Introduction

In the context of partnership disputes or marital dissolution, there may be situations where an appraiser is asked to consider whether real estate appreciation over a period of time is the result of active management decisions versus passive market forces, requiring an appraiser to consider the concept of active versus passive appreciation/depreciation. Evaluating a real estate investment manager’s or trustee’s (“Manager”) impact on asset performance is one of the many issues that may need to be addressed as part of the dissolution or restructuring of real estate ownership interests. The evaluation provides the foundation for questioning and challenging a Manager’s ability to carry out their fiduciary responsibilities and their contribution to asset value; it may also form the basis for a subsequent receivership appointment, trustee replacement and/or forced liquidation of assets. When interested parties are unable to agree on how the real property assets and value are to be divided, it is left to the courts to step in and decide for the interested parties.

An asset’s overall financial performance over a given time frame relative to active and passive appreciation forms a basis for identifying a Manager’s contribution, or lack thereof, to value creation and fiduciary care. However, there is limited to no case law regarding the quantification of active and passive real estate appreciation. Further, the body of appraisal theory and knowledge found in The Appraisal of Real Estate (15th Edition)[1], and The Dictionary of Real Estate Appraisal (7th Edition)[2], is silent as to how to distinguish and quantify active versus passive real estate appreciation.

Real estate appraisers value income-producing assets (including office, retail, industrial and multifamily properties) utilizing the income capitalization approach.[3] This approach converts income into value by dividing the net operating income (“NOI”) by a capitalization rate (“cap rate”), which represents an investor’s unleveraged return on their investment (purchase price).[4] It is the authors’ assertion that a) the cap rate differential between two dates of value is solely passive appreciation (or depreciation), and b) the NOI differential between two dates of value can have both active and passive components contributing to appreciation/depreciation. Classifying appreciation as either active or passive can have far-reaching effects on determining the impact of the Manager’s actions in the resultant value changes under their stewardship.

Active Versus Passive Asset Appreciation

Appreciation is defined as “an increase in the price or value of a property or commodity resulting from an excess of demand over supply or other factors.”[5] Passive appreciation results from externalities, such as market forces, other natural causes, or by the actions of third parties which are outside the control of the Manager.[6]

For instance, the value of an alternative asset such as a work of art may increase over time by its very existence through heightened demand for the artist, general price appreciation within the art world, and inflation. In contrast, income-producing real estate assets require more active management to preserve value, offset depreciation and enable appreciation. Managers of income-producing real estate must maintain the physical condition of the property, secure and retain tenants, satisfy regulatory requirements, collect revenue, and pay operating expenses to maintain and grow value. Therefore, active management is generally assumed to be necessary for most income-producing real estate. However, market forces and other externalities also play a role in financial performance and there may be situations, such as dissolutions, where an appraiser may determine what portion of appreciation results from this active management and what portion results from externalities beyond the Manager’s control.

External factors such as macroeconomics, local market conditions, regulation, and location impact the value of income-producing real property and contribute to passive appreciation. These include, but are not limited to:

- Macroeconomic conditions including monetary and fiscal policy, and economic growth

- Capital markets conditions including the availability and cost of capital (rates of return), and financing terms

- Local market conditions including shifts in supply and demand, which are reflected in occupancy rates, market rents, and expected risk adjusted investment yields

- Regulatory and legislative requirements, including zoning (land use and density), ease and cost of entitlement, as well as fiscal tax policies and the availability of public benefit incentives

- Neighborhood characteristics and community/economic development initiatives that affect value, including surrounding land uses and investment/development trends, socioeconomics, environmental conditions, infrastructure, and demand generators.[7]

Appreciation occurs over time and and the authors’ propose a methodology to distinguish between active and passive appreciation and the value of the property at the start and at the end of the period in question. Frequently, the appreciation is measured between the date of partnership (or date of a marriage in a marital litigation) and the date of filing a complaint.

