While the Japanese real estate market is expected to remain stable and attract global investors’ attention in the first half of 2023, the second half of the year will require careful investment behavior with an eye on concerns of rising interest rates due to possible continued price hikes in Japan and economic recession due to slowing global growth.

Looking Back to 2022

The energy crisis triggered by Russia’s invasion of Ukraine, cap rate widening due to increased policy-driven interest rates in the U.S. and Europe to stop inflation from overheating caused by sharp price hikes, and reduced liquidity due to higher interest costs caused a rapid slowdown in many global real estate markets, effectively shutting them down. While prices in Japan began to rise, but only to a limited extent, the Bank of Japan (“BOJ”) continued its monetary easing policy. Therefore, there was no change in the low-cost financing environment. As a consequence, the domestic economy remained stable, albeit at low growth levels, and the Japanese real estate market performed well, becoming the only established global market open for business. In addition, the yen’s significant depreciation due to the widening interest rate gap between Japan and the U.S. and Eurozone resulted in continued inflows of funds from global institutional investors and family offices into the Japanese real estate markets. In short, the 2022 real estate transaction market in Japan was favorable in terms of both prices and transaction volume.

Economic Outlook for 2023

The average real economic growth rate forecast by 37 economic research organizations for 2023 is 1.07%. Following 2021 and 2022, when the economy emerged from the slowdown caused by COVID-19, positive growth in 2023 is projected for the third consecutive year. Combined with the resumption of economic activity post-COVID, the emergence of pent-up demand, and large fiscal stimulus by the government, low but stable growth is expected. However, there is a high possibility of economic slowdown in the U.S. and Eurozone due to the effects of significant monetary tightening, creating a good chance of a downturn in Japan’s growth rate due to deteriorating external demand after the middle of the year.

