The labour market continued to grow in most sectors, increasing by just over 104,000 new positions in December 2022 with this occuring despite economic uncertainties dropping to 5.0%. The Canadian industry is one directly impacted by this due to our current macroeconomic environment. Inflation is still a major concern with consumers as it remains stubbornly high at 6.3% as of December, with overall consumer spending expected to slow in the first half of 2023, especially if the the Bank of Canada continues to raise interest rates and recession concerns remain.

Capital Markets

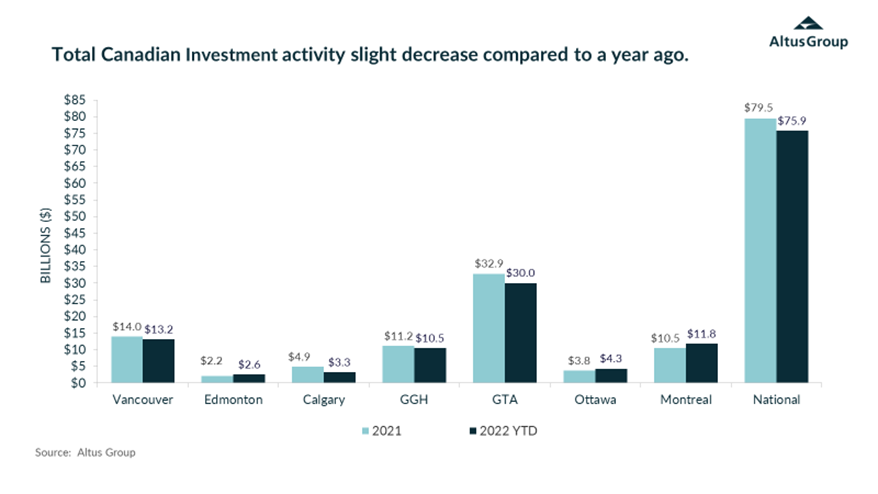

Canadian commercial investment volume in the second half of 2022 recorded a slowdown along with activity, which can be attributed to the impact of increasing rising interest rates, challenges in securing financing for certain assets and a looming economic recession. Moreover, the current period is one of price discovery with buyer and seller expectations still in a period of adjustment with continued pressure indicated by the rising cap rates. National investment volume registered a slight decrease over 2021 to 2022 from $79.5B to $75.9B.

[Insight 107-C hart 1 – Property Transactions-by major market CAN]

With growth recorded across most asset classes nationally in terms of investment volume, the two main drivers of activity across Canada were land sales (both ICI and residential) as well as the industrial sector. Residential land experienced a 9% jump in investment volume, while ICI land noted a 24% increase when compared with the same time last year. Meanwhile, the industrial and multi-family residential sectors remain the strongest in Investor demand.

