Abstract

Current industry research to identify racial and ethnic bias has mostly focused on single-family appraisals but the primary players in multlifamily lending (Freddie Mac, Fannie Mae, and the Federal Housing Finance Agency) are not addressing bias with the same resources or attention.

Racial or ethnic bias is more than a single observation of a poor appraisal, or an appraiser’s questionable word choice, or an insufficient/unsupportable valuation analysis. Rather, it should be a measurable trend that can be identified on an individual, firm, and/or geographic level.

This paper is an attempt to provide an overview of the current progress on identifying bias in appraisals and to suggest a methodology for application to multifamily appraisals.

Keywords: appraisal bias, racial bias, ethnic bias, multifamily, real estate appraisal, multifamily housing, FHFA, Freddie Mac, Fannie Mae, PAVE report, valuation, appraisal, automated valuation model, AVM

Introduction

Racial and ethnic bias in real estate appraisals has garnered much attention in the past couple of years – from press reports of valuations that might have been influenced by the race of the homeowner, to federal government agencies collaborating in a cross-agency action plan to address valuation equity (PAVE report), to published research on bias by the Government Sponsored Enterprises (GSEs) of Freddie Mac and Fannie Mae (along with their conservator, the Federal Housing Finance Agency-FHFA).

The focus of all of these projects and collaborations has been on single-family appraisals but not much has been done to identify and address potential bias in multifamily housing appraisals. Are multifamily appraisers’ valuations influenced by the racial and ethnic make-up of the property’s residents, its owners, the property manager, leasing representatives and/or market area of multifamily housing?

This paper explores the current state of research and activity being performed to identify racial and ethnic bias (primarily in single-family appraising) and discusses potential avenues to identify bias, if any exists, in multifamily appraisals. This paper is not intended to be definitive, but rather is a starting point for a deeper conversation that real estate professionals need to have over a much longer, extended time period regarding if there exists appraiser bias in multifamily real estate appraisals and, if so, solutions for eradicating it.

What is bias?

There cannot be a discussion of bias without defining terms so that participants have a common base-line. There are any number of sources to get a dictionary definition of bias, such as the Oxford English Dictionary:[1]

Noun:

a. A tendency, inclination, or leaning towards a particular characteristic, behaviour (sic), etc.; a propensity. Also: something, especially an action or practice, to which a person is inclined or predisposed.

- That which sways or influences a person in their actions, perceptions, etc.; a controlling or directing influence.

- Tendency to favour (sic) or dislike a person or thing, especially as a result of a preconceived opinion; partiality, or prejudice. Also: an instance of this; any preference or attitude that affects outlook or behaviour (sic), especially by inhibiting impartial consideration or judgement.

And a definition by the traditional Merriam-Webster Dictionary:[2]

Noun: An inclination of temperament or outlook especially: a personal and sometimes unreasoned judgment: PREJUDICE (emphasis and capitalization is in the original).

The Action Plan to Advance Property Appraisal and Valuation Equity (a/k/a PAVE report) offers a definition of valuation bias, that bias is “…based on race, ethnicity, or national origin in the residential valuation process performed as part of mortgage origination, regardless of the valuation method.”[3]

Note the use of the term “residential real estate” in the PAVE materials. As will be discussed, most, if not all of the research and discussion of valuation/appraisal bias to-date has been focused on single-family housing but the purpose of this paper is to expand that conversation to multifamily housing (i.e., 5+ residential rental units).