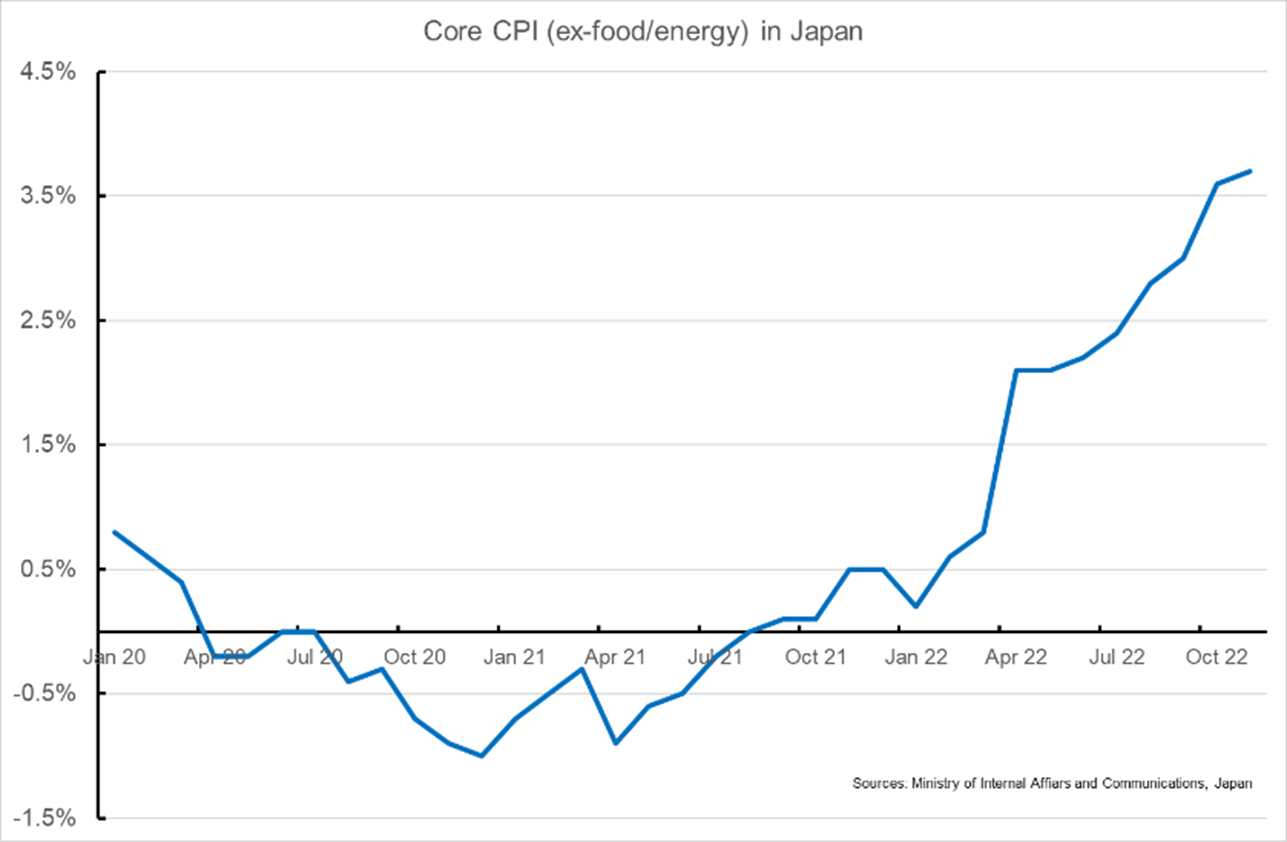

With regard to the situation surrounding prices, it will be difficult for Japan to remain an exception to the global inflationary trend, and the upward trend in prices that started in the second quarter of 2022 will continue thereafter, with the November 2022 CPI (Core CPI excluding food and energy) growth rate reaching 3.7% y/y, the highest growth rate in 40 years and 11 months, far exceeded the inflation target of 2% set by the government and BOJ. With electricity, gas, and food price hikes expected to continue in the first quarter of 2023, the rate of increase is on track to exceed 4% in the first quarter of 2023. In addition, the supply-demand gap in the Japanese economy, as estimated by BOJ, has been negative for the past 10 consecutive quarters, but the supply-demand gap in the third quarter of 2022 is recovering toward zero at 0.06%, indicating that the demand shortage is expected to be resolved and that upward pressure on prices may further strengthen. In addition, the corporate goods price index for the same month also increased for the eighth consecutive month, with the rate of increase reaching a record high of 9.3%.

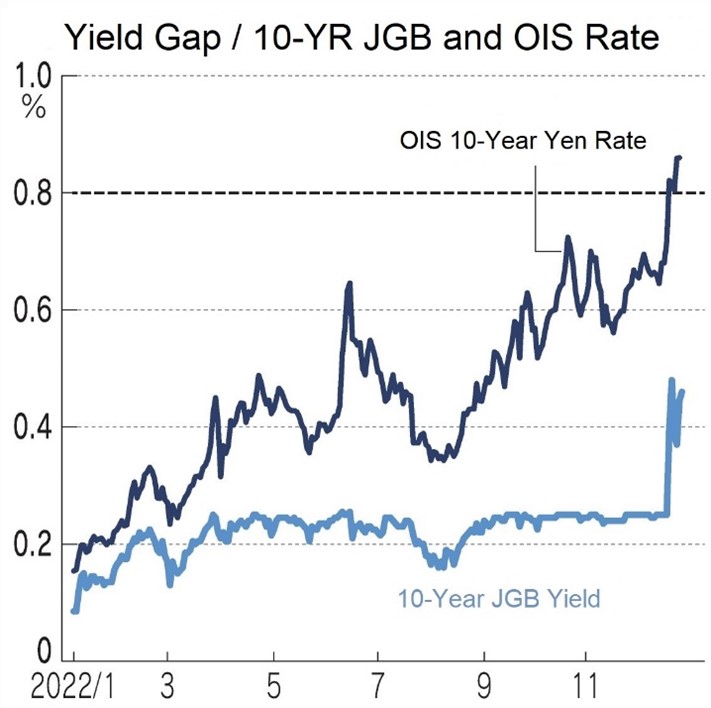

As for monetary policy, while prices continue to rise as mentioned above, the term of BOJ Governor Kuroda will expire in April 2023, and there has been talk of a change in the Bank’s monetary easing policy during 2023. Against this backdrop, on December 20, 2022 the BOJ Policy Board suddenly announced that the Yield Curve Control (“YCC”) maximum target rate will be increased from 0.25% to 0.5%. Although the BOJ has forcefully stated that this is not a change in its monetary easing policy, the market reacted to the BOJ’s move as a real rate hike, and the winning yield in the January 5, 2023 auction for newly issued 10-year JGBs reached 0.5% (the highest level in 7.5 years) at the upper YCC limit. Because the Overnight Index Swap (“OIS”) 10-year rate of the Japanese Yen (not subject to the BOJ’s YCC) is trading at a level close to 0.9%, and if the market is believed to consider the appropriate level of the long-term interest rate for the Japanese yen to be much higher than 0.5%, if JGB’s yield continues to remain at around 0.5% level, the possibility of further policy revisions by BOJ will increase.