Valuation Methodology

For income-producing real estate properties, analyzing changes in the components of value creation identifies why and how the property has appreciated over time. Identifying whether those changes represent active or passive appreciation determine to what extent it’s a product of the Manager’s actions.

“Income-producing real estate is typically acquired as an investment, and from an investor’s point of view, earning power is the critical element affecting property value. A basic investment premise holds that the higher the earnings, the higher the value, provided the risk remains constant.”[8] The income capitalization approach to value converts the expected earnings of the property into an indication of present value. Direct capitalization (one type of income capitalization) presents as an example of the components within the valuation calculation, which are present in all income approach methodologies.

In the direct capitalization approach, a capitalization rate (alternatively, “cap rate”) “implicitly values the anticipated pattern of income over time”[9] using a single year’s NOI. The revenue and operating expenses of the property are netted to produce NOI; the NOI is then divided by the cap rate to yield the property’s present value before capital expenditures. Expected capital expenditures that are not reflected in NOI assumptions, such as lease-up costs for non-stabilized properties or deferred maintenance, are then deducted from the present value of the stabilized property to yield the derived value. Therefore, the components of value that may change and contribute to the appreciation (or depreciation) of the property are:[10]

- Capitalization rate,

- Sources and amounts of revenue,

- Operating expenses, and

- Capital expenditures.

“An overall capitalization rate (R0) is an income rate for a total property that reflects the relationship between a single year’s net operating income and the total property price or value. It includes both the return of and return on capital with consideration of the perceived risk and anticipation of future income or value changes by the investor.”[11] The cap rate is determined by numerous, mostly external factors. ”[The rate applied] should reflect the annual rate of return the market indicates is necessary to attract investment capital. This rate is influenced by many factors, including, but not limited to:

- Degree of perceived risk

- Market expectations regarding future inflation

- Prospective rates of return for alternative investments (i.e., opportunity costs)

- Rates of return earned by comparable properties in the past

- Availability of debt financing

- Prevailing tax law[12].

Derivation of appropriate capitalization rates requires diligent analysis and can include, but not limited to:

- Use of comparable sales with underlying financial data verified by participants to a transaction (primary sources)

- Use of aggregated market data provided by subscription services such as CoStar and Real Capital Analytics (secondary sources)

- Use of surveys such as PwC Real Estate Investor Survey, RealtyRates.com Investor Survey, RERC Real Estate Report and those performed by brokerage houses (secondary sources)

- “Built-up” rates using band of investment or residual analyses[13].

A notable, but rare, non-external factor that could influence the cap rate is the nature (risk) of the property itself. However, the nature of the property is generally static over time; therefore, changes in the cap rate over a specified time period caused by active management of a property are extremely rare, but not impossible. As such, changes in the cap rate over time are essentially considered to be a product of market forces and represent passive appreciation.

Calculating Appreciation

The calculation of appreciation from a change in the cap rate over time is straightforward. Since cap rates in the direct capitalization methodology are the denominator in the calculation of value,[14] the percentage of overall appreciation over the specified time period that is attributable to the change in the cap rate (and thus a portion of the property’s passive appreciation) is the percentage change in the inverse of the capitalization rates. This may be expressed as [1 ÷ Ending Capitalization Rate minus 1 ÷ Beginning Capitalization Rate] ÷ [1 ÷ Beginning Capitalization Rate].

If the cap rate has decreased over the time period, the percentage change in the cap rate multiplied by the change in value over time will yield the amount of passive appreciation attributable to the change in cap rate. If, however, the cap rate increased during that time, the calculation will yield an amount of passive depreciation over the time period.

