Volume 35, Number 1

Published: Spring 2010

By Kenneth P. Riggs, Jr., CRE, FRICS

Photo: Norman Chan/Shutterstock.com

AS WE EMERGE FROM THE MOST SEVERE FINANCIAL CRISIS and economic recession in more than 70 years, we are only beginning to unravel the devastation and debris left in its wake. There are deficits as far as the eye can see—a record $1.6 trillion deficit is expected for fiscal 2010 and more than $9 trillion projected for the coming decade, according to the Congressional Budget Office. The unemployment rate is expected to decline to only 9.3 percent by year’s end, according to the Labor Department and the Wall Street Journal economists’ survey. In addition, hundreds of regional banks are at risk of failing this year, due in great part to the commercial real estate loans on their books. Still, most signs indicate that we have entered the recovery phase of this cycle, and while there will be more struggles ahead, economic activity continues to strengthen.

Commercial real estate activity, which lags the rest of the investment market, remains tepid but growing. Although the fundamentals for this important asset class will see little, if any, improvement in 2010, this will be the year for resilient investors to resume the challenges of investing, managing and adding value to commercial real estate as we continue on the path to recovery.

The State of the Market

Real Estate Research Corporation (RERC) routinely surveys many of the industry’s most knowledgeable institutional investors each quarter and tracks their views on commercial real estate, the economy and other related issues. These views are reported quarterly in the RERC Real Estate Report, and annually in Expectations & Market Realities in Real Estate. 1

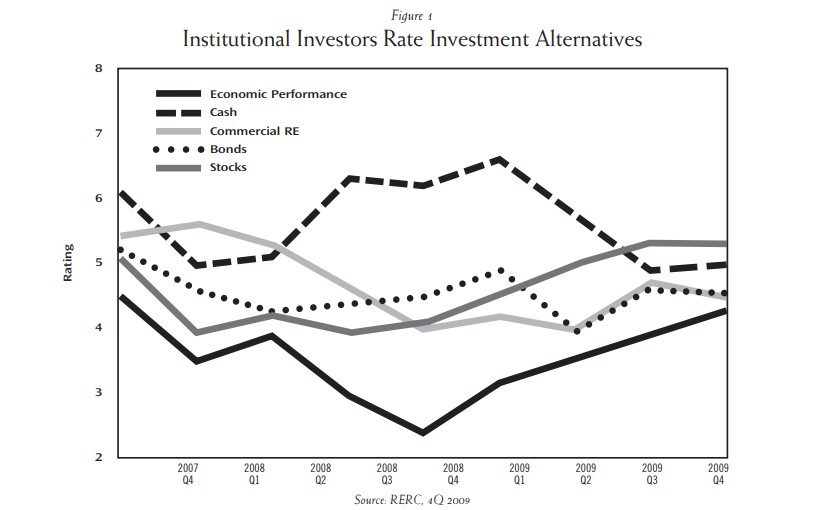

As shown in Figure 1, up until first quarter 2008, commercial real estate’s attractiveness held firm relative to expectations for alternative investments (stocks, bonds and cash), but as the credit crisis overpowered market confidence, there was a mad rush to cash. Commercial real estate bounced around at its 2009 lows, and ended fourth quarter 2009 slightly down from the previous quarter but up from 2008 results. Despite the loss in commercial real estate value, decline in returns and difficulties still ahead for this important asset class, we expect these ratings to remain generally stable through 2010. Investors are hoarding cash and formulating strategies to jump into a beleaguered industry in 2010.