Source: Nikkei Newspaper, January 5, 2023

On the other hand, however, real wages, taking into account CPI increases, fell -3.8% in November 2022, the first significant decline in eight and a half years. The positive spiral of stable price increases with stable wage growth, which the government and BOJ assume as precondition for price stability, is not functioning, raising concerns about a downturn in the Japanese economy due to a decline in personal consumption.

Because of this mixed economic picture, unless extreme conditions such as a sharp acceleration of price hikes occur, it is unlikely that a major change in monetary policy, i.e., a halt in monetary easing, will be implemented before the change of the BOJ Governor scheduled for April 2023. It is also unlikely that a major change in monetary policy will be made immediately after the BOJ’s new executive team takes office before the merits and demerits of the long-term easing measures have been analyzed. Even if the exit from monetary easing policy were to be discussed in earnest, it seems reasonable to assume that it would be based on price inflation trends, wage growth trends, and global economic trends from the middle of this year. However, as mentioned above, the market is expected to see long-term yen interest rates at around 1%, so it is hard to completely rule out a YCC target rate rounding up to the same level by the end of this year.

General Real Estate Investment Market in 2023

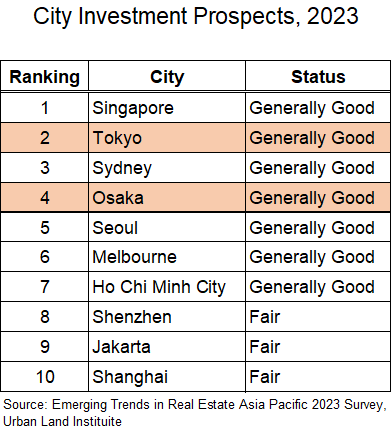

The Japanese economy is expected to continue its gradual recovery in 2023, and there is little likelihood of a sharp increase in interest rates caused by a sudden change in monetary easing policy in a short period of time. In addition, the low-cost real estate financing stance of domestic financial institutions is expected to remain unchanged for the time being, and should continue to provide liquidity to the real estate market. In light of the above, the yield spread over long-term base interest rates for real estate investment can be secured to a considerable extent, and the superiority of the Japanese real estate investment market over other markets around the world, where real estate prices continue to fall as cap rates increase in conjunction with high interest rates, is expected to continue into 2023. The Japanese real estate investment market is likely to remain stable in 2023.

As mentioned above in the outlook for 2023, considering that the risk of higher interest rates caused by a sudden change in monetary easing policy after the middle of the year, combined with the increased risk of domestic economic slowdown due to weakening external demand caused by the global economic slowdown, investment in asset classes with high sensitivity to interest rates (e.g., hotels based on management contracts, rental multifamily residentials with short lease terms) and defensive asset classes (e.g., rental multifamily residentials and logistic assets) should be areas of focus.

In addition, with the virtually complete lifting of the COVID-19 pandemic entry restrictions and domestic activity restrictions, there are growing expectations for a recovery in demand from inbound tourists, and investors are now focusing their attention on retail and hotel properties, which have been in a difficult situation due to the loss of demand over the past three years.

Office

Since the office market is highly regional in nature and it is difficult to look at Japan as a whole, the following is an outlook for Tokyo, the largest market in Japan, and where major institutional investors are concentrating their investments.

