“THE CRE TEAM BROUGHT A NEW PERSPECTIVE TO OUR PROJECT AND HELPED US MOVE FORWARD WITH ‘NEW EYES’. THEY WERE A DIVERSE TEAM WITH A WEALTH OF KNOWLEDGE. IT WAS A FANTASTIC EXPERIENCE AND WELL WORTH THE TIME AND RESOURCES. “

-SHELLEY ZORN, EXECUTIVE DIRECTOR, THOMASVILLE PAYROLL DEVELOPMENT AUTHORITY

CLIENT: The city of Thomasville, Georgia, (pop. 18,000) was once known as “The Vacation Getaway of the South.” For nearly two centuries, wealthy people from northern U.S. states have traveled to Thomasville for its mild climate, abundance of Victorian architecture and an historic downtown of vibrant shops, restaurants and small businesses. But, in 2013, the State of Georgia closed the Southwestern State Hospital, a mental health and developmental disabilities facility which was a major employer. More than 600 jobs were lost. The vacated facility included 18 large buildings totaling 400,000 square feet on a 208-acre campus. Because Thomasville already had many resources and assets, the hospital property was not desirable for public, medical or governmental use.

While the property was languishing on the State of Georgia’s surplus property list, Thomasville’s leaders engaged the CRE Consulting Corps for help to maximize the property’s potential and minimize the possibly adverse alternatives.

One of the buildings on the former Southwest Regional Hospital site.

CHALLENGE: After the closure, the State offered the hospital property to other state agencies, but none expressed interest. Thomasville’s Payroll Development Authority aggressively marketed the property, but received no serious offers from potential buyers. There is a multi-million dollar state bond for roof repairs and the carrying cost for the vacant facility is more than $2 million/year, including substantial electrical costs. As is not unusual in any community, there were many different views as to how the property might be used. The Corps’ assignment was to identify the highest and best use for the property to enhance the overall economic health of the community; to create a vision for the property that would be compatible with Thomasville’s other ongoing initiatives, and develop a strategic plan with action steps (including marketing strategies and cost efficiencies, until the property is sold).

Buildings of the Southwest Regional Hospital site The Consulting Corps team and stakeholders

ASSESSMENT: Located 28 miles northeast of Tallahassee, Florida and 230 miles south of Atlanta, Thomasville is easily accessible by highways. The population is growing and the economy is currently stable. The team interviewed numerous local stakeholders. A SWOT analysis revealed Thomasville’s strengths include a high degree of civic participation with a strong commitment to the arts, education, and health care; and a good working relationship between political representatives and community leaders. The hospital property has an attractive campus appearance; buildings, utilities and other infrastructure are in good condition, but costs to maintain the property are a budgetary challenge. The team analyzed market data, and assessed special-use possibilities. The town itself is architecturally interesting, with beautifully-restored houses and public buildings dating to the late 1800s along with an active business district, making Thomasville overall a very desirable locale.

Entry to the 208-acre hospital property Broad Street, Downtown Thomasville

RECOMMENDATIONS: The team provided strategies for the property that focus on highest and best use to generate a significant new source of employment for the area. Team members noted the need to establish the realistic current value of the property (different from the value established by the State). Along with providing recommendations for potential buyer segments, the team noted property use categories that would not be viable (such as a senior living community), so city leaders could target their efforts most effectively. The team found the property is well suited for a specialized medical facility where housing, training and care would be centralized on the campus and they provided specific action steps based on detailed analyses of types of most-likely potential buyers. The plan additionally included strategies to minimize carryover costs until the property is sold.

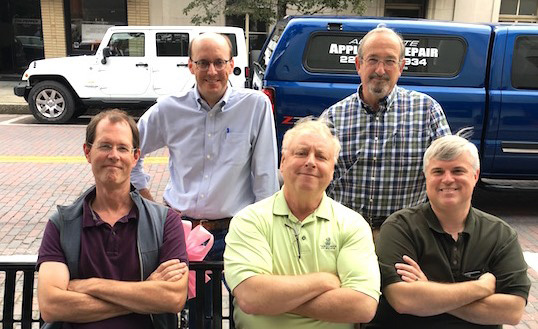

Members of the Thomasville, Georgia CRE consulting team

The CRE Consulting Corps Team members were (front row): Steve Price, CRE, Terra Property Analytics, Seattle, Wash.; John Dalkowski, III, CRE, National Real Estate Research, New York, N.Y.; Craig Benton, CRE, Synovus Financial Corporation, Alpharetta, Ga.; (top row): Casey Pipes, Esq., CRE, Helmsing, Leach, Herlong, Newman & Rouse, Mobile, Ala.; and Robert Dietrich, CRE, Kidder Mathews, Los Angeles, Calif.