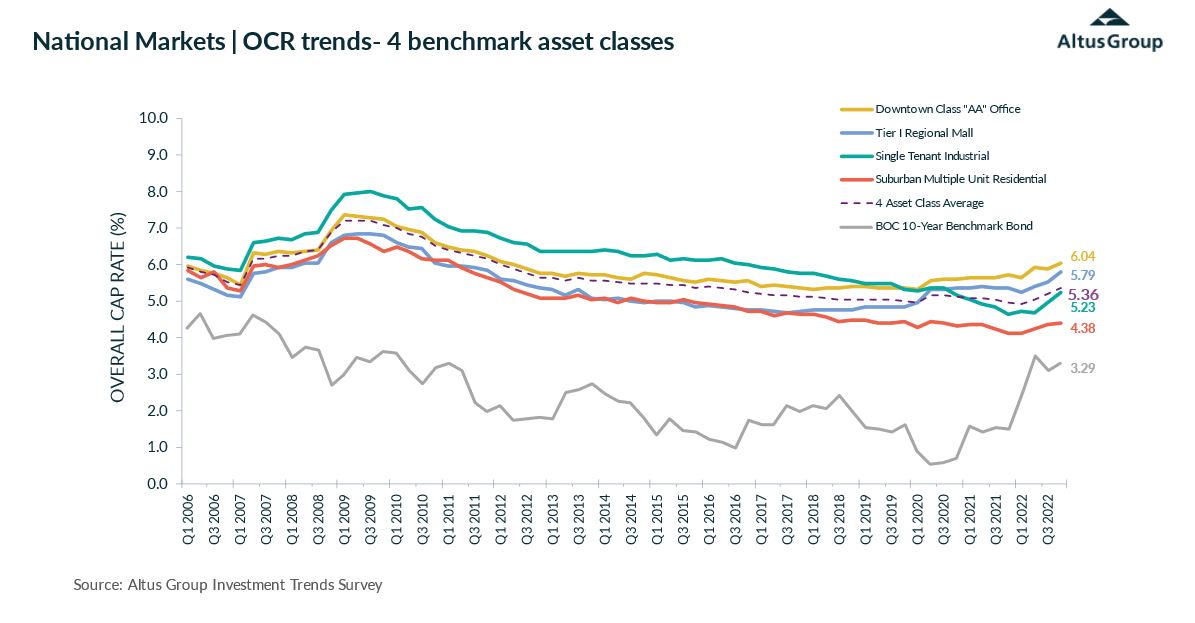

The latest results from Altus Group’s Canadian Investment Trends Survey (ITS) for the four benchmark asset classes show that the Overall Capitalization Rates (OCR) rose to 5.36% in Q4 2022. This compares to the previous quarter which was recorded at 5.17% and 4.95% recorded for the fourth quarter of 2021.

[ITS Q4 2022 Cap Rate Chart]

The top three most preferred property types by investors in the fourth quarter of 2022 were Food Anchored Retail Strip, Industrial Land and Multi-Tenant Industrial assets. Despite being the most investor favoured assets, Food Anchored Retail Strip and Industrial assets reported a downturn in their momentum ratio (percentage of buyers over percentage of sellers). This is a result of the cautiousness in investor sentiment growing amid the continually rising interest rate environment. Interestingly, Downtown Class AA office assets reported an upswing in momentum ratio, with investors preferring to buy instead of sell. This occurs as the office asset has more use with people heading back into the office and investors’ sentiment around the office asset begin to shift. Tier II Regional Malls were the least preferred investor product, with Enclosed Community Malls taking the second last spot. This occurs because retail assets were already slightly risky investments, especially with their pandemic highlighted vulnerabilities. However, the high inflation and the rising interest rate environment are factors causing investors to be even more cautious as they evaluate their investment decisions.

With interest rates on the rise, housing unaffordability remaining an issue, and immigration levels set to increase, the multi-family rental market is expected to continue to flourish in 2023. The multi-family asset class is likely to continue to provide investors with stable returns and remained in the top five most preferred assets among investors. With an investment total of nearly $9.6 billion, the multi-family asset class remained coveted by investors. Due to the challenges of housing affordability, the multi-family apartment sector continues to experience low vacancy rates and year over year increase in rents, in some cases over 25%.