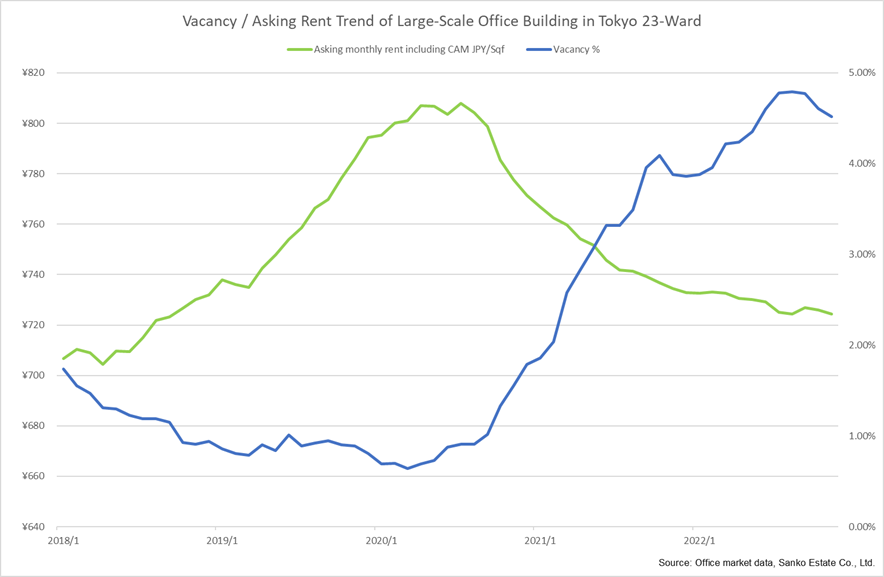

According to data disclosed by Sanko Estate, a major leasing broker in Japan, the vacancy rate for large-scale buildings (standard floor size: over 7,000 sqf) in the 23 wards of Tokyo, which was at its lowest level of 0.69% in the first quarter of 2020, has risen to 4.52% as of November 2022 due to cancellation of floors as a result of behavioral restrictions caused by COVID-19, reduction in corporate activities, and changes in the way offices are used due to the spread of work-from-home. Accordingly, the lagging monthly rent level peaked out at 28,716 yen per Tsubo (including CAM) in the third quarter of 2020, about six months later, and has continued to decline since then, falling 10% to 25,748 yen as of November 2022.

According to research conducted by CBRE and Nikkei newspaper in August 2022, 69% of companies currently implementing remote work intend to continue to do so in the future, but the median office attendance rate of companies that said they will continue a remote work plan is 70%, and their attendance rate in 2-3 years is also expected to be at the same level, 70%. Therefore, it is assumed that the current market conditions have already factored in a considerable degree of office space reduction due to the implementation of remote work, and that it will not be a significant factor in further increase of vacancy rates.

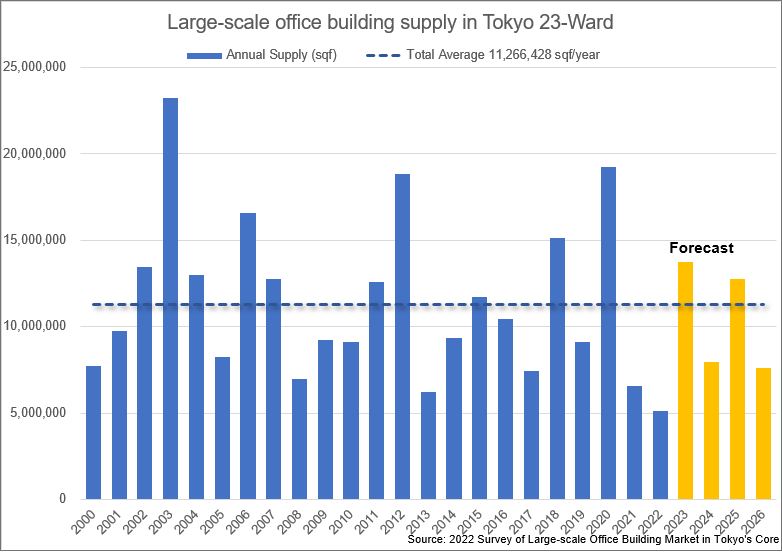

The supply forecast for large office buildings in the 23 wards of Tokyo is shown in the chart and is estimated to be 13.8 million square feet in 2023, approximately 22% higher than the 2000-2026 average of 11.27 million square feet. On the other hand, considering that the net absorption in Tokyo’s 23 wards barely maintained a positive level in 2022, the office supply-demand balance is not expected to improve immediately amid the increase in new supply in 2023 from a supply-demand perspective.

