate purchase transaction in an acquisition decision.

In the case of improving coastal resiliency, prioritization of acquisition efforts is likely to focus on parcels with repeated inundation or projected inundation at high frequency, in vulnerable evacuation zones, or subject to critical erosion events (and in many cases, these attributes overlap). Acquisition for coastal resiliency implies that the parcel is restored to its natural state. The costs include the actual purchase price, legal costs and loss of tax revenue to the county. There are additional costs if demolition or restoration is necessary or there are costs to provide public access (e.g., dune walkovers).

All waterfront parcels within the CHHA below the elevation of the evacuation route were considered potential acquisition candidates. The benefits may include avoided costs of damage repair, environmental or recreational benefits to the public depending on the site location, and avoided costs of continued municipal services. The acquiring body may rent the parcel for a few years to generate revenues sufficient to offset demolition costs.

Land Use Designation Changes

Land use designation changes include changes to the zoning of a parcel or to the future land use as designated in the county’s comprehensive plan. All of the planning strategies discussed in this report incorporate some sort of land use assumption: that development rights associated with the existing land use can be sold or transferred to a different locale, or that a portion of the existing property rights can be sold or transferred under an easement. If used instead as a standalone strategy, land use designation changes that would improve coastal resiliency are likely to also diminish property rights. There are legal precedents defeating measures that diminish property rights without compensation (unless accepted by the owner, who may benefit from reduced property taxes). This constraint negated the need for analysis of land use designation changes as a separate resilience strategy. Accordingly, land use designation changes outside of those embedded as part of a larger strategy were not analyzed for full cost-benefit calculations.

Physical Protection

Physical protection (e.g., armoring, jetties and groins) generally may be a viable strategy for a similar number of parcels as for ownership-based approaches, but with lower average benefit-cost ratios of 1.15 and 1.77 for Okaloosa and Martin Counties respectively. Some negative effects of physical measures, such as increased erosion on adjacent properties, were not quantified in this analysis. For purposes of this analysis, shoreline armoring means engineered structures built along the water’s edge intended to stop or slow erosion of the shoreline. Although armoring structures are mostly effective at meeting this objective, there are numerous negative consequences associated with their construction. Among these are accelerated erosion of adjacent properties, habitat displacement and limited beach access to the public. As a result, the use of coastal armoring is typically considered the last or most extreme option in addressing a coastal erosion problem.

A primary motivator for armoring is the assumption that without it a property may be uninhabitable within a short period of time. Costs and benefits of armoring are calculated using the topography of the parcel in question, all of which must border coastal waters to be considered. The value associated with extending the period of time that a property may be useful can be measured using rents; a benefit associated with the armoring is the market value of rents a beachfront parcel could generate if protected.

Cost Benefit Analysis Under Future Scenarios

To evaluate the effects of SLR, the CHHA line was migrated inland one meter of elevation. In some areas this equates to a few feet inland, while in other areas this is a much greater distance, depending on local slope. The net present values of the costs and benefits generated by policy alternatives were recalculated based on the new shoreline, which reflected some degree of inundation. When post-inundation benefit-cost calculations are compared to the estimates under current conditions, substantial changes to viable strategies can be identified. Important trends across policies included:

Post-inundation, the vast majority of parcels have fewer than two viable strategies. Under the current scenario, the opposite was true–more than 70 percent of parcels had two or more viable strategies. One reason for this is that many properties are lost to inundation, either because the parcel is inundated or access to it is blocked by inundation. If the center point of the parcel was below the inundation line, the parcel was considered inundated. The rationale is that if the inundation line covers the front (seaward) 20 meters of a parcel, but the structures are behind that, the additional costs of inundation may be a nuisance, but would not render the structure uninhabitable.

Another reason is that properties with proximity to more amenities under current CHHA lost a greater proportion of viable strategies under the future CHHA.

- A notable consequence is that properties with proximity to fewest amenities may have no cost-effective strategies as shorelines move inland.