Explicit vs. Implicit Bias

Explicit bias (also referred to as conscious bias) “is the traditional conceptualization of bias. With explicit bias, individuals are aware of their prejudices and attitudes toward certain groups. Positive or negative preferences for a particular group are conscious. Overt racism and racist comments are examples of explicit biases.”[4]

Implicit bias (also is referred to as unconscious bias) “involves all of the subconscious feelings, perceptions, attitudes, and stereotypes that have developed as a result of prior influences and imprints. It is an automatic positive or negative preference for a group, based on one’s subconscious thoughts. However, implicit bias does not require animus; it only requires of a stereotype to produce discriminatory actions. These stereotypes and attitudes are shaped by personal experiences and cultural exposure that leave a recorded imprint on a person’s memory. Implicit bias can be just as problematic as explicit bias because both may produce discriminatory behavior. With implicit bias, the individual may be unaware that biases, rather than the facts of a situation, are driving his or her decision-making.”[5]

In real estate appraisals, is bias (explicit or implicit) the result of pre-conceived notions about a property’s occupants, about its market area, about its situs, or all three? Or are there other causes? That question, the causality of valuation bias, cannot be answered unless bias in appraisals can be identified.

Freddie Mac research on bias in single-family appraisals

In September 2021, Freddie Mac published Racial and Ethnic Valuation Gaps in Home Purchase Appraisals[6] and their research on 12 million single-family appraisals found that:

- There are substantial appraisal valuation gaps for minority (i.e., Black and Latino) versus White census tracts for appraisals for home purchase loans[7]

- That minority mortgage loan applicants are more likely to receive an appraisal value lower than the contract price

- That these valuation gaps are evident for a large fraction of appraisers who provide valuations in both minority and White tracts.

- That these valuation gaps are not explained by differences in comparable sale distances, comparable reconciliation, variances in the comparable sales prices, or by possible systematic overpayment for properties by minorities, and

- A property is more likely to receive an appraisal lower than the contract price if it is located in a minority tract.

However, Freddie Mac’s research does not conclusively conclude that an appraiser’s bias is the determinant factor in their findings.

In May 2022, Freddie Mac updated these observations with a supplemental research project to further refine their research methodology and results using a modeling approach to the analysis.[8] Their modeling project controlled for a wider variety of variables including “house characteristics, neighborhood characteristics, housing market dynamics, and fixed effects,” and the results confirm the findings of their September 2021 paper.

Fannie Mae research on bias in single-family appraisals

Fannie Mae took a slightly different approach in their research on bias in single-family home appraisals. Whereas Freddie Mac researched home purchase appraisals relative to location in minority census tracts, Fannie Mae’s research focused on appraisals for single-family loan refinancing against their variance from a benchmark valuation generated by statistical analysis.[9]

Importantly, Fannie Mae chose to look at refinancing appraisals instead of purchase appraisals since “the appraiser in a refinance transaction typically interacts directly with the homeowner (i.e., the borrower), establishing a pathway for potential bias to influence the appraisal results.” In contrast, in a purchase appraisal, the appraiser typically interacts with the seller and/or broker of the property.

Their primary findings from an analysis of 1.8 million appraisals from 2019 to 2020 between appraised value and a value generated by an automated valuation model (AVM) were:

- Black borrowers refinancing their home on average received a slightly lower appraisal value relative to automated valuation models

- Homes owned by white borrowers were more frequently overvalued than homes owned by Black borrowers

- The frequency of undervaluation did not have a notable racial pattern (that is, undervaluation of Black-owned homes occurred at similar rates as white-owned homes in both majority-white and majority-Black neighborhoods)

- Six states accounted for nearly 50% of the overvalued homes of white owners in majority-Black neighborhoods (Georgia, Louisiana, South Carolina, North Carolina, Mississippi, and Alabama).

Summary of the conclusions of the Freddie Mac and Fannie Mae single-family research projects

- Both research projects demonstrate that there appears to be a relationship between the ethnicity and/or race of the owner of a home and the propensity of the appraiser to be influenced by their race or ethnicity. That is an indicator of appraisal bias.

- The research does not indicate, however, if this bias is the result of the appraiser noting the race of an owner on a loan application or from their impressions (conscious or unconscious) from their inspection of the property and/or neighborhood, or for some other reason.

However, neither Freddie Mac nor Fannie Mae (i.e., “Agencies”) attempt to define racial or ethnic bias nor identify the causes or implications of bias in their papers nor does their research include bias or potential bias in appraisals for multifamily properties even though both organizations have substantial multifamily lending and capital markets divisions.