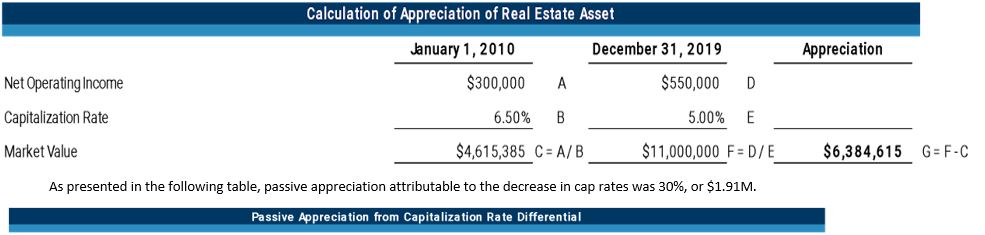

A simplified base case example of appreciation from an income-producing real property is presented in the following tables and begins with the following assumptions:

- Investment period beginning on January 1, 2010 and ending 10 years later on December 31, 2019,

- Net operating income of $300,000 in year 2010 and growing to $550,000 in 2019, and

- Cap rates of 6.50% in 2010 and 5.00% in 2019.

As presented in the following table, these assumptions result in market values of $4.61M in 2010 and $11M in 2019. These values were derived by dividing the NOI of each year by the corresponding cap rate for that year. The decrease in the cap rate and the increase in NOI over the 10 years resulted in $6.38M of appreciation.

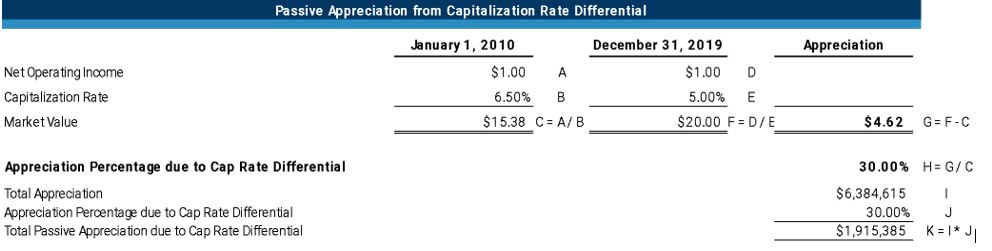

As presented in the following table, passive appreciation attributable to the decrease in cap rates was 30%, or $1.91M.

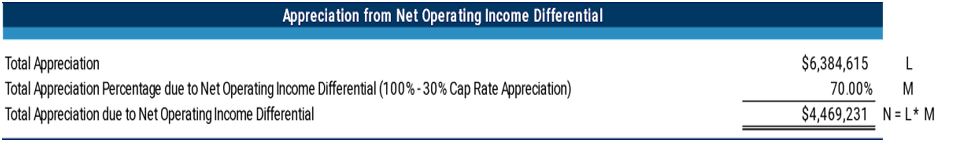

NOI has two distinct components, revenue and operating expenses. The primary variable in NOI over time is revenue, and primarily rent. More often than not, changes in revenue are an appraiser’s primary focus as part of the valuation of active and passive appreciation. The following table demonstrates that 70% or $4.46M of the remaining base case appreciation results from the NOI differential, which may have both an active and passive component.

Typically, property operating expenses fall into a standard range with a steady ratio to revenue over time. Increases in operating expenses generally track inflationary growth and do not significantly contribute to the change in NOI and value over time. If there is a significant change in the operating expenses or the ratio of operating expenses to revenue, the appraiser should understand if a Manager’s actions contributed to this change and determine if they generated active or passive appreciation.

The Impact of Revenue Growth on Active and Passive Appreciation

Income-producing property revenue can increase in two distinct ways: market rent growth and the addition of ancillary sources of revenue. Additional revenue from parking, vending, laundry, cell towers, and signage/billboards is almost always active appreciation resulting from the Manager’s actions, while the classification of market rent growth as active or passive appreciation is more difficult to isolate.

“Inflation is an increase in the volume of money and credit, a rise in the general level of prices, and the erosion of purchasing power.”[15] Other market forces that can increase rental rates include inventory deficiencies, addition of demand generators (e.g., construction of a new corporate headquarters), demographic changes, and changes in regulatory requirements—all natural causes or caused by the action of third parties.