In addition to a simple supply-demand analysis, it has been empirically shown that the macroeconomic business cycle has a lagging effect on the Tokyo office leasing market, and it is also necessary to conduct an analysis from this perspective.

The Cabinet Office’s Business Conditions Index Study Group has determined that the most recent economic peak was in October 2018 and the economic trough was in May 2020. Comparing this to office leasing trends, the vacancy rate bottomed in the second quarter of 2022, approximately two years after the economic peak, and continued to rise for the next two years. Although the multiple restrictions imposed by COVID-19 have slowed the economic recovery and prolonged stagnation, it is not surprising that the increase in the vacancy rate will slow down further in 2023 and show signs of reversal based upon the business cycle analysis.

Taking these factors into account, the increase in the vacancy rate is expected to slow down in the second half of 2023. However, rent levels lag vacancy rate fluctuations, so rents are expected to continue to decline through the end of 2023.

Multi-Family Rental Residential

Tokyo is also the focus for the market outlook of multi-family rental residentials.

Since around 2018, foreign core investors in addition to residential J-REITs have accelerated investments in rental residential assets in metropolitan areas (Tokyo, Osaka, Nagoya, and Fukuoka), focusing on the stability of cash flow due to tenant diversification. Because of intensifying investment competition, expected yields have continued to steadily decline, and according to Mitsubishi UFJ Trust and Banking Corporation, transaction yields are estimated to be around 3.25% in the Tokyo area and 3.75% in the Osaka area respectively in the second half of 2022.

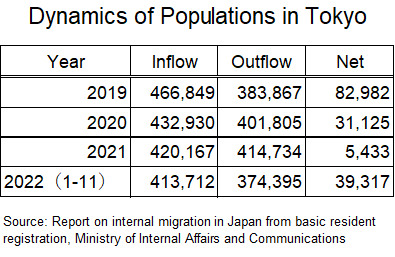

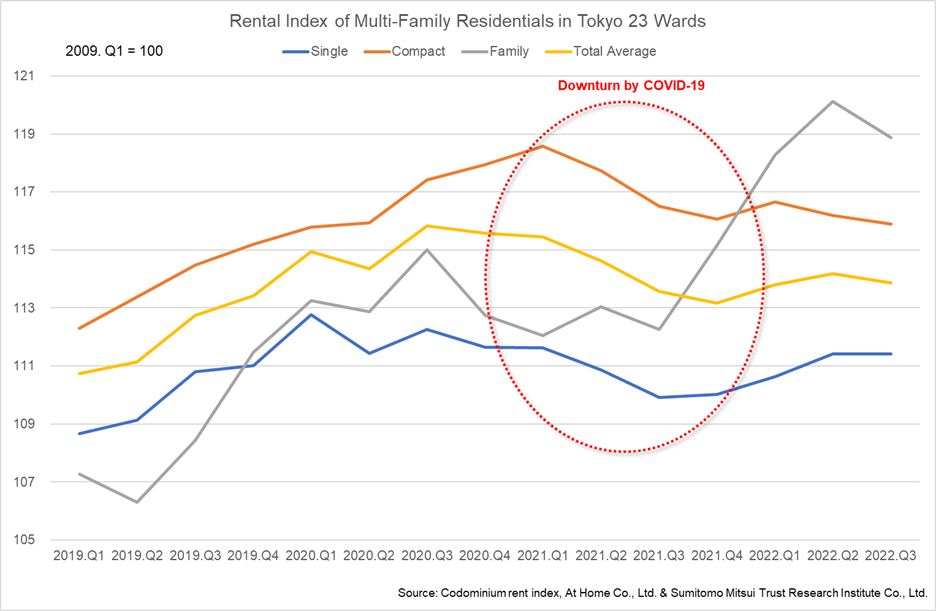

Stable high occupancy rates (>95%) and low (1-2%) but stable rent growth for rental residentials in metropolitan areas have been supported by the continuous inflow of young people to these areas. However, the COVID-19 pandemic from 2020 significantly changed the situation of population inflows to the Tokyo metropolitan area, and in 2020 and 2021, the Tokyo area experienced a significant decline in population inflows. In particular, the occupancy rate and rent level of rental housing for singles declined, as students who have been teaching remotely, foreigners returning to their home countries, and workers in the food service and hotel industries, whose business performance has deteriorated, began to cancel their lease agreements. At the same time, tenants who had been living in studio-type housing in the city center moved to more spacious housing in the suburbs due to the prolonged period of remote work.