The PAVE report and its examination of bias in single-family appraisals

The Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) has been co-led by the US Department of Housing and Urban Development (HUD) and by the White House Domestic Policy Council and is composed of a total of thirteen federal agencies and offices. (Interagency Task Force, 2022).[10]

This task force was directed to “evaluate the causes, extent, and consequences of appraisal bias and to establish a transformative set of recommendations to root out racial and ethnic bias in home valuations.”[11] The task force’s Action Plan:

- Outlines the historical role of racism in the valuation of residential property;

- Examines the various forms of bias that can appear in residential valuation practices;

- Describes affirmative steps that federal agencies must take to advance equity in the appraisal process, and outlines recommendations that government and industry can initiate.

It should be noted that the PAVE report and its Action Plan focus on residential single-family real estate and does not mention multifamily housing, even though it is a subset of residential mortgage lending practice.

Federal Housing Finance Agency (FHFA)

As with the Freddie Mac, Fannie Mae, and the PAVE research, the FHFA paper primarily focuses on single-family residential appraisals and concluded that “The racial and ethnic composition of the neighborhood should never be a factor that influences the value of a family’s home.”[12]

FHFA’s research of single-family appraisals noted a high number of narrative references by appraisers to the racial composition of a neighborhood or other protected class references which implies that the appraiser considered those characteristics are important to establishing a property’s value.

Examples of the types of racial and ethnic references identified in the FHFA report that might be indicative of bias include:

- The percentages of racial and ethnic makeup of the area or as a “racially integrated neighborhood”

- Foreign birthplaces or languages spoken by residents

- Resident’s amenities specifically geared to a race, ethnic, or religious group

- Rising house prices were because of gentrification

- A neighborhood described as one where the residents have “assimilated their culture heritage” into the neighborhood

- A neighborhood characterized where residents leaving an “overcrowded” area for “greater housing opportunity” in that neighborhood[13]

The inclusion of these types of problematic words or phrases could indicate an underlying bias, either explicit or implicit. Even if there is no bias on the part of the appraiser, the inclusion of these types of words or phrases might still influence implicit or explicit bias in the reader of the report.[14]

The question not answered by their research is: Is the observation of problematic words and phrases an indicator of valuation bias or just of poor writing and word choice? Although FHFA identified a potential source of bias in appraisals, they did not take the next step to test the appraisals from their sample to ascertain if there was a correlation between this type of descriptive language and the quantification of bias. They could have applied either the Fannie Mae or Freddie Mac research methodology, as discussed above. This should be their next logical step in the advancement of the measurement of valuation bias in single-family appraisals.

Discussion of current methodologies used to try to identify bias in multifamily appraisals

The Freddie Mac, Fannie Mae, and FHFA research on single-family residential appraisals, as well as the news accounts of potential appraiser bias in specific incidents indicate that appraisers seem to be influenced by the race or ethnicity of the occupant/owner of the home.[15] The research to-date is focused on single-family appraisals, but what about bias in multifamily appraisals? Are appraisers also influenced by the race or ethnicity of the owners, managers, renters, neighbors, or employees of multifamily properties?

In April 2022, FHFA asked Freddie Mac and Fannie Mae to identify indications of bias in multifamily appraisals by searching for problematic words or phrases in a sampling of narrative appraisal reports, as outlined in the FHFA research paper.[16] However, it is not clear that this is a meaningful exercise since merely the existence of certain words or phrases in an appraisal report does not indicate that the appraiser had bias towards the property, its location/situs, the tenants, the property manager, or the owner.

