Introduction: Disruption Hits European Real Estate Investors

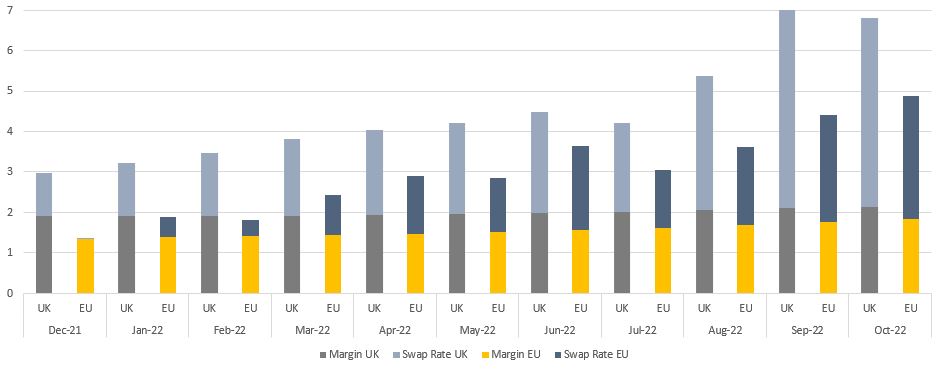

The first European cross-border war in 80 years was certainly not the post-COVID recovery policymakers had planned for. Its impact on energy and food prices combined with already challenging global supply chains have pushed inflation to new record levels. As a result, central banks have been raising policy rates and started quantitative tightening to bring inflation down. At the same time, governments are putting policies in place to protect consumers from impacts of the energy crisis. Bond and stock markets have already priced in further rate hikes, and there is concern about an economic slowdown as well as uncertainty around future monetary and fiscal policies. All-in borrowing for real estate doubled over the last ten months as highlighted in the chart, reminding us that property remains a cyclical business. The key question for our 2023 European Outlook is “How can investors best position themselves for this ongoing market disruption which is finally ending the long post-GFC cycle?”

Macroeconomic Backdrop: Inflation Uncertainty Forces Scenario Analyses

Economic impacts of the war in Ukraine continue to play a central role in Europe. It remains unclear whether the record high inflation has now peaked, as central banks are responding with rate hikes and quantitative tightening. Current wage settlements and fiscal expansionary policies might keep inflation higher for longer. With high levels of uncertainty – especially around inflation – we use our scenarios to map out the possible impacts. Our new base case scenario assumes inflation returns to normal in 2023 combined with short and shallow recession. Our equally probable downside scenario assumes inflation lingers, resulting in a longer and deeper downturn.

Government bond yields were up by nearly 260 bps in mid-November 2022 since the beginning of the year on the back of increasing inflation and the central bank rate hikes trying to fight them. This re-pricing means that lower for longer bond yields cannot be a central theme for real estate any longer. Our base case from Oxford Economics assumes average annual bond yields will peak in 2023 at 3% across our 20-country universe. Our upside and downside scenarios are based on estimated average errors of historical forecasts. Annual average bond yields in these scenarios are forecasted to peak at 3.6% and 2.4% respectively.

Despite low unemployment and a successfully managed rebound from COVID lockdowns, it seems that a recession is now unavoidable for most European economies. Our base case from Oxford Economics assumes a short and shallow recession in Q4 2022 and most of 2023, which seems increasingly less likely given recent negative news flow. To reflect the risk of higher for longer inflation and government bond yields, as well as the elevated sensitivity to higher rates, the downside scenario reflects a deeper and longer downturn and elevated inflation until 2024. Our upside scenario assumes inflation and policy rates will come back down quicker. Again, this is even more unlikely than the base case. Our view of the likelihood of each of the scenarios highlights the heightened level of uncertainty: we allocate a likelihood of 45-50% to our base case, 45-50% to the downside, and only 5% to the upside scenario.

Real Estate Occupier Markets: New Balance for Rental Growth

Our forecasts highlight residential and logistics as the most resilient property types in terms of rental growth. Limited supply is a key driver for this, and with higher costs of debt and construction costs as well as tougher ESG regulations, supply might become even more constrained. This is expected to protect most segments against the recessionary impact on space demand.