However, as of November 2022, the net inflow in 2022 had recovered to 126% of the net inflow in 2020 already, and the negative impact of COVID-19 on rental residentials for singles is expected to be erased in 2023, with occupancy and rent growth returning to the pre-COVID-19 levels.

In this demographic environment, core institutional investors are expected to continue to invest in Tokyo’s rental residential market, but the biggest concern is rising interest rates. As mentioned above, the transaction yield level in Tokyo has fallen to around 3.25%, and even if the YCC target is revised by only 0.25% this time, a commensurate impact on asset values based on the DCF method is expected. The steady trend of cap rate compression in multifamily rental housing over the past several years is expected to change in 2023, as institutional investors, especially foreign investors who assume the risk of further interest rate hikes, are already revising their discount rates upward in underwriting.

Urban Retail

As a showcase for urban retail assets, the following focuses on the central Tokyo area (Ginza and Shinjuku).

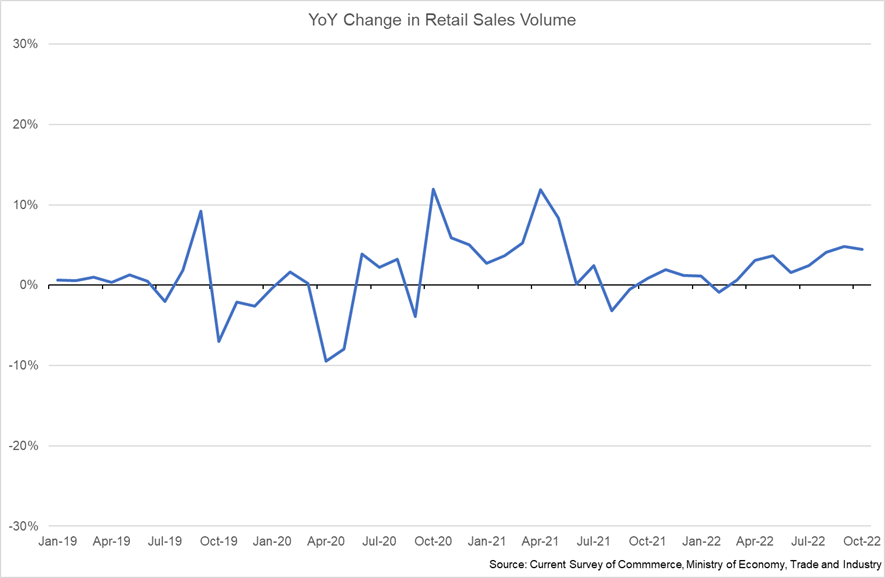

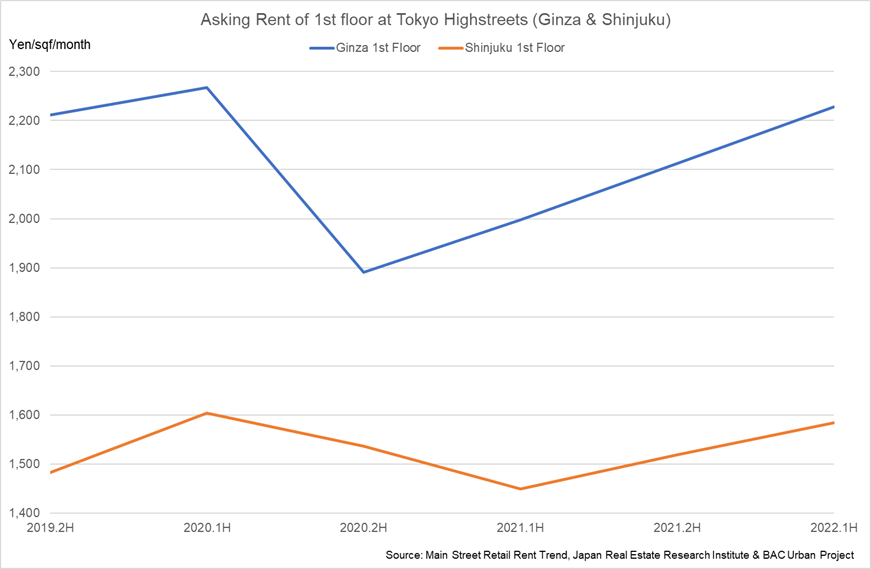

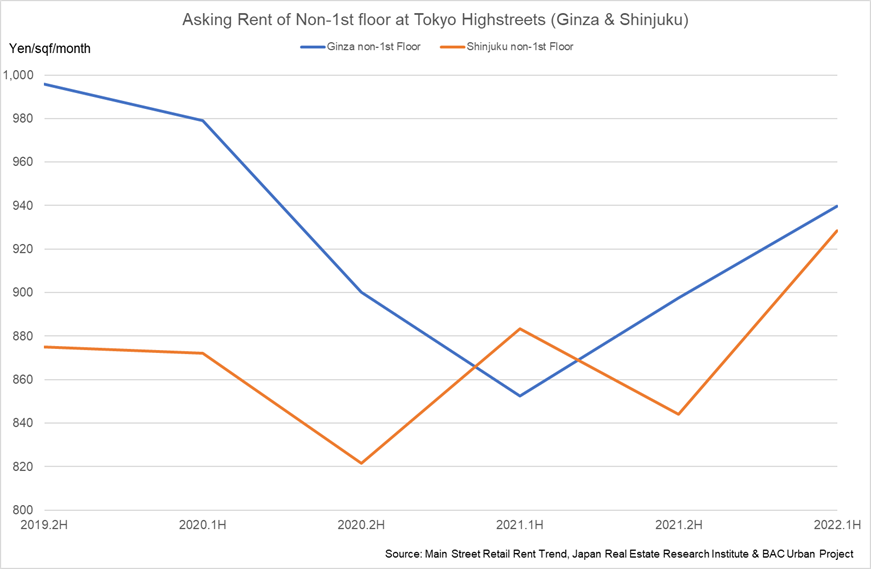

As a result of extremely strict action restrictions and a substantial ban on foreigners visiting Japan due to the spread of COVID-19 starting in the first half of 2020, retail sales fell sharply in April 2020 and remained stagnant until March 2022 when the domestic movement restrictions were completely lifted. Under the macro environment described above, retail tenants’ performance deteriorated, and store closings accelerated through 2020 and 2021, resulting in an increase in vacancy rates and a decline in rent levels as owners rushed to fill the vacancies.