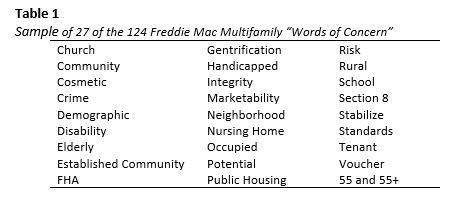

For example, the Freddie Mac Multifamily methodology for complying with the FHFA directive has been to test a sample of multifamily appraisal reports for inclusion of a list of problematic words or phrases and then to manually review each of the reports to identify the context of the use of the word or phrase to ascertain if its use indicates racial or ethnic bias in the valuation.[17] In December 2022, Freddie Mac Multifamily published a list of 124 “Words of Concern” that “the Freddie Mac Multifamily team advises to use with discretion.”[18] Table 1 is a list of a sample of the words and phrases of the 124 words on Freddie Mac’s list.

Context is everything in a project such as this. As can be seen, many of the words in Table 1 are concepts that are commonly used in multifamily appraisals; any automated screening process that searches for these words will get many false positive hits in just about every appraisal report. Automating the search for these words is relatively easy but an analyst then must read through each report to understand the context of each instance of these words and phrases. It is also not clear if Freddie Mac Multifamily is performing this analysis on a sample of its appraisals or on their entire inventory of 5,000± appraisal reports per year.

This work by Freddie Mac is ongoing but it is not clear that this exercise will uncover actual bias in multifamily appraisals. The difficulty with this type of project is that it is very time-consuming and subjective so the primacy its application and an outcome of useful results is not necessarily predictable. Each narrative report must be read in sufficient detail so that the analyst can judge if the context of the statement results in a degree of bias on the part of the appraiser (implicit or explicit). How is valuation bias subjectively identified by the analysts? Additionally, this also requires that the analyst has sufficient experience with multifamily appraisals, bias training, and that they understand the nuances of commercial appraisal methodology.

Also, because this is a subjective analysis, interpretation of bias can result in differing interpretations and conclusions based on the professional experience and, yes, personal bias of the reviewing analyst. Any time there is a subjective analysis, there is the potential for an individual’s bias (implicit and/or explicit) to affect the outcome. And, if the analyst is only reviewing a single report by an individual appraiser or firm how valid is the analyst’s observation of an issue in that report? Is it an instance of valuation bias, or rather an instance of poor data selection, analysis, or report writing by the appraiser or perhaps misinterpretation of the appraisal data, analyses, and conclusions by the reviewing analyst?

Proposed analytical methodology for bias identification

Since it is an objective tool, the development of benchmark statistical valuation models and duplicating the Fannie Mae analytical protocol would provide the best methodology to-date of how racial and ethnic bias might be observed and measured in a multifamily appraisal.

As in the Fannie Mae single-family residential methodology, there needs to be a benchmark in the multifamily test of bias from which to measure/evaluate the subject property’s appraised value; just reviewing the contents of an appraisal report will not provide an objective indication of bias.[19] Likewise, just observing that a property is located in a majority white or majority minority census tract as in the Freddie Mac protocol[20] will not be indicative of bias – there needs to be a valuation benchmark, and this could be a modeled valuation using statistical analysis.

The goal of this type of analysis is to, a) identify potential variances between an appraiser’s subjective estimate of value vs. an established benchmark valuation model, and b) understand if those differences, if any, are the result of racial/ethnic bias or because of another factor unrelated to racial/ethnic bias.

To pilot this methodology and assess the veracity of its application to understanding bias, the appraised values from a sample of multifamily appraisal reports would be compared to a base valuation model or models to ascertain the frequency and degree of difference between the model’s values and the appraisal values.[21] Variances between the valuation model and the appraised values could be statistically analyzed against the property neighborhood’s composition of race, ethnicity, age, gentrification, crime, school quality, or any number of other valuation-variance explanatory factors including appraisal firm, mortgage lender, experience/competency of the appraiser, age of the property, proximity to employment, proximity to transportation, recent sales price of the property, depth of available market and comparable sales data, and the like. That is, a variance between a benchmark modeled value and an appraiser’s value of a multifamily property might not be the result of racial or ethnic bias, but might be due to any number of other explanatory factors.