As demand for logistics space increased, the development of new supply has accelerated over the last five years. Going forward, we expect a stabilization of both demand and supply at relatively balanced levels. However, there might be some downside to a new supply. This is because apart from increasing construction costs, the shortage of land for industrial development is likely to increase. EU policy objectives aim at zero net land take by 2050. With fewer greenfield sites available, existing stock eligible for conversion or brownfield sites need to be considered. The average logistics vacancy rate in Europe is projected to slightly increase just above 3% as net absorption is expected to balance the more limited level of future completions.

The impact of working-from-home (WFH) on office demand is lower than previously expected. Based on the latest data, we now project that 35.5% of employees working in an office-based sector in Europe will WFH by 2026. This ratio compares to 27.5% pre-COVID and 66.4% of office-based employees working from home during the peak of the pandemic in July of 2020. There has been an improvement to our estimated growth of office employment, adjusted for WFH, from 0.5% in our previous estimate to a still modest 0.8% p.a. across 32 markets. Annualized office employment growth for 2022-2026, adjusted for WFH impact, shows strongest improvements in London, Amsterdam and The Hague, compared to our last forecasts.

European retail might have survived the worst. Prime high street retail posted 9% p.a. rental growth, with 4% for prime shopping centers in 2012-15, ahead of offices and logistics. But, after 2018, prime shopping center rental growth turned negative, as it was hit harder by the growing share of online sales as most retailers shifted from quantity to quality of outlets. As a result, many retailers opened or expanded (flagship) stores in central locations, supporting prime high street rental growth. COVID-19 lockdowns and closings hit 2020 prime rents hard for both high street retail (-16%) and shopping centers (-20%). Many retailers’ revenues dropped in 2020 with many forced to “right-size” their store footprints or go out of business. As lockdowns have lifted, re-openings have returned cash rent collections to normal levels and have stabilized prime rents. Some retail markets are still bound to see concessions from the reported headline rents, especially as discretionary consumer spending might be impeded in the upcoming recession.

When we turn to residential next, we note that despite a post-COVID rebound, the number of residential building permits filed in the EU27 remained low in 2022. With the latest increases in financing, as well as construction costs, building permits might not translate into actual new residential developments going forward. Developer profits might be impacted to such an extent, especially in markets where rent controls apply, that new developments are either postponed or canceled. Major differences between countries endure. Spain and Italy have experienced a rebound in permits over the past year, while the reverse is true for Denmark, the Netherlands, and Sweden. As a consequence, the most supply-constrained cities are likely to become even tighter than before.

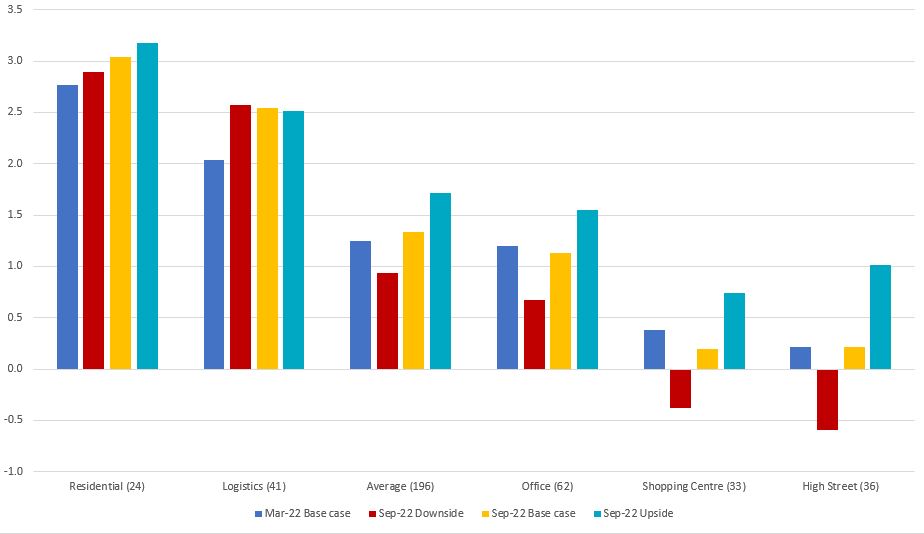

Across all property types, our average 1.3% p.a. prime rental growth forecasts remain mostly unchanged from March and continue to highlight residential and logistics as the most resilient sector for prime rental growth. Logistics rental growth shifted up to just over 2.5% p.a. But, our residential markets rents retain their top spot with a 3.0% annual increase over the next five years. With e-commerce penetration expected to resume, our current forecasts remain in line with our mid-year update. Across all sectors, rental growth is between 0.9% and 1.7% p.a. for our three current scenarios. Within retail, our 5-year rental forecasts still show positive growth for both prime high street retail and shopping centres, albeit the latter at a lower rate than expected a few months ago. However, widespread retail lease re-negotiations during Covid lockdowns should have led to more sustainable rent agreements and facilitated the sector’s structural adaptation.