Although market rent growth does not result directly from the actions of the Manager, if the property was not actively managed (as required of most income-producing real estate), the underlying revenue (from tenants and other sources) would not have been maintained and the growth would not have been captured. Therefore, preservation of revenue and increasing rents to track market growth typically require active management, and the authors’ posit that appreciation from inflationary market rent growth would be active appreciation.

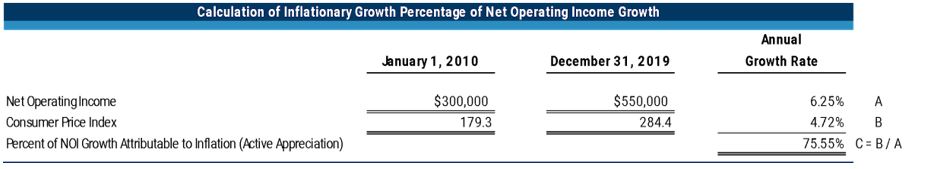

Changes in the consumer price index (“CPI”) can be used to identify inflationary growth in net operating income. As noted above, operating expenses can generally be assumed to track inflation, and any growth in NOI in excess of inflation will typically be from revenue growth or other active management activities. The inflationary portion of NOI growth is captured by the active management required to maintain the revenue stream of the property.

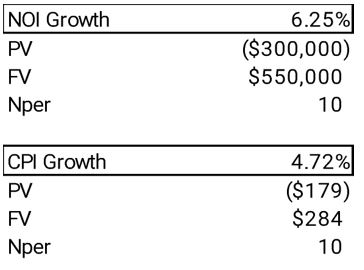

As presented in the following table, the NOI and CPI grew at an annual rate of 6.25% and 4.72%, respectively. Dividing the annual CPI growth from the annual NOI growth resulted in 75.55% of active appreciation, the percent of NOI growth attributable to inflation.

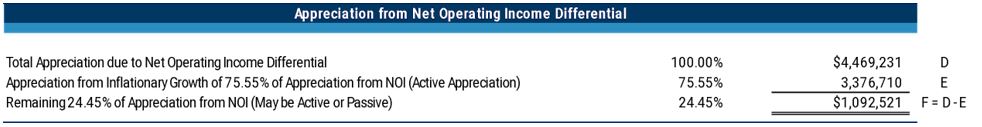

In the table below, $3.37M is appreciation from inflationary growth of 75.55% of appreciation from the NOI differential (active appreciation).

The remaining $1.09M or 24.45% of appreciation from the NOI differential may be active or passive appreciation. An appraiser needs to examine the cause of the revenue changes and determine whether these changes result from active or passive appreciation. The remaining appreciation may be caused by other market forces, by additional revenue, or, in rare cases, by significant decreases in operating expenses such as tax appeals or tax abatements.

It is the authors’ opinion that capital expenditures made over the time period require an active management decision, and any improvement in NOI attributed to those expenditures would be considered active appreciation. Rental growth resulting from active management is a product of specific actions (and often capital expenditures) taken by the Manager such as providing new amenities, upgrading building systems, improving common areas, or other significant periodic upgrades to actively obtain higher rents. Other examples of capital expenditures may include lease-up costs/concessions, deferred maintenance, the addition of tenant space, technological upgrades, and interior or exterior upgrades.

However, if the base case NOI and CPI growth were reversed (CPI growth was 6.25% and the NOI growth was 4.72%), then the authors’ posit that NOI is not keeping up with inflation and 100% of the NOI differential would be classified as active appreciation—and demonstrate a Manager’s failure to achieve market-rate performance. This result would provide the foundation for questioning and challenging a Manager’s ability to carry out their fiduciary responsibilities.

If the base case assumptions are changed and cap rates are assumed to have increased or remained the same over time, then the differential in NOI will contribute to all of the property’s appreciation. (Note that as cap rates increase, values decline if all other components of the value calculation stay the same.)