If the pilot is a workable framework, it can then be automated into the Agencies’ lending process and applied to every multifamily appraisal that is submitted to Freddie Mac and Fannie Mae as part of a lender’s underwriting package.

Unfortunately, unlike in the single-family lending arena, neither Freddie Mac nor Fannie Mae have yet developed a viable statistically-based multifamily valuation model(s) to use as a benchmark/baseline for testing of multifamily appraisal bias. A valuation model needs accurate sales and a sufficient database of operational data and, although each Agency has extensive acquisition and operational data in their files, neither has adequately culled the data from their appraisals and public records to create a workable, calibrated database from which to develop rigorous valuation models.[22] The valuation industry and academia would make good partners in developing rigorous multifamily valuation modeling criteria and methodology.

To accomplish this type of analytical solution, both Agencies, FHFA, the lending industry, or academia would need to:

- Invest in the development of valuation modeling (personnel, time, financial support, research facilities, doctoral dissertation guidance, task prioritization)

- Apply their internal operational and transactional data to populate the model

- Acquire/access external demographic and economic data for the model

- Educate stakeholders in the positive outcomes of model-based valuation (i.e., borrowers, lenders, owners, property managers, appraisers, capital markets investors, lending industry regulators, academic researchers)

- Embrace the electronic transfer of appraisal data (i.e., the transmission of hundreds of data points sent from the appraiser to the lender, and not solely the receipt of a PDF version of an appraisal that requires a human to re-enter into the Agency’s underwriting system the property’s operational data, its physical attributes, and market transactional/analytical data).[23]

Although much work has been done in the development of valuation modeling for single-family housing, neither the industry nor academia has yet developed practical, rigorous, and calibrated valuation models for multifamily/commercial real estate, though some firms are beginning this process.

Without benchmark valuation models, the identification and measurement of racial and ethnic bias in multifamily property cannot be achieved. To understand and objectively measure the extent of valuation bias, it is imperative that the Agencies and FHFA tap into these resources and create a 21st Century statistical modeling solution to observe, measure, and discuss solutions of valuation bias.

Conclusion

Is racial and ethnic bias in a real estate appraisal the result of pre-conceived notions about a property’s occupants, about its market area, about its situs, or all three? Or another reason not yet identified?

Is the incidence of racial and ethnic bias in multifamily appraisals greater than, equal to, or lesser than found in single-family appraisals?

What corrective actions can be taken to help eliminate underlying racial and ethnic bias in multifamily appraisals, if found?

We cannot know the answers to these questions until a baseline valuation modeling protocol is developed for multifamily property. The Agencies’ transactional and operational data coupled with external demographic and economic data, can be the basis for developing a vigorous econometric model for providing a valuation benchmark from which potential bias in multifamily appraisals can be observed and measured. Without an objective process to identify bias and its source, it is impossible to provide solutions to identify, correct, and eliminate ethnic and racial bias in multifamily appraisals.

Table 1

Sample of 27 of the 124 Freddie Mac Multifamily “Words of Concern”

The complete list of 124 Freddie Mac “Words of Concern” may be found at: https://mf.freddiemac.com/docs/wordsofconcern.pdf

[1] Oxford English Dictionary. 2021. Bias. In Oxford English Dictionary. Retrieved February 27, 2023, from https://www-oed-com.dclibrary.idm.oclc.org/view/Entry/18564?result=1&rskey=zLGRFl&

[2] Merriam-Webster. (n.d.). Bias. In Merriam-Webster.com dictionary. Retrieved February 27, 2023, from https://www.merriam-webster.com/dictionary/bias

[3] Interagency Task Force on Property Appraisal and Valuation Equity (PAVE). March 2022. Action Plan to Advance Property Appraisal and Valuation Equity: Closing the Racial Wealth Gap by Addressing Mis-valuations for Families and Communities of Color. Retrieved from https://pave.hud.gov/sites/pave.hud.gov/files/documents/PAVEActionPlan.pdf

[4] U.S. Department of Justice, Community Relations Services. March 29, 2016. Understanding Bias: A Resource Guide. Retrieved from https://www.justice.gov/file/1437326/download#:~:text=Overt%20racism%20and%20racist%20comments,automatic%20positive%20or%20negative%20preference

[5] U.S. Department of Justice, 2016.