However, with the removal of restrictions on domestic activity, retail sales have been improving since February 2022, turning positive on a year-over-year basis. In addition, inbound tourists’ demand is returning, albeit gradually, due to the virtually complete removal of restrictions on the entry of foreign nationals, which was implemented in October 2022. Depending on the recovery of tourists from China, where the explosive spread of COVID-19 infection has continued since December 2022 due to the elimination of the zero-corona policy, consumption by inbound tourists is also expected to increase steadily in 2023.

With market conditions showing signs of brightening, vacancy rates have begun to decline, and the supply-demand balance in the urban retail market is showing signs of recovery. However, since the absolute vacancy rate level is higher than before COVID-19, rent levels have not recovered to the level before COVID-19 and are expected to remain flat in 2023 from FY2022.

With regard to cap rates, while the outlook for COVID-19 infection was not clear in 2020 and 2021, the outlook for the commercial market and future rent level also became uncertain, therefore, investors became defensive and reluctant to invest in urban commercial retails, and certain cap rate widening occurred, but due to the market recovery described above, the cap rate is expected to remain flat in FY2023.

The more important factor to consider is the concern of institutional investors about rising interest rates, as also mentioned in the section on multi-family rental residentials. According to CBRE’s cap rate survey in September 2022, investors’ expected cap rate average for Tokyo high-end retail properties reached to 3.3%. Therefore, if an upward revision of an applicable cap rate in underwriting is made assuming a reasonable risk of interest rate hikes, the underwritten value will suffer a negative impact accordingly. Depending on interest rate trends, in the worst-case scenario, it is undeniable that cap rates may turn from flat to widening after the middle of 2023.

siriwat sriphojaroen/Shutterstock.com

siriwat sriphojaroen/Shutterstock.com