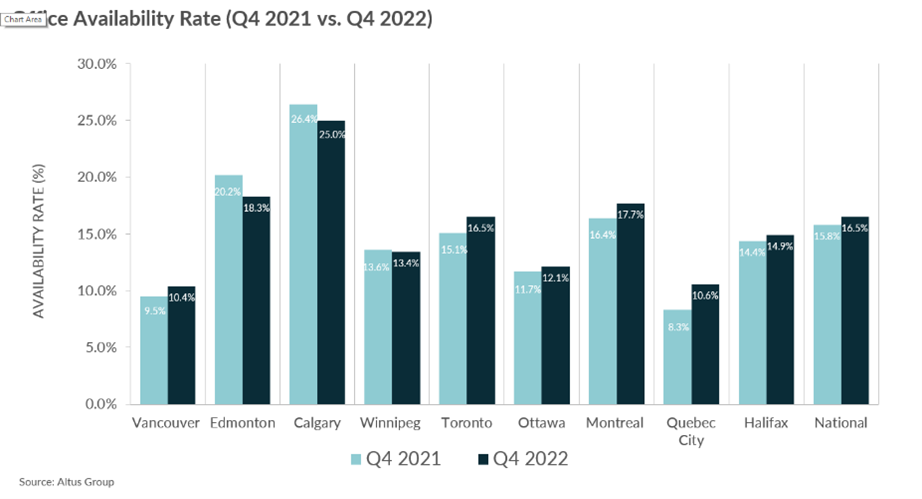

Office

The office sector continues to struggle with evolving space needs by tenants transitioning to a hybrid model, Canadian office availability rates continued to climb from 15.8% a year ago to 16.5% as of Q4 2022. Newer office buildings with better ammenties continue to attract most of the leasing activity. The return to the office continues improve but there is still a fair amount of hestitancy and employees continue to prefer the hybrid model. The factors most affecting thereturn to the office remain:

- Office commute time a factor

- Redesign of the workplace to meet the change demands of how we use the office, a place to interact and share ideas

- Purpose driven return to the office, not just sitting at working at the desk 9-5

While Class B and C buildings are not being leased, investors and owners are beginning to consider alternative uses for these assets. Some of these buildings may see a makeover to elevate them and make them more attractive to tenants, while others may be converted to residential buildings to help alleviate our housing crisis, while also producing returns.

[Office National Availabilities Chart by Market]

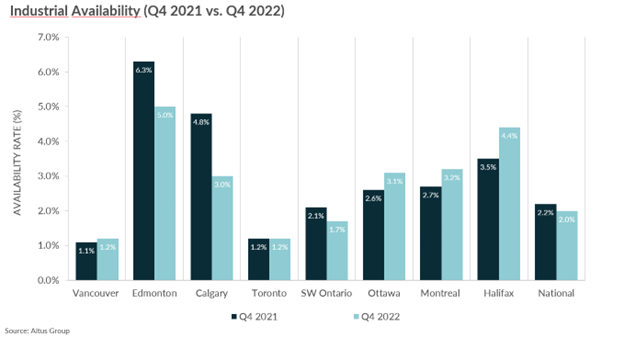

Industrial

The industrial asset class has experienced continued elevated demand, further exacerbated by the pandemic, with the industrial asset class continuing to perform strongly. This is further supported when looking at industrial availability rates, which sit at 2% nationally as of year end 2022 compared to 2.2% recorded in the same time period in 2021. Demand for industrial product, especially warehouse and distribution space continues to outstrip supply. The concern regarding industrial assets remains with the rapidly increasing rents and how high can they go before impacting demand.

[Industrial Availabilities National Chart by Market]

Retail

The retail sector continues to evolve, especially with the increased activity in mixed-use development, incorporating residential with commercial. The 2022 year saw a return of consumers to brick and mortar, however, it remains to be seen if in-person shopping will regain some of the ground lost to online sales. With interest rates rising, and talks of a possible recession, there is an impact on consumer spending is expected and this may affect the demand for retail assets. In spite of this, the improvement in public confidence for shopping in stores bodes with returning consumers with possible concerns with the effort to control inflation and higher interest rates.

Overall, Canadian market fundamentals are expected to be flat into 2023, with uncertainty still looming in the office sector. Canadian investment activity is expected to continue to decline in the first half of 2023, with a possible increase in activity in the second half of the year. There is strong demand by investors, the challenge regarding investment activity remains with buyer and seller expectations along with concerns with a possible shallow recession in 2023 and high interest rates.

Ken Felepchuk/Shutterstock.com

Ken Felepchuk/Shutterstock.com