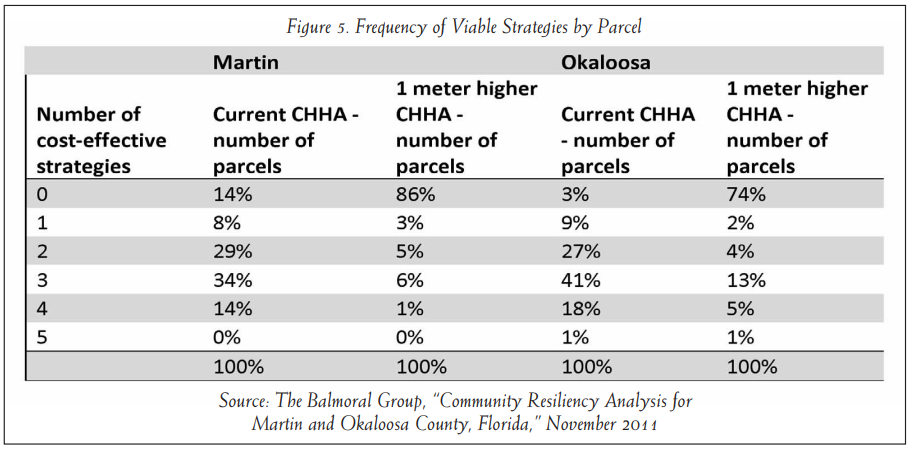

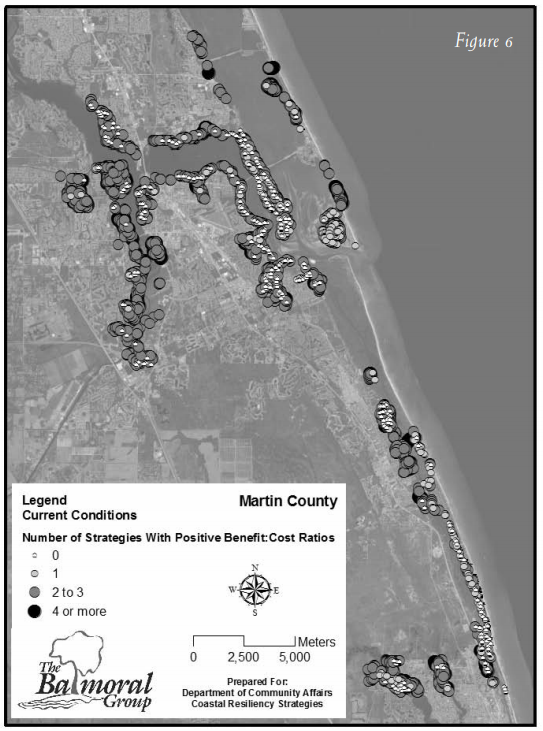

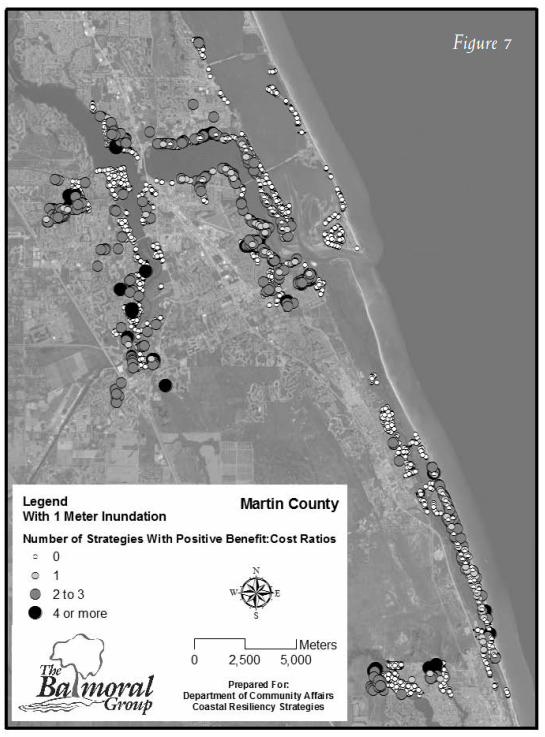

- The change in viability for each strategy varied by county, and was directly linked to local topography. Figure 5 shows the sharp increase in the number of parcels with no viable strategy. It also shows the large percent reduction in the number of parcels with four and five viable strategies.