[6] Freddie Mac Research Note. September 20, 2021. Racial and Ethnic Valuation Gaps in Home Purchase Appraisals. Retrieved from https://www.freddiemac.com/research/insight/20210920-home-Appraisals

[7] The term “appraisal gap” is defined by Freddie Mac as “the percent difference between minority and White groups in the share of properties or applicants receiving an appraisal value lower than contract price.”

[8] Freddie Mac Research Note. May 10, 2022. Racial & Ethnic Valuation Gaps in Home Purchase Appraisals – A Modeling Approach. Retrieved from https://www.freddiemac.com/research/insight/20220510-racial-ethnic-valuation-gaps-home-purchase-appraisals-modeling-approach

[9] Fannie Mae. Williamson, Jake. Palim, Mark. February 16, 2022. Appraising the Appraisal: A closer look at divergent appraisal values for Black and white borrowers refinancing their home. Retrieved from https://www.fanniemae.com/media/document/pdf/appraising-appraisal.pdf

[10] These agencies are:

- Appraisal Subcommittee (ASC)

- Federal Reserve Board (FRB)

- Consumer Financial Protection Bureau (CFPB)

- Federal Deposit Insurance Corporation (FDIC)

- Federal Housing Finance Agency (FHFA)

- National Credit Union Administration (NCUA)

- Comptroller of the Currency (OCC)

- US Department of Agriculture

- Us Department of Justice

- US Department of Labor

- US Department of Veterans Affairs

[11] Interagency Task Force on Property Appraisal and Valuation Equity (PAVE). March 2022.

[12] Federal Housing Finance Agency (FHFA), Broadnax, Chandra. December 14, 2021. Reducing Valuation Bias by Addressing Appraiser and Property Valuation Commentary. Retrieved from https://www.fhfa.gov/Media/Blog/Pages/Reducing-Valuation-Bias-by-Addressing-Appraiser-and-Property-Valuation-Commentary.aspx

[13] Additional guidance and examples of words and phrases that are often used in residential real estate were published by the Federal Housing Administration, and can be found in Part 109.20 (Fair Housing Advertising) of the Implementation of the Fair Housing Amendments Act of 1988.

[14] Fannie Mae. Appraiser Update. June 2021 (p 3). Retrieved from https://singlefamily.fanniemae.com/media/26126/display

[15] For example: https://www.cbsnews.com/baltimore/news/homeowning-while-black-baltimore-couple-alleges-bias-in-appraisal/, and https://www.mercurynews.com/2021/12/07/marin-appraiser-sued-for-alleged-race-discrimination/

[16] Professional experience of the author.

[17] The list of problematic words and phrases was generated by Freddie Mac, in part, with guidance from FHFA’s Reducing Valuation Bias by Addressing Appraiser and Property Valuation Commentary (2021).

[18] Freddie Mac Multifamily. December 8, 2022. Multifamily Words of Concern. Retrieved from https://mf.freddiemac.com/docs/wordsofconcern.pdf

[19] Fannie Mae, 2022.

[20] Freddie Mac, 2021.

[21] The Fannie Mae single-family research project used two proprietary automated valuation models that used different modeling frameworks, analytical techniques, and data inputs, that provided mutually independent estimates of a property’s value. Both models have been used extensively by Fannie Mae and had a high degree of confidence and internal acceptance (Fannie Mae, 2022. 4-5).

[22] Professional experience of the author.

[23] See the work of MISMO commercial (multifamily) appraisal, financial statement, and rent roll electronic data standards, for example: https://www.mismo.org/standards-resources/commercial Retrieved February 27, 2023.

gettyimages/Andrii Yalanskyi

gettyimages/Andrii Yalanskyi