Real Estate Investment Markets: Activity Slows as Cap Rates Widen Out

Investment market volumes have been coming down in the second half of 2022 as leveraged investors were priced out by higher costs of debt. After the 2021 record of €350bn invested in the European real estate market, AEW expects 2022 full-year volumes to land at €260bn, with €218bn invested in the first three quarters. As borrowing rates went up, yield widening started in Q2 2022 across all sectors from recent record lows. This disruption in borrowing costs is putting an end to the more than a decade long post-GFC cycle. Increased borrowing costs will also cause problems with the re-financing of some existing loans, which will also face the decline of collateral values and lenders’ lower refinancing LTV’s. The resulting debt funding gap is estimated at EUR 24.2 bn and offers opportunities for new equity and new debt sources to bridge it.

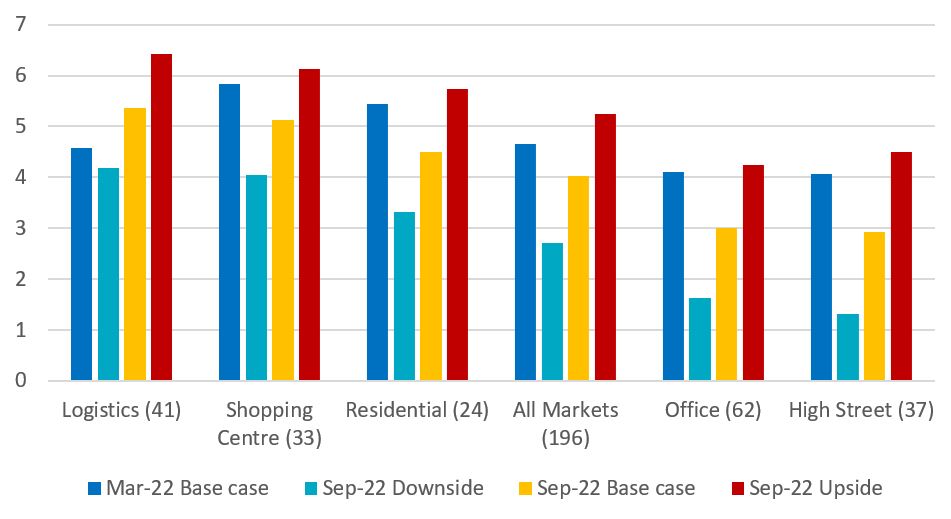

Prime European cap rates (or yields as we call them) moved out for all property types in 2022 as they were all impacted by the higher swap rates and associated all-in borrowing costs. In a reversal from recent years, logistics prime yields widened the most of any sector by 50 bps on average in 2022, while prime yields for other sectors widened by 30-40 bps on average. Prime shopping center yields have widened by over 150 bps since 2018 with high street retail at over 80 bps. This significant past re-pricing in retail recorded over the last four years means that further widening is projected to be less at 30-40 bps over the next five years. For non-retail sectors, we expect prime yields to move out by a further 40 to 60 bps in the next five years to reflect the impact of higher bond yields and borrowing costs.

Forecasted yield widening has pushed expected prime returns across all sectors down from 4.7% p.a. in our mid-year outlook to 4.0% p.a. for the same 2023-27 period. Logistics markets are projected to have the highest returns at 5.4% p.a. in the next five years — due to forecasted solid rental growth. Prime shopping centers have slipped to second place with returns of 5.1% p.a. on the backs of high current yields and lower rental growth projections compared to our mid-year forecasts. Our downside scenario produces returns at below 3% p.a. on average across sectors, mostly due to stronger yield widening.