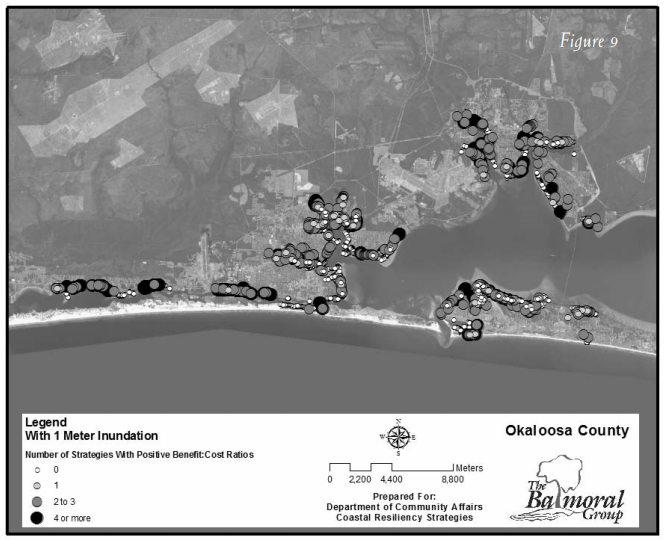

Figures 6–9 show an aerial view of the changes described in Figure 5 for Martin and Okaloosa counties, respectively.

Martin County

Okaloosa County

Transferability to Other Cities and Communities

Speaking in broad terms, most parcels have multiple planning strategies available to them currently.

- Properties with proximity to beaches, open land, conservation areas and parks have greatest flexibility in current planning scenarios to pursue multiple avenues of coastal resiliency. Communities that encourage inward migration of development rights from these parcels, or easements along these parcels, are most likely to achieve coastal resiliency in a manner that is market-driven and cost effective for the property owner and larger community.

- TDRs and PDRs are cost effective for most property types and parcels, although PDRs are considered beyond the reach of political will in most communities. Local ordinances that allow for flexibility in trading development rights between near-shore parcels and inland properties without restrictive criteria may have the greatest single impact in attaining coastal resiliency.

- Rolling and conservation easements have the highest returns overall in both counties, but have fewer candidates.

- Land use type (SFR, commercial, etc.) is not as important to benefit-cost ratio as location of the parcel. Property value is not as important to benefit-cost ratio as proximity to amenities.

Collectively all of these strategies affect decisions about locating specific real estate activities. In addition, the real estate industry may begin to assess the population of investors, and users will become increasingly informed about flood and storm risks, and able to make more discriminating investments. The industry should plan for shifting tastes and preferences to change the location of ideal properties and to shift the value inland or to higher elevations. Paradoxically, however, despite the presence of projects such as Climate Central that will increasingly inform the public about the factors affecting climate change risk, there is also an overall dearth of information. The industry should keep a close watch on new publications in climate change research and data analysis to adapt as intelligently as possible. The real estate world also must accept that universal business practices cannot be extrapolated generally in the long term; geographical features and time frames must be carefully considered, and strategies must be as customized as possible to consider the unique market risks each community faces on the local level.

Findings and Conclusions

For the real estate professional, this analysis provides a framework for considering the questions posed at the outset. Where is property most vulnerable/valuable? Which characteristics make this so? Where are the opportunities for the future? And, what are the costs and benefits of protecting existing property and critical infrastructure against SLR? Do the risks associated with having no viable strategies in place warrant value premiums or costs?