Research Shows Commercial Real Estate Investment a ‘Buy’

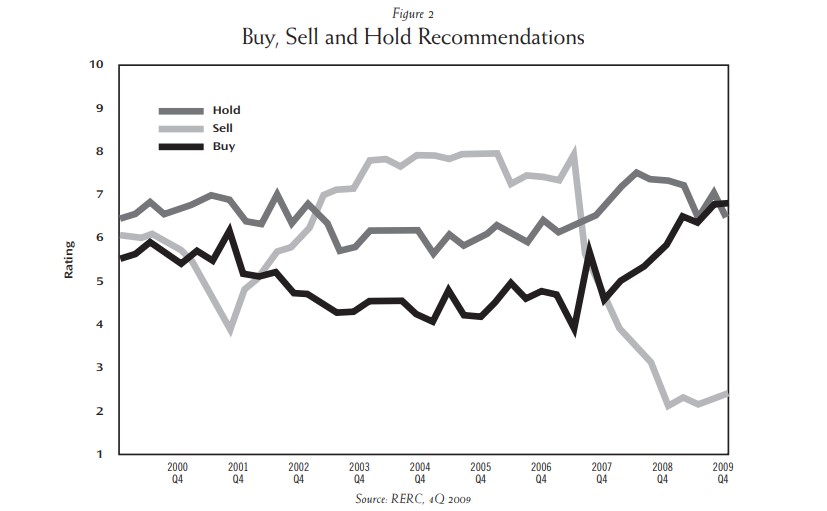

As illustrated in Figure 2, today’s market is filled with high buy and hold (versus sell) recommendations for those investors looking for quality properties. Properties offered for sale have been marked down on a gross asset level by approximately 30 percent, and in some cases, 50–60 percent. Even with such markdowns, there is still a divide between price and value, but that gap is expected to narrow over the next several quarters and the number of transactions will increase in 2010.

The distress in the market means that pricing and yields are coming much more in line with buyer expectations. Buyers, already in the driver’s seat, can afford to wait until property prices hit bottom, but they should be preparing to make their move soon so that they can take advantage of the value and price increases that will follow. As we examine the recent evidence, and with fourth quarter 2009 recommendations remaining unchanged from those of third quarter (and up significantly from 2008 results), note that the buy period began taking shape during first quarter 2010. Further, capital is still scarce, and while there is an uptick in availability, it is a time to buy and not to sell (if one can avoid doing so). RERC believes that the bottom is forming on commercial real estate prices, but values have not yet matched that reality.

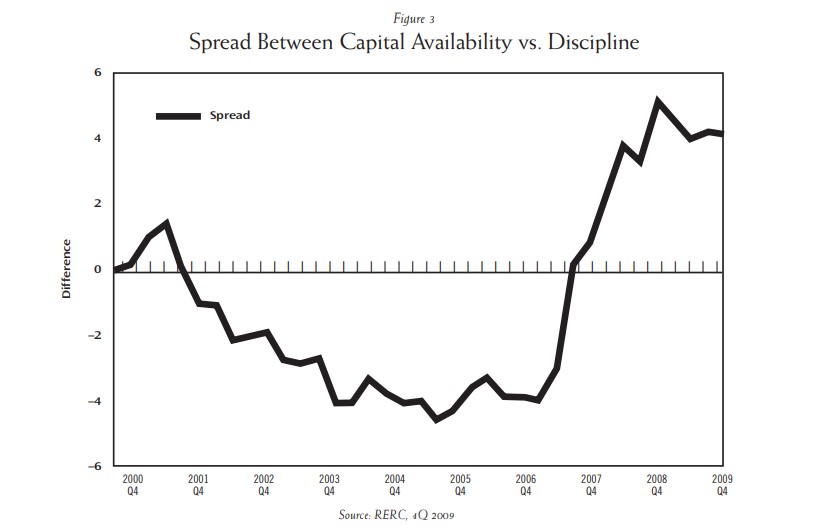

Looking back, and as noted by RERC’s institutional investment survey respondents, capital availability reached a peak—almost 9 on a scale of one to 10, with 10 being high, with the discipline of capital being average—in first quarter 2007. However, that dynamic of excess capital yielded a spread of -4 between the discipline of capital versus the availability of capital, as illustrated in Figure 3. (Zero would suggest that there is a good balance.)