Relative Value Assessment

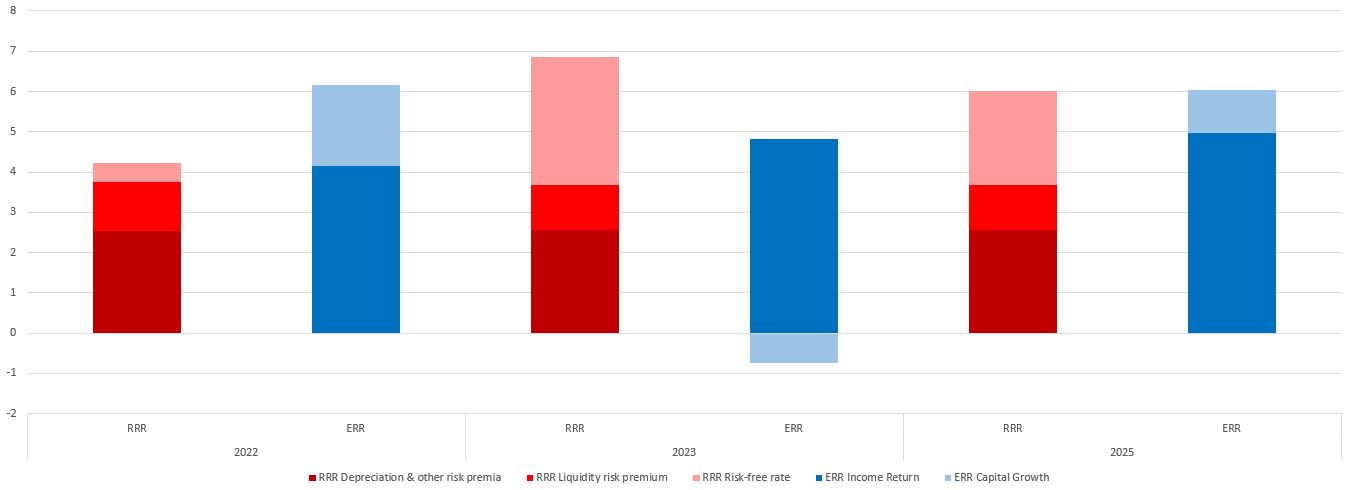

Our risk-adjusted return approach is based on a comparison between the required rate of return (RRR) and the expected rate of return (ERR) over the next five years. Our graph shows that the average RRR, based on our 168 European markets’, stands at 6.9% (more than double last year’s level of 3.4%) while the ERR is 4.1% pa (down from 5.7%). This means that the ERR has a negative excess spread of 278 bps over the RRR. This is down from a positive excess spread of 190 bps over the RRR in our 2022 outlook. Due to the recent bond yield widening, the risk-free rate is now the largest component of the RRR while the other risk premia remained stable. In short, on average investors are not being compensated for the risks they take across European real estate markets.

This year’s challenging relative value results are due to the double impact from the 270 bps increase in our average government bond yield. It has pushed our RRR up and our ERR down, reversing last year’s favorable 190 bps excess spread. As yields stabilize by year-end 2024, ERR and RRR revert to a more favorable balance, per the below chart.

Finally, by comparing the ERR with the RRR, we can also classify individual markets as attractive, neutral or less attractive. Despite the overall challenging market environment, over 30% or 52 out of our 168 covered European markets are classified as neutral (47) or attractive (5) where investors can make their RRR. The five attractive markets are Paris (light industrial), Berlin and Copenhagen (logistics), and Stockholm and London (shopping centers). Geographically, the UK and Benelux rank on top while CEE markets rank in the bottom. It seems counter-intuitive that the UK is most attractive. However, this is due to UK bond and property yields staying at higher levels over the last few years when compared with the Continent due to Brexit and the BoE’s earlier rate hikes.

Across property types, logistics and retail stand out. Due to its solid projected rental growth, prime logistics is now the most attractive sector. 17 of 37 covered markets are deemed attractive or neutral based on our methodology. As prime retail yields already widened in the last three years, 24 of 63 retail markets covered are classified as attractive or neutral, so there is still plenty to choose from. Offices are impacted most of any sector, as all except two of 43 covered markets are classified as less attractive. This is due to the lower rental growth projections and yield widening. Apart from offices, the change from last year’s residential market classification again confirms the dramatic reversal. In this case, we still have 8 neutral residential markets. Despite nearly 70% of markets being classified as less attractive, it should still be possible to source and execute attractive individual deals, especially for managers with local presence.

Yavuz Meyveci/Shutterstock.com

Yavuz Meyveci/Shutterstock.com