Considering each in turn, the analysis provided strong insights into where parcels were most vulnerable and most valuable. Parcels with close proximity to public amenities will have the most options in future; those without, the least. The public amenities referred to here are not restaurants and pubs, but beach access points and other natural resources that generate public willingness to pay.

The most expensive parcels under current conditions tend to have the fewest cost-effective options, simply because the breakeven point is higher for most calculations. This is a risk consideration that should be reflected in the course of due diligence analysis. The old saying about the cheapest house on the most expensive block may have a new twist: a moderately priced property (relatively speaking) with proximity to the most amenities may be the most desirable, in a SLR-impacted environment.

Opportunities for the future are presented by the need for coastal communities to migrate construction and redevelopment activities landward. Parcels slightly removed from the shoreline today may be the waterfront parcels of tomorrow, depending on local topography; an evolving situation that needs to be considered by the development community, investors and subsequent owners. Perhaps more important, parcels upland of critical coastal habitats will warrant more flexibility of development rights, and clever developers will seize the opportunity to be early adopters in this dynamic situation.

Finally, what are the costs and benefits of protecting property and critical infrastructure to mitigate losses due to SLR? At the outset of the analysis described herein, the expectation was that one or more strategies would be found to be cost effective and others not. On the contrary, the analysis found that no coastal resiliency strategy, or even a subset of strategies, is the single right answer for a community, so by extension, no single solution may work to achieve a specific investment objective. Instead, the characteristics of individual properties dictate the cost-effective strategies, and savvy property owners will begin to address this in their evaluation processes. What is clear is that more flexibility in local planning and development codes will be needed to achieve coastal resiliency. Communities that show leadership in establishing clear demarcation of areas where redevelopment or construction is undesirable, and provide flexible options for the market to respond accordingly, can be expected to reap the greatest long-term gains. Perhaps the lesson is that keen real estate professionals should be on the lookout for areas that show the political will to address SLR, and avoid areas that do not.

Endnotes

1. Jacob, Klaus H., Noah Edelblum and Jonathan Arnold, “Risk Increase to Infrastructure Due To Sea Level Rise,” Lamont-Doherty Earth Observatory, Columbia University, 2000.

2. Cooper, Matthew J.P., Michael D. Beevers and Michael Oppenheimer, “Future Sea Level Rise and the New Jersey Coast: Assessing Potential Impacts and Opportunities,” Science, Technology and Environmental Policy Program, Woodrow Wilson School of Public and International Affairs, Princeton University, 2005.

3. Neumann, James E., Gary Yohe, Robert Nicholls and Michelle Manion, “Sea Level Rise & Global Climate Change: A Review of Impacts to U.S. Coasts,” Pew Center on Global Climate Change, 2000.

4. Bin, Okmyung,“ Measuring the Impacts of Sea-Level Rise on Coastal Real Estate in North Carolina,” Center for Natural Hazards Research, Thomas Harriot College of Arts and Sciences, East Carolina University, 2008.

5. Gillis, Justin, “Rising Sea Levels Seen as Threat to Coastal U.S.,” The New York Times, March 13, 2012.

6. Ruth, Matthias, Dana Coelho and Daria Karetnikov,“ The U.S. Economic Impacts of Climate Change and the Costs of Inaction,” A Review and Assessment by the Center for Integrative Environmental Research, University of Maryland, 2007.

7. The coastal high hazard area is defined in Florida as the area subject to inundation by a Category 1 storm, as determined by the Sea, Lake and Overland Surge from Hurricane (SLOSH) models.

8. A prototypical transfer of development rights (TDR) program allows landowners to transfer the right to develop from one parcel of land to a different parcel of land, and helps shift development from sensitive areas to designated growth areas with access to services. Shoreline armoring means engineered structures built along the water’s edge intended to stop or slow erosion of the shoreline.