Bid-Ask Spread Narrows

In 2009, the bid-ask spread narrowed significantly as sellers began accepting and reflecting the realities of dramatic market change within their valuation assumptions. But until fourth quarter 2009, the bid-ask spread resulted in a nearly non-existent transaction market, with 2008 and 2009 sales volume, according to Real Capital Analytics, down from 2007 levels by approximately 72 percent and 90 percent, respectively. (That drop, however, is from 2007 transaction levels that were unsustainable, given the euphoric state of the investment market.) A more relevant statistic is a comparison of 2009 sales volume to 2003 sales volume (the previous post-recessionary environment), with 2009 activity approximately 60 percent off 2003 levels. But regardless of the year of comparison, transactions have been few and far between, although it appears that the tide turned in fourth quarter 2009.

With commercial real estate re-priced downward by between 30–40 percent, according to various index calculations, investment capital is beginning to re-emerge. It is clear that we do not have the liquidity problem experienced in the 1990s when sellers could not find buyers at any price. Instead, today’s challenge is in bridging market pricing to market values amid the uncertainty that surrounds forecasting cash flow under stressful economic conditions. Although commercial real estate investors perceive a market opportunity, most institutional real estate funds are held back from taking advantage of the favorable buying dynamics due to fund investment limitations. Values and pricing are expected to achieve greater equilibrium by year-end 2010, resulting in a more active and fluid transaction market.

More Value-Price Adjustments to Come

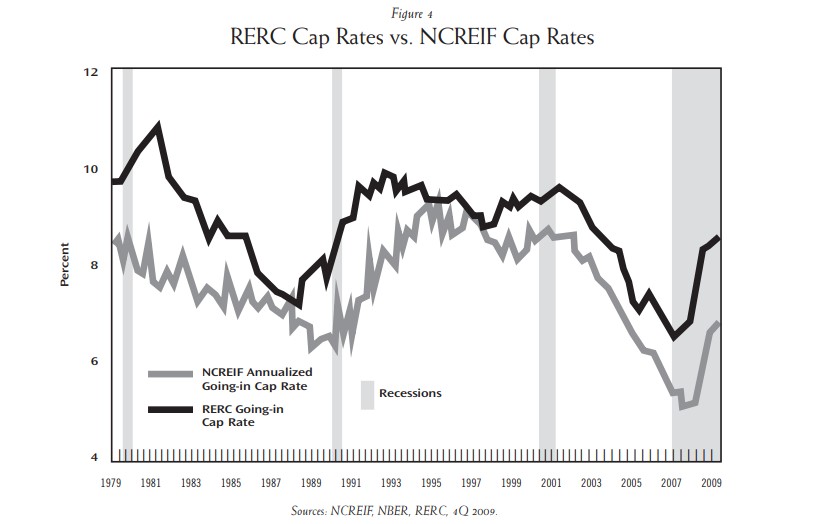

RERC’s required going-in capitalization rates (all property types average) last peaked at 9.6 percent in first quarter 2002. In comparison, the lowest cap rate average occurred in third quarter 2007 and was 6.5 percent (the lowest cap rate average since RERC started tracking rates in 1979). Since this all-time low, RERC’s required going-in cap rates have increased 210 basis points, although they remained relatively stable during 2009 and have returned to fourth quarter 2003 levels, which was prior to the period of cap rate compression.

As shown in Figure 4, the spread between RERC’s required (forward-looking) going-in cap rates versus the realized cap rates reported by the National Council of Real Estate Investment Fiduciaries (NCREIF) was 180 basis points (8.6 percent versus 6.8 percent) in fourth quarter 2009. For NCREIF’s reported cap rates to realign with RERC’s required cap rates, NCREIF cap rates would need to rise another 90 basis points, indicating that there are still value adjustments to come that will be reflected in higher NCREIF reported cap rates. RERC’s required or “expected” rates have already priced-in the full correction, as the market sees it today. This is essential for institutional properties that are unleveraged, and is important because investors dealing with Class B or Class C assets with 60-percent leverage will likely see their equity wiped out from a value perspective. However, this also encourages lenders to continue to “blend and extend” as they work with investors.