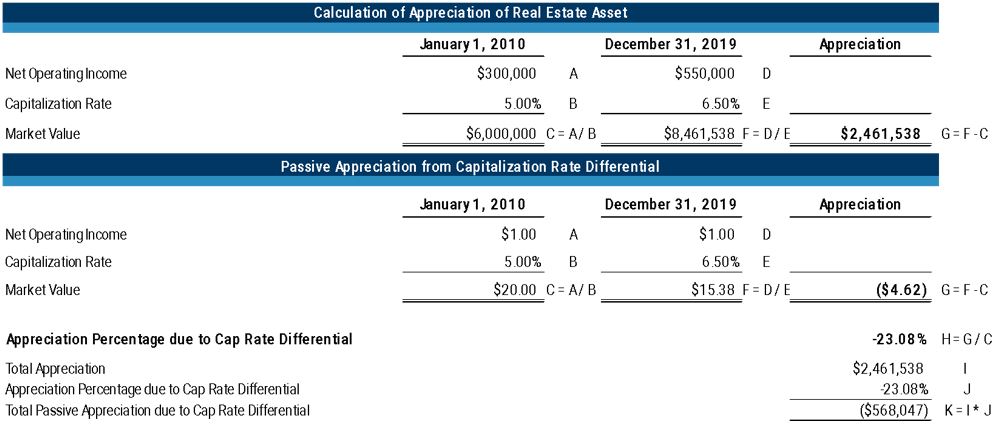

For example, and as presented in the following table, assuming the cap rate increased from 5.0% to 6.5% over the ten-year period, then $2.46M in appreciation results from the increase in NOI over the period. It is the authors’ opinion that the depreciation attributed to the increase in cap rates is considered passive appreciation.

Conclusion

Real estate appraisers value income-producing assets utilizing the income capitalization approach which converts income into value by dividing the NOI by a cap rate. The cap rate differential between two dates of value is solely passive appreciation (or depreciation), assuming changes in the cap rate over time are effectively a product of market forces. The NOI differential between two dates of value can have both an active and passive component contributing to appreciation. Income-producing real estate requires active management to maintain and grow revenue and enable appreciation. The Manager must maintain the property’s physical condition, secure and retain tenants, satisfy regulatory requirements, collect revenue, and pay operating expenses just to preserve value. Thus, in income-producing real estate, most appreciation from changes in NOI can be defended as active.

###

The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates, or its other professionals. FTI Consulting, Inc., including its subsidiaries and affiliates, is a consulting firm and is not a certified public accounting firm or a law firm.

FTI Consulting is an independent global business advisory firm dedicated to helping organizations manage change, mitigate risk and resolve disputes: financial, legal, operational, political & regulatory, reputational and transactional. FTI Consulting professionals, located in all major business centers throughout the world, work closely with clients to anticipate, illuminate and overcome complex business challenges and opportunities. ©2023 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com

ENDNOTES

[1] Appraisal Institute, The Appraisal of Real Estate, 15th Edition. (Chicago: Appraisal Institute, 2020).

[2] Appraisal Institute, The Dictionary of Real Estate Appraisal, 7th Edition. (Chicago: Appraisal Institute, 2022).

[3] Appraisal Institute, The Appraisal of Real Estate, 15th Edition. (Chicago: Appraisal Institute, 2020). p. 413.

[4] Ibid, p. 486.

[5] Ibid, p. 10.

[6] Ibid, pgs. 353, 529.

[7] Ibid, p. 28.

[8] Ibid, p. 413.

[9] Ibid, p. 414.

[10] Ibid, p. 414.

[11] Ibid, pgs. 428, 429.

[12] Ibid, pgs. 429, 430.

[13] Ibid, pgs. 460-470.

[14] Ibid, p. 486.

[15] Ibid, p. 431.

2jenn/Shutterstock.com

2jenn/Shutterstock.com