NCREIF net and gross value declines since second quarter 2008 were roughly 31 percent and 29 percent, respectively. (The 200-basis-point spread is attributable to the loss in capital improvement, as owners are putting very little money into properties today.) Figure 5 reflects RERC’s view of values in this current down cycle versus value declines in the 1990s down cycle.

Real Estate Value Outlook

Following the relatively minor value correction that took place early in the decade, real estate values experienced an unprecedented (and clearly unsustainable) value increase of approximately 48 percent before coming to a dramatic halt in 2008. NCREIF reported a current peak-to-fourth-quarter 2009 value decline of approximately 31 percent, which compares to RERC’s projected peak-to-trough value loss projection of approximately 40 percent for the same period. That is also on track with the recorded price decline of 41 percent reported last fall by Moody’s/Real Commercial Property Price Index (CPPI) for all property types; that index showed its first faint upward move (one percent) late last year.

Going forward for the near and medium term, commercial real estate investment returns will focus on the income (dividend) component, as opposed to chasing value appreciation. This cyclical re-evaluation is inherent in the boom-to-bust mentality. Commercial real estate was, at its basis, a bond-like investment with some equity (appreciation) upside, and we are witnessing a return to investment basics. Understanding this renewed focus on income provides guidance on investor expectations and what investors find attractive in the asset class. Further consideration of the return-to-basics investment strategies can be found by examining the historical NCREIF capital (value) index. NCRIEF, in combination with RERC’s value projection going forward, indicates that value “appreciation” would have been almost non-existent over the 32-year reporting history of NCREIF if capital expenditures for value maintenance were excluded.

As presented in RERC’s base case scenario provided in Figure 5, our forecast is for aggregate NCREIF values to decline at a relatively steady pace through mid-2011 to an anticipated aggregate value decline of approximately 41 percent—in line with the decline recorded by the Moody’s/Real CPPI. RERC’s overall range for the peak-to-trough values is 35–48 percent. It is important to note that the NCREIF Index is unleveraged, and the use of leverage (even prudent levels exhibited by core funds) has a compounding impact on the value decline of a fund. Based on the value outlook presented in Figure 5, RERC expects commercial real estate to begin recording positive total returns (income and capital changes) once again in 2011. It is important to note that this is an average view for the entire industry, and is not a projection for a specific fund. As often written and cited, the NCRIEF Index tends to lag the realities of the marketplace relative to value changes.

Looking Ahead

The commercial real estate industry will continue to experience challenges and obstacles in its path to recovery, and RERC expects commercial real estate values to continue to decline at a measured pace throughout 2010. Going forward, the commercial real estate market’s focus will be on how far values and eventually prices will decline from their peaks recorded in early 2007. We believe that most structural issues in the commercial real estate marketplace, including capitalization rate expansion, have been priced in, but valuations are still catching up and will not converge with prices until end-of-year 2010. When this occurs, we estimate that institutional commercial real estate will see a peak-to-trough average loss of 35–45 percent on an unlevered basis by year-end 2010.

Although institutional real estate has already taken many of its lumps, smaller investors and borrowers present a looming crisis because they have not yet marked their investments to market, and many regional banks are less able to continue to “extend and pretend.” As such, investors seeking to seize market opportunities will find 2010 to be the best time in some years to buy high-quality, well-priced, long-term investments in commercial real estate.

Endnote

1. The RERC Real Estate Report is published quarterly by Real Estate Research Corporation (RERC). “Expectations & Market Realities in Real Estate 2010: Crossing the Divide—The Passage to Recovery,” was co-published by RERC, Holliday Fenoglio Fowler (HFF), and Real Capital Analytics. Both reports are available at www.rerc.com